- Ethereum presented a bearish possibility on the price charts for April and May.

- The chances of an ETF approval for Ethereum were bleak, at best.

“Sell in May, walk away” used to be a popular saying in crypto. It is not May yet, but Ethereum [ETH] holders are already beginning to walk away.

Crypto analyst Daan Crypto took to X to highlight some scenarios that could play out regarding the Ethereum ETF speculation.

Eric Balchunas, senior ETF analyst at Bloomberg, revealed that their odds of an ETH ETF approval were at 25%. With the deadline in May, a negative outcome could cause prices to slide further south.

AMBCrypto analyzed the price action and relevant metrics to understand the market situation, and if (or when) investors should turn bullish on the altcoin king.

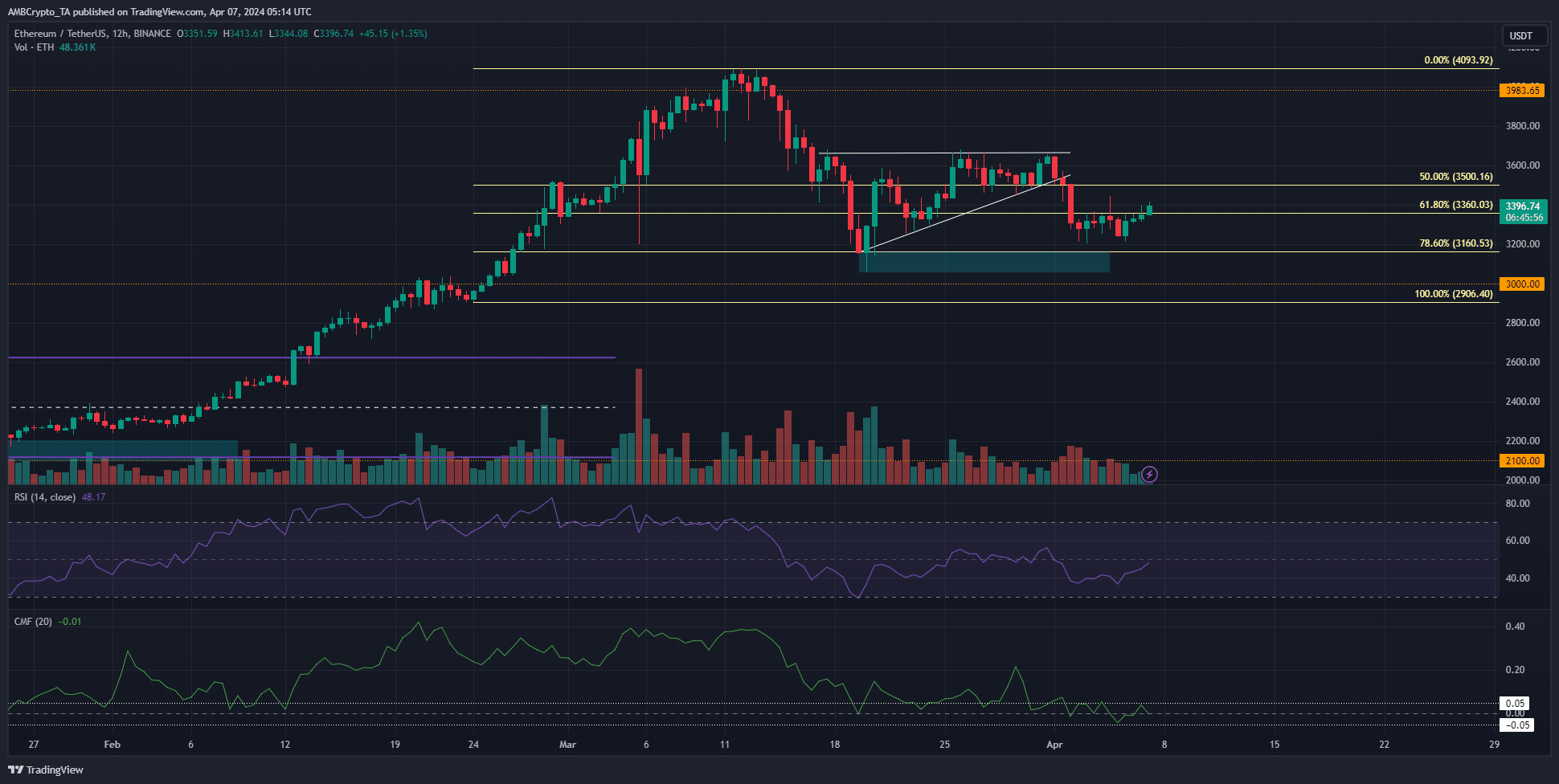

The bearish pennant was playing out

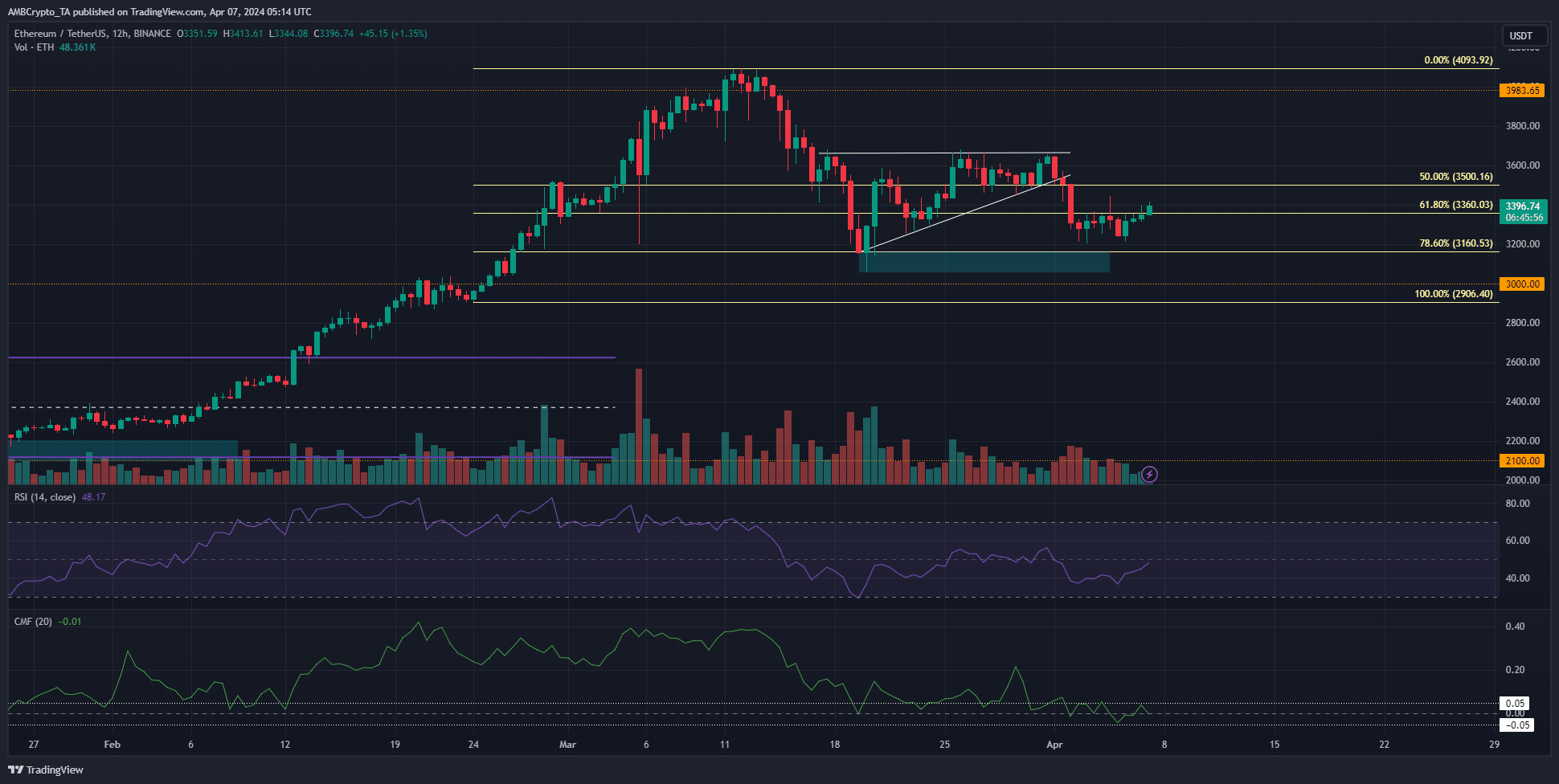

Source: ETH/USDT on TradingView

The 12-hour market structure was still bullish. ETH set a higher low at $3056 on the 20th of March. A recent AMBCrypto report showed that a bearish chart pattern had developed and could see prices fall to $2800.

This bearish outlook has not yet changed. A move below $3056 would mean that swing traders should shift their bias toward selling. The technical indicators were also growing increasingly bearish.

The RSI showed a reading of 44 and has been below neutral 50 for the majority of the time since the 15th of March. The CMF was also trending downward to show capital outflow was rising.

However, neither the momentum nor the capital flow were significantly bearish on the 12-hour chart.

The bulls still have some hope that the bearish chart pattern would not move toward its completion – which is a drop to the $2.6k-$2.8k region.

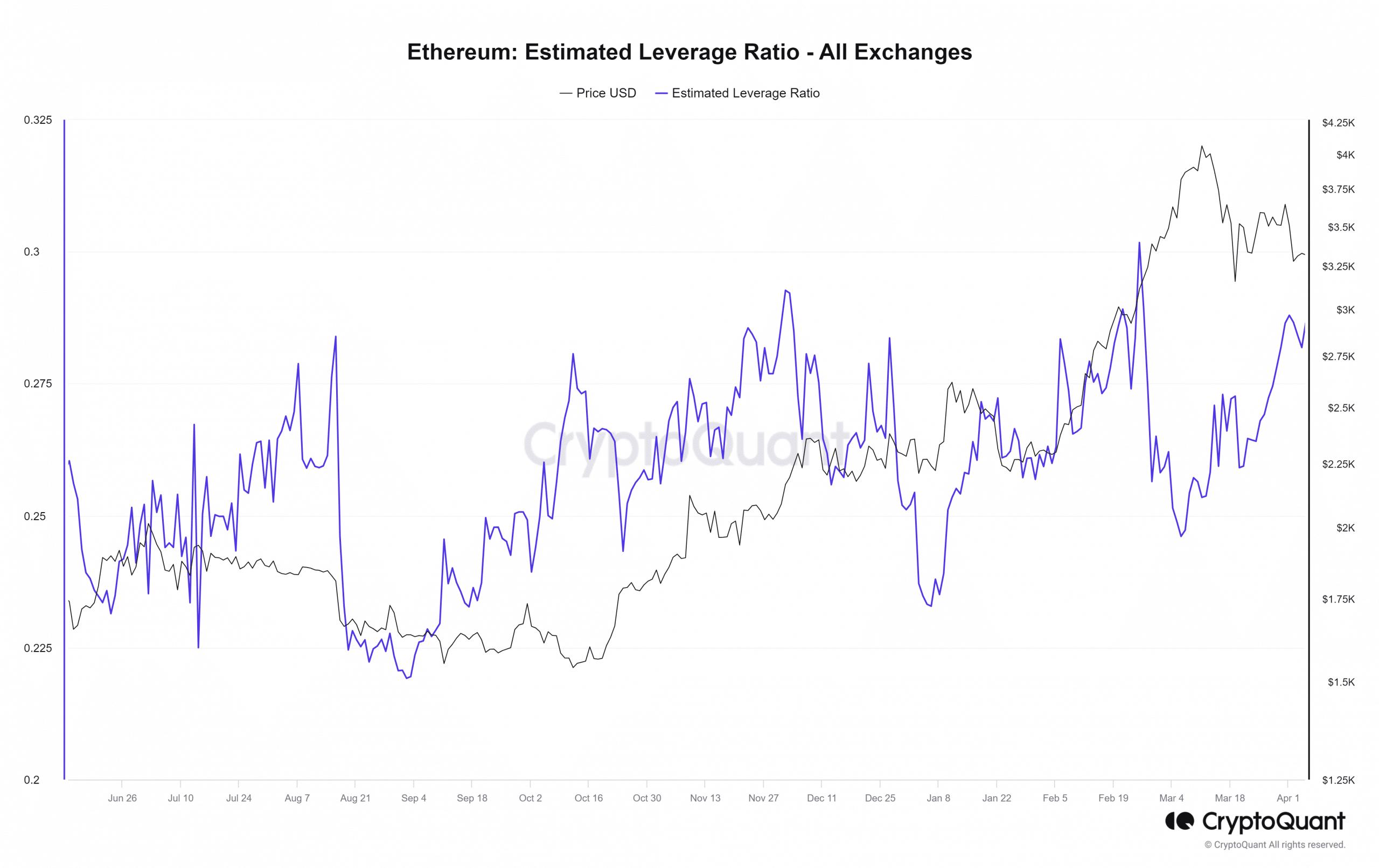

The on-chain metrics showed volatility ahead

In March, Ethereum faced a rejection at $4.1k. A week before this pullback, the estimated leverage ratio (ELR) began to fall. After the pullback, the ELR began to trend higher.

The ratio is defined as Open Interest/exchange reserve (of Ethereum).

Hence, a rising ELR means the OI is rising, or that the reserve is trending downward. A rising Open Interest was not in evidence based on Coinglass data for the past two weeks.

The recent ETH losses saw the ratio decline slightly. It showed speculators were beginning to unwind their leverage positions in the face of market adversity.

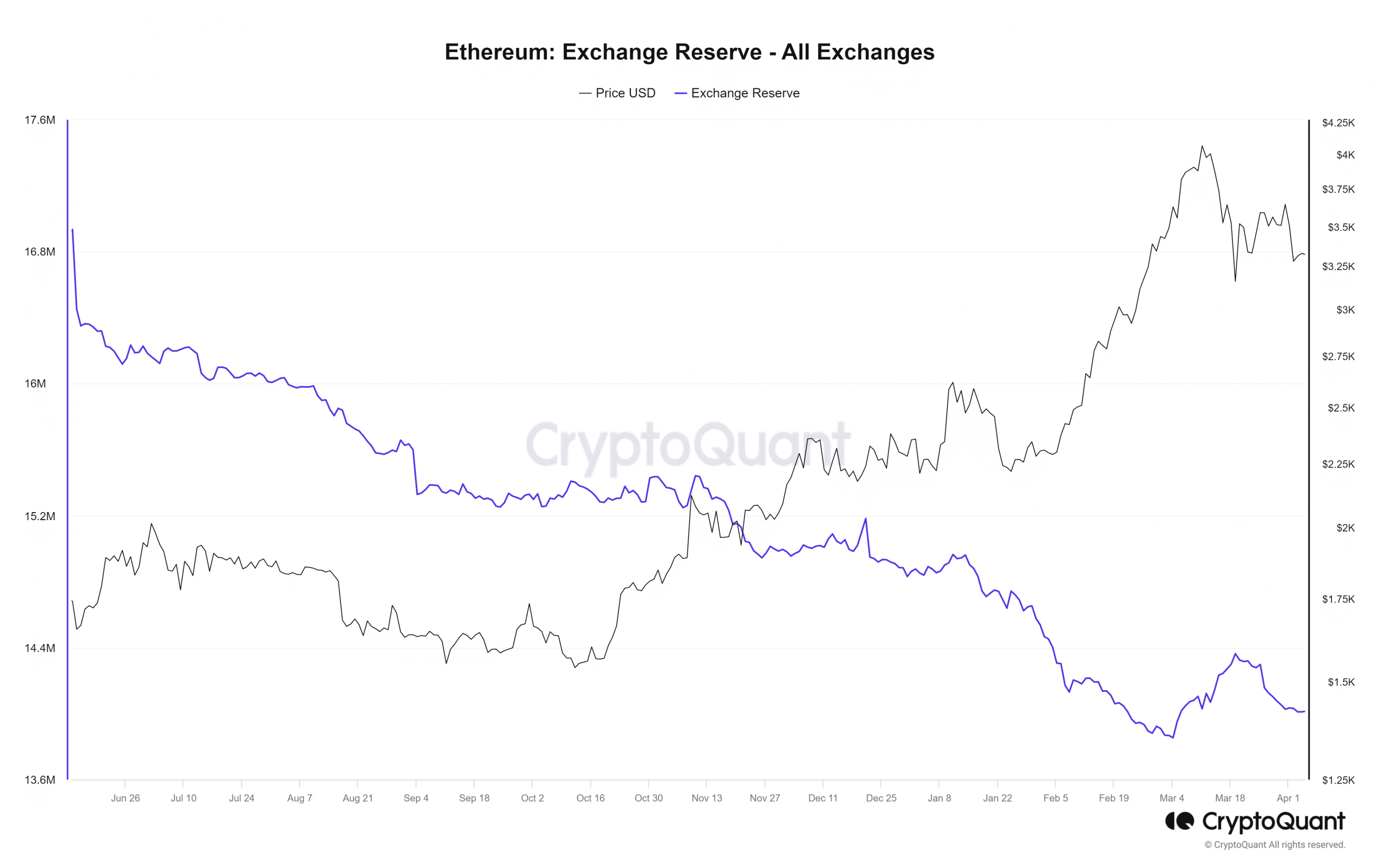

Do long-term holders anticipate volatility, too?

Analysis of the Ethereum exchange reserve showed a downtrend since mid-March, after a two-week spike in early March. This showed that holders had likely taken profits and the wave of selling has begun to lighten.

Falling exchange reserves indicate rising accumulation, and were a positive take-away for ETH investors.

