- Ethereum’s price nears $4,000, influenced by optimism around newly approved ETFs.

- Market analysts suggest the potential for Ethereum to reach as high as $10,000 in the current cycle.

In the wake of the U.S. Securities and Exchange Commission (SEC) approving applications for Ethereum [ETH]-based Exchange Traded Funds (ETFs), the king of altcoins has showcased a vigorous uptick.

Starting the week on a strong note, Ethereum recorded a 3.7% increase in the last 24 hours, pushing its price near the significant $4,000 mark, a considerable rise from recent weeks.

At press time, Ethereum traded at $3,899, marking a significant rebound from earlier fluctuations.

Ethereum faces potential $4,500 target

Amid this price movement from Ethereum, Arthur Cheong, CEO of DeFiance Capital, suggested that Ethereum might reach $4,500 before the trading of its spot ETFs commences, potentially in July or August.

Cheong drew parallels to the 2017 crypto boom, indicating that the introduction of spot Ethereum ETFs could attract a substantial retail investor base.

This is much like its Bitcoin [BTC] counterparts, which are seeing over 70% of positions held by retail investors.

The enthusiasm around Ethereum’s future performance is palpable among investors and market spectators.

However, it’s crucial to note that these projections remain speculative, with the actual market trajectory dependent on numerous factors including broader economic conditions and investor sentiment.

Moreover, the SEC’s current regulatory landscape shows a green light only for the initial 19b-4 requests for Ethereum ETFs, with the essential S-1 forms still awaiting approval.

Ethereum’s bullish trends

Despite these regulatory hurdles, Ethereum’s market dynamics have shown robust growth, not only in price but also in fundamental on-chain metrics.

