- A key Fibonacci retracement level has been conquered.

- TON bulls seek to drive an intense rally after recently setting an all-time high.

Toncoin [TON] was in a strong uptrend. It reversed all losses the bears inflicted in the second half of April and set a new all-time high at $7.76 on the 5th of June.

According to CoinMarketCap, TON is the ninth-largest crypto asset by market capitalization.

The $18.2 billion market cap token is likely to grow further. The technical indicators were firmly bullish, and the $10 level could be the next long-term target for the bulls.

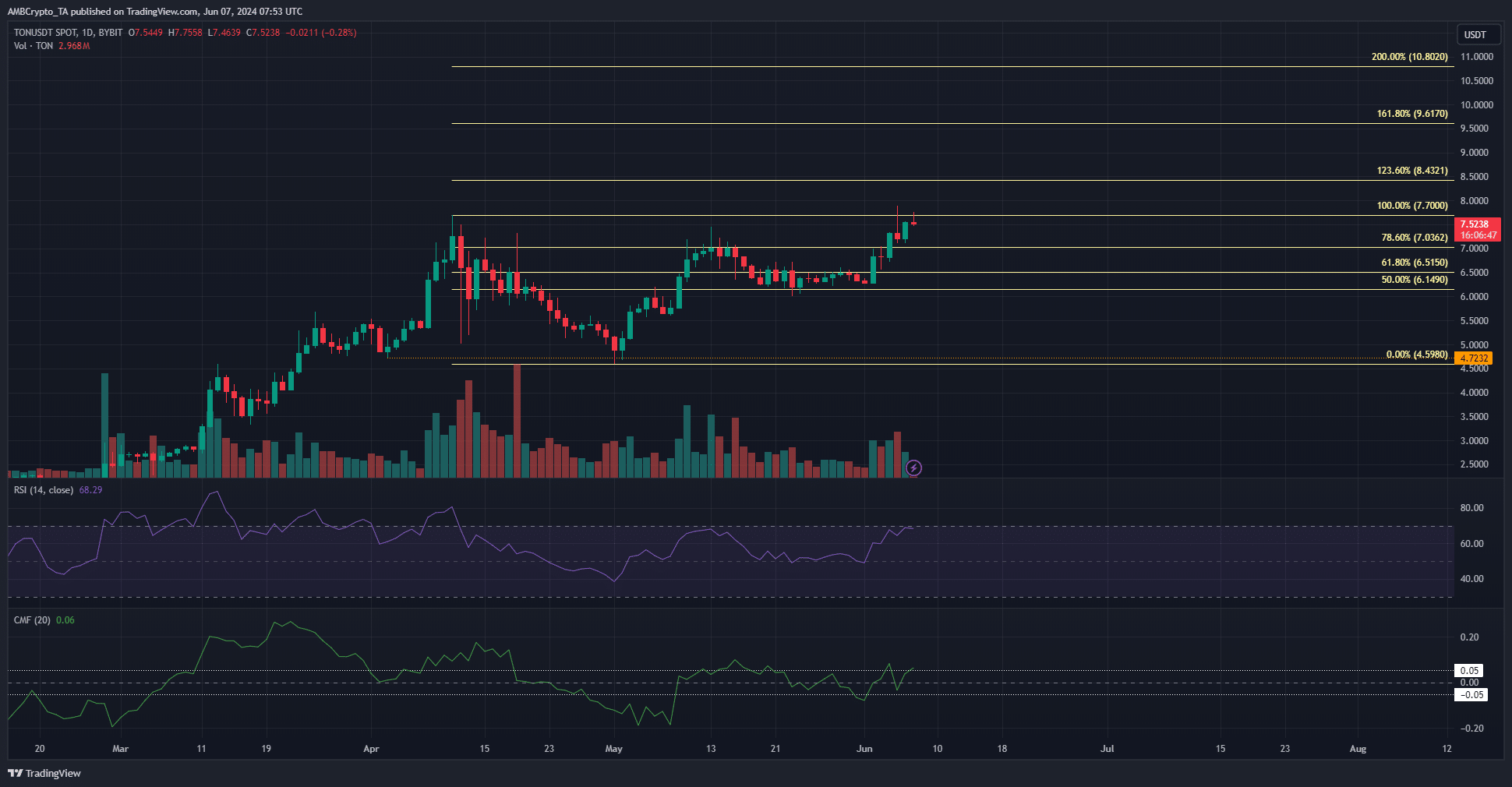

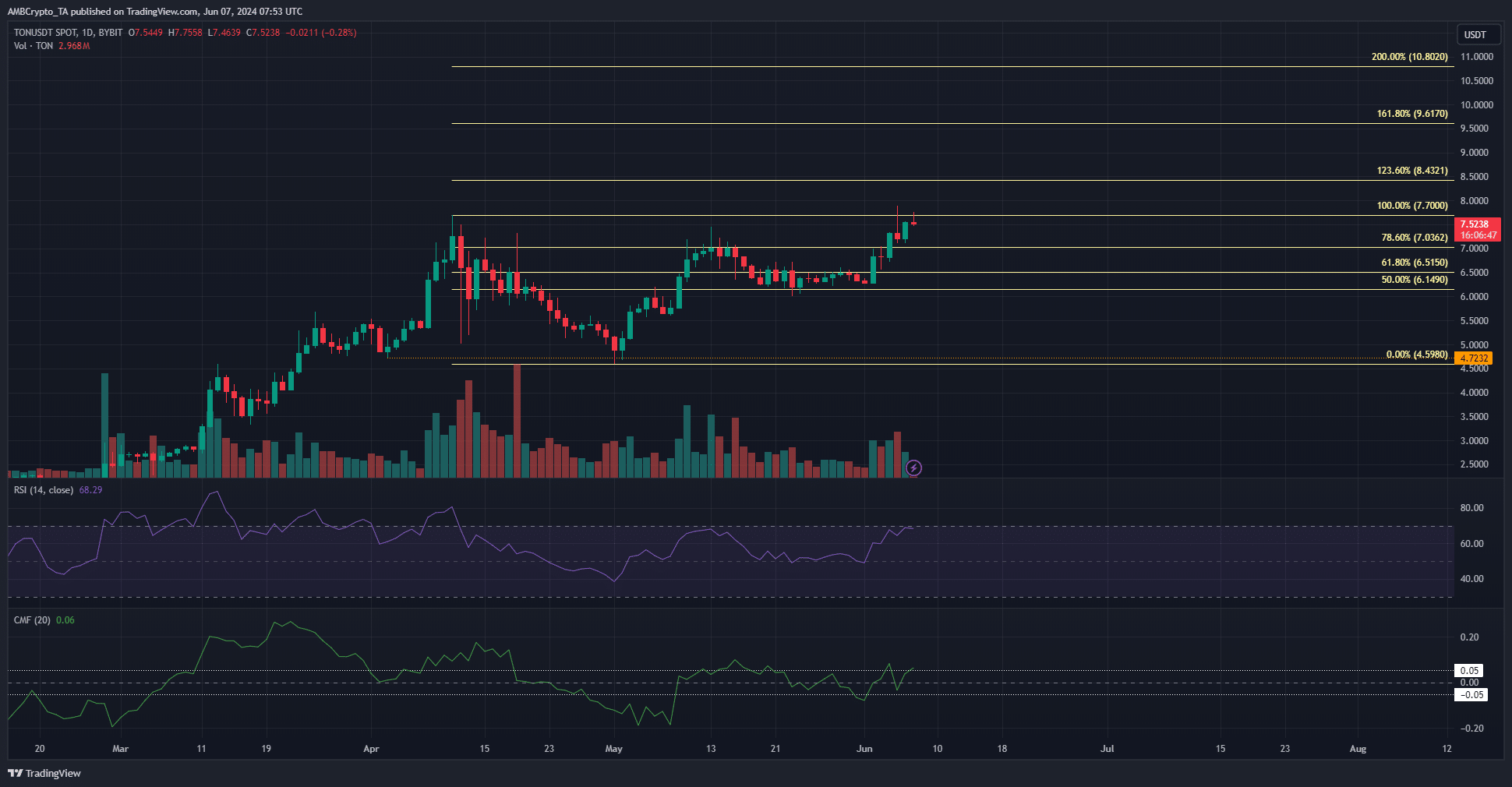

The 78.6% Fibonacci level was reclaimed

Source: TON/USDT on TradingView

In the 1-day timeframe, the market structure was bullish once again. The April retracement was followed by a bounce to $7 in the first half of May. This move was rejected at the 78.6% retracement level at $7.03.

The subsequent 12.5% dip saw TON retest the $6.15 region as support before climbing higher once more. In the past five days, Toncoin has gained 20.2% in value.

The daily RSI has been above neutral 50 for more than a month, showing a steady uptrend. The reading of 68 at press time indicated hefty bullish momentum.

The CMF was weaker, with only a +0.06 reading. This showed capital inflows were significant.

A continued uptick in the CMF would be a strong sign that the prices would climb higher. The trading volume has also picked up over the past week.

