- DOGE prices have stagnated below $0.17 amidst a drop in interest in the derivatives market.

- Will DOGE interest improve after the reported change in traders’ focus to higher beta memecoins?

Since 23rd May, Bitcoin’s [BTC] price has been quiet, consolidating above $67K. With an impending supply overhang from the Mt Gox exchange, some traders are reportedly shifting focus to memecoins, especially legacy memes like Dogecoin [DOGE].

According to Singapore-based crypto-trading firm QCP Capital, traders shifted focus to legacy memecoins.

“Traders are shifting focus to higher beta meme tokens like Shiba Inu (SHIBA), Dogecoin (DOGE), and Pepe (PEPE), which have seen double-digit gains (10-20%) and are polling in the top 10 for Open Interest.’

A spot check on the Coinalyze showed that Pepe [PEPE] and Floki [FLOKI] recorded an upswing in open interest rates in the past 24 hours. However, Dogecoin’s OI was still negative at the time of writing, down about 5%, which could delay a strong short-term recovery for DOGE.

Will DOGE see a short-term reprieve?

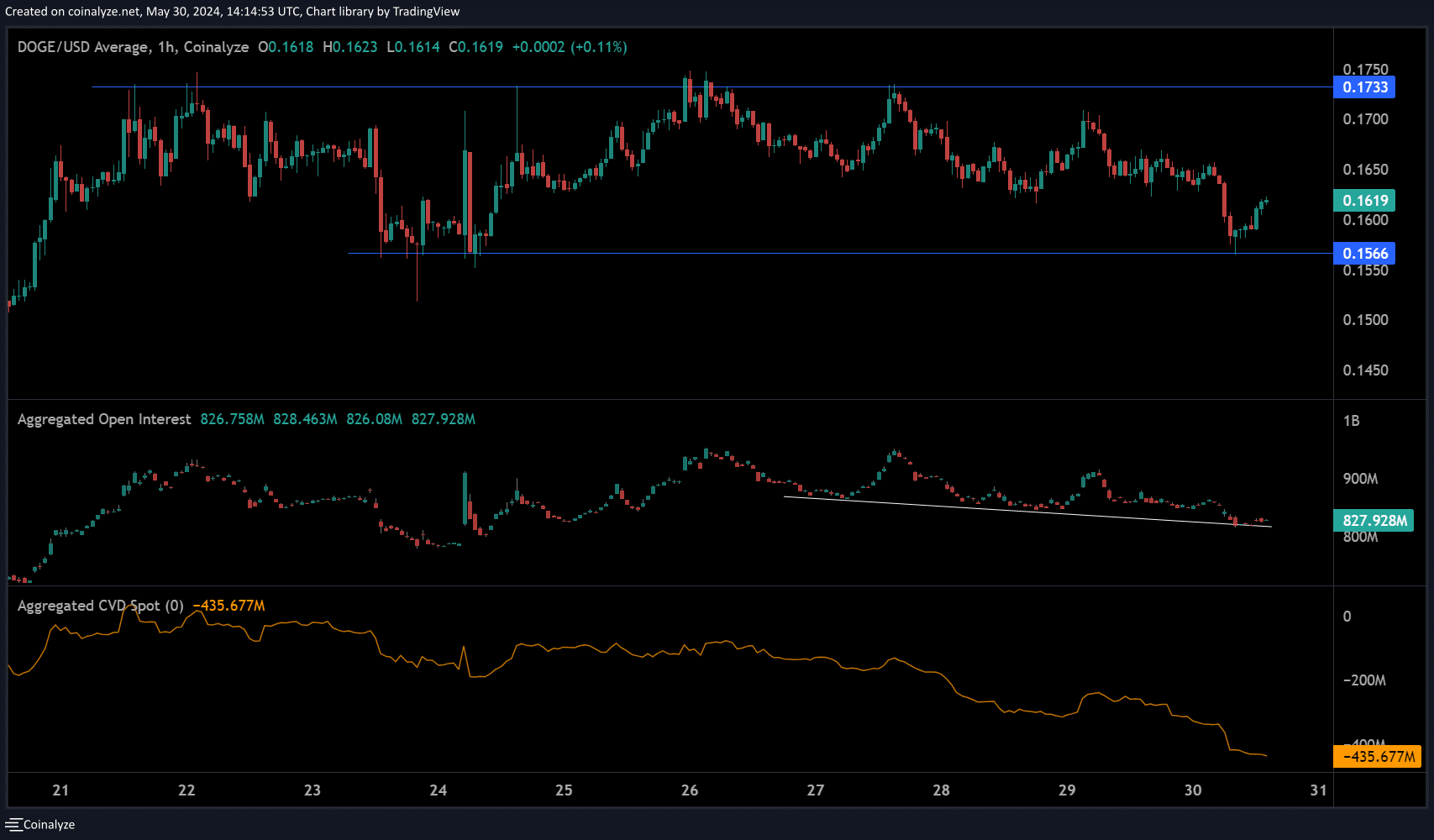

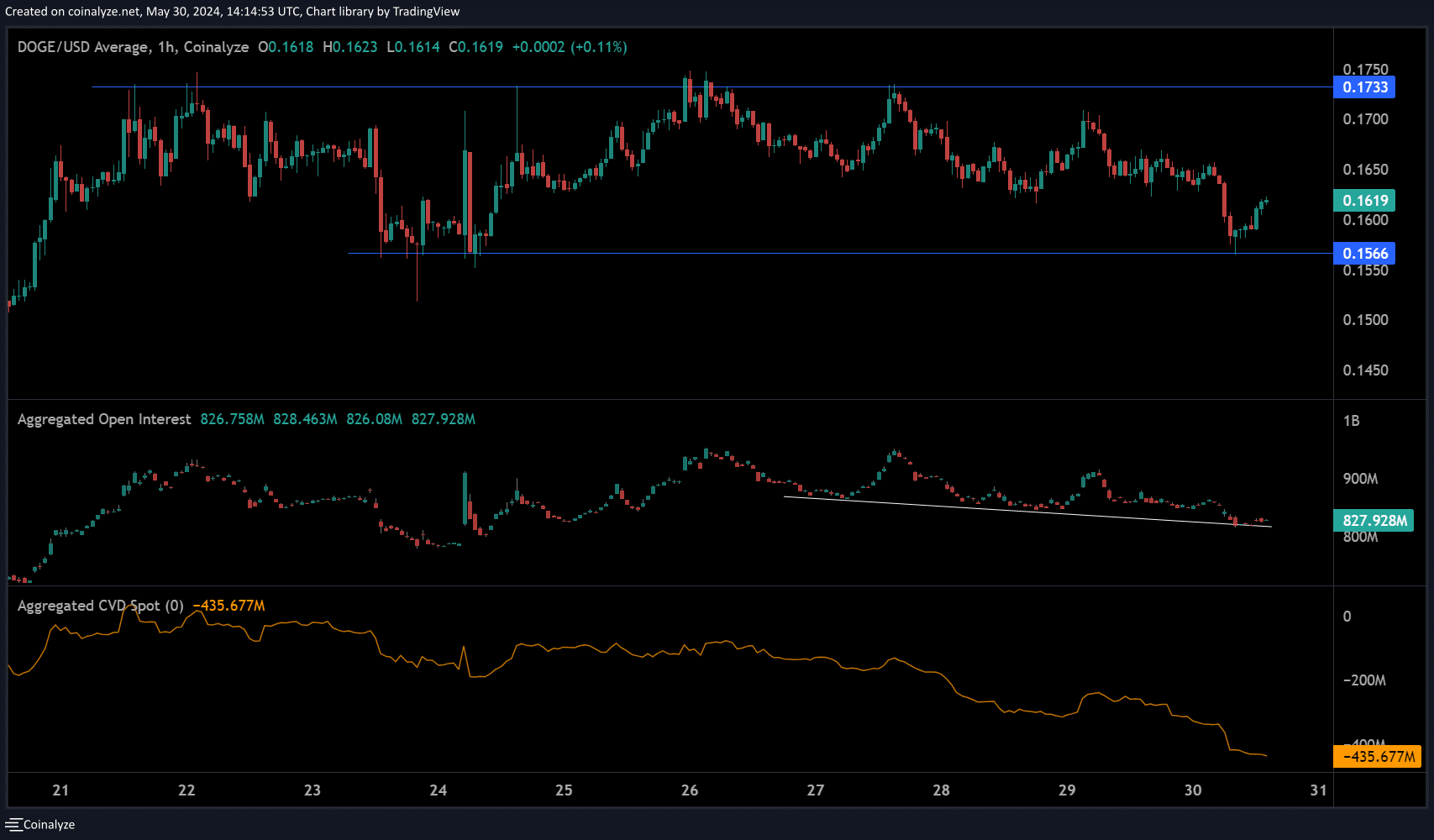

Source: Coinalyze

For the unfamiliar, Open Interest (OI) rates track opened futures contracts alongside the money flowing into or out of them. A rising OI suggests a bullish sentiment, while a declining OI underscores a bearish sentiment.

