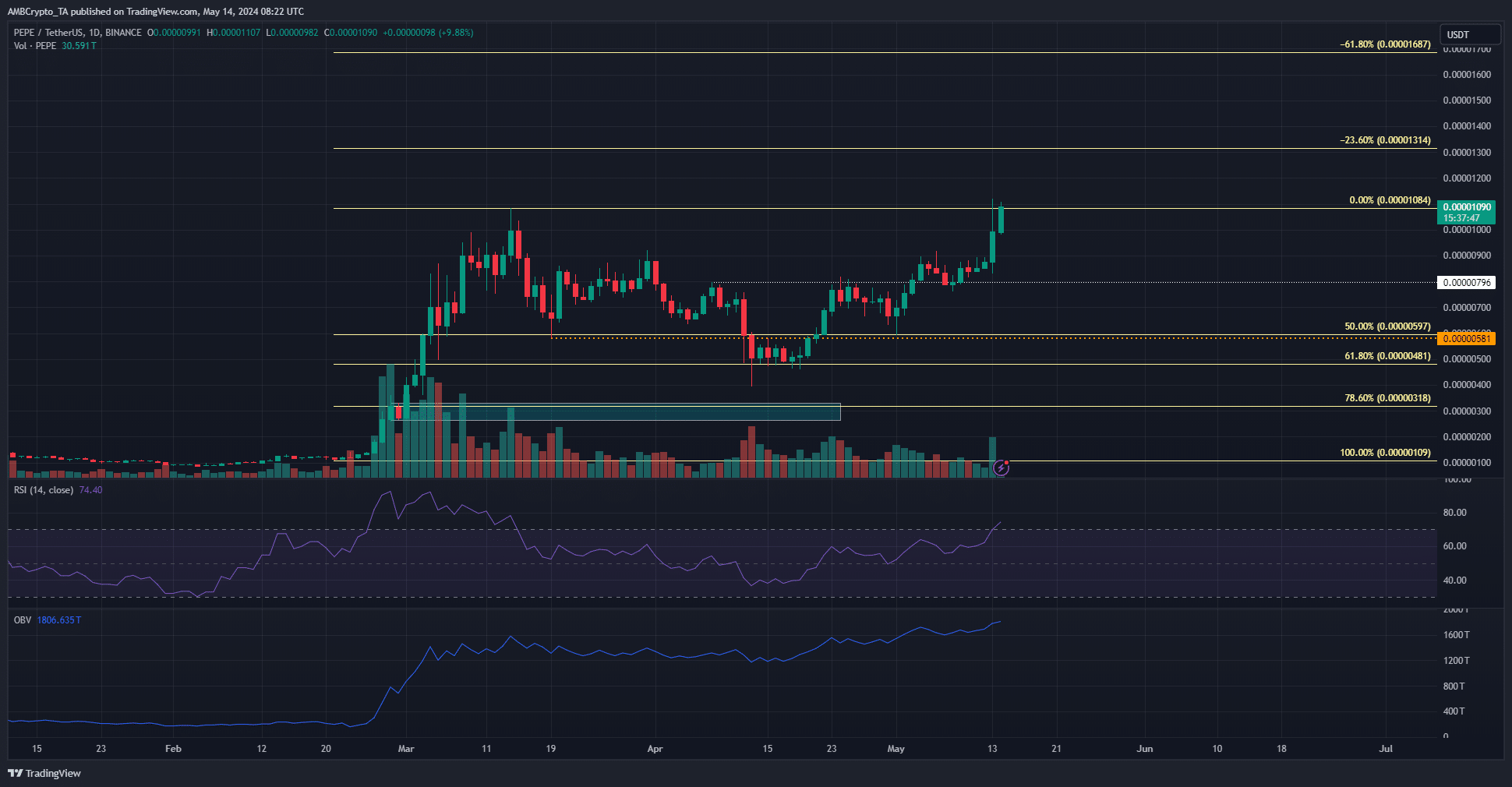

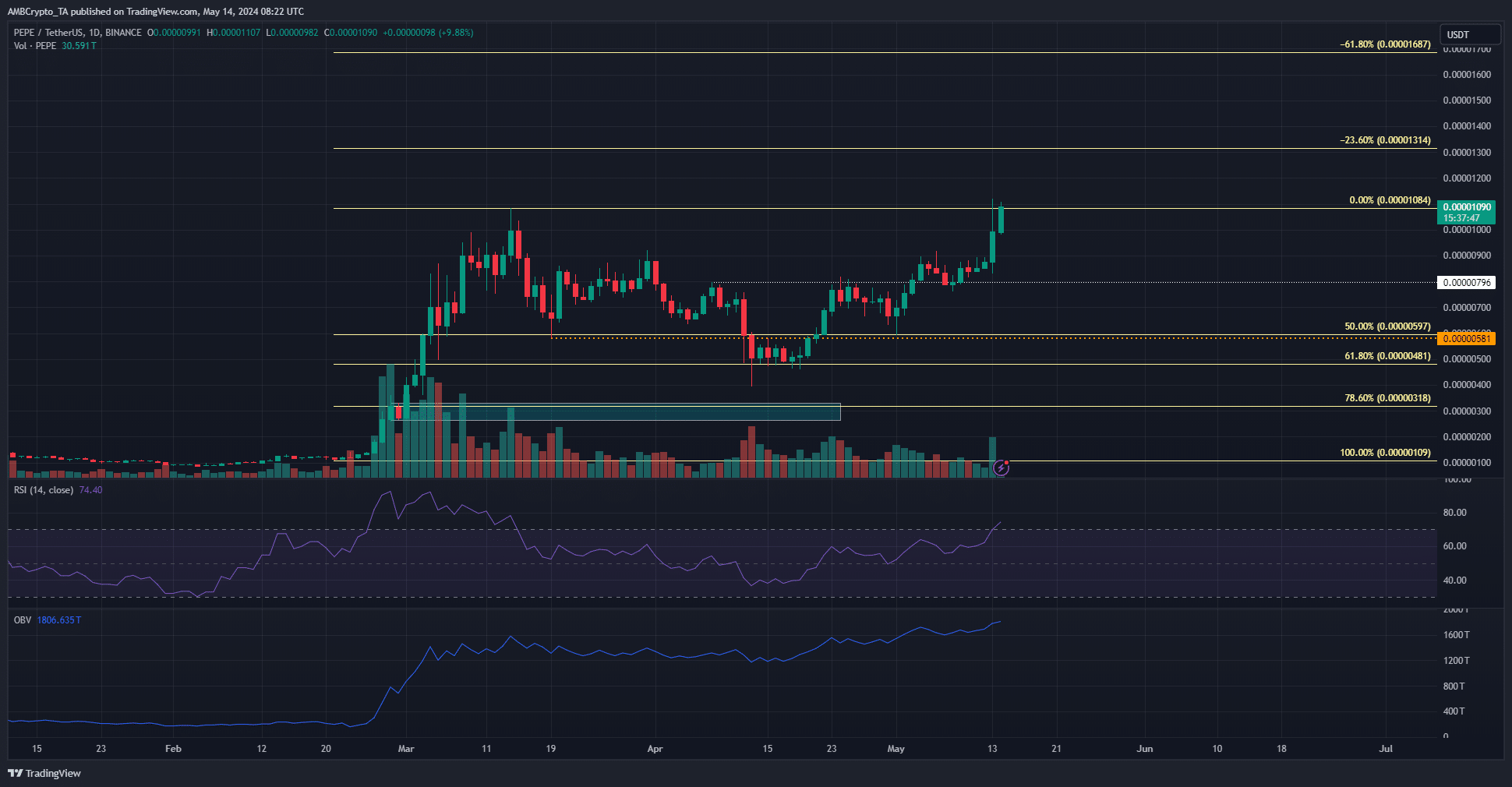

- The price action and market structure of PEPE were strongly bullish even on the 1-day timeframe.

- The futures market highlighted bullish sentiment in the short term, which could lead to sustained gains.

Pepe [PEPE] was in a strong uptrend and reached the recent local highs. A recent AMBCrypto analysis showed that a 30% move upward was expected, and the recent rally vindicated this.

Whales were also accumulating the token in anticipation of continued gains. The Weighted Sentiment behind the meme coin was also positive, reflecting bullish expectations.

The local high was breached, and the next targets were clear

Source: PEPE/USDT on TradingView

In the first half of March, PEPE ascended to $0.00001084 and faced rejection. This drop only reached the 61.8% Fibonacci retracement level (pale yellow) before a recovery began.

Once the $0.00000796 level was flipped to support, the bias became strongly bullish.

Additionally, the RSI on the daily chart has been above neutral 50 for close to a month. The OBV was also in a strong uptrend to convey heavy buying pressure. Together, they supported the idea of further gains.

