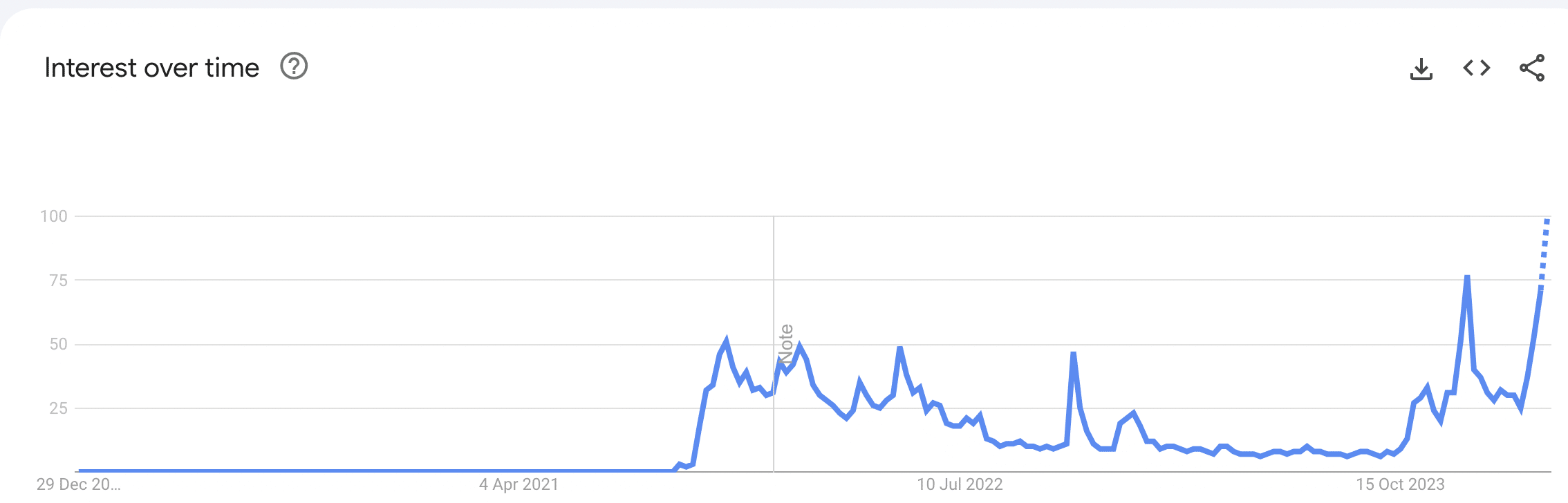

- Search interest for Solana hit new highs as prices appreciated

- Whales engaged in profit taking could cause potential problems for SOL though

Solana [SOL] has had one of the most positive runs in the crypto-space during this bull run. The hype around the network was largely generated by the memecoin ecosystem that has developed lately on the Solana network. Low gas fees and an engaged culture have contributed to the growth of the platform over the last few weeks.

The popularity of Solana grows

Due to memecoins doing so well on the Solana network, the platform has been gaining significant traction on social media. Due to this and other factors, search interest for Solana spiked. In fact, recent data revealed that Solana’s global Google search interest hit its historical peak.

This increased visibility can lead to greater adoption of Solana-based projects and platforms, driving up demand for SOL tokens and potentially boosting its price. Furthermore, as more people become aware of Solana’s technology and capabilities through their online searches, it could enhance Solana’s reputation and position within the cryptocurrency market, fostering long-term growth and sustainability.

Source: Google Trends

However, this heightened search interest also carries potential risks for Solana. If the surge in searches is driven primarily by speculative interest or hype, rather than genuine interest in the technology and fundamentals of Solana, it could lead to short-term price volatility and instability.

