- Solana’s popularity remained high as investors actively traded SOL.

- A few metrics and market indicators hinted at a price increase.

Solana [SOL] witnessed much traction in the recent past as several investors withdrew SOL to buy other Solana-ecosystem tokens. While activity around SOL remained high, its price action turned bearish in the last 24 hours.

Let’s have a closer look at what’s going on.

Solana’s trading volume rises

Lookonchain’s recent tweets revealed that an insider used just $1.2k worth of SOL to buy 190.2 million HULK, which accounted for 19% of the latter’s total supply.

Soon after that, the insider sold off the recently accumulated HULK for 5,760.7 SOL, which was worth $979k.

Another whale withdrew 8,943 SOL, worth $1.54 million, from Binance to buy 8.6 million MOTHER at $0.1789. Thanks to all these transactions, SOL’s trading volume remained high throughout the last week.

In the last 24 hours alone, SOL’s tracing volume remained at more than $2 billion.

Meanwhile, SOL managed to push its price up by nearly 3% in the last seven days. But the trend changed in the last 24 hours as the token’s value dropped by over 1%.

According to CoinMarketCap, at the time of writing, Solana was trading at $171.88 with a market capitalization of over $79 billion.

Will SOL remain bearish?

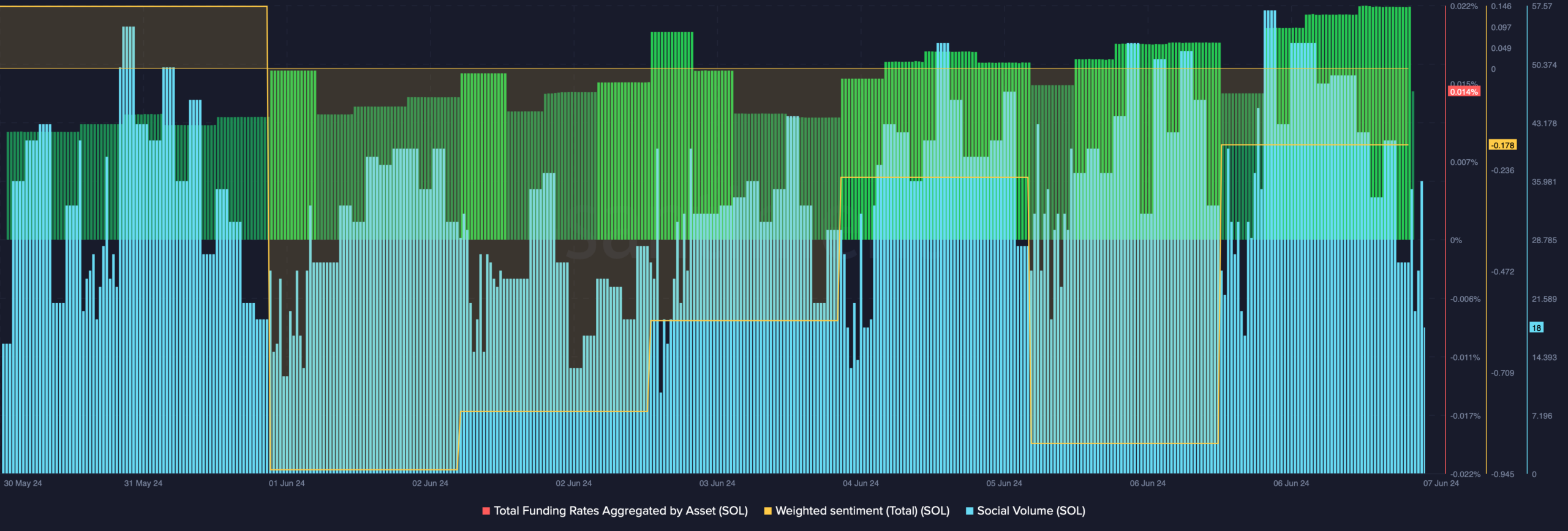

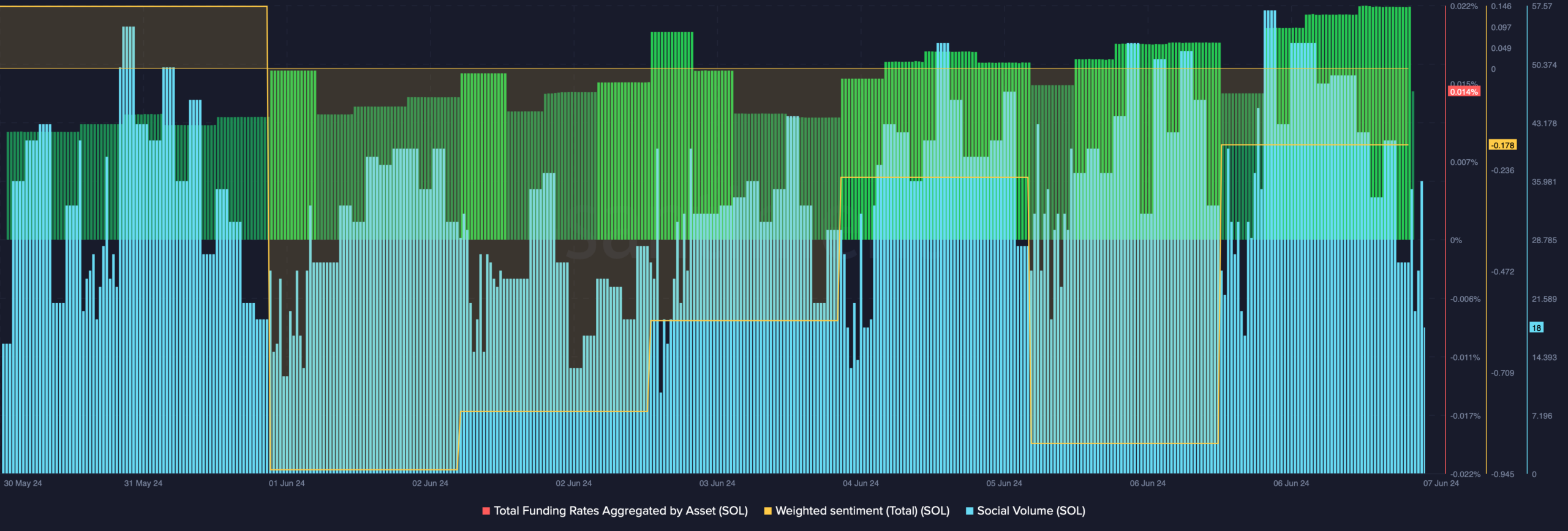

To see whether SOL would continue to remain bearish, AMBCrypto then analyzed its on-chain data. We found that SOL’s weighted sentiment remained in the negative zone. This meant that bearish sentiment around the token was dominant in the market.

Its funding rate has increased substantially over the last few days. Nonetheless, its social volume was high, reflecting its popularity in the crypto space.

