- BNB saw less decline in the last seven days.

- BNB remained below zero in funding rate.

Assets within the top five of the crypto market capitalization experienced declines over the past seven days, with Binance Coin [BNB] exhibiting the smallest decrease.

However, despite BNB’s relatively minor decline, the current market sentiment remains negative.

Binance Coin shows less decline

AMBCrypto’s analysis of data from CoinMarketCap revealed that BNB stood out as the only asset among the top five cryptocurrencies that has yet to experience a decline in the past seven days as of press time.

Bitcoin [BTC] and Ethereum [ETH], in contrast, witnessed declines of over 3% and 7%, respectively, during the same period. Meanwhile, BNB saw a slight increase of less than 1% over the last seven days.

Analyzing the BNB price trend

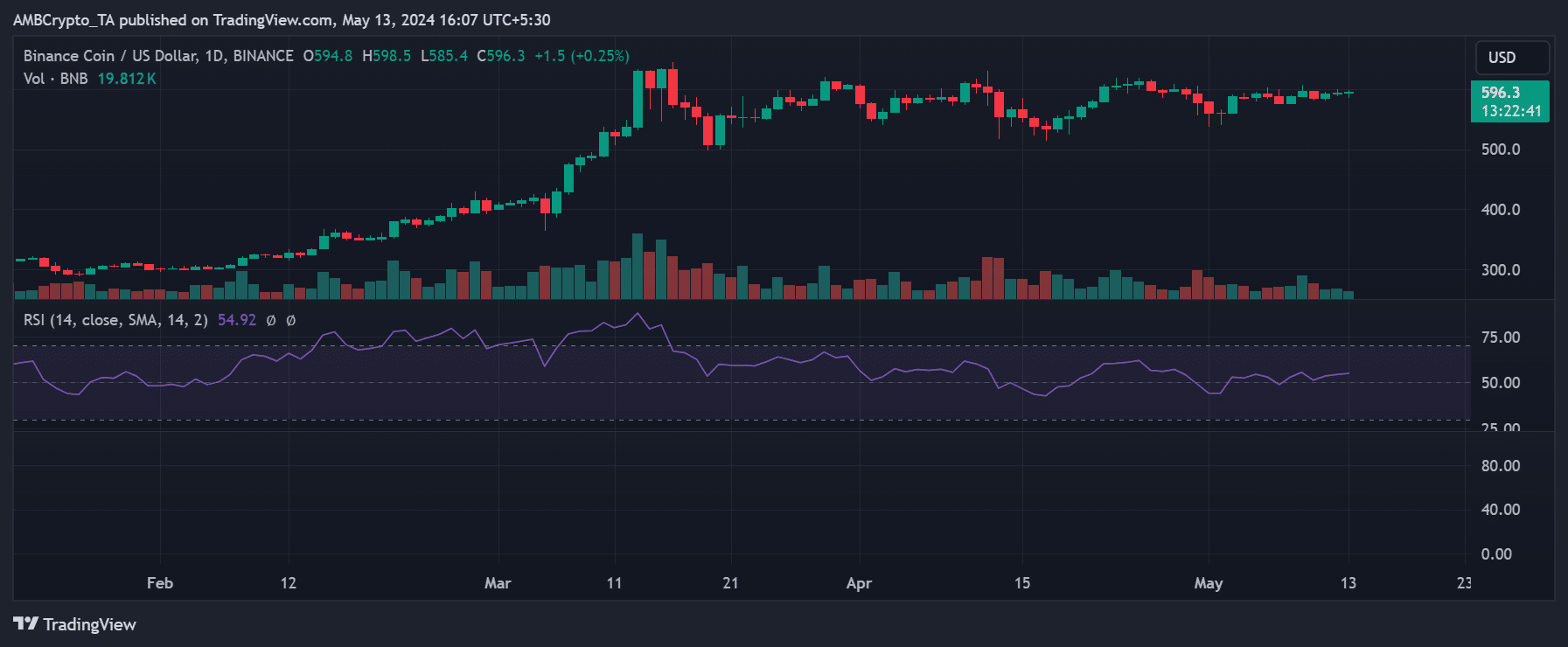

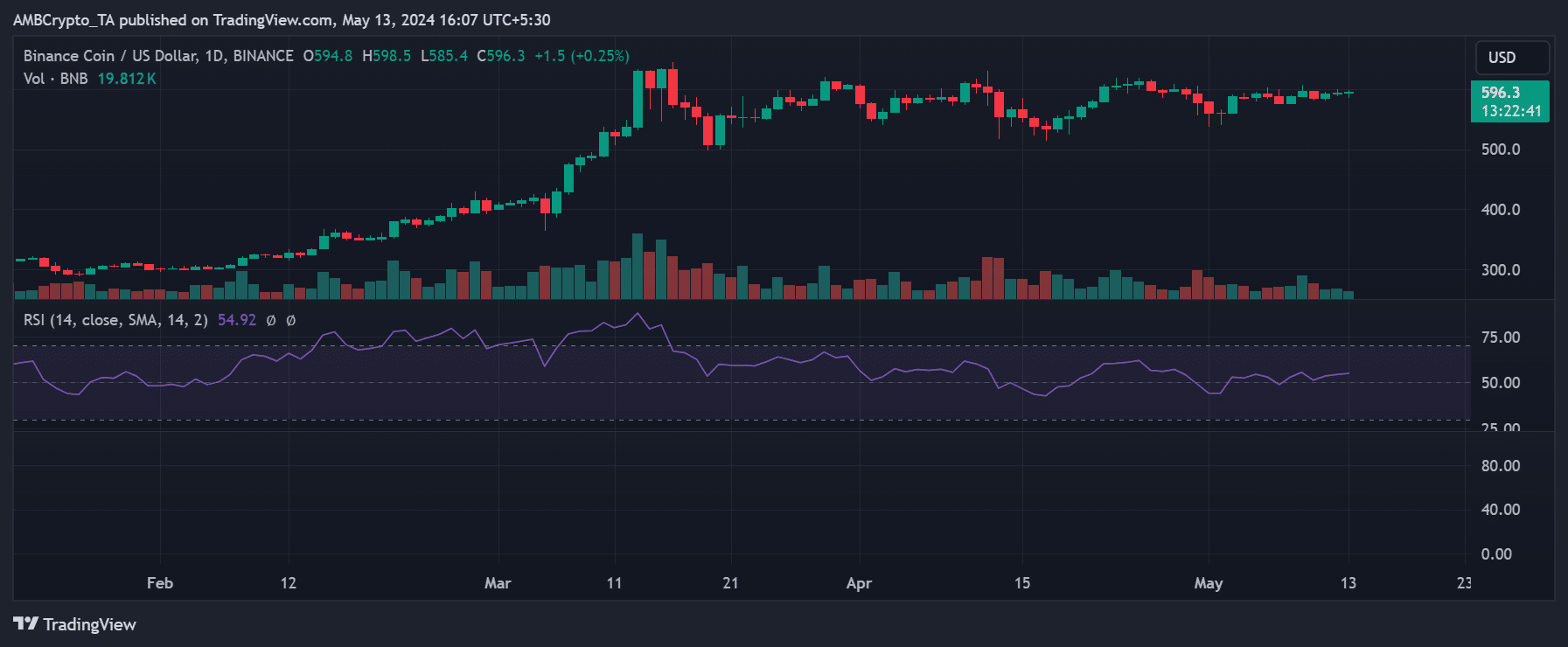

AMBCrypto’s look at BNB’s daily price trend over the past seven days indicates a lack of significant movement, explaining the absence of notable uptrends or downtrends.

Source: TradingView

As of this writing, BNB was trading at around $590, with a less than 1% increase. Also, the Bollinger Band analysis suggests a period of low volatility.

The movement appeared relatively stable and lacked significant fluctuations.

While this stability may be perceived positively, it also suggests the potential for increased volatility shortly.

Furthermore, the Relative Strength Index (RSI) indicated a continuing bullish trend for BNB, with the RSI slightly below 55 and showing no significant deviations.

