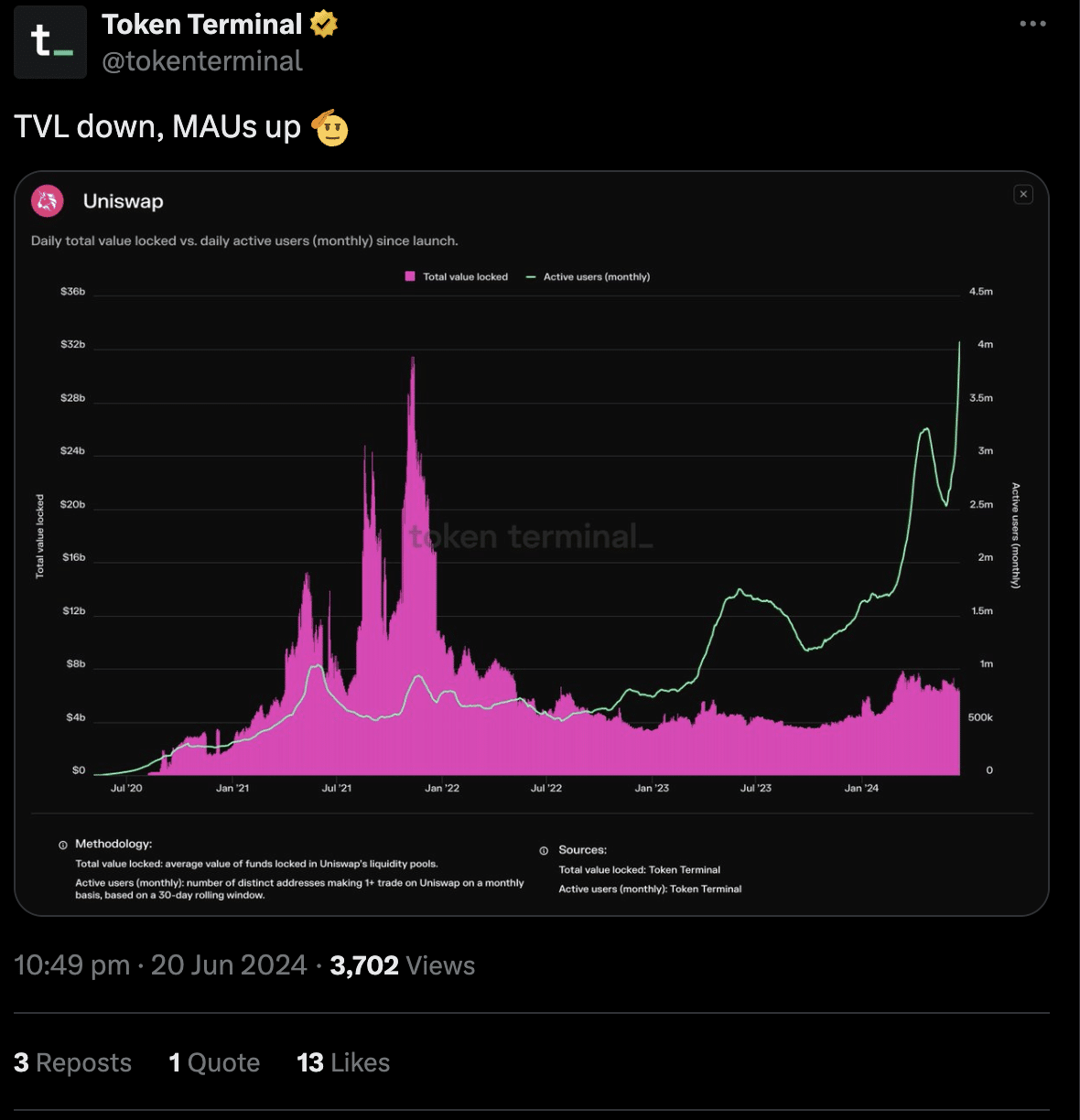

- Monthly activity on the Uniswap network surged as overall TVL declined.