The 23.6% and 61.8% extension levels northward were the next bullish targets. Since Bitcoin [BTC] could see some volatility, PEPE’s progress to these levels might take a while to play out.

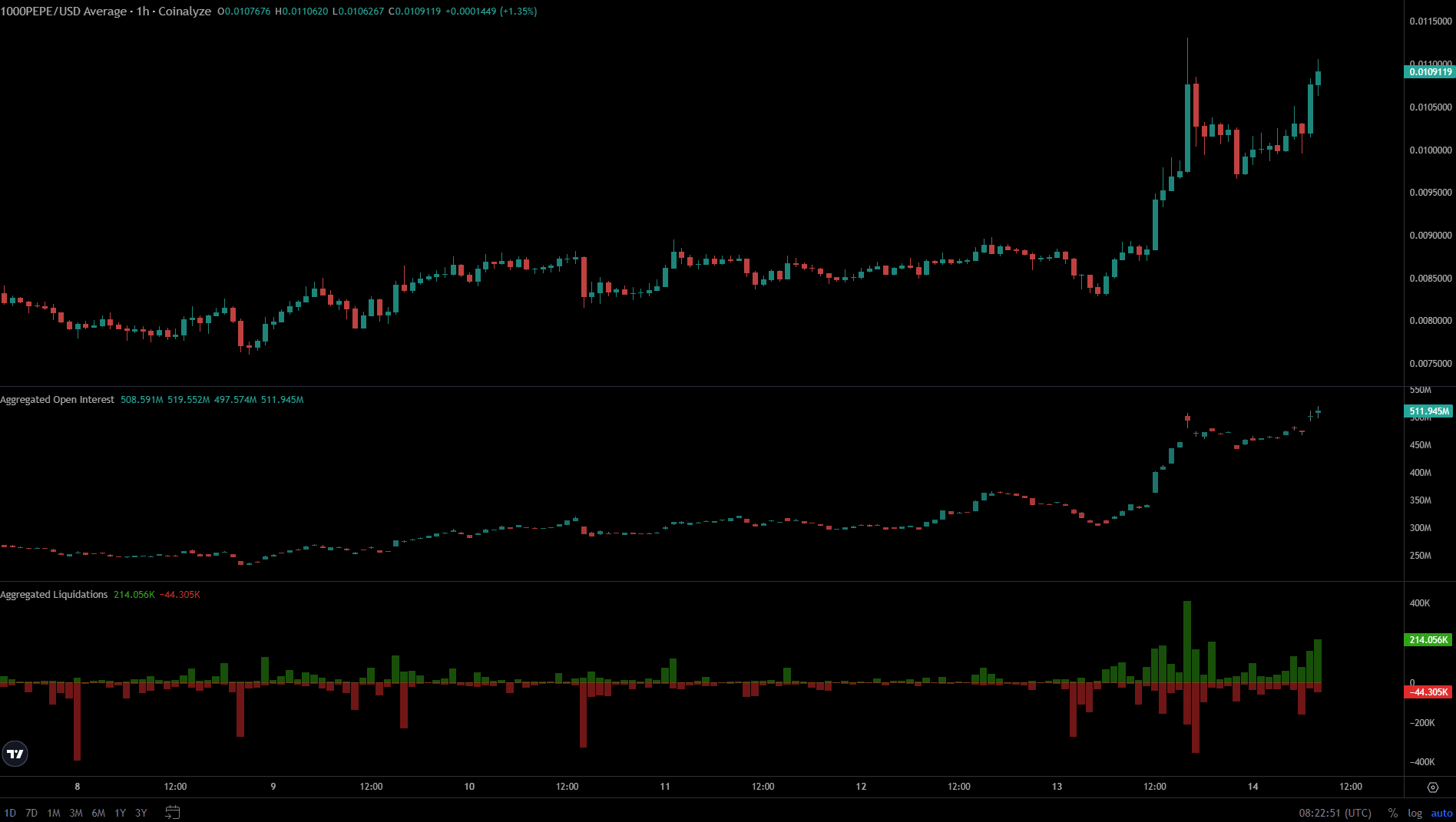

The futures market conveyed firm bullish conviction

The Open Interest chart shot higher from $300 million on the 13th of May to $511 million at press time. The price increased by 30% while the OI by close to 70%.

This was a sign of intense bullish sentiment and speculators eager to go long on the meme coin.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

The aggregated liquidations showed that many short positions were blown out of the water during this rally, fueling the upward move higher.

A retest of the $0.0000108 region as support could present a short-term buying opportunity.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.