- ETH plunged by 8% despite the remarkable US spot ETH ETF debut.

- Analysts offer mixed views on the ETH’s downward pressure.

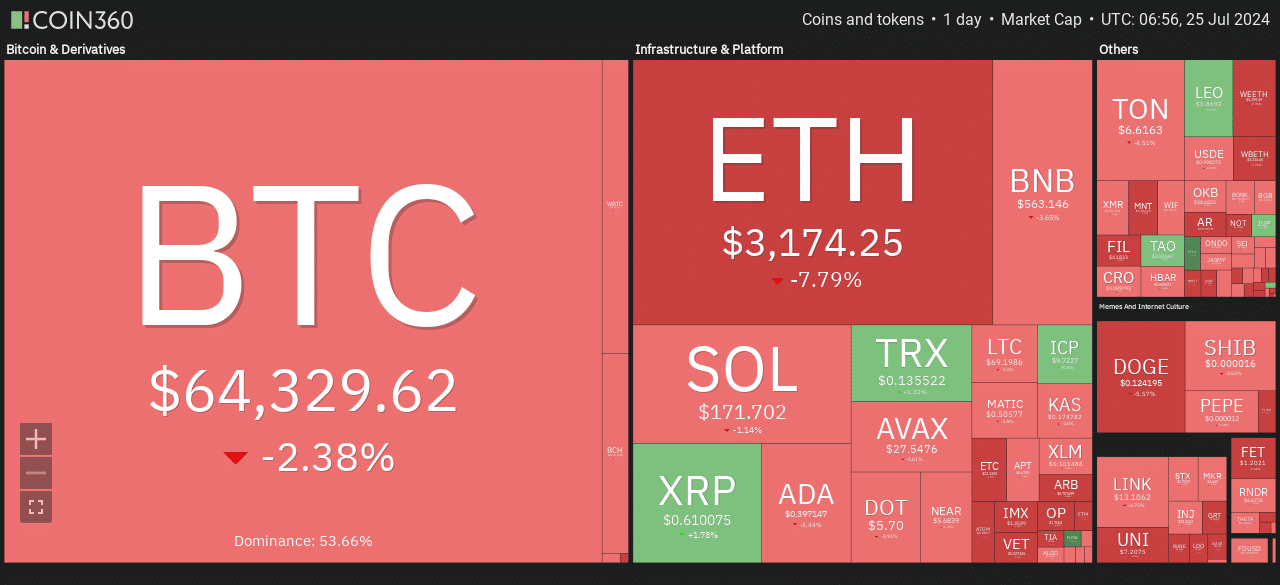

Ethereum [ETH] dropped by over 7% on 24th July’s intraday trading session, following an overall meltdown across US equities that reportedly wiped out over $1 trillion in value.

Amidst the market crash, the largest altcoin, which has been consolidating below $3.5k before and after the US spot ETH ETF debut, inched closer to the $3000 mark.

Source: Coin360

Interestingly, the remarkable performance of ETH ETF the last couple of days didn’t deter the massive plunge. So, why is Ethereum down?

Market observers had mixed views on the plunge. According to Hsaka, a renowned altcoin trader and market analyst, the US stock market crash could have dragged ETH prices.

‘Ethereum finally gets integrated with TradFi. Within 24hrs, Nasdaq worst close in 2 years, $1.1 trillion wiped out from the US stock market today.’

However, the dump was not entirely unexpected, according to Charles Edwards, founder of crypto hedge fund Capriole Investments. Edwards argued that the ETH ETF was ‘bad’ for both Bitcoin and ETH.

‘The ETH ETF launch has been bad for BTC and bad for ETH. ETH has been languishing this entire cycle, and now it’s muddied the waters at the institutional level with the ETF launch.’

