- Two whales were seen moving big chunks of their holdings to exchanges.

- Contrasting signals emerged upon examination of on-chain indicators.

Leading memecoins trended lower in the last few days of trading, triggering concerns and speculations over the possible end of what has been a wild bull market for various dog and frog-themed tokens.

While second-largest memecoin Shiba Inu [SHIB] retraced 12% since the 9th of March, frog-themed Pepe [PEPE] was down by nearly 5% in the same time period, AMBCrypto noticed using CoinMarketCap.

Did whales spot bull market peak?

What raised anxiety among the memecoin community was the movement of large chunk of holdings from whales to exchanges recently.

According to on-chain data tracker Spot On Chain, a smart money investor deposited 200 billion SHIB tokens, equating to nearly $6.5 million, to Gemini and Crypto.com on the 12th of March.

Notably, the whale was an early buyer and had amassed 15.2 trillion SHIBs in August 2020. The smart investor was sitting on estimated profits of $129 million with 2.6 trillion still in their kitty.

In the second instance, a whale transferred 500 billion Pepe tokens, worth over $4 million, to OKX exchange. If they decide to sell, they would make profit of $3.39 million.

Typically, large movement of coins from whale wallets to exchanges signals an impending sell-off, and therefore big correction in prices.

Not as straight forward as you think it is

AMBCrypto investigated other key indicators of the aforementioned tokens to understand the market mood.