DOGE’s OI has been trending lower since 27th May and slid below $900 million as of press time. The drop denoted underlying bearish sentiment on DOGE’s price prospects.

The downsloping spot CVD (Cumulative Volume Delta) further demonstrated sellers’ market leverage from 27th May.

However, DOGE was headed into a key short-term support near $0.15. A rebound in the short-term demand could push DOGE toward the short-term supply at $0.17 or $0.2.

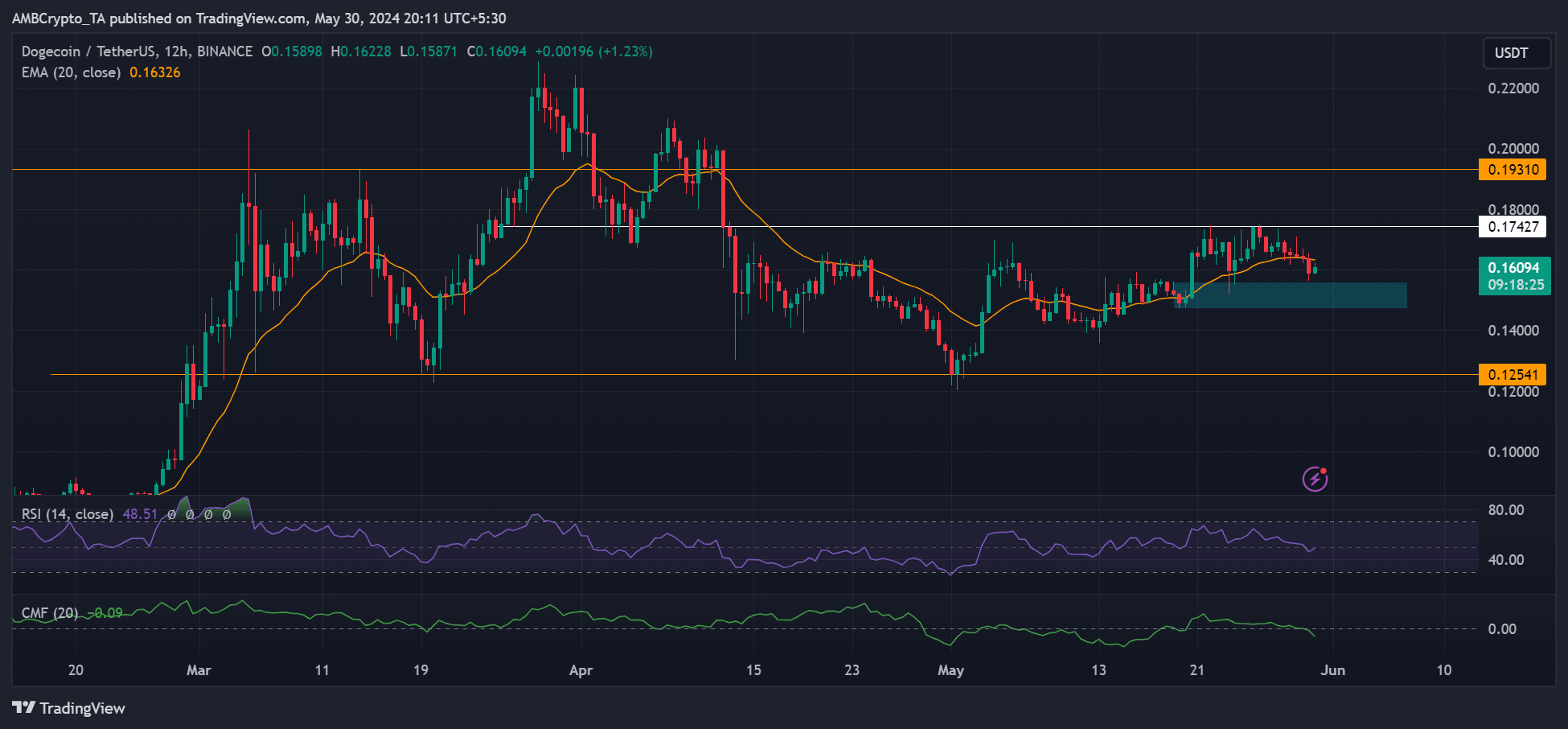

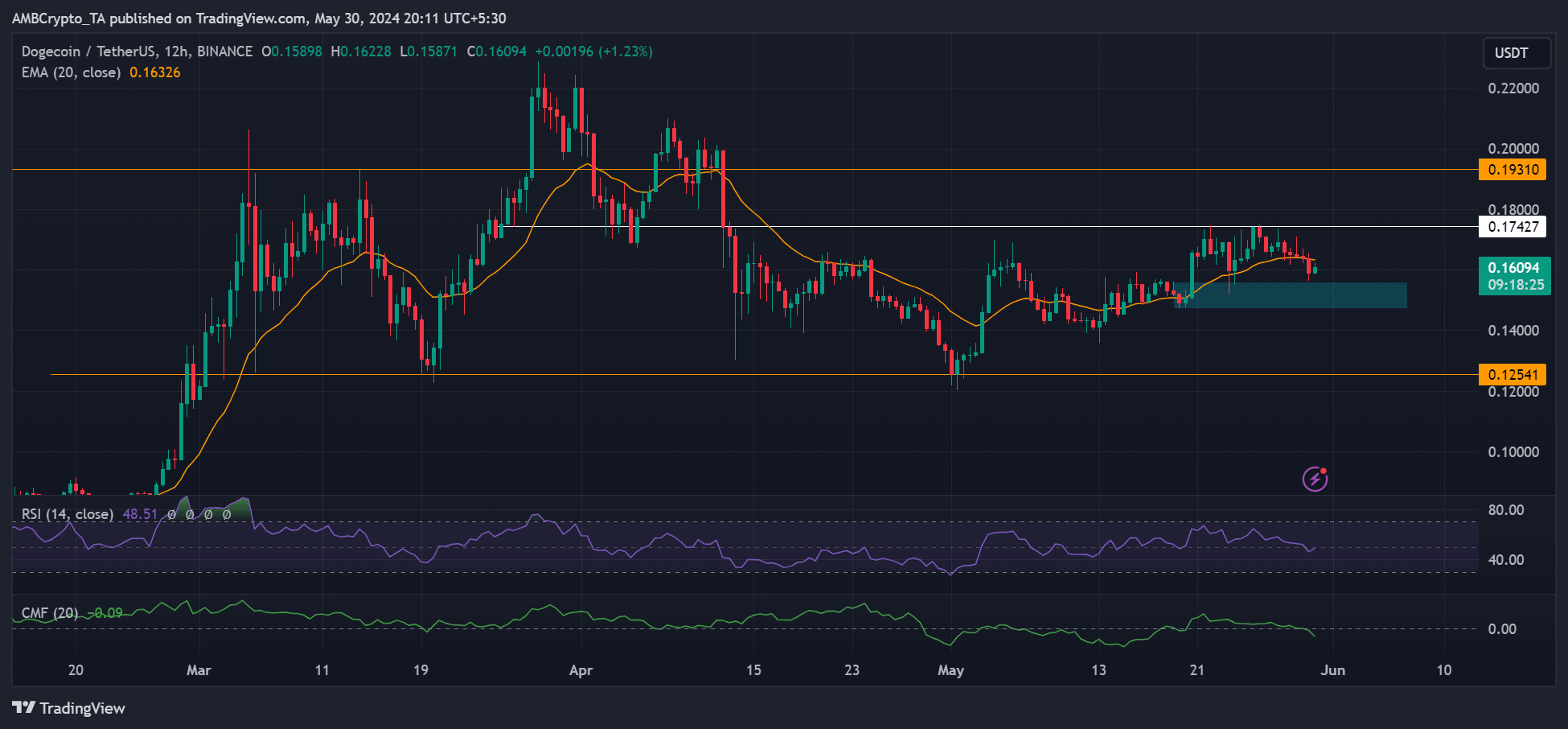

Source: DOGE/USDT

The below-average readings on the RSI (Relative Strength Index) and CMF (Chaikin Money Flow) meant that a retest of the demand area, marked by cyan, was possible. If so, a surge in OI could confirm the above rebound the reversal scenario.

However, a breach below $0.15 could drag DOGE to multi-month support at $0.13.