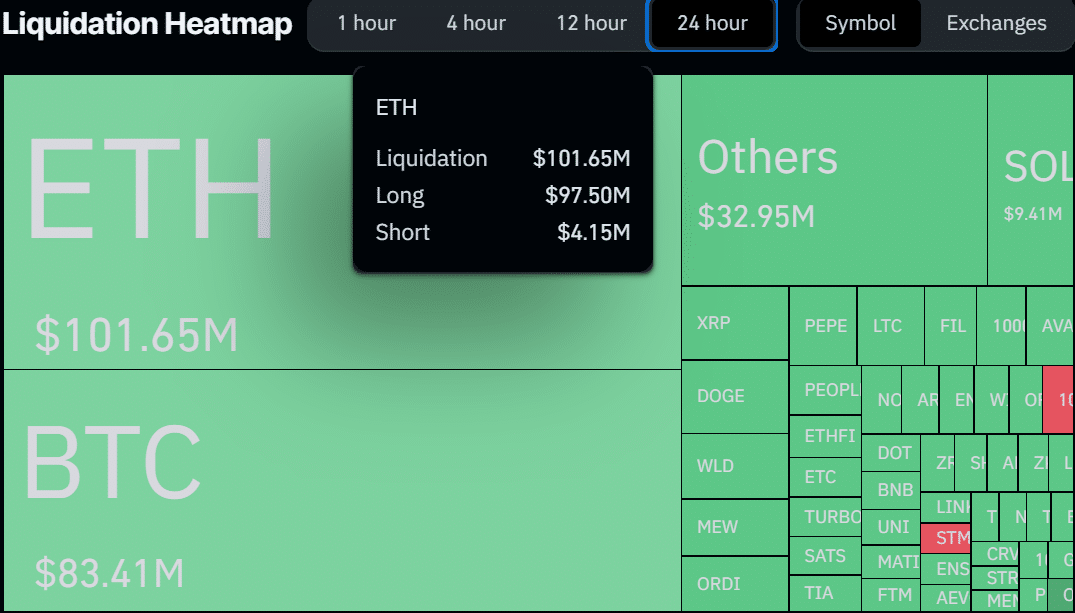

Ethereum dump trigger $100 million in liquidations

The 7% plunge triggered over $100 million in liquidation in the past 24 hours, with the leveraged bulls suffering the most.

Per Coinglass data, long positions worth $97.5 million were rekt, while bears only experienced a blip, worth about $4.15 million.

Source: Coinglass

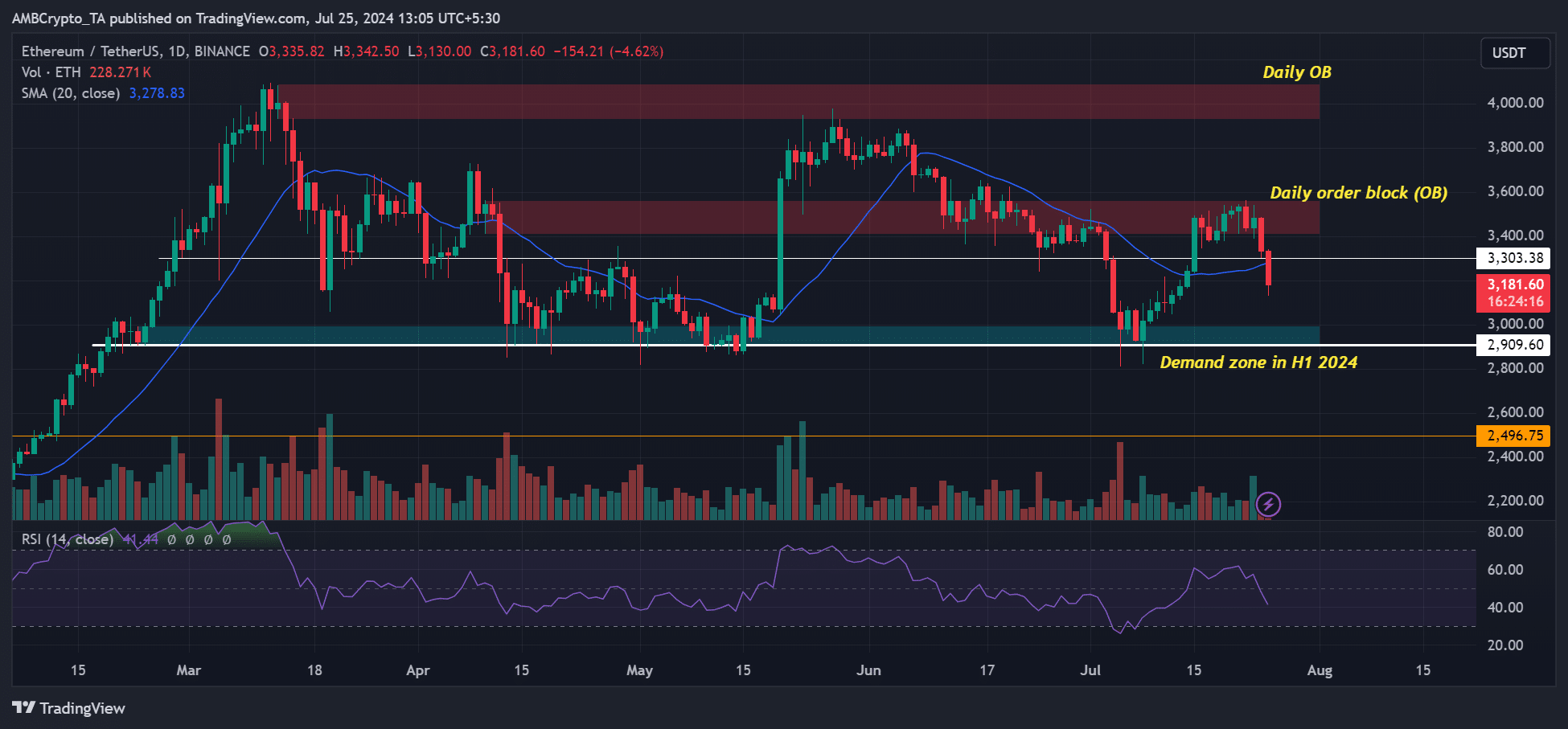

Additionally, as of press time, key derivatives signals, from volume to open interest (OI) rates, were in red, underscoring bearish sentiment on the futures side of the market.

This meant that the ETH price could be subdued into the weekend if the negative market sentiment persists.

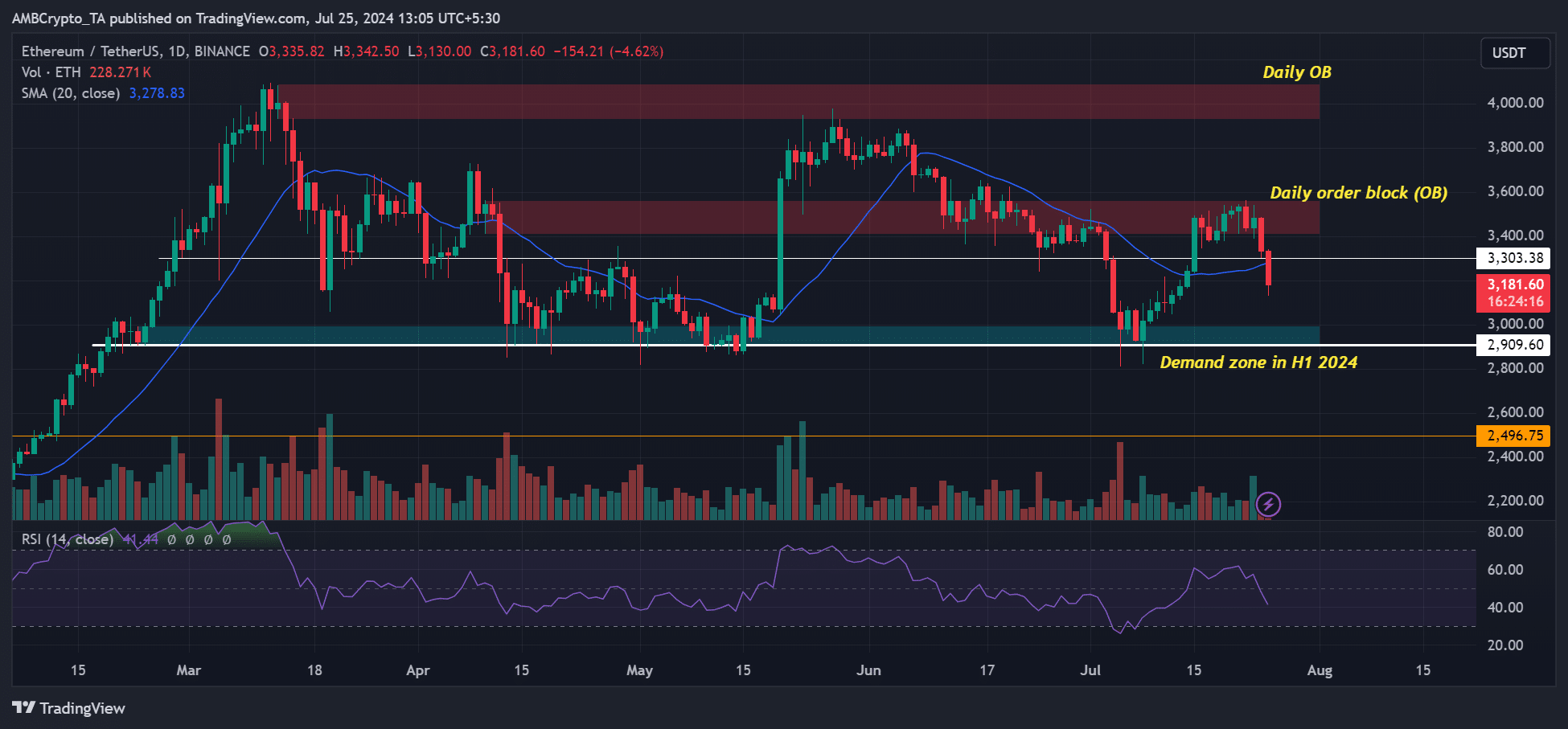

If the downward pressure was sustained, then a retest of $3000 could be likely. The psychological level has been a key demand zone in 2024 and has been defended during past dumps.

A daily candlestick close below the 20-day SMA (Simple Moving Average) could accelerate a drop to the $3k demand level.

Source: ETH/USDT, TradingView