- SOL resisted a nosedive despite the large exchange inflow.

- Technical analysis suggested a bearish bias for the token.

Four Solana [SOL] transactions valued at almost $160 million were sent to Coinbase, according to a Whale Alert post on X. From AMBCrypto’s observation, all transactions happened around the same period.

Typically, when whales send a large number of tokens, the cryptocurrency affected, experiences a decline. This is because the intent is usually to sell.

SOL proves strong

For SOL, this has not been the case. At press time, Solana’s price was $196.37— a similar price that it was 24 hours ago. The value of the cryptocurrency indicates that the participant involved might not have sold the tokens yet.

If the same goes through, then the price of the token might decline. Should selling pressure be intense, the value of SOL might drop below $190.

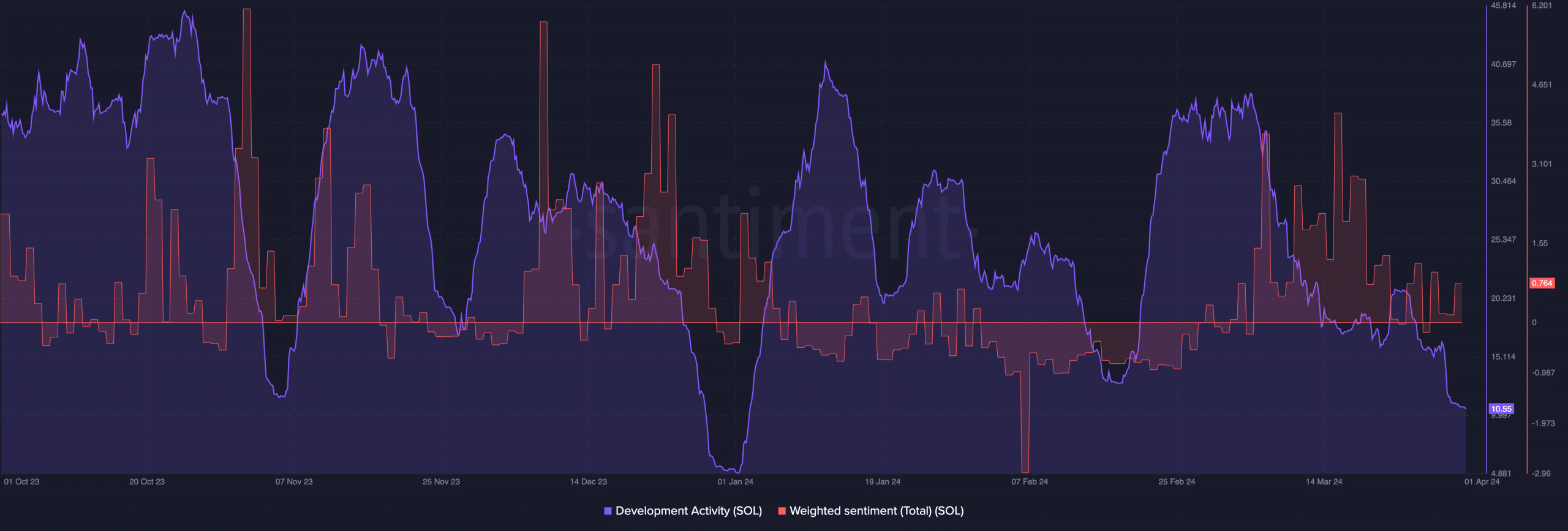

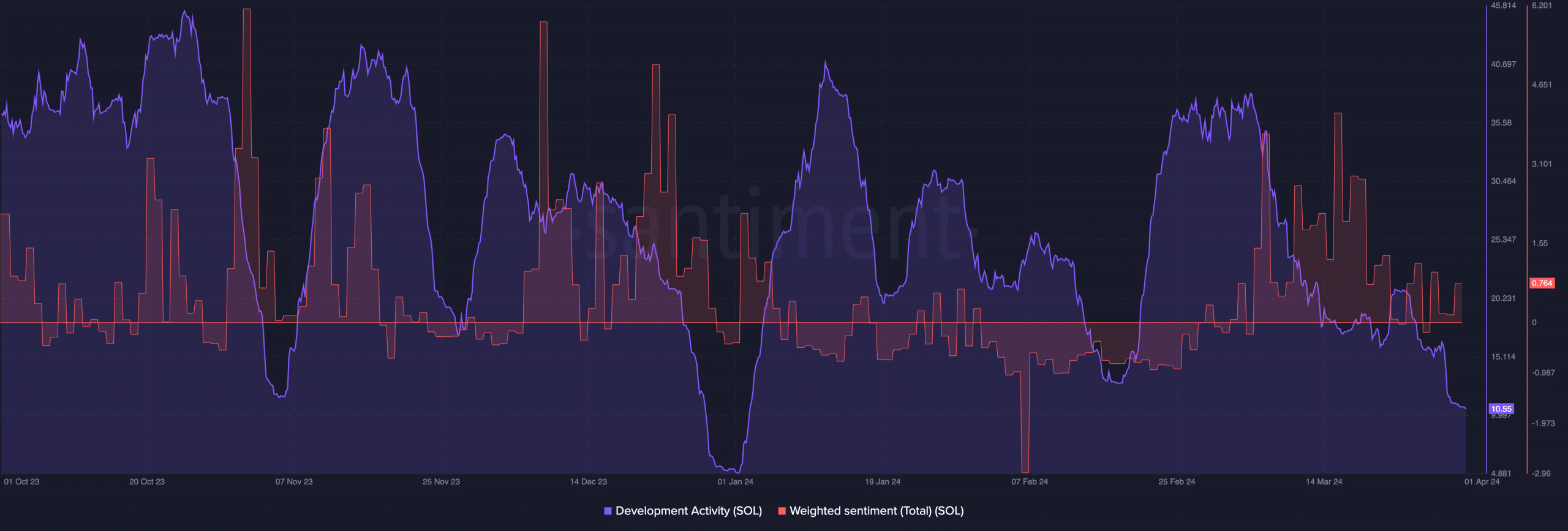

Besides this speculation, AMBCrypto looked at Solana’s on-chain condition. According to Santiment, development activity on the network had dropped to 10.55.

Development activity tracks the public GitHub repositories dedicated to a project. If the metric increases, then it means developers are contributing codes to the proper functioning of the network

However, the decline in the metric implies that features shipped on the network had reduced. Concerning the sentiment around SOL, this condition implies that participants were bearish on the token.

We also checked the Weighted Sentiment. According to on-chain data, the Weighted Sentiment had climbed from the negative region.

Source: Santiment

This reading implied that comments about SOL were mostly positive. If this continues, then the predicted decline might not last for a long period. Should the sentiment continue to rise, then SOL might climb past $210.

