With the ongoing Interest of UK governments and users, there seems to be a Good future of Cryptocurrencies and blockchain. Cryptocurrencies are not banned in the UK nor are they subjected to any specified regulations. Cryptocurrencies are termed ‘Exchange Tokens’ in the UK as they are intended to be used as a mode of payment. Exchange tokens in the UK are regulated for Money Laundering purposes.

Cryptocurrency exchanges in the UK are generally required to register with the Financial Conduct Authority(FCA). The FCA guidelines mentioned that the entities involved in crypto-related activities which come under existing financial regulations for derivatives require authorization.

It is also important to note the Government’s provision to access to the Financial Ombudsman Service or the Financial Services Compensation Scheme (FSCS) was allowed – The investors can use these services in case of any dispute in the purchase of cryptocurrencies. However, the FCA does recognize the potential and risks of trading cryptocurrencies.

So, what’s happening in the UK cryptocurrency regulations? Below is the timeline of a series of events and announcements taken towards the crypto industry. Let us find out more!!

Timeline of UK Crypto Regulations

2024

16-04-2024: The UK Treasury plans to unveil clearer regulations for crypto assets and stablecoins by July, aiming to foster local innovation. Economic Secretary Bim Afolami emphasized the importance of regulatory clarity for global competitiveness.

19-03-2024: The UK’s Financial Conduct Authority (FCA) plans to enhance its monitoring and intervention systems to combat crypto market abuse. Advanced analytics will be developed to aid detection, including network analysis and cross-asset class visualizations

12-03-2024: The UK Treasury released a consultation paper proposing changes to money laundering regulations to enhance crypto asset supervision and AML measures.

2023

06-11-2023: The Financial Conduct Authority (FCA) of the United Kingdom (UK) and the Bank of England (BOE) released discussion papers on Nov 6 regarding stablecoin regulation.

30-10-2023: The UK government prohibited non-fiat-backed stablecoins in regulated payment chains.

21-09-2023:UK FCA gives unregistered crypto firms ‘final warning’ on ads regime compliance

14-09-2023: UK House of Lords passes bill to seize stolen crypto

07-09-2023: FCA sets expectations ahead of incoming crypto marketing rules

24-08-2023: Ban on cold calling for consumer financial services and products

17-08-2023: The UK’s Travel Rule came into effect, potentially impacting certain cryptocurrency transfers.

22-07-2023: Ripple applied for a crypto license in the United Kingdom.

11-07-2023: UK FCA shuts down 26 crypto ATMs following coordinated investigation

04-07-2023:The UK government advanced a bill designed to empower authorities to seize cryptocurrencies.

03-07-2023: UK Law Commission recommends ‘distinct’ legal category for crypto

19-06-2023: The UK government advanced the financial markets bill to potentially regulate cryptocurrencies.

30-05-2023: Binance canceled the registration for inactive businesses in the UK

05-05-2023: FCA continues action against unregistered crypto ATMs across the UK

30-03-2023: The UK government announced ‘robust’ crypto regulation as a component of the economic crime plan.

31-01-2023 : A UK-native stablecoin was integrated into 18,000 ATMs nationwide.

23-01-2023: The Regulatory Policy Committee offers its viewpoint on the FCA’s restriction of selling crypto-referencing investment products to retail clients.

How are Cryptocurrencies Taxed in the UK?