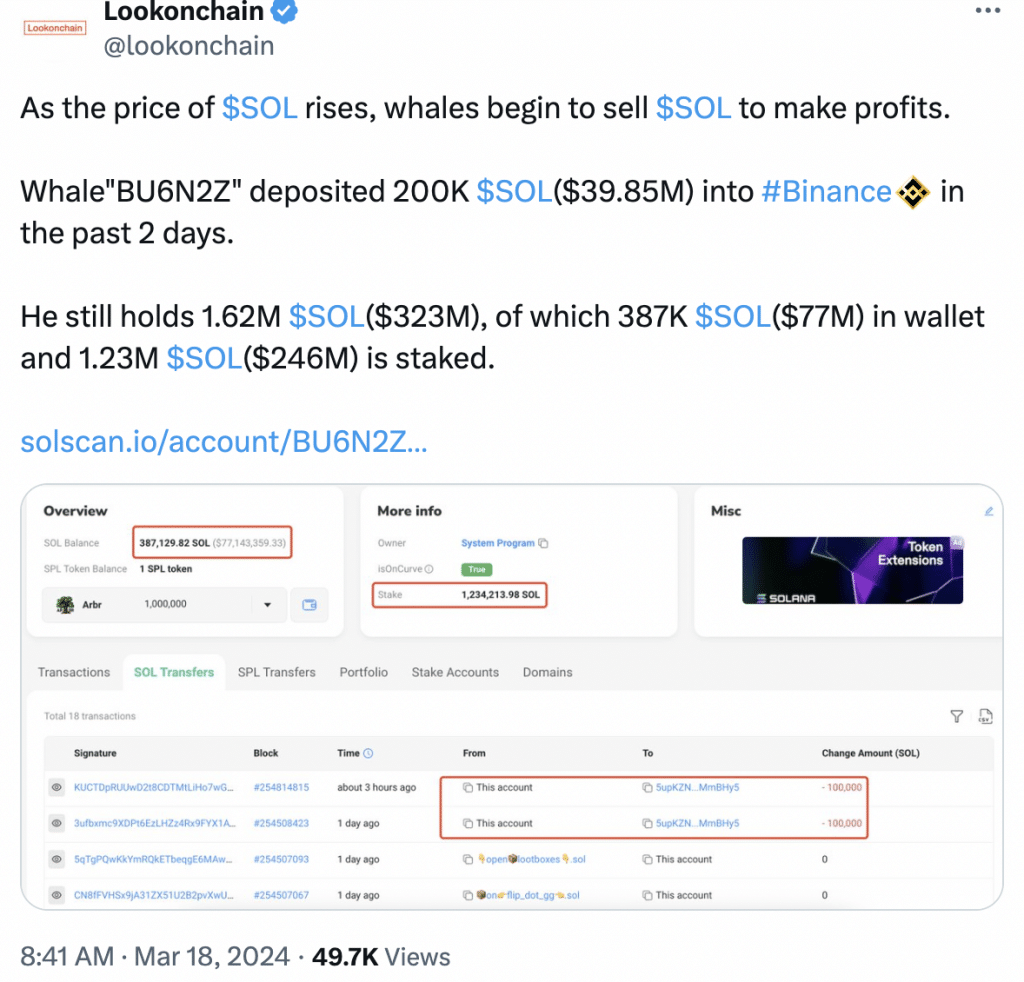

Whales get bearish

Moreover, whale behavior also pointed to a precautionary perspective taken up by traders. As the price of SOL registered an uptrend, whales initiated selling actions to capitalize on profit-taking opportunities. Notably, the whale identified as “BU6N2Z” deposited 200,000 SOL, equivalent to $39.85 million, into Binance over the last 2 days.

Despite this recent deposit, “BU6N2Z” still retains a significant holding of 1.62 million SOL though, valued at $323 million. Within this holding, 387,000 SOL, worth $77 million, remains within the wallet, while the remaining 1.23 million SOL, valued at $246 million, is staked.

When whales begin to offload their holdings, especially during periods of price appreciation, it often signals profit-taking behavior. As they sell their SOL holdings, this influx of supply into the market can outweigh buying demand, leading to downward pressure on SOL’s price. Moreover, large sell orders from whales can trigger sell-offs from other investors, exacerbating the selling pressure on SOL. This increased selling activity can result in price declines as the market adjusts to accommodate the heightened supply.

How much are 1,10,100 SOLs worth today?