Source: Santiment

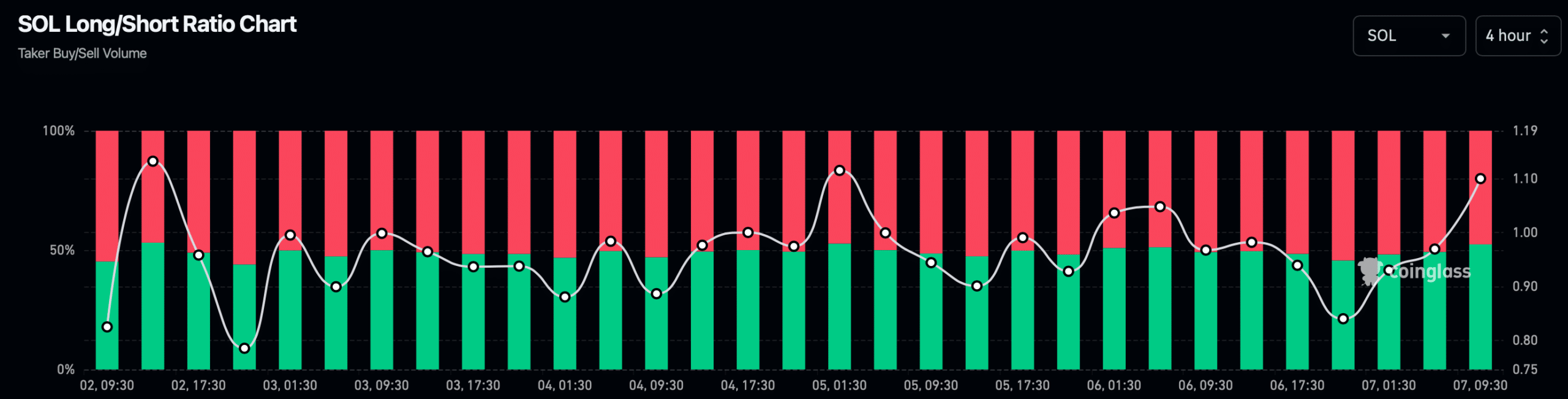

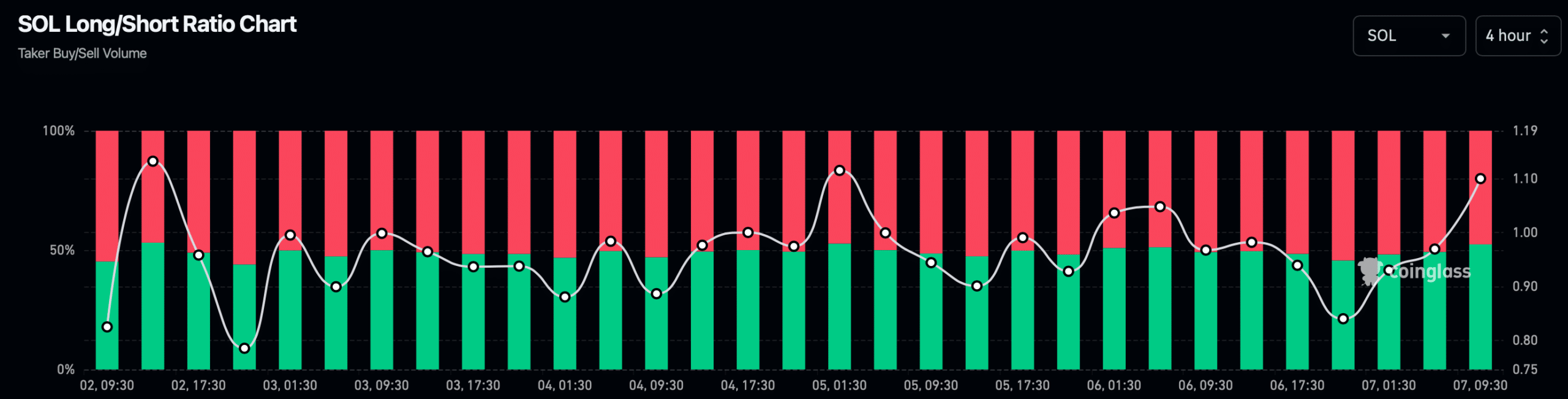

AMBCrypto’s look at Coinglass’ data revealed a bullish metric. We found that SOL’s long/short ratio increased sharply in the last four hours.

For starters, a high long/short ratio suggests that there are more buyers than sellers in the market, which can be inferred as a bullish signal for the token.

Source: Coinglass

Our analysis of Solana’s daily chart also revealed a few bullish indicators. For instance, the Money Flow Index (MFI) registered a sharp uptick over the last few days.

Read Solana (SOL) Price Prediction 2024-25

Additionally, its Relative Strength Index (RSI) also followed a similar trend and went up. These suggested that the chances of SOL’s price rising were high.

Nonetheless, the Chaikin Money Flow (CMF) remained bearish as it continued to trade under the neutral mark of 0.

Source: TradingView