Cross-chain messaging platform Wormhole has introduced native token transfers (NTT) as a way to preserve token characteristics and address liquidity fragmentation across different blockchains.

Sending tokens across different blockchain platforms today usually requires a token bridge. These bridges often use either the “lock and mint” or “burn and mint” approach when enabling these transfers.

This process involves users locking up the native asset into a smart contract on one chain and then swapping it for a synthetic version of that asset before it is transferred to a different chain. Once on another chain, users will again need to go through the process of switching the synthetic asset to a native token.

Read more: Wormhole garners whopping $2.5B valuation as new unit emerges

However, according to Nikhil Suri, product lead at the Wormhole Foundation, because interoperability protocols deploy wrapped assets on behalf of a project, these assets are non-fungible between the different interoperability protocols, leading to liquidity fragmentation, which can result in a bad UX and sub-optimal markets.

“Another drawback of wrapped assets is that they are owned by interoperability protocol contracts, so they conform to a fixed token implementation. This limits flexibility for protocols looking to take their own tokens cross-chain since their tokens won’t behave consistently on all chains and will not retain any advanced functionality,” Suri told Blockworks.

Another way of transferring assets across different blockchains today could be by having a unified liquidity pool shared by multiple different chains. However, this type of bridging can not guarantee instant finality as the different chains must ensure enough liquidity in the pools to fulfill all requests.

Read more: Why cross-chain messaging is becoming more popular

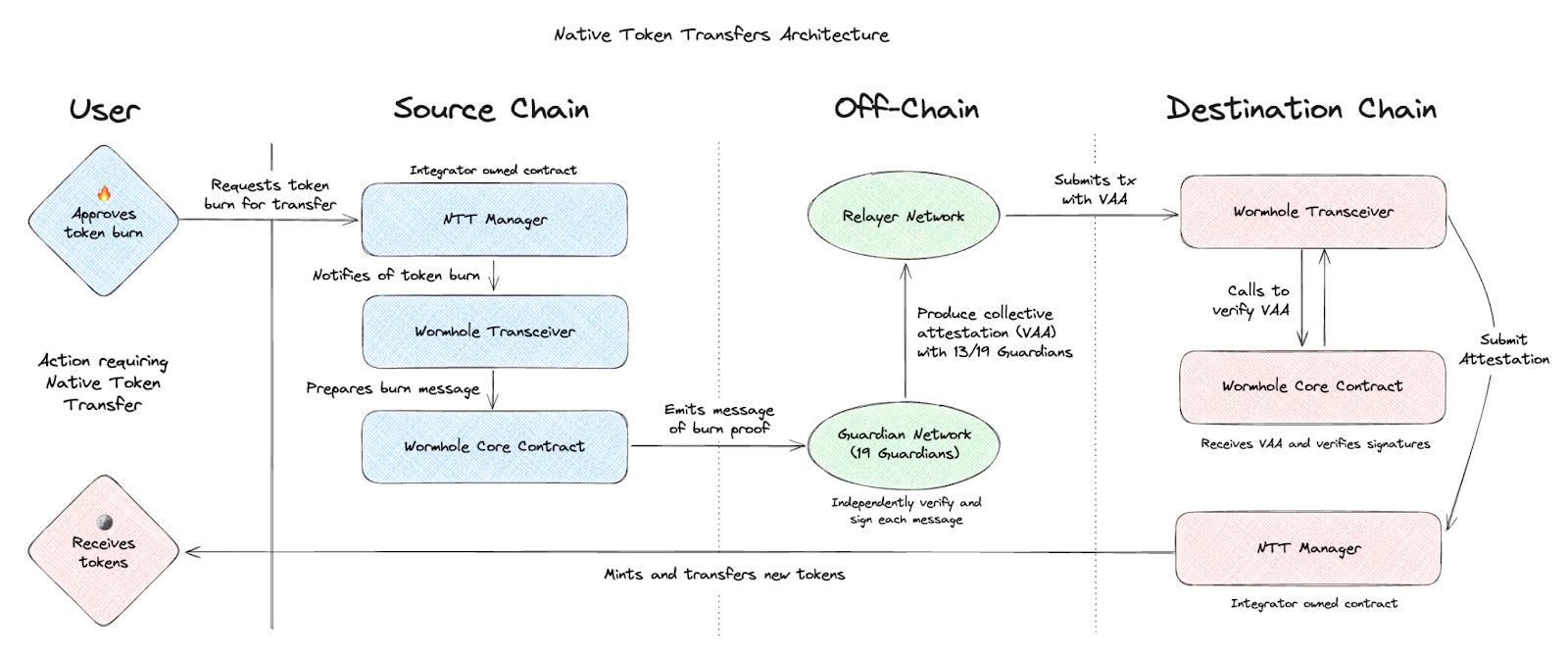

Unlike existing methods for transferring tokens across chains, NTT involves protocols natively deploying their canonical token to multiple blockchains and using interoperability layers to facilitate the transfers between these canonical deployments.

This means that when new tokens are transferred using the “burn and mint” or “lock and mint” method with multichain’s NTT, instead of swapping the native token for a synthetic asset before sending it to another chain and then switching it back again once it arrives on the destination chain, users will be able to directly transfer native tokens from one chain to another.

“In comparison to wrapped assets, native token transfers ensure that projects maintain ownership, upgradeability and customizability over their tokens on various blockchains. This means that tokens can maintain their unique characteristics no matter which chain they are transferred to,” Suri said. “Native token transfers also avoid liquidity fragmentation by transferring value instead of double counting it.”

For this reason, Suri believes that native tokens are more than just a technical evolution, but also a step toward realizing the potential of blockchain technology.

“They can serve as long-term solutions that are able to evolve alongside the protocols that leverage them,” he said. “As we move forward, interoperability will continue to play an important role in shaping a robust and user-centric DeFi space and provide projects with the sovereignty to define what works best for them.”