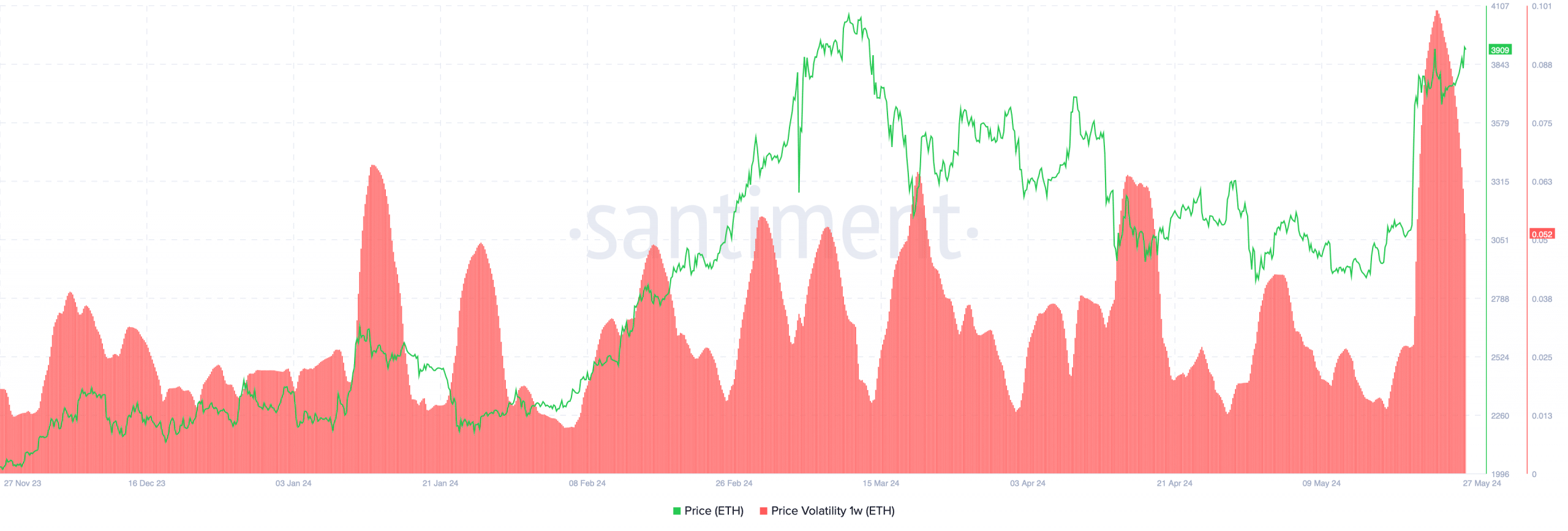

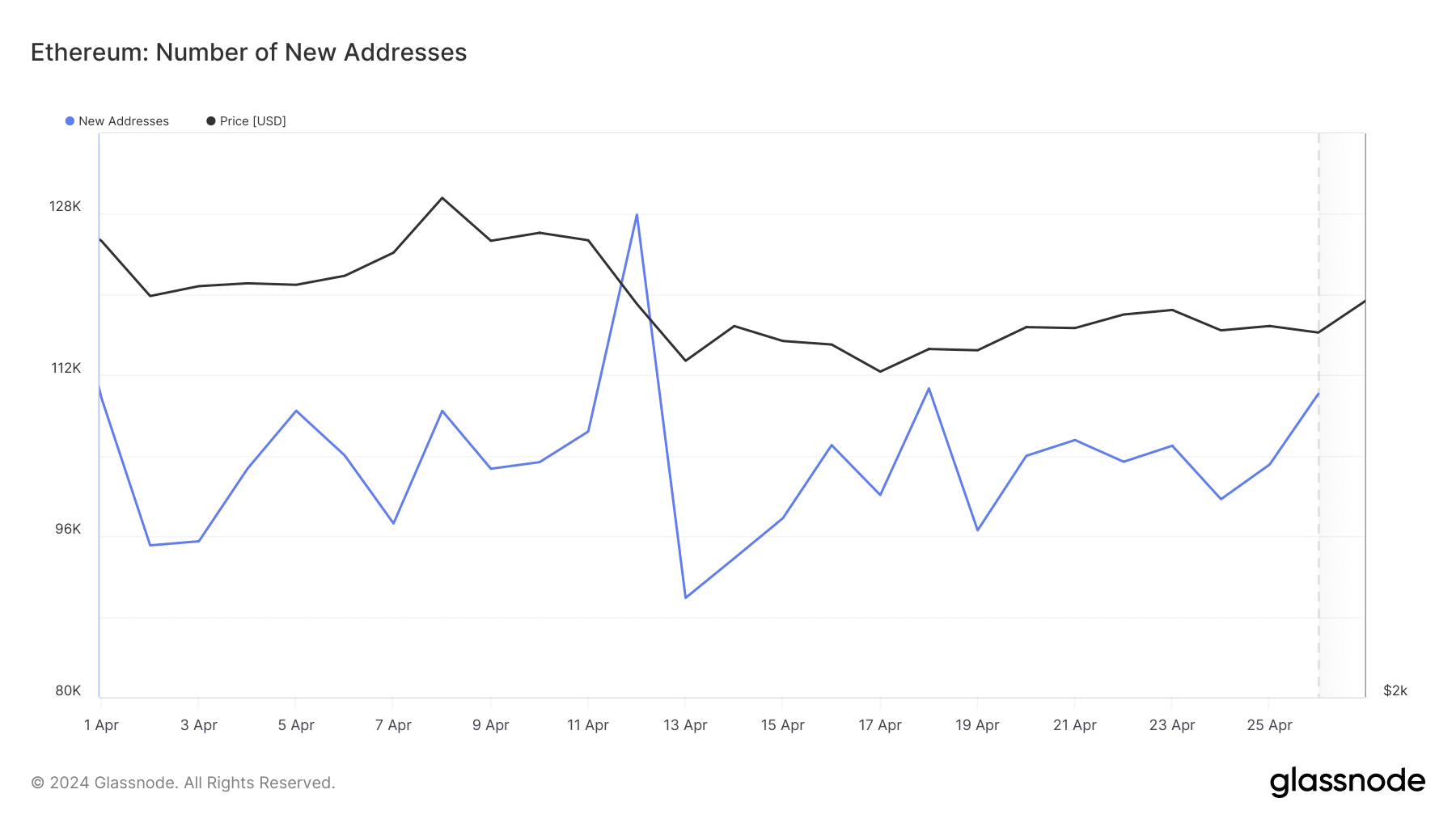

Data from Santiment highlighted a surge in Ethereum’s price volatility, a metric that has significantly increased from its low in the past fortnight to a notable peak today.

