- Judge Netburn’s scheduling order offers hope amid uncertainty in the Ripple-SEC legal battle

- FBI’s caution and SEC’s actions signal growing regulatory pressure on crypto

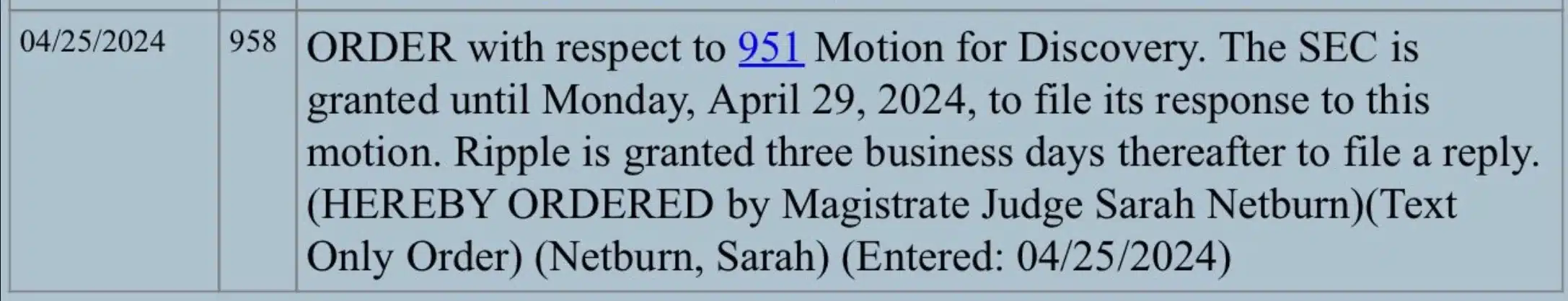

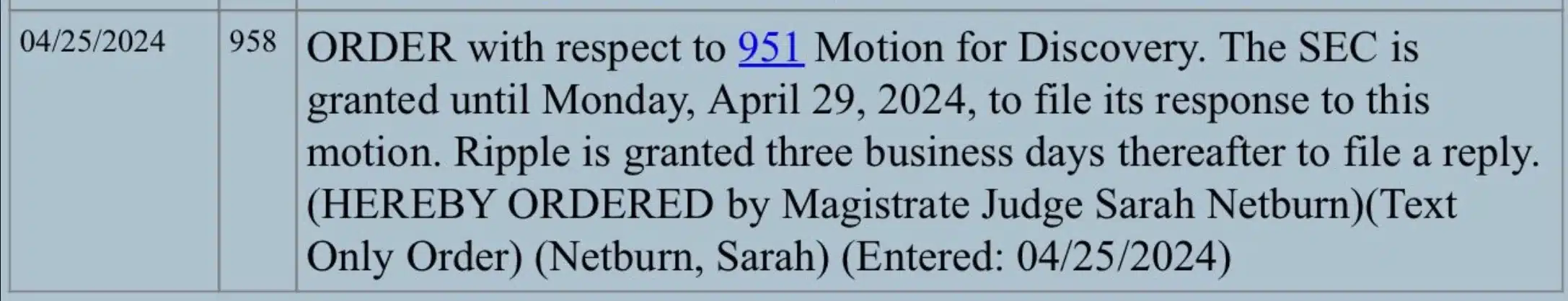

The United States’ Securities and Exchange Commission (SEC) has been closely monitoring crypto-firms for a long time, with Ripple being a prime example. The aforementioned lawsuit, filed originally in 2020, is in the news today after Magistrate Judge Sarah Netburn issued a scheduling order.

Source: James K. Filan/Twitter

Ripple’s latest motion for an order seeks to dismiss the SEC’s new expert reports supporting its case. Following the same, Judge Netburn granted the SEC an extension until 29 April to respond to Ripple’s request. Subsequently, Ripple will now have a brief window of three business days to share its response to the same.

This latest development raises a crucial question – Could this signal the end of the long-standing legal battle between the SEC and Ripple?

What are the execs saying?

In its defense, XRP is challenging the SEC’s proposed civil penalties, advocating for a maximum penalty of $10 million. According to Ripple, the SEC’s accusations are exaggerated and lack evidence. They also highlight the absence of evidence for future violations in their institutional XRP sales, Ripple aded.

Analyzing the looming uncertainty, many crypto-commentators have had a lot to say, with one stating,

“#Ripple Vs #Sec Lawsuit Could Reach Supreme Court Of The United States.”