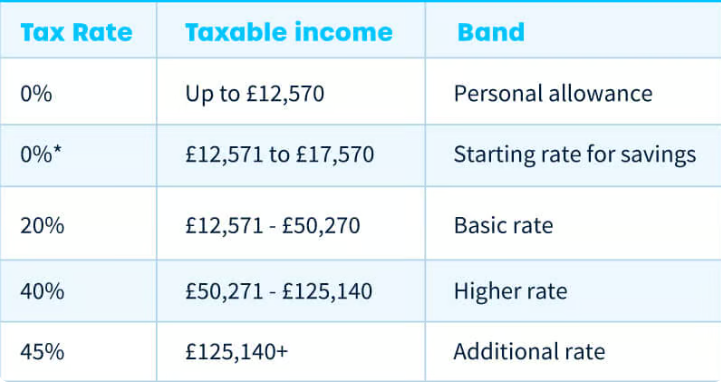

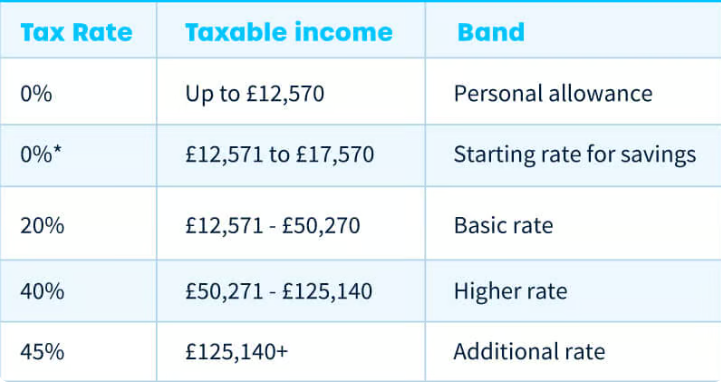

Here in the UK, crypto-assets are taxed in different scenarios under different taxes for individuals.

- One is when the individuals who hold crypto-assets utilize them for their personal purchases. Here they are taxed under Capital Gains Tax (CGT).

- In the other case, the individuals are taxed under Income Tax and also liable to contribute under National Insurance when they receive crypto-assets from their employer in the form of payment.

- Individuals who acquire cryptocurrencies through mining are liable to pay tax on the gains. However, the amount of taxation will vary depending on the specific crypto token and the current valuation of the UK crypto market.

A UK citizen who operates crypto exchanges is subjected to pay taxes on the trading of cryptocurrencies with the UK fiat currency. Here, the individual is charged with income tax on the trade profit earned.

When you make money from activities like staking or mining cryptocurrency, you’ll need to report it as income based on its value when received. In England, Wales, and Northern Ireland, income from cryptocurrency and other sources is subject to specific tax rates.

Cryptocurrency Mining in the UK

Like other countries, cryptocurrency mining is allowed in the UK without any specific regulations. The taxes will be applied only when a cryptocurrency is awarded upon successful mining.

The tax of cryptocurrency mining depends on 4 different factors: Degree of activity

- Organization

- Risk

- Commerciality

Historic Events and Announcements

2022

15-03-2022: UK Crime Agency Calls for Tougher Crypto Regulations

UK crime agency calls for regulation of a cryptocurrency that disguises transactions on the blockchain and facilitates the crypto moments using crypto mixers. These applications called decentralized crypto mixers enable criminals to operate on the dark web while laundering money.

For more details click here.

05-02-2022: UK Government Updates Crypto Tax Rules on DeFi, Staking

Her Majesty’s Revenue and Customs Office has updated the tax rules that govern decentralized finance and staking. HMRC has set out a series of “guiding principles” that act as general guidance on determining the nature of return related to DeFi or staking should be classed as income or as capital gains. HMRC has published four distinct points designed to assist individuals in determining the nature of their return.

For more details click here.

2021

29-11-2021: A recent update to Her Majesty’s Revenue and Customs(HMRC) regulations has introduced a digital service tax that will be levied on cryptocurrency exchanges operating in the UK. Uk crypto exchanges now have to pay 2% of digital service tax according to a Telegraph report.

03-06-2021: standard chartered unit to offer crypto trading services in the UK. SC ventures, the innovations, and ventures unit of global bank standard chartered, announced on Wednesday that it would launch a crypto brokerage and exchange platform for institutions’ clients in UK and Europe.

27-05-2021: White House review on crypto regulations to ensure traders can “DogecOin to their heart’s content.” The Biden administration is implementing new ways to regulate Bitcoin and cryptocurrency according to the report in the Washington Post, White House officials have briefed the Treasury Department about cryptocurrency risks. They are now looking forward to ensuring the industry is properly enforced without stifling innovations or damaging the market.

For more details click here.

09-03-2021:The leading digital payment platform, Wirex, has launched its multi-currency Mastercard debit card in UK and EEA, and a rewards program, X-tras, across the globe as well. These new features will easily make crypto more accessible to people.

For more details click here.

29-04-2021: UK tax authority updates treatment of Crypto Assets corporate Staking. Her Majesty’s Revenue and Customs (HMRC)has updated its guidance on the taxation of crypto assets to incorporate income from staking in proof-of-stake networks. For the first time, HMRC has released guidance on describing how staking is treated for taxation purposes. staking comes under the guidance of mining thus the same guidance has continued as previously assumed.