Source: Santiment

Notably, as the cryptocurrency’s price volatility is increasing along with its price, this indicates a period of heightened trading activity and interest, often driven by speculative buying.

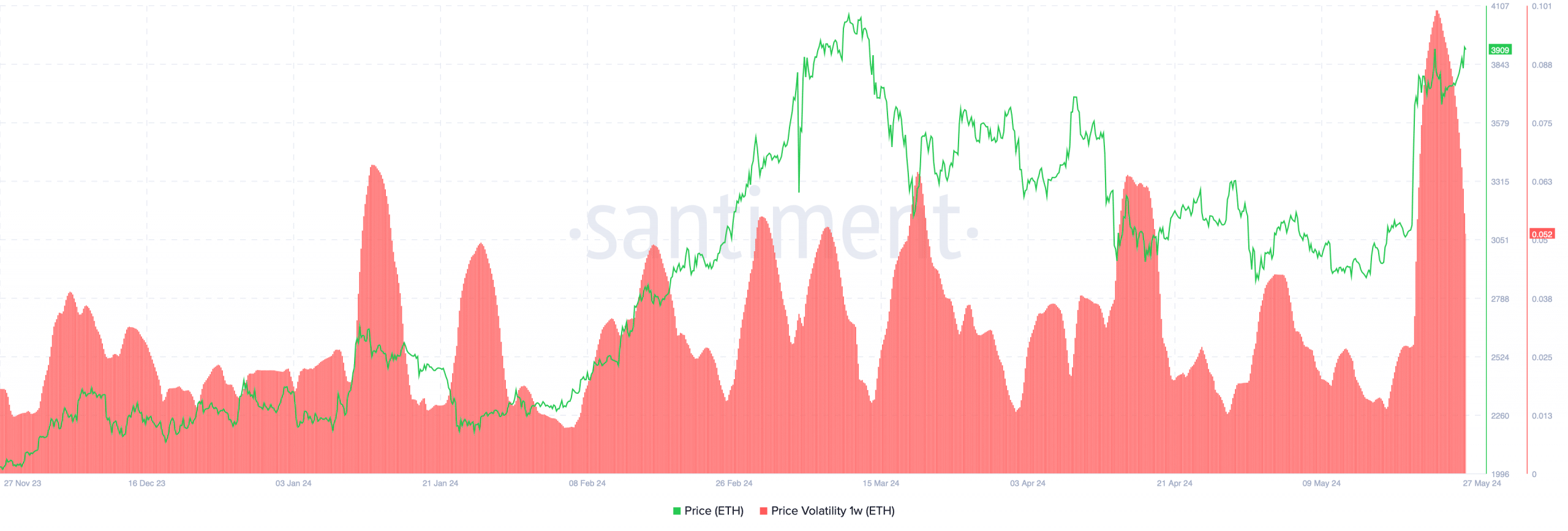

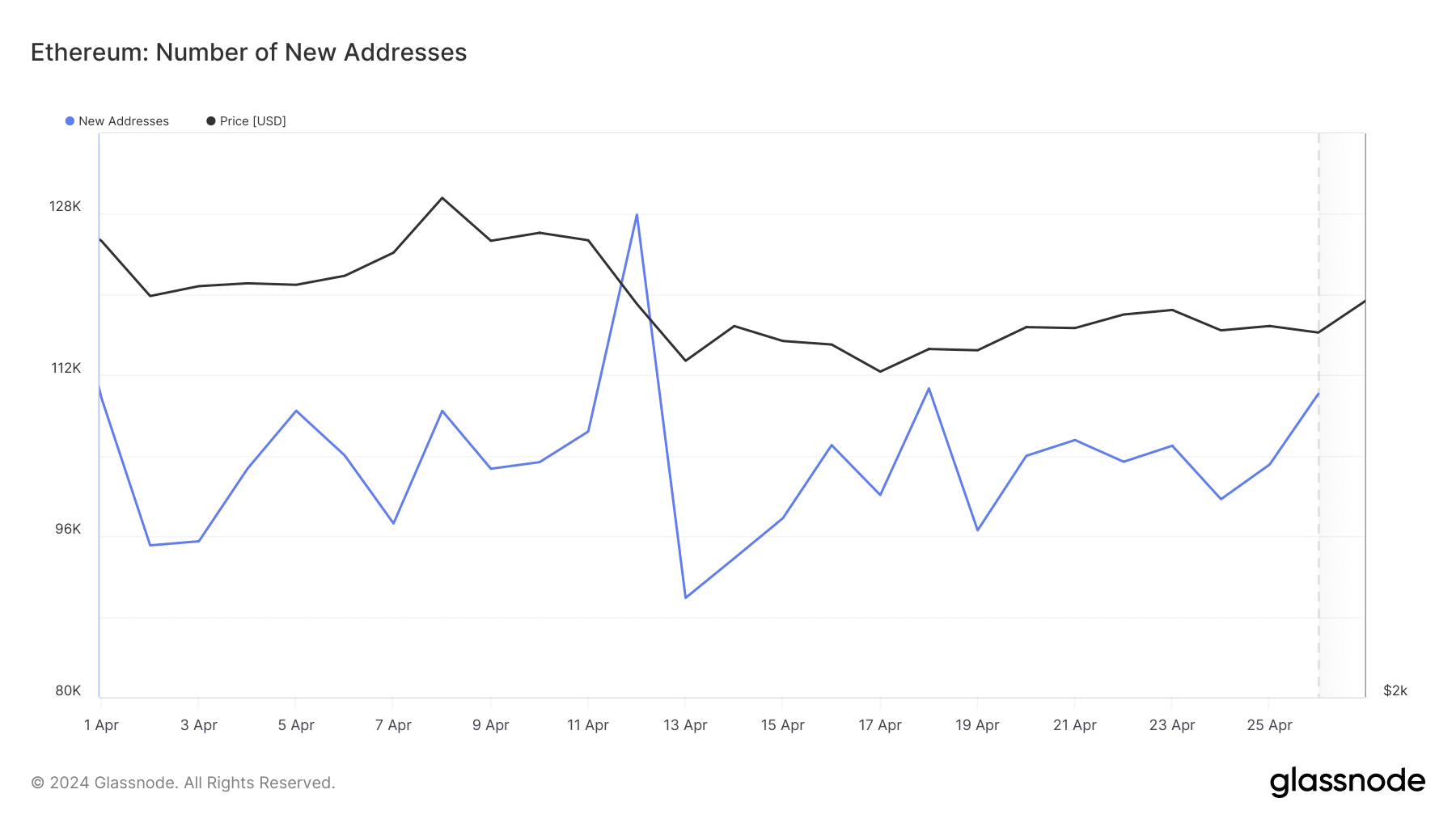

Adding to the growing interest, Glassnode reported an uptick in the number of new Ethereum addresses, suggesting an expanding network of users.

Such a rise typically signifies increased market participation, potentially buoyed by the positive market sentiment and broader adoption.