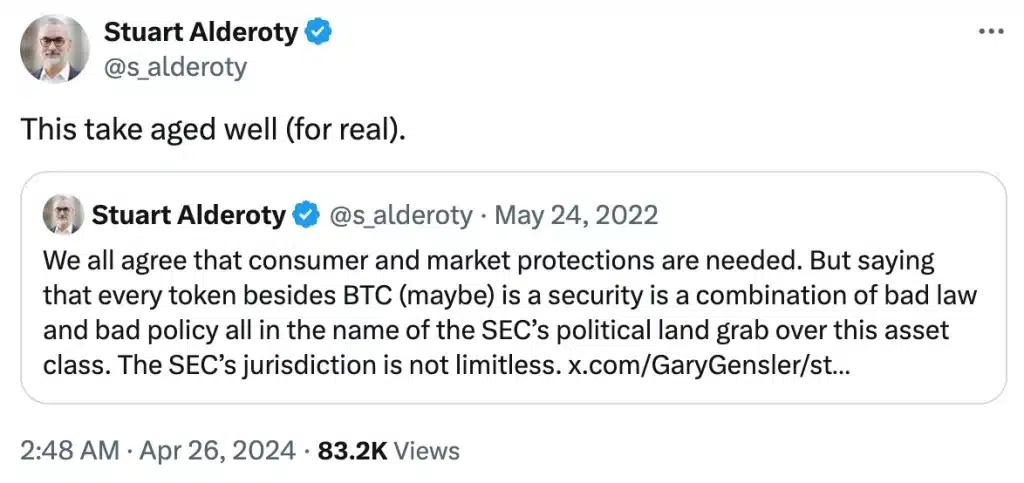

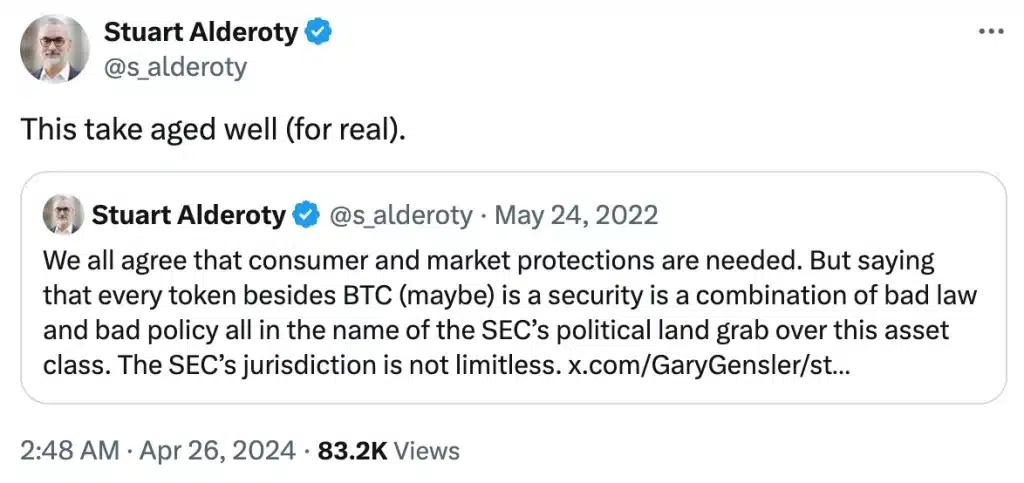

He wasn’t alone, with Stuart Alderoty, Chief Legal Officer of Ripple, criticizing SEC for its “gross abuse of power.”

Source: Stuart Alderoty/Twitter

SEC’s abuse of power

Needless to say, it’s not just Ripple on the SEC radar. Coinbase and Uniswap are also in the mix now. In fact, Uniswap just got hit with a Wells Notice from the SEC. Sharing worries about this move and its effects on the crypto-community Hayden Adams, Uniswap’s CEO, in a separate interview on the “Bankless” podcast, said,

“The SEC is essentially taking very aggressive stances and basically trying to shut down crypto.”

Amid concerns over the SEC’s supposed overreach, Bloomberg reported the resignation of two SEC lawyers recently following a federal judge’s sanctions and strong criticism of the Wall Street regulator for what was described as a “gross abuse of power” in a cryptocurrency case.

Echoing similar sentiments, Jake Chervinsky, Chief Legal Officer of Variant, claimed on “Unchained,”

“I think it really is time for Congress to step in and decide what the law should be instead of leaving us all in this sort of haze of regulatory uncertainty.”

After the SEC, now it’s the FBI

Interestingly, it’s not just the SEC that’s going after crypto and crypto-entities.

The Federal Bureau of Investigation (FBI) joined the ranks of regulators recently, cautioning Americans against utilizing non-KYC Bitcoin and cryptocurrency money-transmitting services. At the moment though, it’s too soon to say whether this advice will have any impact on the thousands who constitute the crypto-community in the USA.

Source: Bitcoin Magazine/Twitter