For more details click here.

2020

11-10-2020: UK banning the sale of Crypto derivatives, the US creating 22% of all $USD in existence in 2020 alone.UK Financial Conduct Authority(FCA) announced a ban on the sale of crypto- derivatives and exchange-traded notes(ETNs) referencing certain types of crypto-assets(crypto-ETNs) to retail consumers.

For more details click here.

30-06-2020: FCA lifted the ban on Wirecard UK, all UK cards have been reactivated and card balances were refunded to users’ crypto wallets. Britain’s financial watchdog has lifted a ban on the payment activities of Wirecard’s UK arm, and Restored services for millions of customers who were temporarily unavailable to access money or make payments using fintech apps relying on its technology.

For more details click here.

24-04-2020:- A University in the UK, Birmingham City University is developing the world’s first digital safety certificate to protect suppliers and consumers from risks associated with COVID-19. The CCC “Coronavirus Clearance Certificate” based on Blockchain technology has been developed by the Birmingham City Business School.

16-03-2020:- The FCA issued an advisory on its official website warning the public about the rise in scams amid the coronavirus situation and urged them to keep their assets safe by not investing in them.

19-02-2020:- London-based Bitcoin exchange, Coinfloor now focuses on consumer BTC services. These include ‘NO BS Education’ which will provide free access to provide simple and trusted knowledge about cryptocurrencies.

06-02-2020:- The FCA, UK’s financial industry regulator posted a job for a cryptocurrency and blockchain expert. This was done on the virtue of a better understanding of the concept and also to monitor this sector to minimize the scams.

21-01-2020:- Bank of England to consider adopting cryptocurrency. The bank officials will carry out complete research by meeting the Central Banks of Japan, Europe, Canada, Swiss Bank and Bank for International settlements. The main objective would be to examine the better way the country could adopt Bitcoin-style digital currency.

02-01-2020:- Mark Hipperson, an ex-employee of Barclay’s group heading the Technology for a decade and former CTO at UK challenger bank, is planning to launch UK’s first regulated Crypto Bank in 2020.

2019

29-10-2019:- The UK’s Financial Regulator, FCA proposed a ban on cryptocurrencies. The ban was proposed amid the growing popularity of crypto-assets in the millennials. FCA mentioned that it wants to mitigate the risks to the customers and market integrity and prevent the use of crypto-assets for illicit activity. The FCA also reported that the crypto investors lost over $34 million due to forex scams in the year 2018-19. Following the report from FCA, the regulators intensified their investigations on cryptos by 74% as compared to that of 2018.

27-09-2019:- UK police raised about $369,000 by auctioning the seized cryptocurrencies above the market value. In total, 62 lots of cryptocurrencies including Bitcoin, Ethereum, Ripple and Bitcoin Satoshi versions were sold. The currencies were seized by 20 yr old Norwich man Elliot Gunton who was found guilty of supplying stolen personal data and hacking services in exchange of cryptocurrencies. He was sentenced to 20 months imprisonment and a fine of $491,000.

2018

24-12-2018:- At least 340 UK Crypto or Blockchain companies were dissolved due to the low growth rate. In the due course, 60-70% of the employees were laid off.

19-09-2018:- The UK parliament issued a report which recommended regulation of the crypto-asset market. The report mentioned that the currencies have no inherent value and could pose risks for inexperienced investors. The report also mentioned that the self-regulatory bodies within the crypto market were insufficient to address the concerns of customers and anti-money laundering laws.

07-08-2018:- The UK Financial Conduct Authority proposed the creation of the Global Financial Innovation Network (GFIN). GFIN could be a collaborative effort with twelve financial regulators across the globe. This would provide a free passage for all the regulators to interact and navigate regulators while building new ideas.

11-06-2018:- The regulation authorities, Prudential Regulation Authority(PRA) and Financial Conduct Authority(FCA) issued a written letter to the CEO’s of banks, insurance companies and investment firms. In the letter, the CEO’s were reminded of the obligations under the PRA and FCA rules providing services to clients relating to crypto-assets.