Source: X

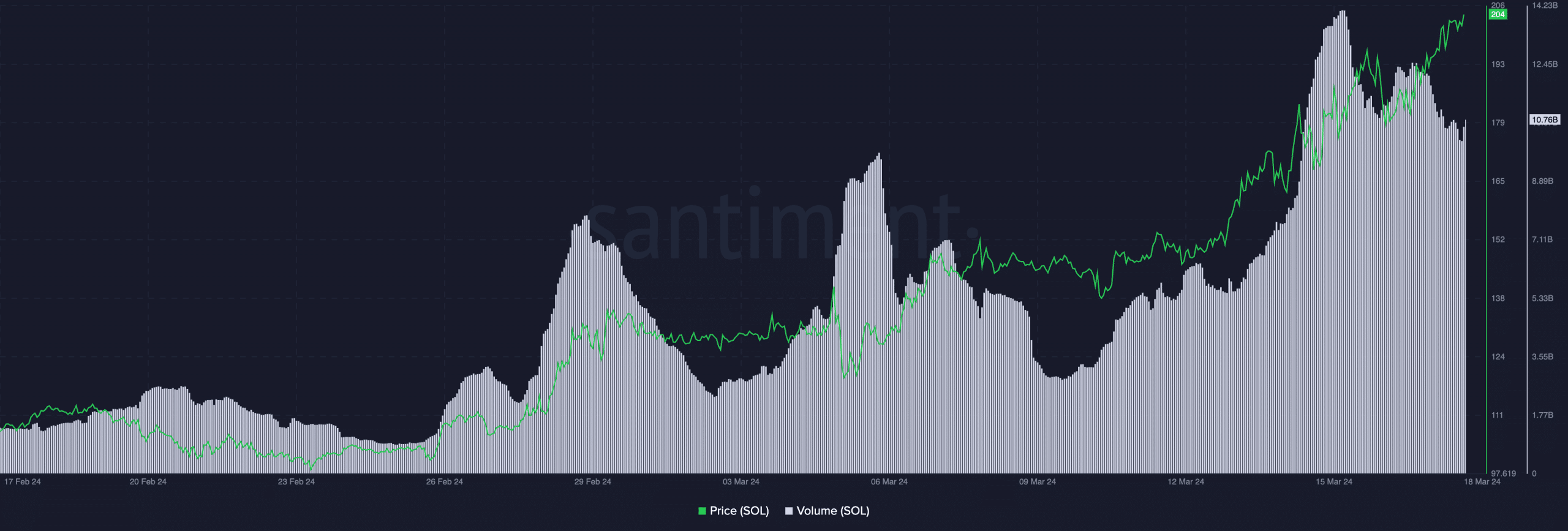

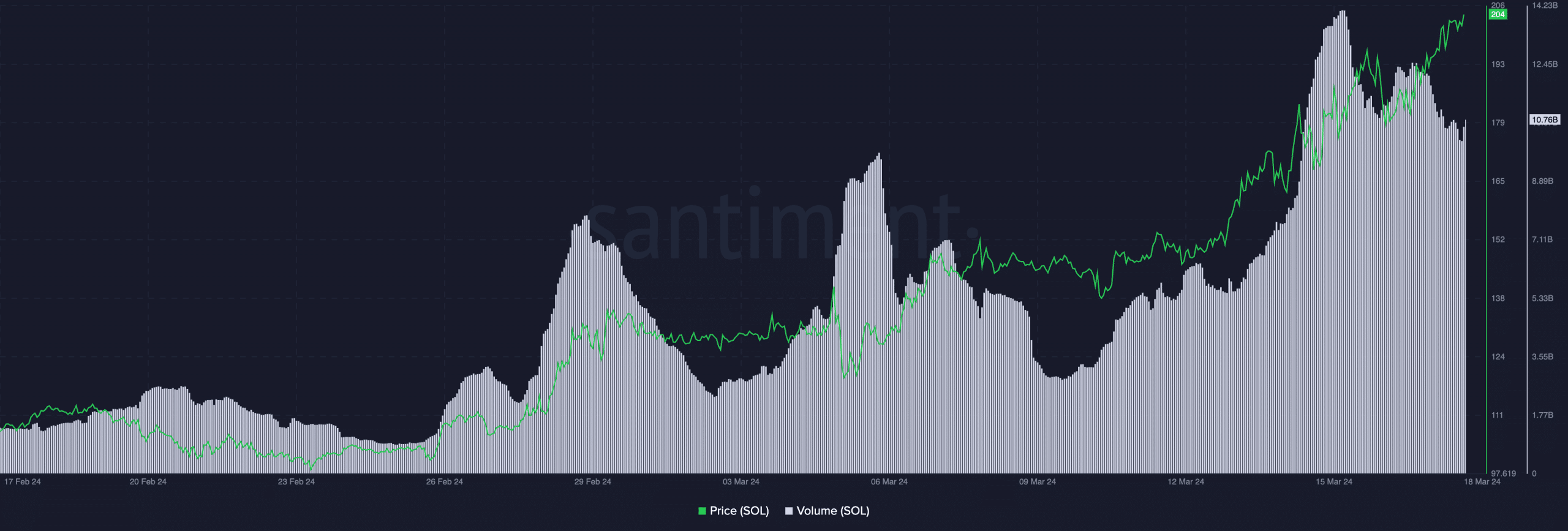

At press time, SOL was trading at $208.02 and its price had risen by 7.55% in the last 24 hours. On the contrary, the volume at which SOL was trading at had fallen by 13.39% over the same period.

Source: Santiment