Data shows Binance’s NFT marketplace wasn’t really a popular destination for Ordinals anyway — with traders now fixated on Runes instead.

Binance’s decision to scrap support for Ordinals in April raised eyebrows among Bitcoin enthusiasts.

The embattled exchange, which has been fighting legal battles on multiple fronts in recent months, said the move was designed to “streamline” its product offering.

It went on to warn anyone who holds Bitcoin NFTs to move them somewhere else so they could continue to be eligible for airdrops.

This marks quite a sudden U-turn from Binance, which is the biggest crypto platform in terms of trading volume.

Ordinals only became technologically possible early last year and allow inscriptions to be made on a single satoshi — the equivalent to one 100-millionth of a Bitcoin.

Images, videos, and other forms of data can now be attached to sats as a result, but critics claim this only serves to clog up Bitcoin’s blockchain.

Only last May, Binance’s head of product Mayur Kamat said:

“Bitcoin is the OG of crypto. We believe things are just getting started here and can’t wait to see what the future holds in this space.”

Mayur Kamat

So why the dramatic reversal — and will this serve as a crushing blow to the future of Ordinals?

How are Ordinals holding up?

Binance officially ended support for Ordinals on April 18, meaning they could no longer be traded through the platform’s NFT marketplace.

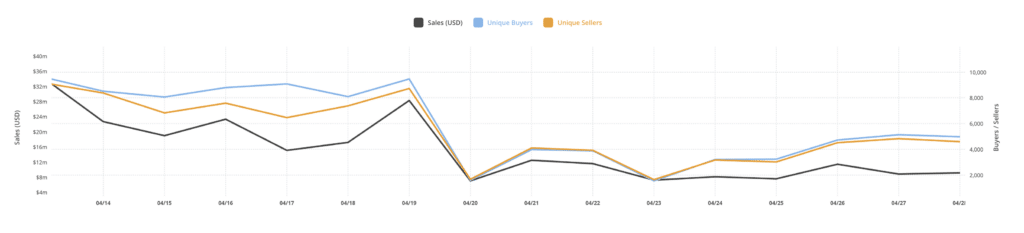

Data from CryptoSlam! does show that there has been a marked fall in Ordinals sales volumes — as well as the number of unique buyers and sellers — since.

Ordinals sales, unique buyers and sellers | Source: CryptoSlam!

Sales volumes stood at $28.2 million on April 19, with 9,469 unique buyers and 9,728 unique sellers overall.

Fast forward one week to April 26, and revenues had slumped to $11.4 million. Meanwhile, the number of buyers and sellers had more than halved to 4,722 and 4,515 respectively.

However, it’s important to stress that correlation does not imply causation, and there are other factors at play here.

For one, April 19 officially marked the latest Bitcoin halving, which saw block rewards tumble from 6.25 to 3.125 BTC. Traders have been preoccupied with other things.

But second, the halving also led to the launch of Runes — a new standard that allows fungible tokens (like ERC-20 on Ethereum) to be rolled out more efficiently on Bitcoin.

Data from Dune Analytics powerfully explains what happened during the second half of April:

Source: Dune Analytics

On April 19, Ordinals had a 6.5% share of transactions on the Bitcoin blockchain.

A day later — when Runes made their debut — Ordinals represented just 0.4% share as frenzied demand for memecoins shot up.

The hot pink in the chart above represents the proportion of daily Runes transactions, which hit a staggering share of 73.5% on launch day.

Put another way, Binance isn’t solely to blame for dwindling demand for Ordinals — Runes are stealing their lunch money.

What next for Ordinals?

It’s unlikely that Ordinals collectors will lose much sleep over Binance exiting the market — especially considering the exchange has been banned or severely restricted in 20 countries worldwide. They include Canada, China, Japan, Italy, Australia, the U.K. and the U.S.

Further Dune Analytics dashboards show Binance’s NFT platform wasn’t really a popular destination for Ordinals anyway.

On April 29, two marketplaces — OKX and Magic Eden — handled 94% of transactions between them.

Source: Dune Analytics

You could argue that this amounts to Binance placing its resources into areas where it can actually gain a larger market share.

The bigger question now is this: will Binance be rolling out support for Runes any time soon?

Binance teases listing Runes

They didn’t list BRC-20 until many months after it launched

But when they did, there was hundreds of millions of dollars in volume and it led $ORDI to hit $1B valuation pic.twitter.com/ut7hVx3B7t

— trevor.btc (@TO) April 22, 2024

As trading volumes continue to surge for newly launched memecoins on the Bitcoin network, it seems inevitable that Binance will want a slice of the pie.

With exchanges engaging in a brutal price war to stay competitive on transaction fees, trading platforms are always looking to diversify their revenue streams.

Demand for Ordinals may have dipped in recent weeks, but Bitcoin remains the second-largest blockchain for NFT sales volume — streets ahead of Solana, with Ethereum recently returning to the top spot.

If appetite for Bitcoin NFTs recovers, Binance’s decision to bow out of offering Ordinals through its marketplace may prove short-sighted.

Read more: Binance’s CZ in talks with Sam Altman to explore AI investments