Groundbreaking technology at the heart of cryptocurrencies such as Bitcoin and Ethereum has paved the way for innovative applications. Yet, their significant volatility has limited their utility for everyday transactions, making them challenging to use as substitutes for fiat currencies. Enter stablecoins—a more stable alternative.

In this article, we delve into the world of stablecoins, exploring their definition, the challenges they help overcome, and a brief history of this fascinating asset class. Let’s dive in!

What Is a Stablecoin?

Stablecoins, often dubbed the “holy grail” of cryptocurrencies, are a type of digital currency created to address the need for price stability in the crypto market.

Designed to maintain constant value by being linked to stable assets such as the US dollar or gold, stablecoins are available in various forms, including fiat-backed, crypto-backed, and algorithmic.

They are less prone to the abrupt price fluctuations seen in typical cryptocurrencies and were first conceptualized in 2014, with the first stablecoin, BitUSD, launching in 2014.

Example of Stablecoins

Stablecoins vary in type and utility, providing users with multiple options depending on their needs. Here’s a look at some of the most popular and unique stablecoins on the market:

- Tether (USDT): Tether is arguably the most recognized stablecoin, pegged to the US dollar in a 1:1 ratio and primarily used for trading and as a dollar substitute on crypto exchanges. Tether’s operational success is notable, generating a net income of $6.2 billion in 2023.

Tether has recently joined forces with the TON Foundation, introducing USDt on The Open Network (TON). This initiative is set to transform the digital token space by facilitating simple, borderless peer-to-peer (P2P) payments for Telegram Messenger’s over 900 million global users.

The integration of USDt on TON not only creates a new user experience but also leverages TON’s advanced multi-layered blockchain technology with the sharding principle at its heart, enhancing transaction efficiency and reach. Additionally, to boost USDt adoption, the TON Foundation will commit 11 million Toncoin (worth approximately $80M) to support USDT-TON integration, including rewards and free withdrawals on major exchanges.

- USD Coin (USDC): Similar to Tether, USDC is a fiat-collateralized stablecoin, also pegged to the US dollar. It offers full transparency with regular audits, which makes it a trusted choice among crypto users for trading and saving.

- Dai (DAI): Operated by the MakerDAO system, Dai is a crypto-collateralized stablecoin. Unlike USDT and USDC, Dai is backed by a mix of other cryptocurrencies deposited into smart-contract vaults. This makes it highly unique as it is governed by a decentralized community of MKR token holders.

- Binance USD (BUSD): BUSD is a stablecoin approved by the New York State Department of Financial Services and backed by fiat money—the US dollar. Its 1:1 ratio contributes to stability and security when trading.

- Paxos Standard (PAX): PAX is another digital dollar like USDC and Tether, but with a twist: it emphasizes regulatory compliance and consumer protection, so it’s no surprise it’s known for its stability and reliability.

- TerraUSD (UST): Before its infamous depegging event, TerraUSD was an algorithmic stablecoin that tried to maintain its peg through a complex mechanism involving its sister token, LUNA. This example highlights both the potential and risks inherent in non-collateralized or algorithmic stablecoins.

- TrueUSD (TUSD): This stablecoin provides legal protection, regular audits, and full collateral for its users. A transparent alternative in the stablecoin space, it ensures that each token is fully backed by dollars in reserved accounts.

Each of these stablecoins has its features and use cases, catering to different segments of the crypto market. Whether for trading, savings, or as a hedge against volatility, stablecoins are becoming an integral part of the cryptocurrency landscape.

Read also: Best 5 stablecoins, compared.

Why Are Stablecoins Important?

Stablecoins serve as a practical tool in the digital financial landscape, acting as a bridge between traditional finance and the dynamic world of cryptocurrencies. They provide a reliable medium of exchange for daily transactions, contribute to the growth of decentralized finance (DeFi), and offer a safety net during market volatility. For example, a merchant receiving $50 in cryptocurrency might find its value reduced to $40 the next day due to market fluctuations—a problem stablecoins aim to solve.