06-04-2018:- The FCA on this day announced that the companies offering cryptocurrency derivatives need to comply with the FCA rules and EU regulations. According to the FCA statement, the derivatives that are bought under their rules are Cryptocurrency Futures, Cryptocurrency contracts for differences (CFDs) and Cryptocurrency options.

22-03-2018:- UK Chancellor of the Exchequer, Philp Hammond announced the creation of a ‘crypto-asset task force’. This force will include the Bank of England and the Financial Conduct Authority in addition to the treasury. The step was taken to manage risk around the cryptocurrencies as well as harness the potential benefits of the technologies.

15-03-2018:- UK crypto exchange Coinfloor announced the launch of the world’s first physically delivered Bitcoin Futures in April 2018. The exchange confirmed the news via twitter.

2017

04-12-2017:- The UK and the other EU governments together plan to bring bitcoins and other cryptocurrencies under the Anti-Money Laundering Act and Counter-Terrorism Financial Legislation. Under this legislation, traders would be forced to disclose their identities, putting an end to any speculation of drug dealing or illegal activities.

14-11-2017:- The UK’s FCA issued a warning to the customers against investments in the cryptocurrency’s Contract-for-differences(CFDs). CFDs are complex financial instruments that allow the user to speculate on the price of an asset. They are offered leverage which multiplies with the profit or losses. And hence the risk of losing money is very high. The risks include price volatility, leverage potential multiplying the losses of the investor, fees, and lack of transparency.

27-10-2017:- The UK parliament is in discussion with the EU for the amendment of the current Anti-Money Laundering Act. The proposal within this Act included bringing the digital currency exchange platforms and custodian wallets under existing legislation.

2016

02-12-2016:- The Royal Mint, an HM-owned institution has paired with the CME group to build and launch a digitalized gold offering called Royal Mint Gold(RMG). The royal mint is expected to put $1 million worth of gold on blockchain technology that will enable the customers to own and trade fractions of gold stored in their royal vaults.

25-04-2016:- The UK Treasury said it would not bring digital wallet providers under the Anti-money laundering Act.

15-03-2016:- The Bank of England announced its plan to launch its own Bitcoin-like cryptocurrency called RSCoin. The new coin will function on blockchain technology.

2015

October 2015:- The HM treasury published ‘UK National Risk assessment of money laundering and terrorist financing. The report involved a detailed report of the risks involved in dealing with digital currencies.

18-09-2015:- The Bank of England’s chief economist Haldane, proposed the abolishment of paper cash by replacing it with state-backed digital currency.

01-09-2015:- British banking firm Barclays starts testing Bitcoin and also plans to integrate cryptocurrency into Online Banking. The UK government also invested 10 Million Pounds in the research of cryptocurrency.

02-07-2015:- London based Coinfloor, a Bitcoin exchange, launches its own P2P marketplace allowing investors and consumers to buy from bitcoin brokers in a safe environment.

March 2015:- At the end of March, the HM treasury released a report regarding the benefits and risks of cryptocurrencies. In the report, it mentioned its plans to regulate bitcoin exchanges.

2014

06-08-2014:- Chancellor Geroge Osborne commissioned a treasury to research cryptocurrencies examining their benefits and risks, Osborne said.

03-03-2014:- HMRC published a document regarding the tax information on cryptocurrencies. In this report, HMRC lists out the tax collected with activities involved in Bitcoin or any similar cryptocurrencies. According to the report, Bitcoin or any similar cryptocurrency is liable for VAT, Capital Gain Tax(CGT), Income Tax( IT) or Corporation Tax(CT) for various activities.

2013

08-07-2013:- HMRC in a reply to a letter from Joel Dallas, director of exchange FYB-UK, said that exchanges are not required to register with HMRC under money laundering regulations at present.

19-06-2013:- Her Majesty Revenue & Customs(HMRC) says that digital currencies are covered by the UK tax system. The profits of the currencies are subjected to taxes.

Closing Note

The UK’s marketplace could be best suitable for crypto lovers as no strict rules are applied. Not only dealing with crypto’s, if you carry out your business within the circumference of the laws, then no worries at all!!!

Same here in the UK, the government no doubt has given a free hand but also kept a close watch. Despite this many scams do occur, many people do get fooled but some prosper also. The regulatory authorities always wanted to bring cryptos under regulation.

My suggestion to all my readers and crypto lovers, Please to keep yourself updated on the latest regulatory news or announcements.