Source: Glassnode

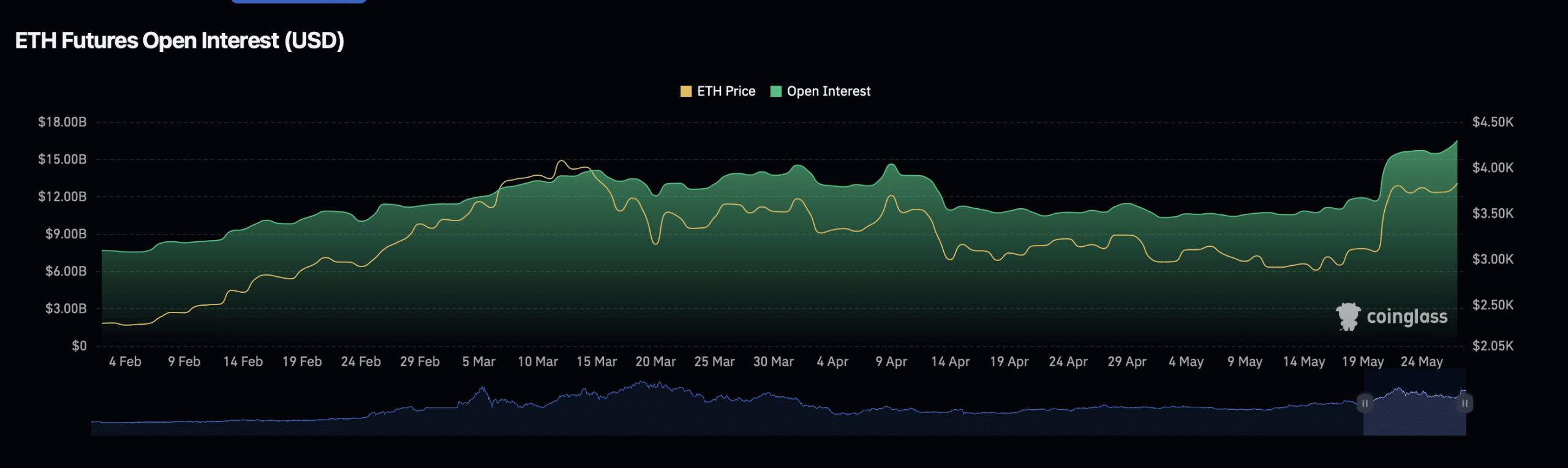

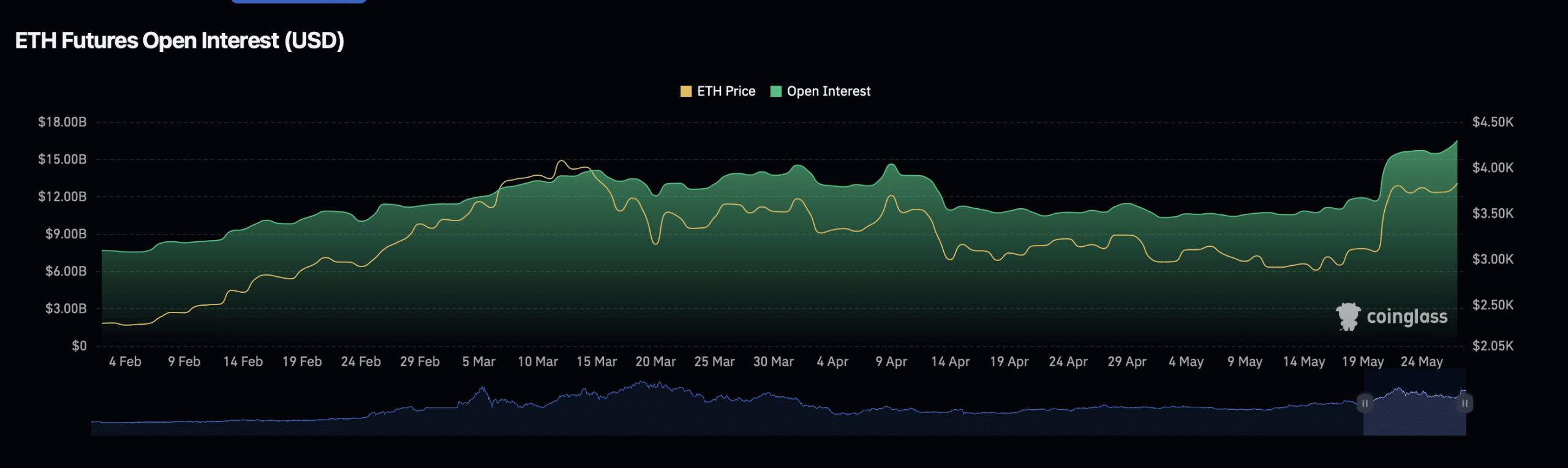

Moreover, Coinglass’ data revealed a spike in Ethereum’s Open Interest, underscoring an active derivatives market with heightened trading volumes.

This not only pointed to increased liquidity, but also to a rising speculative interest where traders anticipate forthcoming price movements.

Source: Coinglass

Nonetheless, an increase in Open Interest also implies greater market leverage, which could amplify both gains and losses, depending on market directions.