Where to Buy Stablecoins?

Changelly makes it super easy to buy stablecoins like Tether right on our platform. If you can’t purchase directly with cash, you can buy Bitcoin first and then exchange it for a stablecoin.

Also, we have exciting news for TON ecosystem fans: Changelly is happy to be one of the first to offer USDt exchanges!

To mark the launch of USDt, we’re thrilled to introduce The Probably Serious Quiz — an engaging challenge that invites participants to explore the history of stablecoins and The Open Network. Those who join will benefit from a 0% service fee on USDt and Toncoin swaps, enhancing access to the newly introduced stablecoin and supporting the growth of the TON ecosystem. This promotional campaign runs from April 23 to May 7, 2024 only — don’t miss your chance to participate!

When Stablecoins Are a Bad Idea?

While stablecoins are great for those seeking stability, they are not suited for investors aiming for high returns due to their design to mirror stable assets like the US dollar. Over time, inflation can also diminish the purchasing power of the asset backing a stablecoin, leading to potential losses in real value, which, in turn, makes it less appealing for long-term investment growth compared to more volatile cryptocurrencies.

Overall, stablecoins offer a strategic solution to the volatility and practicality issues in cryptocurrency transactions, playing a crucial role in the evolution of digital payments and the broader financial sector.

How Do Stablecoins Work?

The stablecoins segment has developed significantly over the past year. Decentralized stablecoins, for example, are more transparent and also more stable than conventional stablecoins because their value is automatically stabilized. As decentralized stablecoins become larger, they can provide more stability and transparency within the traditional financial system.

To put it simply, a stablecoin is an asset based on the blockchain. This asset is tied to a specific price, usually one US dollar.

Here are the advantages of stablecoin that attract many investors:

- Due to this price-fixing, holders of stablecoins are independent of the fluctuations of the crypto market.

- Stablecoins offer a secure and stable investment solution.

- Assets invested in stablecoins remain in the crypto space and can be invested more quickly in the growing DeFi sector.

To ensure their legitimacy as a means of payment, stablecoins must be backed by fiat currency, other cryptocurrencies, or on-chain tokens.

