- Memecoins boomed in 2024, with a $50.8 billion market cap and high returns.

- VanEck’s Memecoin Index reflected upon the speculative nature of memecoins.

In 2024, though Bitcoin [BTC] took center stage with its spot Exchange Traded Fund (ETF) approval and halving event, it’s impossible to ignore the memecoin mania.

According to CoinGecko, the memecoin market cap was at $50.8 billion at the time of writing.

Reportedly they were, by far, the most profitable crypto narrative with returns of more than 1300% on average across the top tokens.

Controversies surrounding memecoins

However, amidst these optimistic growths, the controversies surrounding memecoins can not be ignored.

Remarking on the same, memecoin trader Ansem in a recent conversation with the “Unchained” podcast, said,

“I think it’s more of like an attention thing, and like an internet thing, than really like thinking about teams that are building out products.”

Adding to the fray, Kelxyz, a memecoin trader in the same conversation noted,

“With crypto and the ability to tokenize anything, financialize anything, it makes sense that memecoins would end up capturing a lot of that attentional flow and in turn some of that value as well.”

This highlighted that memecoins showed both growth and controversy, wherein the high market cap and returns contrasted with questions about value and purpose.

All about VanEck’s memecoin index

The memecoin craze was further confirmed by VanEck’s stride into the memecoin market.

Shedding light on the same, Matthew Sigel, VanEck’s Head of Digital Assets took to X (Formerly Twitter) and noted,