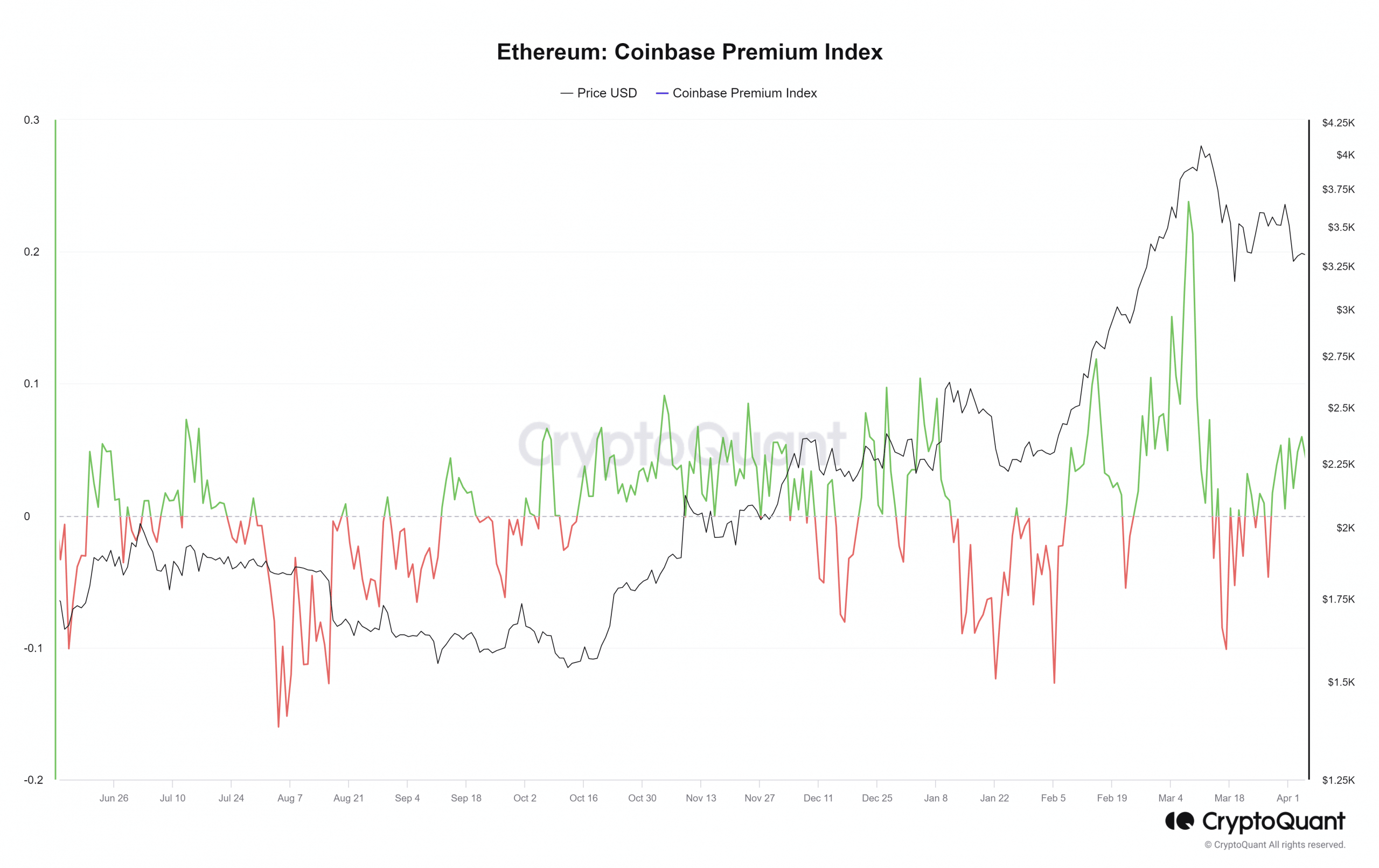

The Coinbase Premium Index reflects the percentage difference between Ethereum prices on Binance and Coinbase on the USDT (Tether) pair. The past two weeks saw the Premium Index trend higher.

While it did not reach the highs from earlier in March, it still hinted at bullish U.S. investors.

The technical analysis showed a bearish performance was likely in April. The leverage ratio revealed that speculators were also beginning to move toward the sidelines for fear of volatility.

Meanwhile, other on-chain metrics showed bullish investors despite the losses.

Read Ethereum [ETH] Price Prediction 2024-25

Overall, the impact of the Ethereum ETF, or its denial, would be a pivotal event in May. As things stand, the U.S. SEC favored denial, and Balchunas states,

“There were no positive signs.”

The Bitcoin [BTC] performance in the weeks following the halving could lead to more downside. Hence, Ethereum investors have a reason to be wary for the next 6–8 weeks.