The recent win of Trump in the US election has surges the growth of crypto tokens. On November 6, SOL touched $188 and displaced BNB coin from its fourth position. It has been moving in an upward channel for quite some time. Let’s analyze the market and see what the fourth largest crypto brings for its investors.

Solana’s Strong Technical Signals Point to Growth

On the technical side, Solana is showing encouraging signs. Currently, SOL is trading above its 20-day Exponential Moving Average (EMA), a key indicator of market optimism. This has drawn in buyers and built up positive sentiment. Since October 10, Solana’s price has been trending within an upward channel, though it briefly dipped below it on November 1. By November 6, however, it rebounded back inside the channel, signaling potential strength. Now SOL is facing resistance around $188, testing the power of this rally.

More Room to Grow

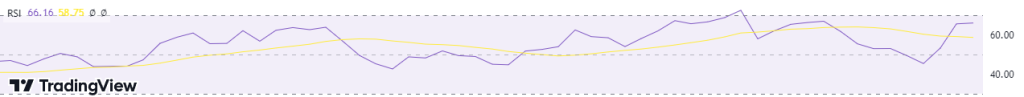

Market indicators suggest room for further gains. Solana’s Relative Strength Index (RSI) sits at 66.16, showing steady buying interest without reaching overbought levels. This could mean that SOL has more ground to cover.

At $187.41, SOL has crossed a key support level of $186.40. If demand remains steady, it could aim for the next resistance level at $193.34. If momentum continues, SOL might even attempt its yearly high of $210.03.

What’s Next for Solana?

TraderSZ have shared four possible targets for Solana’s price in the coming weeks: $173.04, $183.44, $193.85, and a high of $204.25, close to its April peak. With recent gains of 8.64% on November 5 and a sharp 19.96% on November 6, the rally looks strong.

Whether SOL hits a new all-time high soon remains to be seen, but with robust buying interest and technical signals aligning, Solana could be set for exciting moves in the coming weeks.