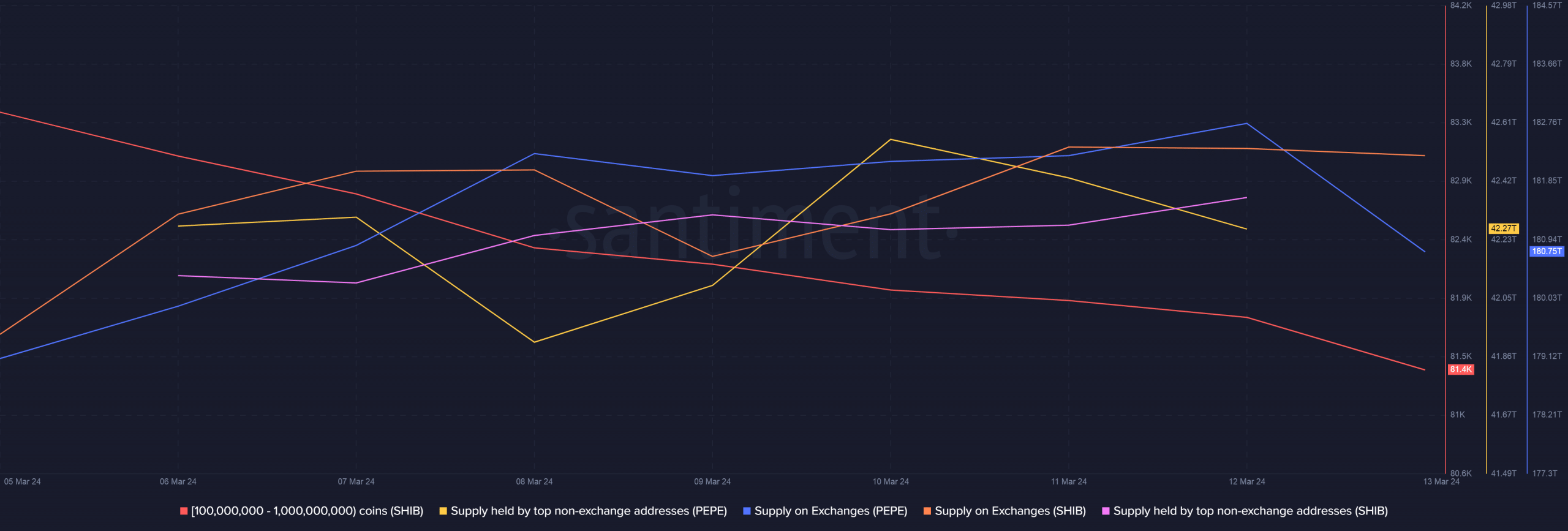

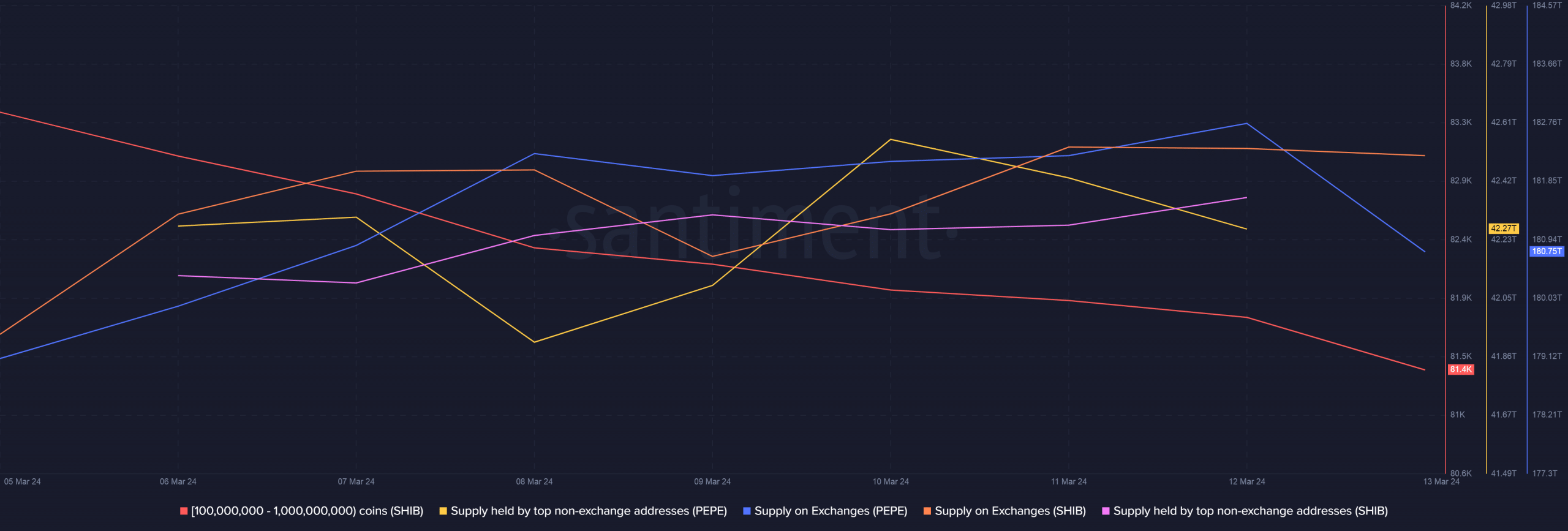

According to data fetched from Santiment, the supply held by top Pepe wallets dropped since the start of the week. In contrast, the supply held by SHIB whales rose in the same time.

Surprisingly, exchange reserve for both the meme tokens dropped in the last few days. This countered previous concerns of a broader market whale dumping event.