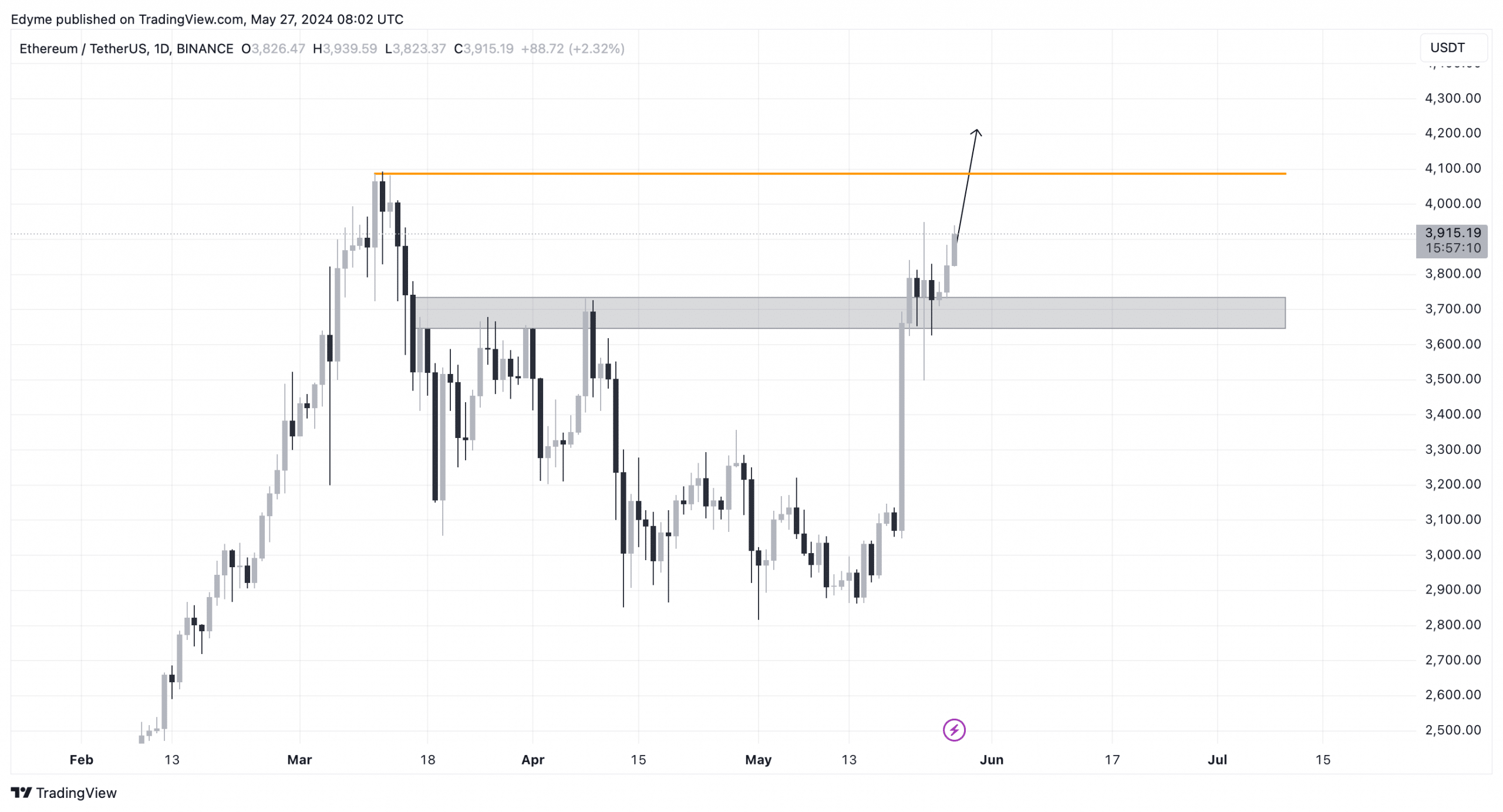

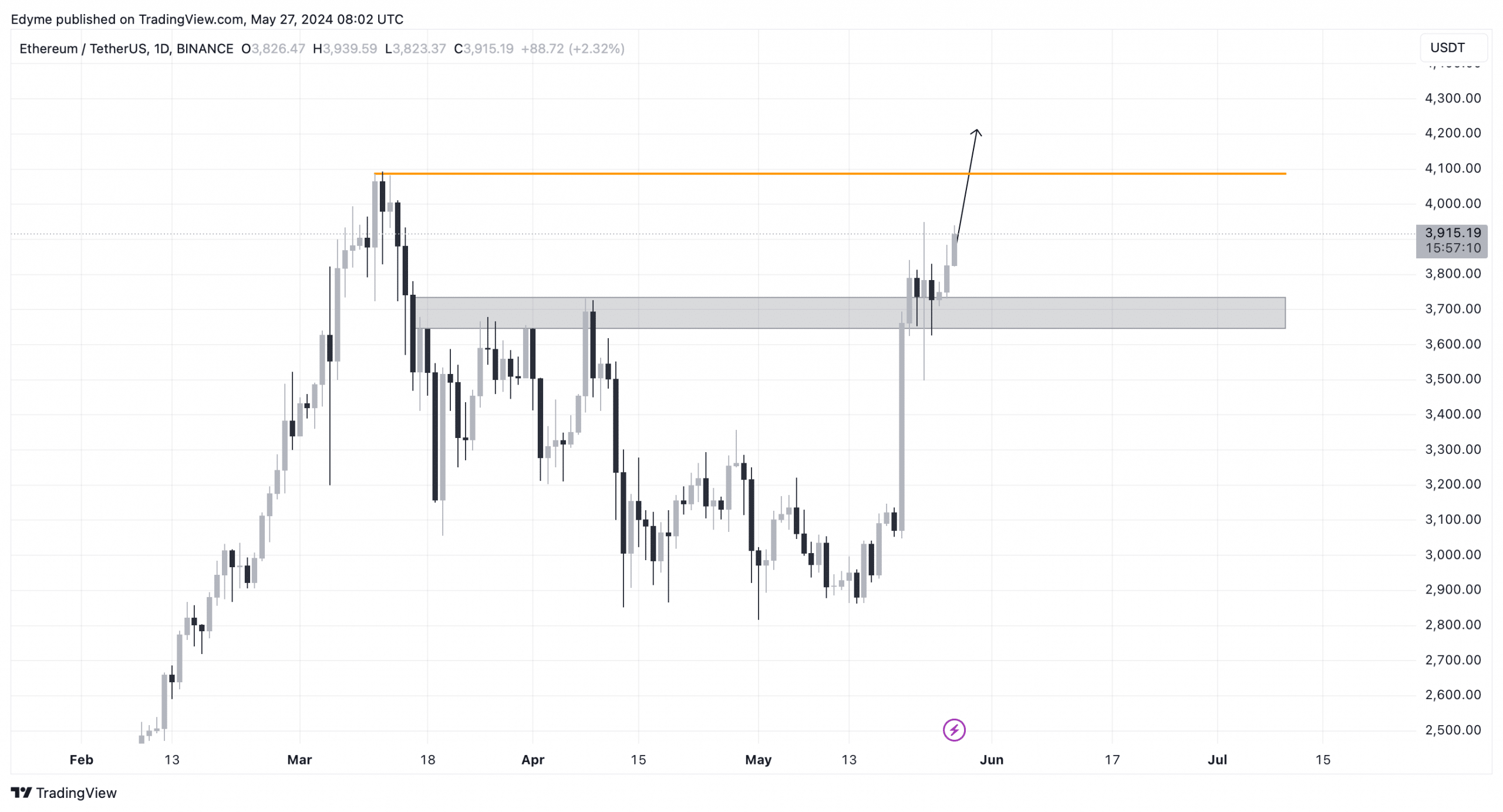

Technical analysis of Ethereum’s daily chart revealed that the cryptocurrency has recently breached the $3,700 resistance level flipping it to support, setting its sights on the next significant milestone at $4,000.

This breakthrough suggests that bullish momentum is strong, potentially driving further gains.

Source: TradingView

Is your portfolio green? Check out the ETH Profit Calculator

Concurrently, AMBCrypto, citing data from Glassnode, reported a significant decrease in Ethereum’s Network Value to Transaction (NVT) ratio.

A reduction in this ratio suggests that the asset is currently undervalued, which may indicate an impending rise in its market price.