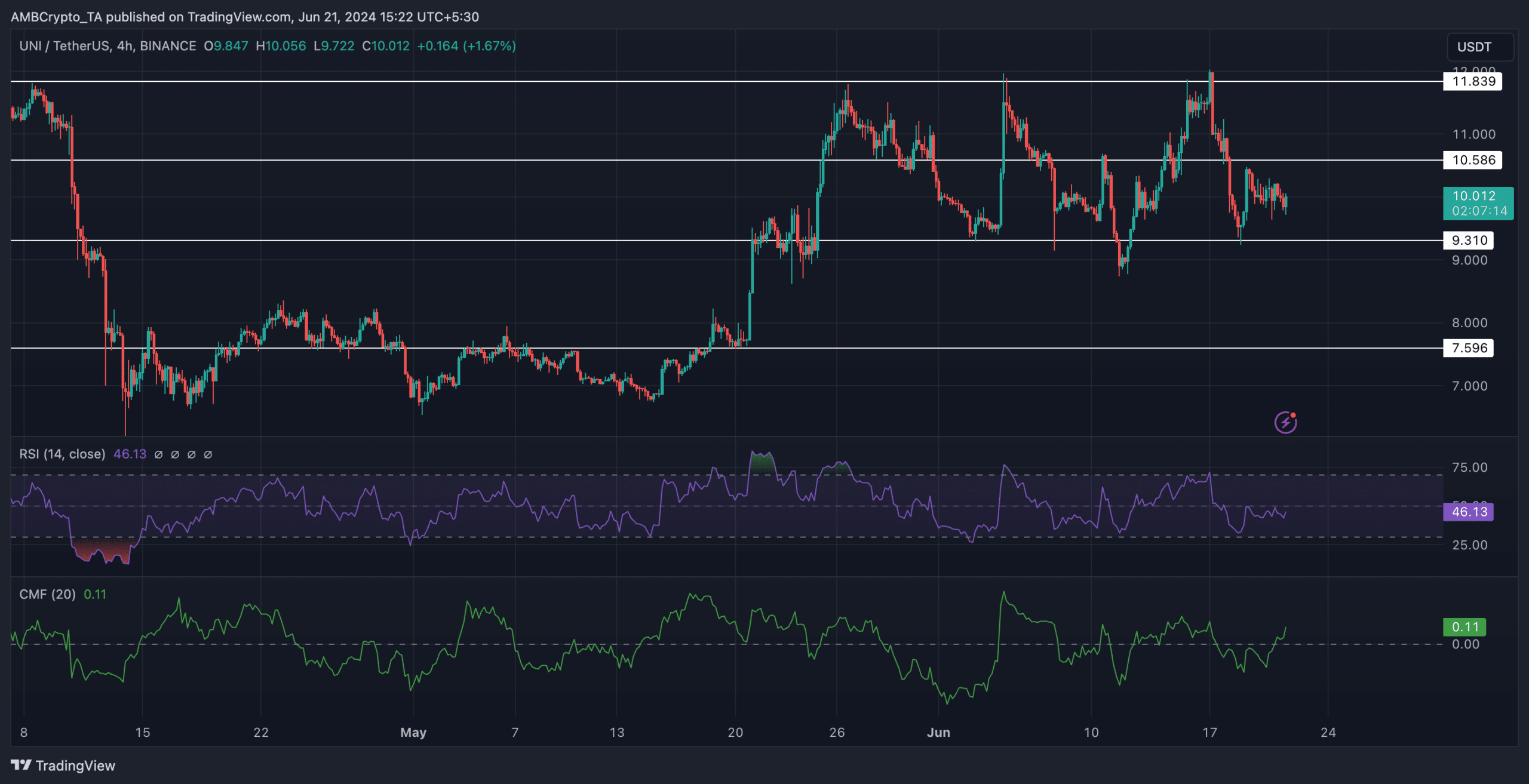

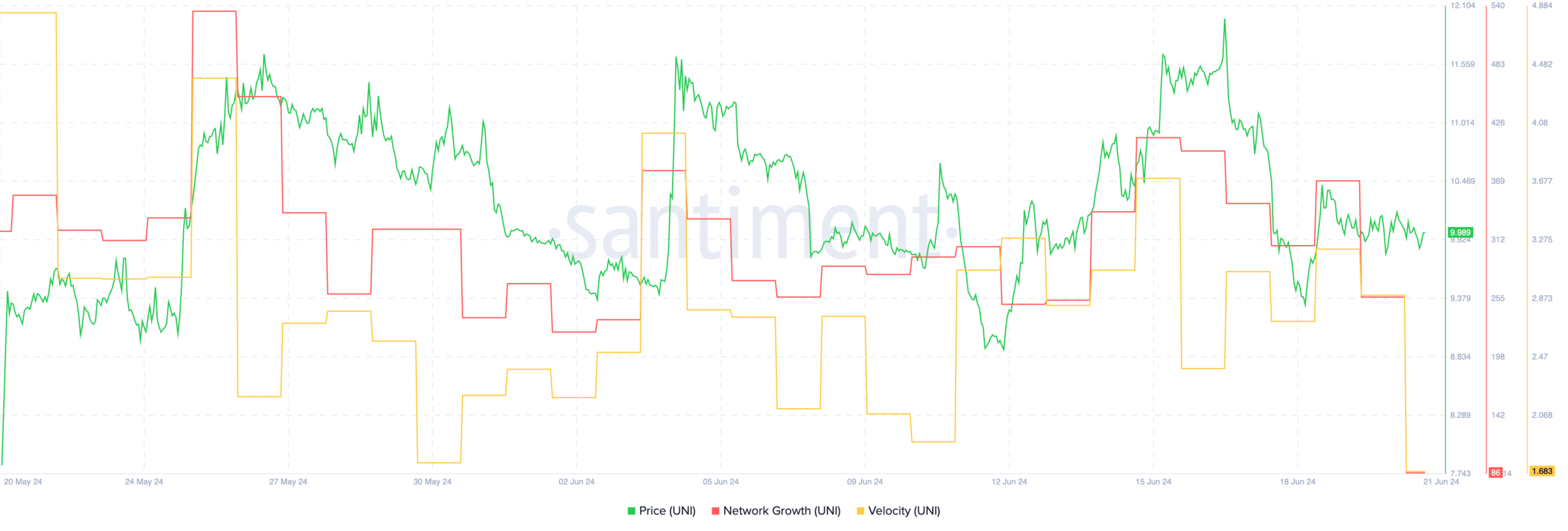

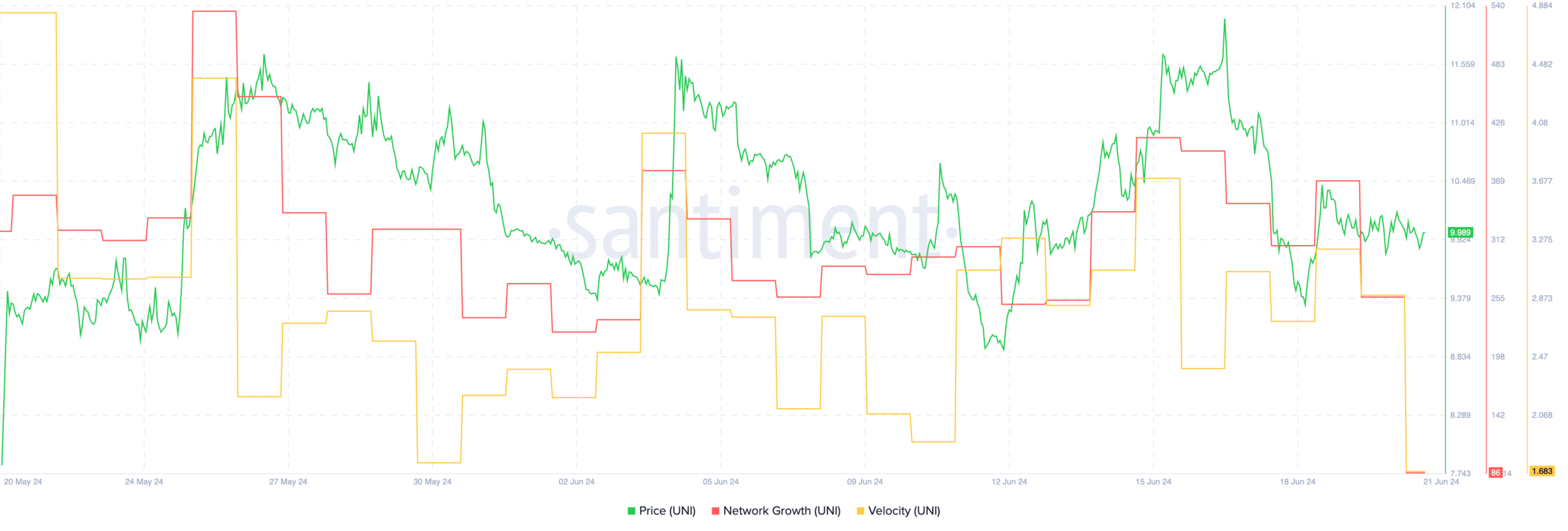

- UNI’s price fell significantly along with network growth over the past few days.

Due to Uniswap’s [UNI] dominance in the crypto space, it has seen a significant surge in activity over the last few days.

Looking at DeFi stats

According to recent data provided by Token Terminal, the number of monthly active users on Uniswap have soared. However, the overall TVL (Total Value Locked) on the network declined significantly during the same period.

This could be due to a few reasons. Even with a rising market, people might be using Uniswap for smaller, more frequent trades or quick swaps to capture short-term gains, rather than committing to larger, long-term holdings.

Alternatively, there could be a migration to competing DeFi platforms offering features or functionalities that better suit current market conditions.

Moreover, lower TVL could lead to reduced revenue from fees and decreased liquidity for smooth trading.

Source: X

At press time, UNI was trading at $10.01. The price of UNI had appreciated significantly since the 15th of May. After this, the overall price movement moved sideways between the $11.839 level and the $9.31 level.

There was no significant pattern or trend established by the price of the UNI token during this period.

The RSI (Relative Strength Index) for the UNI token had declined significantly in the last few days as well. This implied that the bullish sentiment around the UNI token had declined.

Moreover, the CMF (Chaikin Money Flow) for the UNI token also decreased significantly. A declining CMF meant that the money flowing into UNI had fallen materially.

For UNI to see green again in the future, the token would have to break past the $11.839 level. Because this level has been tested and weakened in the past, the likelihood of UNI surpassing this level is relatively high.

Source: TradingView

Is your portfolio green? Check out the UNI Profit Calculator

On-chain data paints a bearish picture

Along with the price, the network growth for the token had also decreased materially. A falling network growth meant that new addresses weren’t showing interest in the UNI token at the time of writing.

If this trend continues, UNI won’t be able to rally going forward. Additionally, the velocity at which UNI was trading at had also decreased, implying a reduction in the frequency at which UNI was being traded.

Source: Santiment