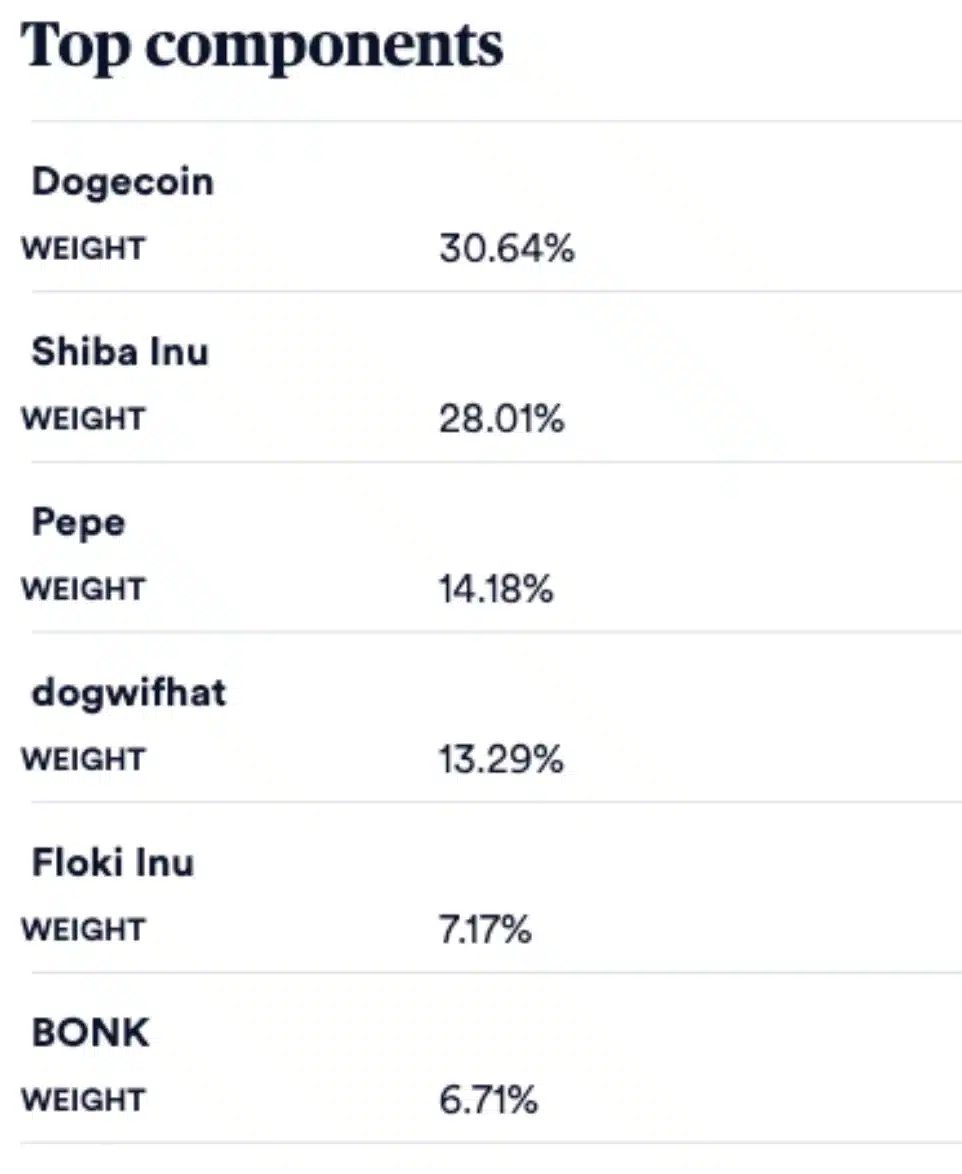

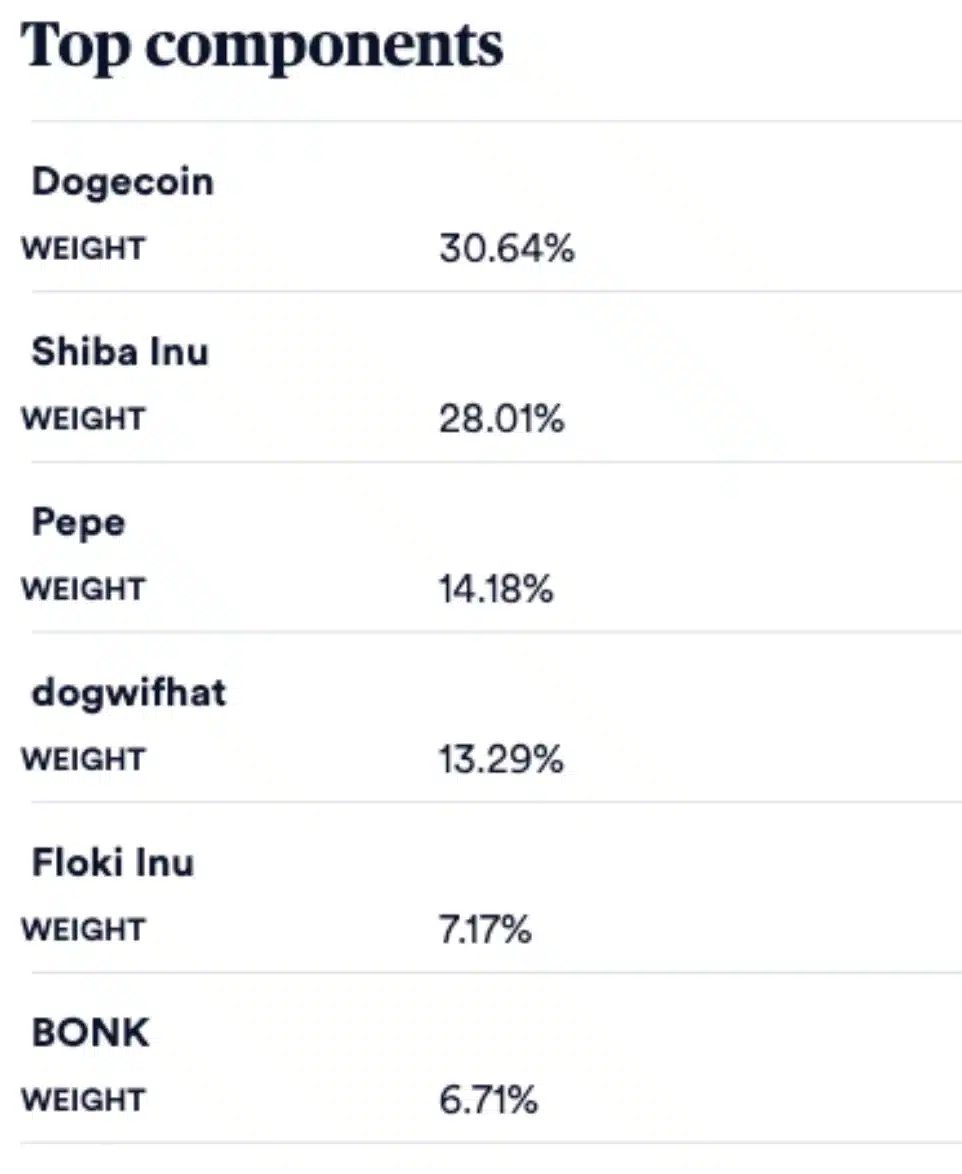

“VanEck’s @MarketVector launches $MEMECOIN index, top 6 assets, 30% cap.”

Source: MarketVector

He even issued a word of caution and added,

“These coins are intended for entertainment purposes”

However, seeing the potential for the memecoin asset class, an X user @free_electron0 said,

“And so it starts. The introduction of the ‘memecoin asset class’ to the world by TradFi.”

Memecoin’s future outlook

Ansem defied memecoin controversies by highlighting their substantial profits, surpassing any associated losses. He claimed,

“Looking at price is valid because anything that people can speculate on whether it’s like stocks, crypto, altcoins, Bitcoin, Ethereum…people can buy the top and lose money. Hence, that’s not really specific to memecoins.”