Source: Santiment

Read SHIB’s Price Prediction 2024-25

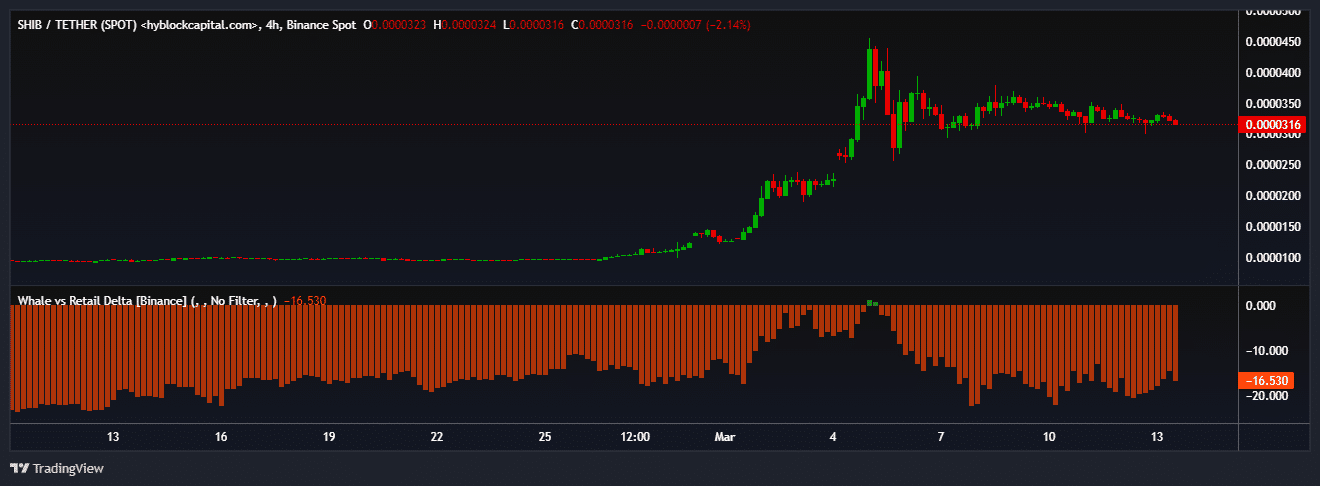

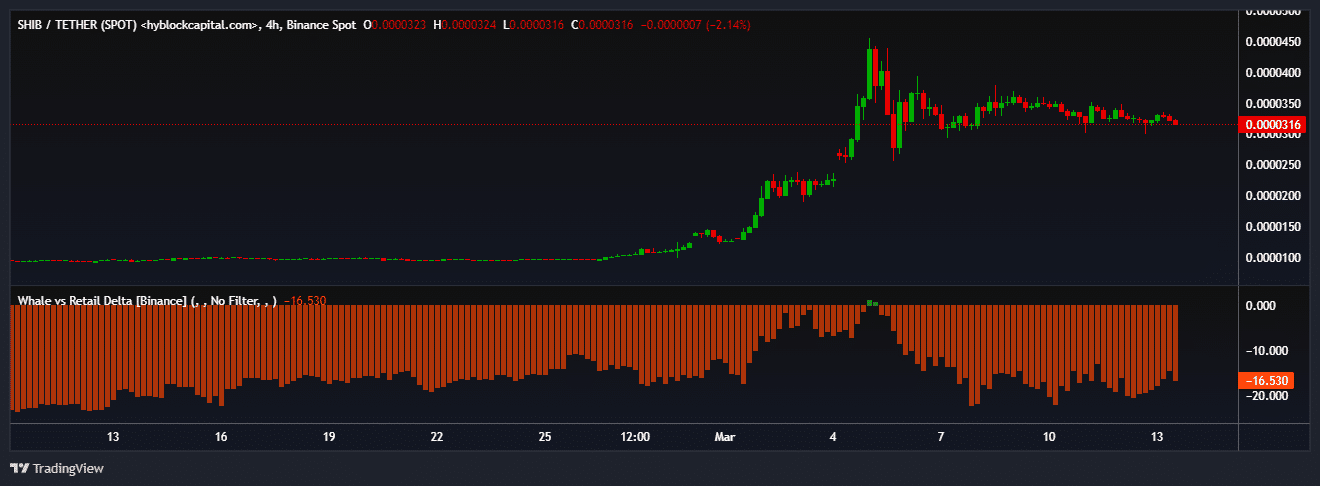

Whales bearish on SHIB

Additionally, top whales have been reducing their long exposure to SHIB over the past week, as per AMBCrypto’s analysis of Hyblock Capital’s data.

The signaled that they were not too optimistic of SHIB’s northward movement in the short-term, justifying their profit-taking.

Source: Santiment