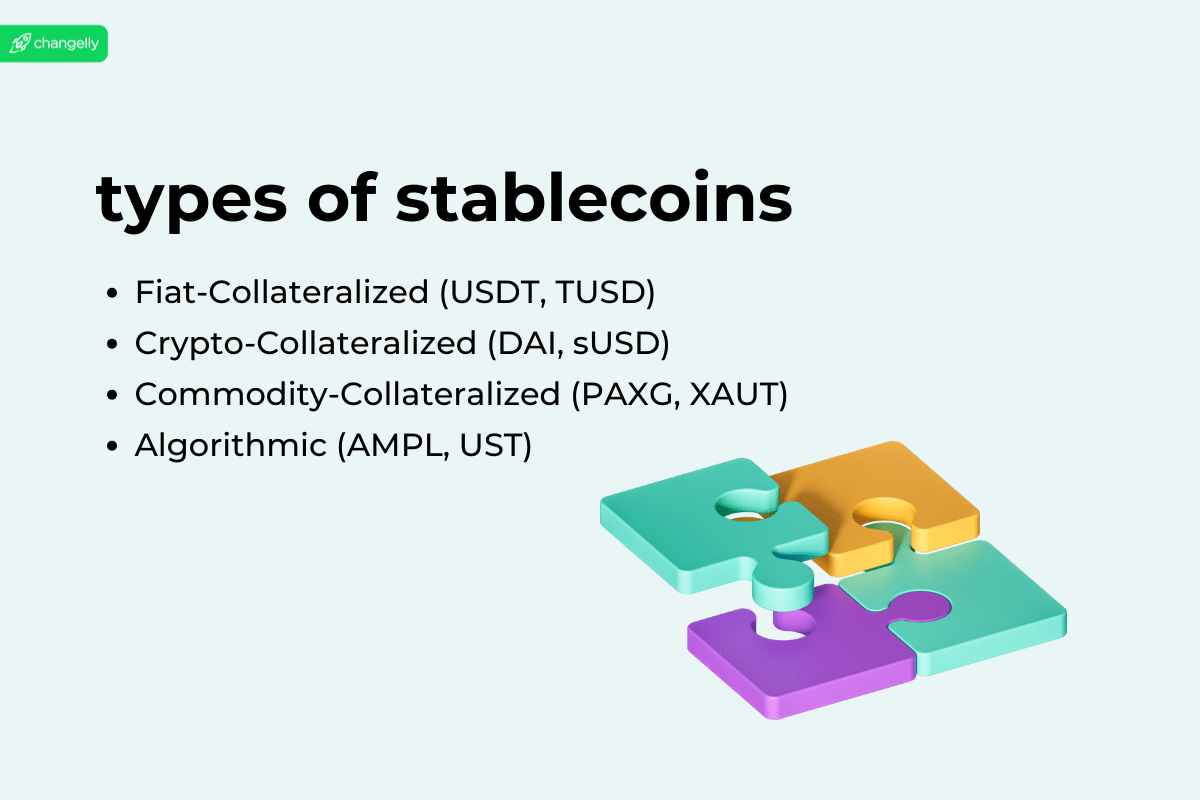

Types of Stablecoins

Each stablecoin project has developed its own mechanism, but they generally boil down to four basic models. Find more information in this article below.

Fiat-Collateralized Stablecoins

This model is used by Tether, for example. Fiat currency, like the US dollar, can back the crypto’s value. With this mechanism, a centralized company or financial institution holds assets and issues tokens in return. This gives the digital token value because it represents a claim on another asset with a certain value.

However, the problem with this approach is that it is controlled by a centralized company. As this model involves fiat currency, the issuing party must have a basic trust that they actually have the appropriate assets to pay out the tokens. Fiat currencies introduce serious counterparty risk for token holders. The example of Tether shows this difficulty because the solvency and legitimacy of the company were publicly questioned several times in the past.

Commodity-Collateralized Stablecoins

Commodity-backed stablecoins are backed by the value of commodities, such as gold, oil, diamonds, silver, and other precious metals. The most popular commodity to be collateralized as a backing asset is gold; Tether Gold (XAUT) and Paxos Gold (PAXG) are the most common examples here.

While commodity-backed stablecoins are less prone to inflation than fiat-backed ones, they are also less liquid and harder to redeem.

Crypto-Collateralized Stablecoins

This approach aims to create stablecoins backed by other trusted assets on the blockchain. This model was initially developed by BitShares but is also used by other stablecoins. Here, security is backed by another decentralized cryptocurrency. This approach has the advantage of being decentralized. The collateral is stored confidentially in a smart contract, so users do not rely on third parties.

However, the problem is that the collateral intended to back the stablecoins is itself a volatile cryptocurrency. If the value of this cryptocurrency falls too quickly, the issued stablecoins may no longer be adequately secured. The solution would be overinsurance. However, this would result in inefficient use of capital, and larger amounts of money would have to be frozen as collateral compared to the first model.

Non-Collateralized Stablecoins a.k.a. Algorithmic Stablecoins

Uncollateralized stablecoins are price-stable cryptocurrencies that are not backed by collateral. Most implementations currently use an algorithm. Depending on the current price of the coin, more algorithmic stablecoins will be issued or bought from the open market. This is intended to be a counter-regulation to keep the course as stable as possible.

The advantage of this type of algorithmic stablecoins is that it is independent of other currencies. In addition, the system is decentralized as it is not under the control of a third party but is solely controlled by the algorithm.

However, the most severe disadvantage is that there is no pledged security in the event of a crash since the value of the stablecoin is not tied to any other asset in that case.

How Are Stablecoins Different from Traditional Cryptocurrencies?