Negative sentiment dominates BNB

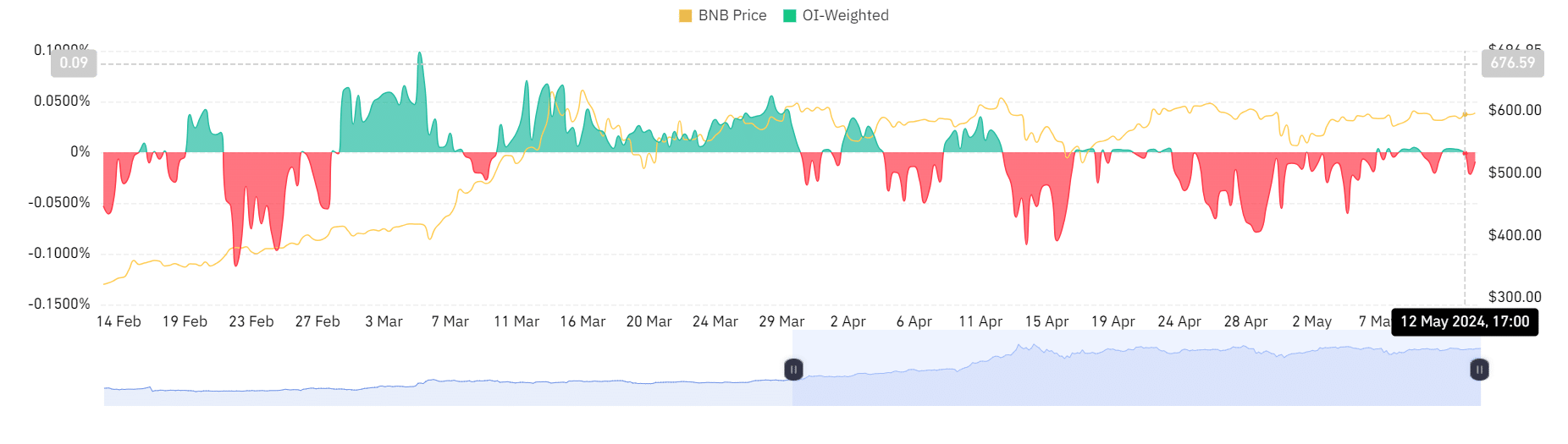

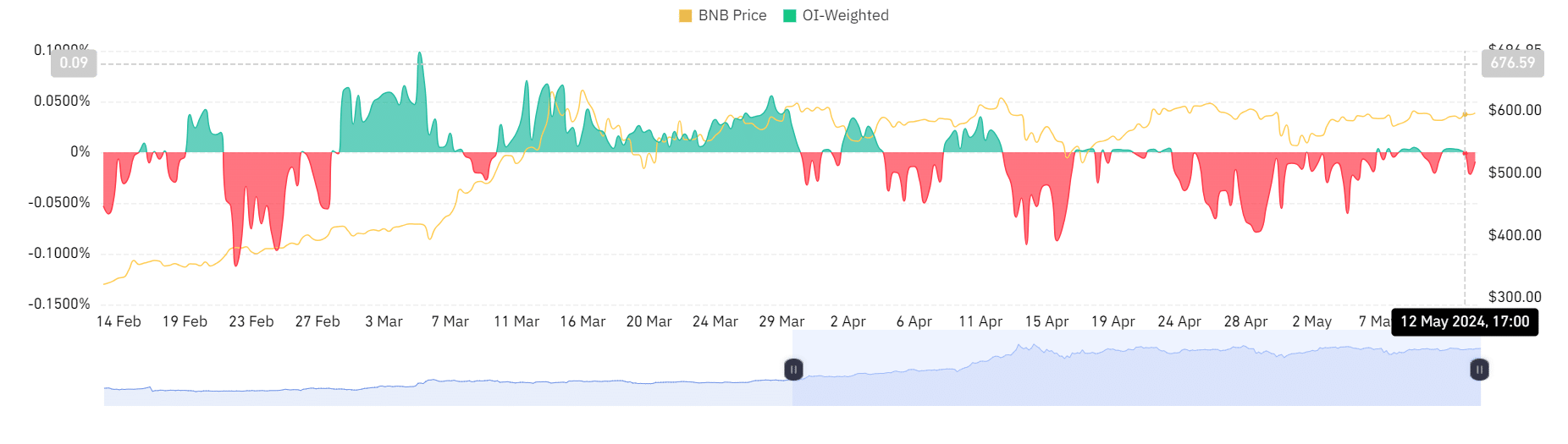

AMBCrypto’s examination of BNB’s Funding Rate on Coinglass indicated a negative value, suggesting prevailing seller dominance in BNB trading.

Standing at around 0.0092% at press time, with indications of a climbing trajectory, the Funding Rate earlier dipped to as low as 0.0218%.

This trend signified that most traders are opting for short positions on BNB. It meant they were anticipating further price declines.

Source: Coinglass

Is your portfolio green? Check out the BNB Profit Calculator

Additionally, the liquidation chart reinforces this sentiment, with a short position liquidation volume of approximately $143,000, compared to a long position liquidation volume of around $243,000.

However, a significant upward price trend could potentially liquidate these short positions, posing a risk to traders betting against BNB’s price.