The bullish sentiment prevailed in the futures market as well

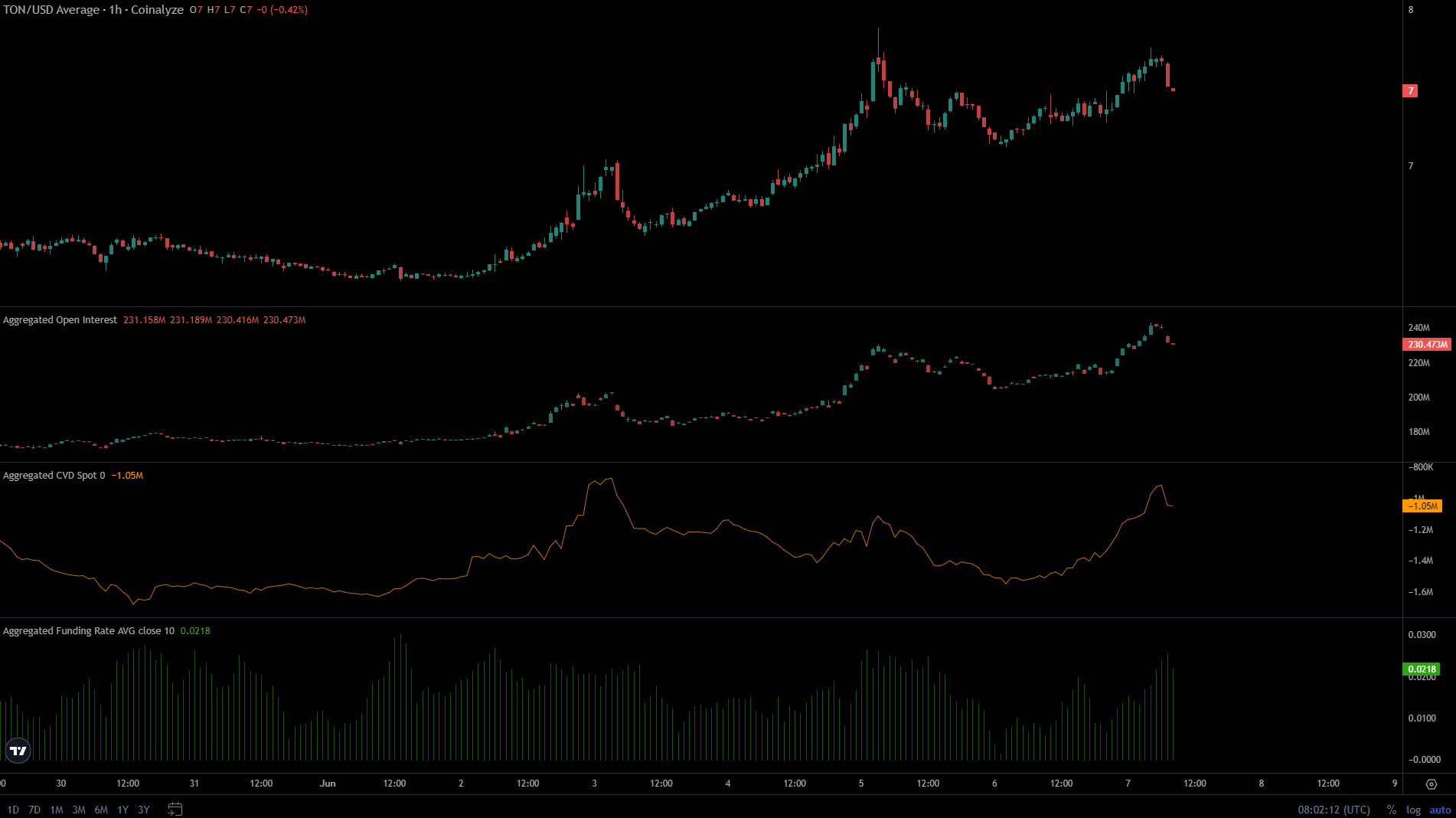

The Open Interest behind Toncoin has climbed from $180 million to $230 million within the past five days. This came alongside the price surge, meaning that speculators were willing to bid and possessed bullish convictions.

The spot CVD was also in a firm uptrend over the past 24 hours. The demand in the spot and futures market meant there was room for TON bulls to drive prices higher.

Read Toncoin’s [TON] Price Prediction 2024-25

The funding rate was also positive and the market was more eager to go long than short on TON assets.

Overall, bullish strength was evident and the $8.4, $9.6, and $10.8 Fibonacci extension levels would be the next target.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.