Stablecoins represent a significant evolution in the digital currency space, offering a stable value that addresses the high volatility often seen in traditional cryptocurrencies. These tokens act as a reliable digital money option for everyday financial transactions, bridging the gap between the dynamic world of cryptocurrencies and the stability of traditional financial markets. As reserve assets, stablecoins facilitate a seamless integration of digital and fiat currencies and create a reliable platform for both users and investors.

For traders and investors, stablecoins offer more than just stability; they are a critical tool in crypto portfolios, serving as a hedge against market fluctuations and protecting the value of their investments. The growing acceptance of stablecoins is a testament to their potential to stand on equal footing with centralized currencies traditionally regulated by central banks.

The domains of credit and lending are poised for dramatic changes in the future. With stablecoins, particularly algorithmic ones, we are entering a new era where smart contracts on the blockchain enable transparent, rapid, and traceable financial activities, from loan repayments to subscription management. This integration heralds a shift towards a more efficient and accountable financial ecosystem, underscoring the transformative role of stablecoins in digital money.

What Are the Risks of Stablecoins?

Even though stablecoins are viewed as a low-cost means of trading crypto assets and transferring funds across borders, the transparency issue remains. Because there are many different issuers of stablecoins, each offering their own policies and varying degrees of transparency, do your own thorough research.

And, like everything else, stablecoins have some disadvantages.

Because, in most cases, their fixed value is pegged to another asset, fiat-backed stablecoins enjoy less decentralization than other cryptocurrencies. So, they are subject to fiat currency regulations, and since fiat-backed stablecoins are very tightly coupled to their underlying assets, they risk crashing if the macroeconomy enters a recession. Traders must trust central issuers or banks that the issued tokens are fully and securely backed by fiat. If these issuers do not have sufficient assets, traders could face the risk of being unable to convert their stablecoins back into fiat when needed.

With crypto-backed stablecoins, token holders must trust the unanimous consent of all users of the system as well as the source code. The lack of a central issuer or regulator can make crypto-backed stablecoins vulnerable to the risk of plutocracy, meaning the power of governance rests in the hands of those who hold a large number of tokens. Additionally, the value of crypto-backed currencies is less stable than that of fiat-backed stablecoins. If there is an increase or decrease in the supply of collateralized stablecoins, the stablecoin will also experience drastic impacts, resulting in less stability in the deposit system.

Stablecoins Regulation

Key regulatory concerns surrounding stablecoins encompass several areas. Financial stability is paramount; a sudden loss of confidence in a popular stablecoin could instigate a rush to liquidate it, posing risks to the broader financial system. Equally vital is consumer protection, necessitating transparent and secure management of the underlying assets by stablecoin issuers. Additionally, as with other digital assets, there’s the potential for stablecoins to be employed in illicit activities, which underscores the importance of robust Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regulations.

Different countries have approached stablecoin regulation differently:

- U.S.: The U.S. has been proactive in addressing stablecoin regulation. Various agencies, including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), have shown interest in stablecoins, depending on their structure and use. The Office of the Comptroller of the Currency (OCC) has also provided guidance allowing national banks to hold stablecoin reserves.

- EU: The European Union is working on a comprehensive framework for crypto assets, including stablecoins. The proposed Markets in Crypto-assets (MiCA) regulation aims to provide clarity on stablecoins and their issuance and operation within the EU.

- Other Countries: Many nations are still in the early stages of formulating stablecoin regulations, with some (e.g., China) focusing more on launching their own central bank digital currencies (CBDCs) as an alternative.

As the digital asset space evolves, so does the regulatory landscape. There’s a growing consensus on the need for international collaboration to create a consistent regulatory framework. This is especially true because stablecoins, unlike traditional assets, operate on decentralized networks that transcend borders.

What Can You Do with a Stablecoin?

Now that we’ve explained what stablecoins are, let’s move on to what we can do with them. Lend them to generate profits. Lending stablecoins has a significant benefit as it takes market volatility out of the equation.

