- Buying momentum on Coinbase decreased, suggesting a further decline for Bitcoin.

- The negative Sharpe Ratio indicated that BTC might not produce good gains in the short term.

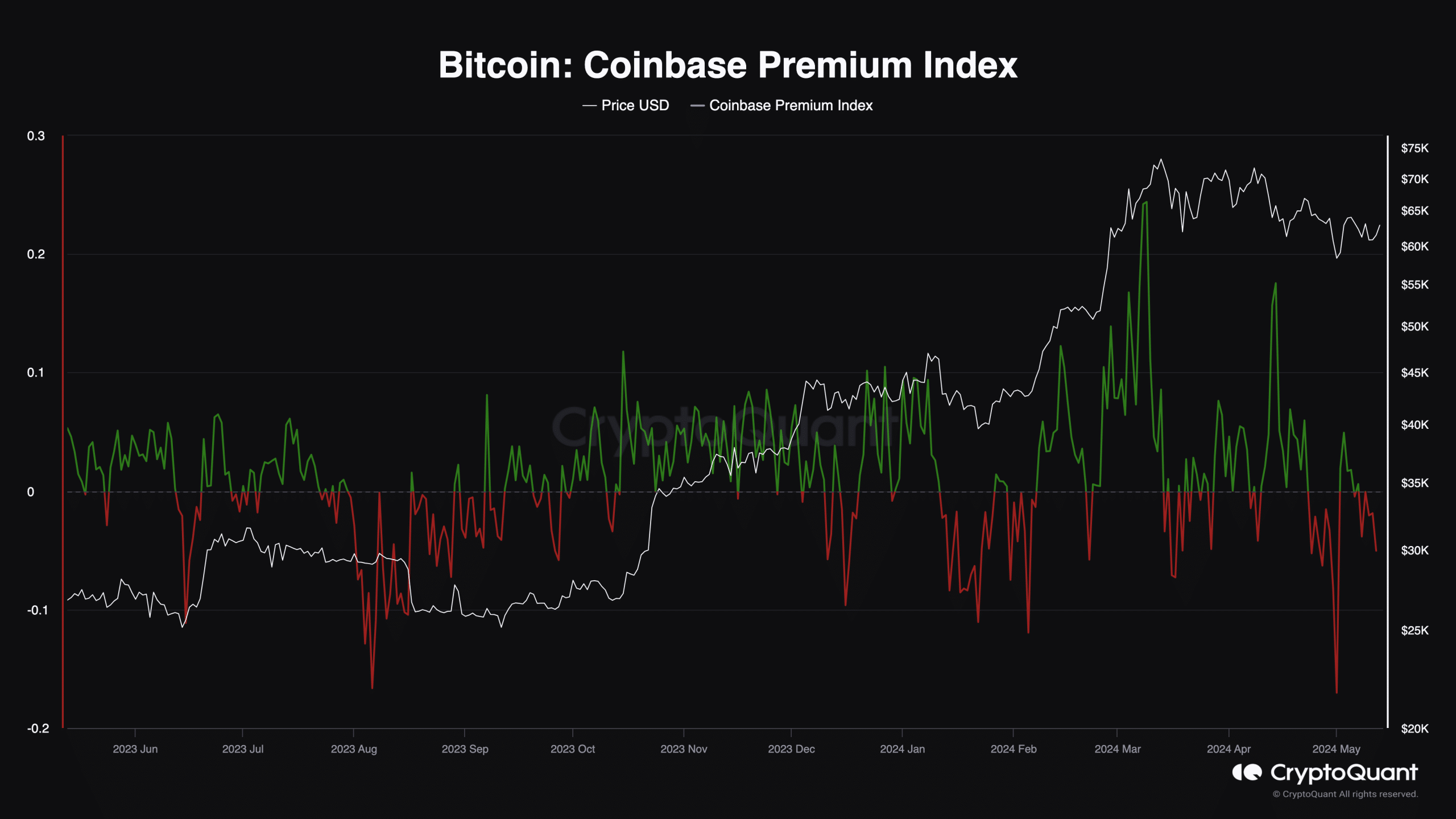

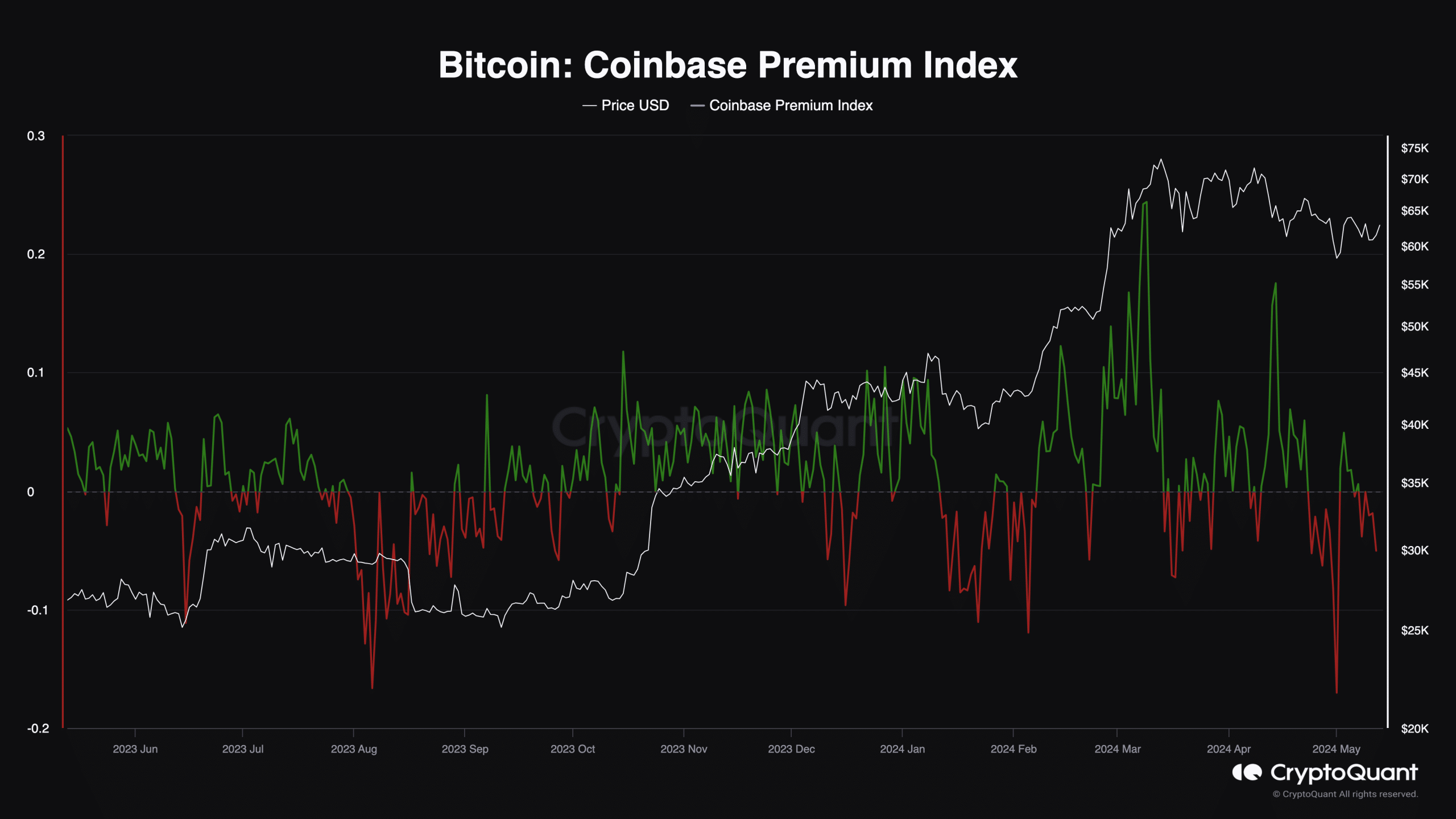

Bitcoin [BTC] might experience another downturn, according to signals from the Coinbase Premium Index.

This index shows the level of buying pressure among investors in the U.S.— especially as the nation has a high number of Bitcoin holders.

High premium values indicate an increase in buying pressure. On the other hand, a low reading of the Coinbase Premium Index suggests a surge in sell-offs.

The big players are letting go

According to AMBCrypto’s analysis using CryptoQuant, the index was -0.050 at press time. This was a sign that many U.S. Bitcoin holders were selling instead of accumulating.

Source: CryptoQuant

Signal Quant, a wallet profiler and author on CryptoQuant commented on the trend.

According to the handle, the state of this leading indicator means that Bitcoin’s price might experience another correction before a significant bounce.

“The current Coinbase Premium trend is currently positive, close to zero. So if the historical pattern repeats itself, we may have a better chance of success if we wait a bit longer and invest in the rebound after the trend turns negative.”

At press time, the price of BTC was $62,785 — a 2.94% increase in the last 24 hours. Coming from the analysis above, this price increase might not last long.

But if users in the U.S. start to buy in large numbers, this bearish outlook might be invalidated. However, AMBCrypto considered other metrics to confirm it a rise beyond Bitcoin’s current peak could take more time.

Risky season is here

To do this, we looked at the Sharpe Ratio. In simple terms, this metric tells you whether to take a risk with an investment or not.

If the Sharpe Ratio is positive, it means that the potential Return On Investment (ROI) might be great compared to the risk involved.

Furthermore, a negative Sharpe Ratio indicates that the possible reward might not be worth the risk. This was the case with Bitcoin, as blockchain analytics tool Messari showed that the reading was -2.22.

Source: Messari

However, returns for BTC might start to rise once the metric rises to the zero midpoint. In the meantime, Bitcoin’s total supply in profits was 87.03%.

For a significant bounce to occur, the percentage might need to decrease. And a reasonable point for it to drop to could be 78.20%. This was the same profit supply Bitcoin had before it rallied back in March.

If the supply declines to a similar level, BTC might begin a run that could take it above $75,000.

Source: Santiment

Is your portfolio green? Check the Bitcoin Profit Calculator

In addition, the one-day circulation was down to 17,600, indicating that the number of coins engaged in transactions has decreased.

Should the circulation increase, Bitcoin might begin another trip down the charts.