- Vitalik Buterin explains the reasoning behind ETH sales.

- ETH suffers amid a bearish market.

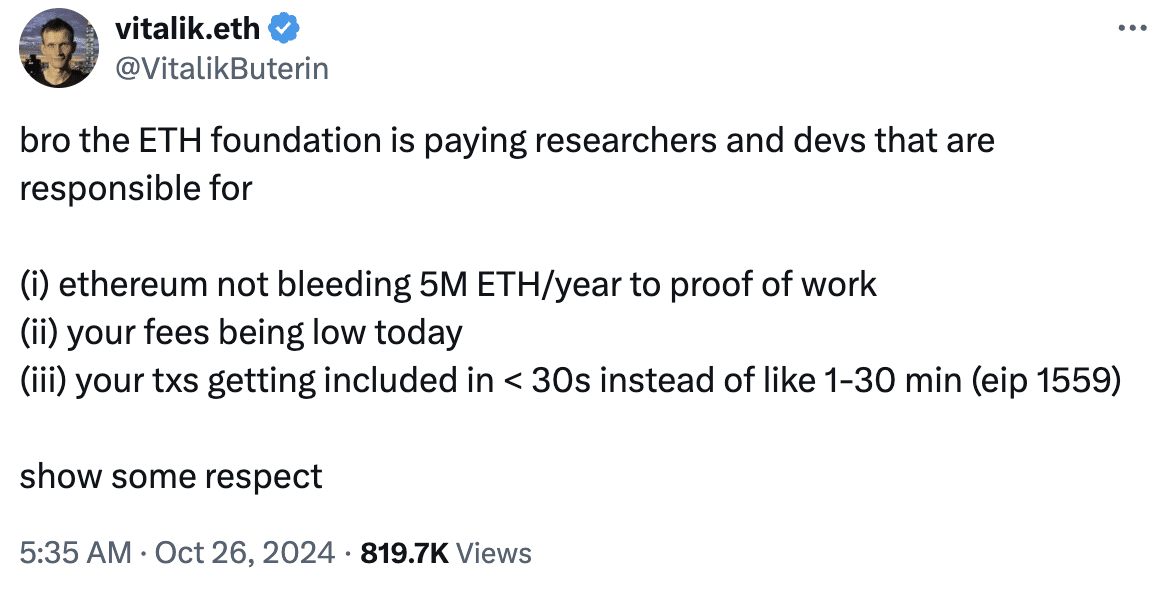

Ethereum [ETH] co-founder Vitalik Buterin has shut down mounting criticism from the community following the ETH sell-offs by the Ethereum Foundation.

AMBCrypto previously reported that the Foundation liquidated 2,500 ETH, valued at over $6 million. This move stirred discontent within the community, with some members accusing Buterin of dumping ETH.

While Buterin himself has not sold any ETH since the 12th of September, the Foundation’s sell-offs have sparked concerns about the broader implications of these transactions.

Vitalik Buterin’s defense of ETH sales

In response to the criticism, Buterin took to X, stating,

“Show some respect.”

Source: Vitalik Buterin/X

He emphasized that the funds are critical to supporting Ethereum’s core development efforts, which in turn benefit the entire community.

Buterin highlighted that these funds are used to sustain the ongoing work of researchers and developers responsible for Ethereum’s operational advancements.

These initiatives, he detailed, are what make Ethereum viable and scalable by reducing the network’s reliance on proof-of-work. It also keeps transaction fees low, ensures faster transaction inclusion times through EIP-1559, and supports privacy enhancements like zk-rollup technology.

Additionally, Buterin noted that the Foundation’s budget covers other vital areas. These include account abstraction technology that improves user security, the hosting of local Ethereum events worldwide, and maintaining the network’s resilience.

He added that the Foundation has achieved “zero downtime from DoS attacks and consensus failures since 2016,” emphasizing the importance of security efforts funded through these sales.

Community criticism: Why not stake ETH?

However, a recurring question within the community was why doesn’t the Foundation simply stake its ETH holdings to cover costs, rather than selling them and potentially impacting the market price.

Buterin responded to these concerns, explaining that the reason to avoid staking is to prevent,

“Being forced to make an ‘official choice’ in the event of a contentious hard fork.”