A decline may be next

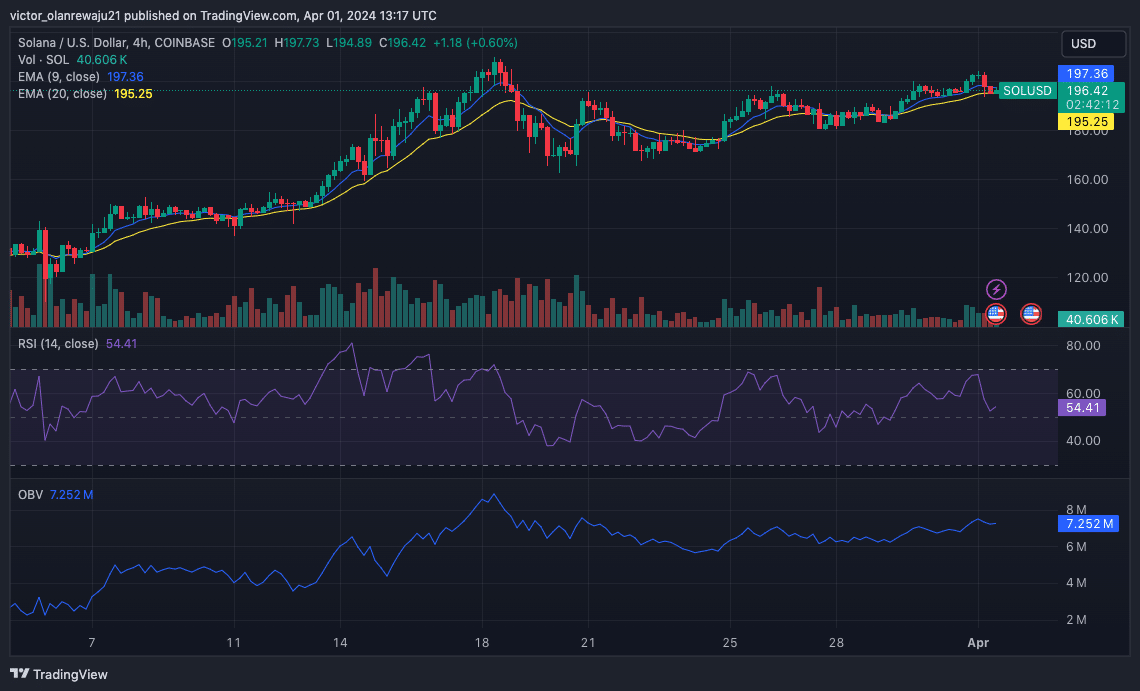

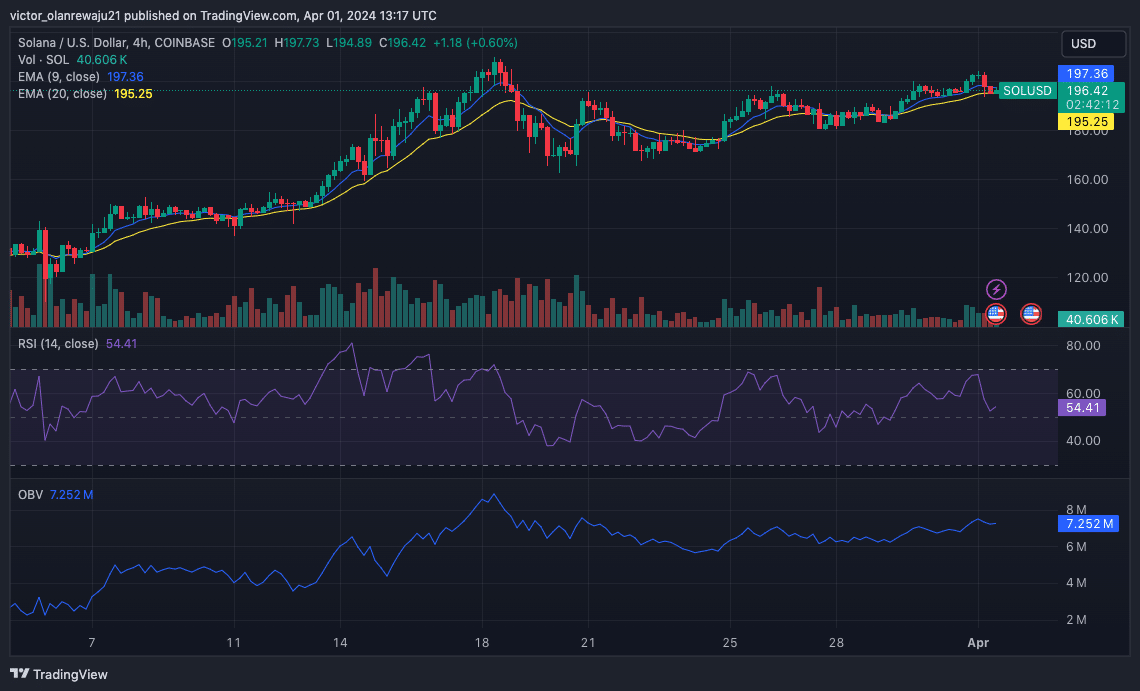

From a technical perspective, AMBCrypto considered the Exponential Moving Average (EMA). As of this writing, the 9 EMA (blue) had crossed over the 20 EMA( yellow). Typically, this would have suggested a bullish bias.

But SOL’s price at press time was on the verge of dropping below the EMAs. Once it does, SOL’s bullish thesis might be invalidated.

Furthermore, the Relative Strength Index (RSI) showed that buying momentum had decreased. If the reading continues to decrease, SOL might find it hard to bounce.

A look at the On Balance Volume (OBV) revealed that the reading had stalled. This implies that buying pressure was almost non-existent. However, the reading did not support intense selling pressure either.

Source: TradingView

Read Solana’s [SOL] Price Prediction 2024-2025

When all of these indicators are combined, one can assume that Solana might not be ready for an upward trajectory. Instead, the price of the token might move sideways.

In a highly bullish case, the price of SOL might move toward $210. But a bearish thesis for SOL could see the price of the cryptocurrency slump as low as $171.