- High memecoin trading helped the blockchain’s volume, with fees hitting $2.1 million

- The number of validators decreased but the TVL jumped.

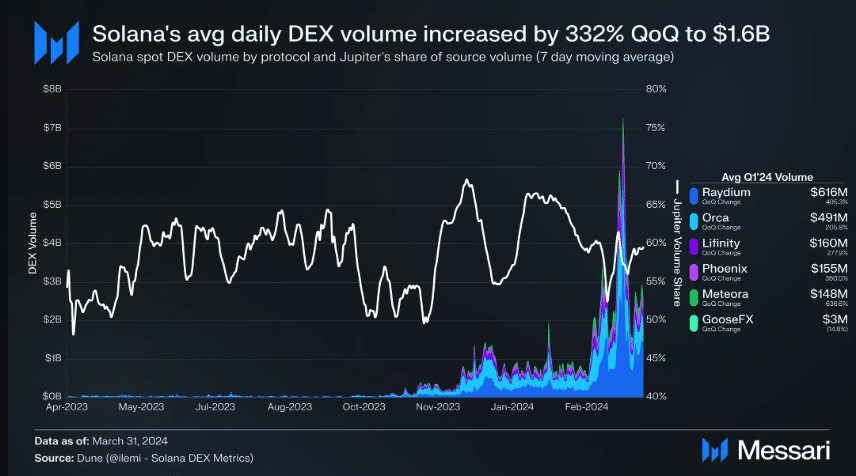

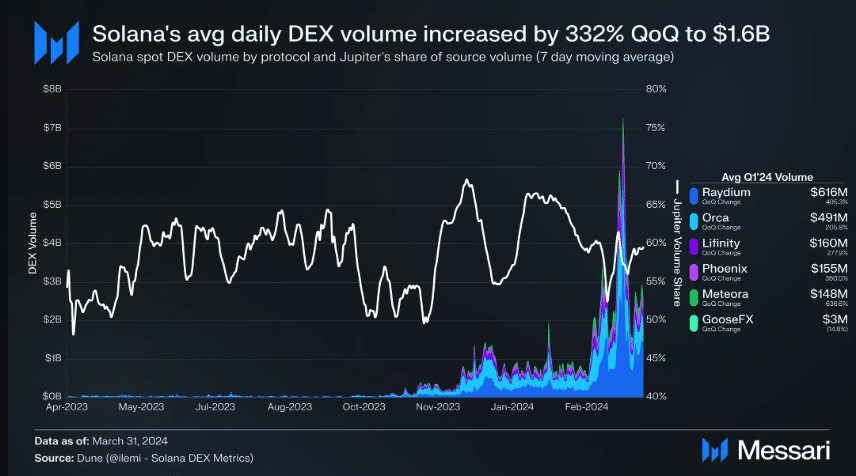

According to Messari, the first quarter (Q1) of 2024 was a superb one for Solana [SOL] as the blockchain hit one record after another. In its report, the intelligence firm revealed that Solana’s DEX volume jumped by 319%, when compared to the previous quarter.

Memecoins to the rescue again

When DEX volume increases, it means that market participants are involved in buying and selling tokens built under a blockchain via decentralized platforms. Based on the report, Raydium and Orca had the largest share of liquidity. However, memecoins were the major reason for the hike in volume.

Source: Messari

On several occasions, AMBCrypto has reported how many memecoins emerged on Solana, with Messari confirming the same.

“The increase in DEX volumes was largely driven by memecoin trading. Following SOL-stable and stable-stable pairs, SLERF-SOL and WIF-SOL accounted for the fourth and fifth-highest token pair trading volume in Q1.”

This trading activity was also one of the reasons Solana recorded a mind-blowing $2.1 million in fees generated. With Q2 already in motion, a hike in memecoin trading could bring in more revenue for the blockchain.