Through the CeFi and DeFi lending platforms, investors can earn above-average interest rates, which are higher than the usual interest rates in traditional finance. Most banks offer annual interest rates that do not exceed 1%, while interest rates for stablecoins range from 4% to 12% per year. Many lending platforms even offer daily interest payouts, allowing investors to earn on compound interest.

FAQ

Stablecoins explained: let’s dive deep into the most frequently asked questions about stablecoins!

Which is the best stablecoin?

Determining the best stablecoin depends on individual preferences, use cases, and trust in the underlying mechanisms that back these digital currencies. Stablecoins are designed to mirror the value of traditional financial assets, ensuring stability in the often volatile crypto market.

While there are many stablecoins in the market, the choice frequently narrows down to popular options like USDC and USDT. Both have their merits and are widely accepted across various platforms. To get a more in-depth comparison of these two prominent stablecoins, I recommend reading this article where I’ve compared USDC vs. USDT. This comparison will provide insights into their respective advantages, helping you make an informed decision based on your needs.

How many stablecoins are there?

As of 2023, there are more than 100 stablecoins in the crypto space. This number may be shocking as we usually only hear about 4–5 popular ones. Check this list by CoinMarketCap to learn more.

What is the most popular stablecoin?

According to data from Blockworks Research, Tether holds a commanding 63% of the market share. Considering there are over 100 stablecoin projects in the industry, this figure is notable.

What is an example of a stablecoin?

The 5 most popular stablecoins are as follows:

- USDT, aka Tether

- EURL (LUGH), a stablecoin pegged to the euro and designed to be in full legal compliance with relevant EU regulations

- USD Coin (USDC), a USD-backed stablecoin

- DAI, a mixed breed of stablecoin pegged to USD but backed by Ether

- BUSD, a coin by Binance that has its full value backed by USD

What makes a coin a stablecoin?

Stablecoins are cryptocurrencies intended to maintain value parity with an underlying asset value, such as the US dollar, through unique mechanisms. Therefore, they are less volatile than cryptocurrencies, such as Bitcoin.

Is stablecoin the same as Bitcoin?

In contrast to a typical specimen like Bitcoin, the stablecoins linked to currencies are remarkably stable in their value retention. Stablecoins lack the critical advantages of Bitcoin and Ethereum, though: large profit margins and independence. Nevertheless, they are interesting as they offer advantages over other investment options, as reported by BTC-Echo. They are based on crypto technology and can be traded digitally. This eliminates the need for depots or the storage of real money. Stablecoins can also be combined with smart contracts. Their protection is also digitized.

What is stablecoin used for?

You can invest in stablecoins or use them in your business like other cryptocurrencies. One of the most significant advantages of stablecoins lies in the transfer: while bank transfers made according to the outdated SEPA or SWIFT standards are associated with high costs and long time frames, funds can be sent via stablecoins within (fractions of) seconds — worldwide.

Is stablecoin a cryptocurrency?

Yes, a stablecoin is a cryptocurrency. A stablecoin is not a single crypto but a term for a group of cryptocurrencies.

Is Binance Coin a stablecoin?

No, Binance Coin (BNB) is not a stablecoin.

Binance Coin (BNB) is the native cryptocurrency of the Binance platform, one of the world’s largest cryptocurrency exchanges. But Binance also has its own stablecoin — BUSD.

Are stablecoins a good investment?

Stability means that large profit jumps are not possible. Stablecoins will not see an increase in value like Bitcoin has achieved this year. That is the nature of these digital currencies. They are based on other values that are not as volatile as the original cryptocurrencies and promise systematic passive crypto income. How to invest in stablecoin? They can be easily bought through platforms like Changelly and will be a good addition to an investment portfolio.

Is Tether backed by USD?

In March 2019, Tether Limited announced that Tether’s backing is not just fiat money (US dollars). Other digital assets and outstanding amounts from loans granted to third parties also cover the tokens.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.