He also shared an innovative proposal currently being explored: offering grants where recipients would have the autonomy to stake the Foundation’s ETH on their terms, provided it aligns with ethical practices.

Another strategy, the exec suggested, could involve dispersing the legitimacy and resources of Ethereum to various organizations, reducing the Foundation’s central influence. This step would promote a more decentralized ecosystem.

ETH’s roadmap and market position

This latest wave of responses from Buterin follows his consistent updates on Ethereum’s technical roadmap. He has been vocal about how the planned “Merge,” “Surge,” “Scourge,” “Verge,” and “Purge” stages are expected to impact Ethereum’s scalability, security, and overall efficiency.

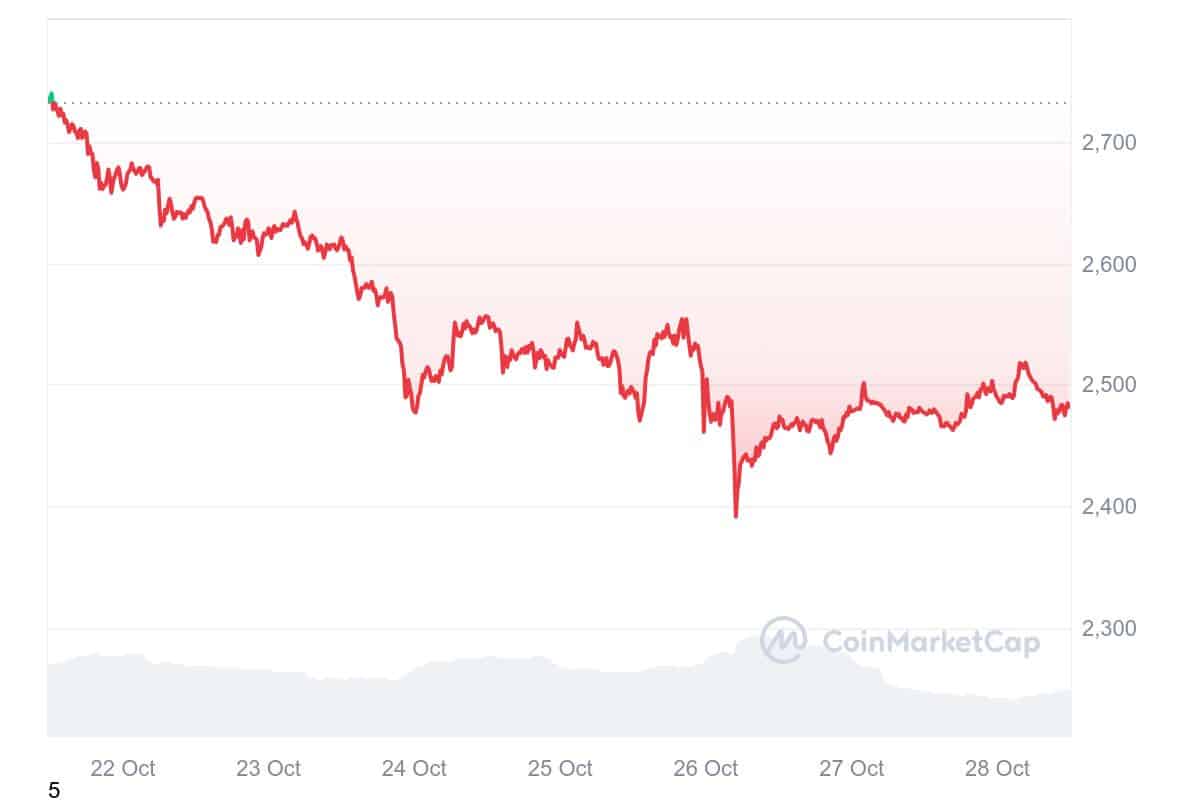

Meanwhile, ETH’s price performance has been less than impressive. After closing in on $2,800 last week, the altcoin dropped to a press time value of $2,482.

Read Ethereum’s [ETH] Price Prediction 2024–2025

According to CoinMarketCap, this reflected a 9.21% decrease over the past week. Although the altcoin gained 0.17% in the last day.

Source: CoinMarketCap

The market’s reaction underscores the challenges facing the Foundation as it balances community expectations with Ethereum’s evolving financial ecosystem.