Hold on! Everything is not rosy

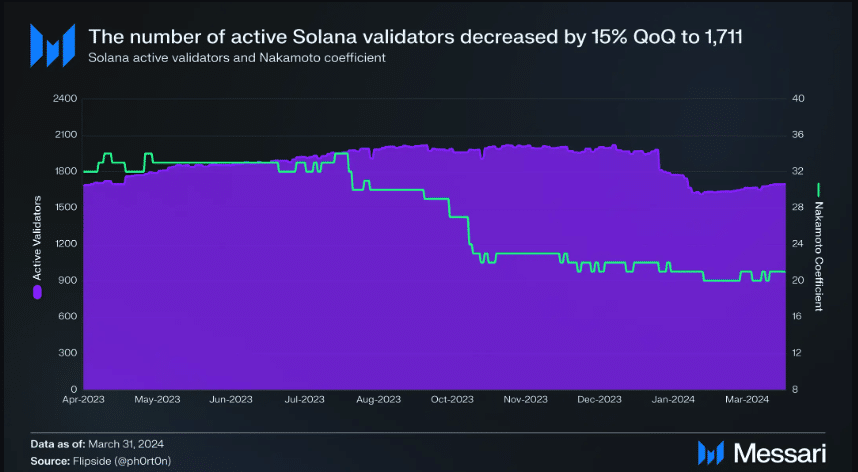

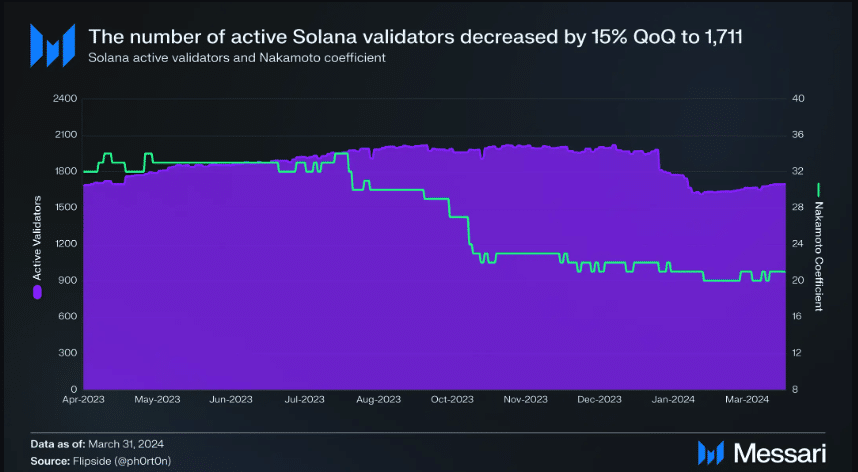

On the other hand, a decline wound down the DEX volume. Despite the aforementioned, Solana recorded some downsides. One of them was the outage on 6 February. Another one was the fall in the number of active Solana validators.

For those unfamiliar, validators support the blockchain’s operations by helping to secure the network.

Source: Messari

According to the report, Solana validators dropped by 15% on a Quarter-on-quarter (QoQ) basis. The report read,

“Solana network’s 1,711 active validators are hosted in 36 countries, up 33% YoY. The United States leads with 27% of all stake, down 10% QoQ.”

A decline in validator count opens the network to risks. If unchecked in Q2, Solana might go through another outage. Worst-case scenario, the blockchain will be prone to attack.

However, if the number of validators increases this quarter, censorship resistance might also increase. Meanwhile, the drawdown seemed to end at the validators and the outage.

Will potential yield save SOL?

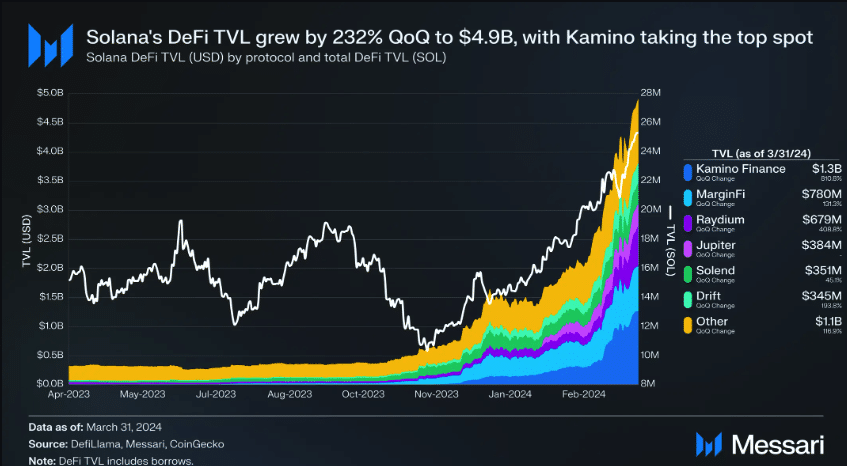

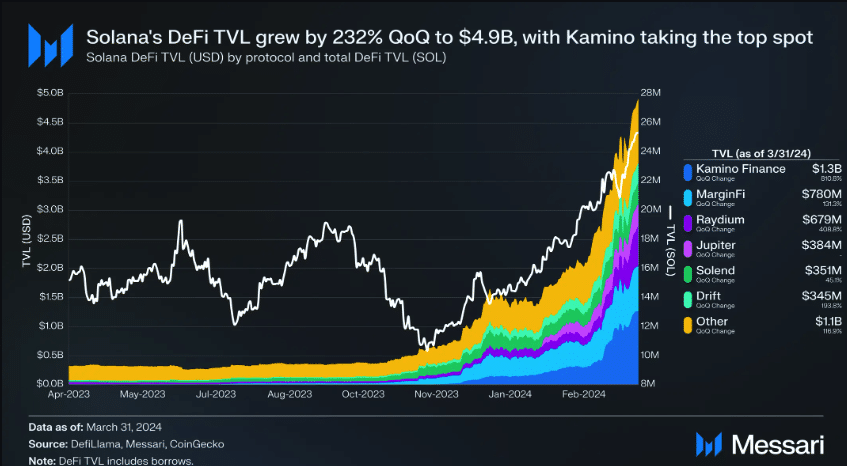

As per the Total Value Locked (TVL), Solana hit $4.96 billion on the charts. This represented a 232% hike from Q4 2023. TVL measures the health of a protocol. When it decreases, it implies a decline in assets staked or locked. On the other hand, an increase underlines perceived trust and a surge in assets deposited.

For Solana, there have been some reasons for the surge. In fact, one of the major ones was lending protocol Kamino disclosing that it would airdrop tokens to some of its users.

Source: Messari

Announcements like this drive optimism and trigger an increase in liquidity for protocols. By Q2, another protocol like MarginFi might toe the same line too.

Read Solana’s [SOL] Price Prediction 2024-2025

Should this be the case, Solana’s TVL might record another pump and probably inch closer to its 2021 high. Additionally, the price of the altcoin might breach its all-time high over the same period.