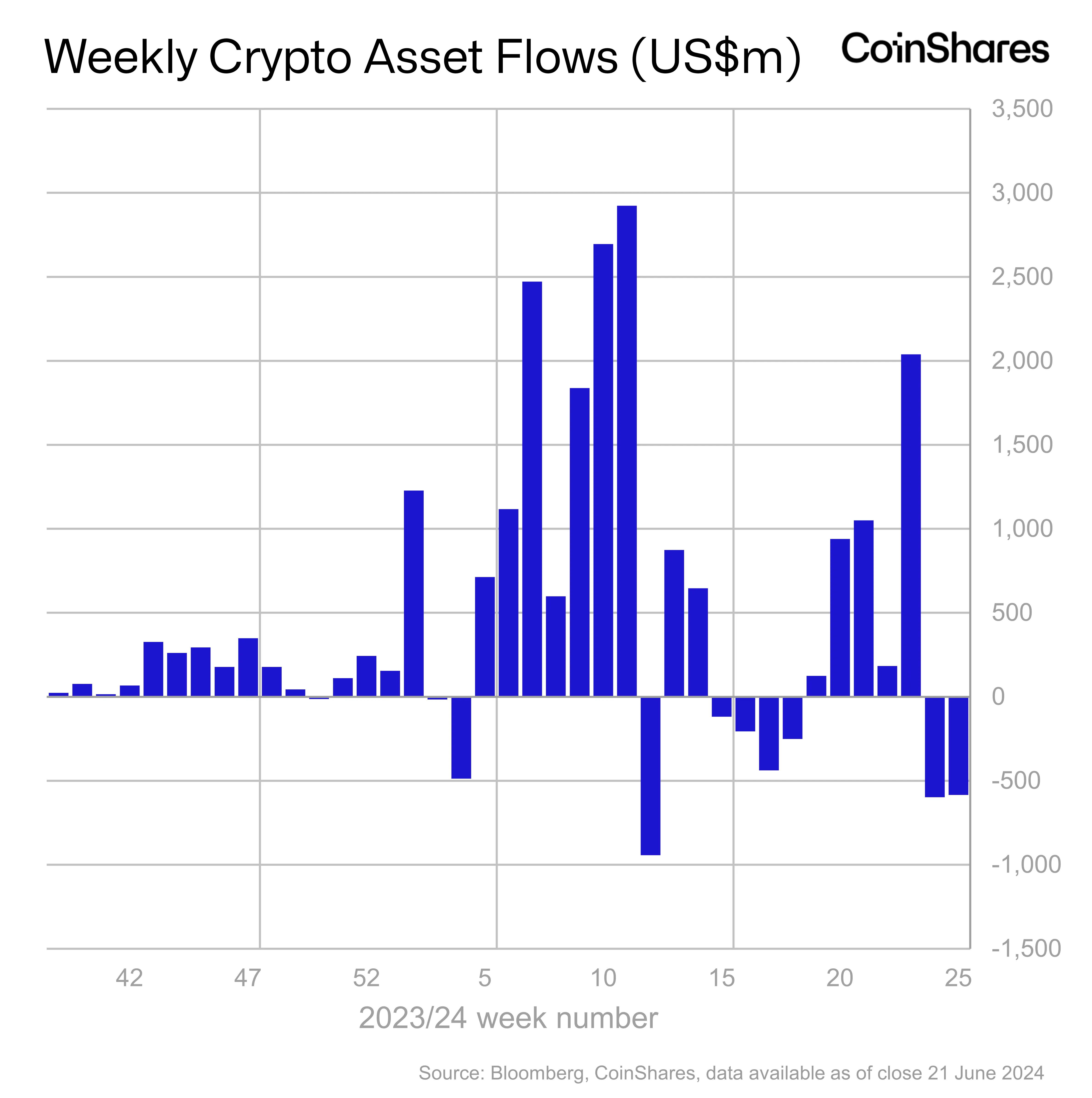

Digital assets manager CoinShares says crypto products bled out last week for the second time in a row to the tune of $584 million.

In its latest Digital Asset Fund Flows report, CoinShares says institutional investors have shaved off $1.2 billion in crypto investment products in the last two weeks.

“Digital asset investment products saw a second consecutive week of outflows totaling US$584m, shaving off US$1.2bn in total. We believe this is in reaction to the pessimism amongst investors for the prospect interest rate cuts by the FED this year. Last week also saw the lowest volumes traded on ETPs (Exchange-Traded Products) globally since the US ETFs (Exchange-Traded Funds) were launched in January, seeing just US$6.9bn for the week.”

Last week, CoinShares reported that crypto products lost $600 million.

The US and Canada regions accounted for $584 in outflows, while Germany and Hong Kong lost $24 million and $19 million, respectively. Meanwhile, Switzerland and Brazil brought in $39 million and $48.5 million, respectively.

Bitcoin (BTC) led the trend with $630 million in outflows. Ethereum (ETH) lost $58 million as Cardano (ADA) lost $0.3 million. Altcoins Solana (SOL), Litecoin (LTC) and Polygon (MATIC) saw outflows of $2.7 million, $1.3 million, and 1 million a piece.

“Multi-asset products saw US$98m inflows, suggesting investors saw the weakness in the altcoin market as a buying opportunity.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney