- Solana and Sui network witnessed a surge in daily activity.

- Social activity on the network also fell materially indicating reduced popularity.

Solana [SOL] and Sui Network[SUI] have had a positive quarter and witnessed growth on many fronts.

Activity on the rise

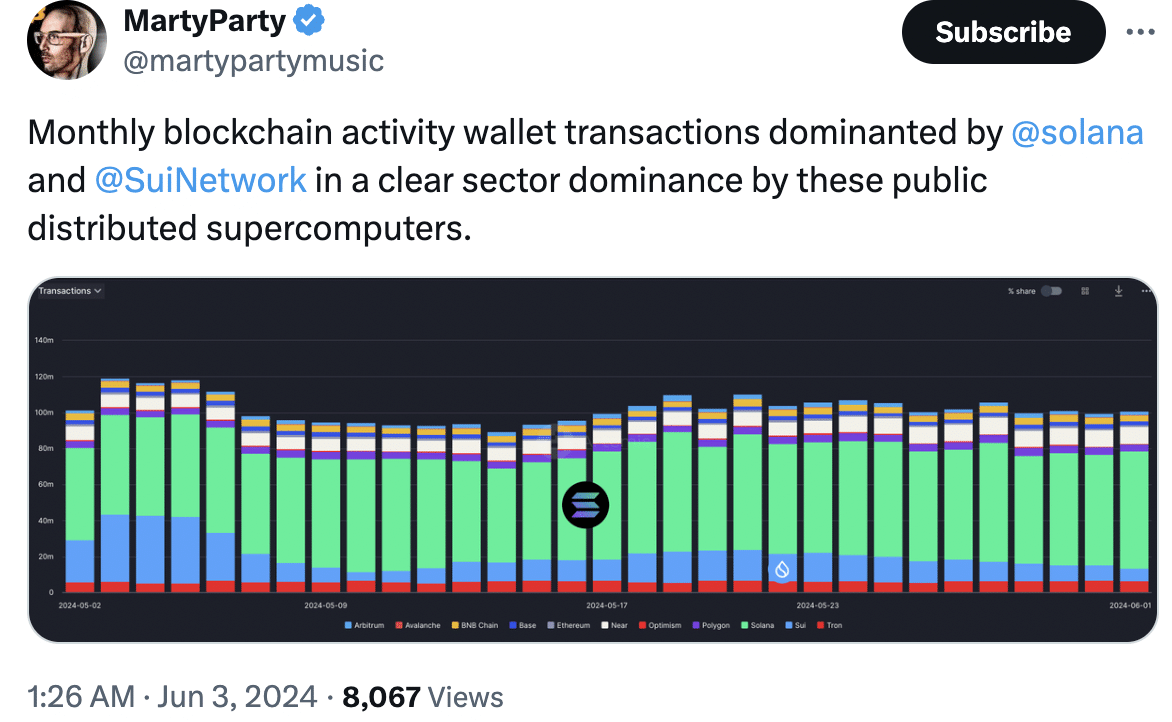

Solana and SuiNetwork are currently leading the blockchain space in monthly wallet transactions, and have solidified their dominance in the sector.

Source: X

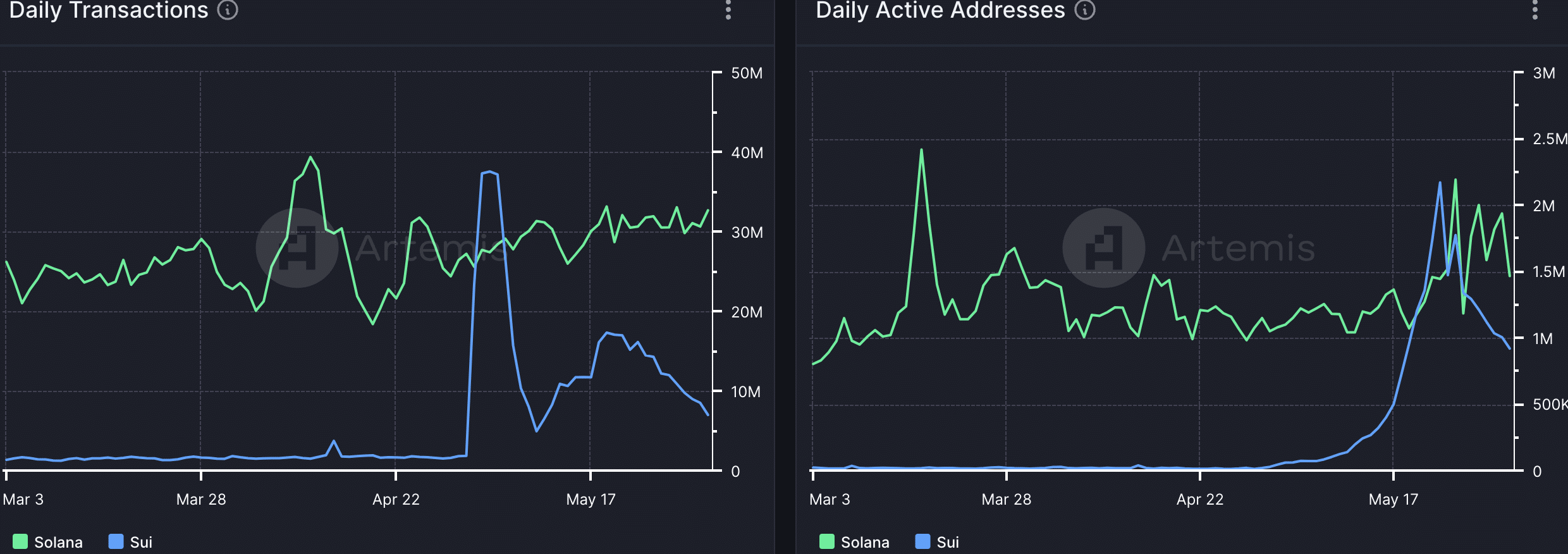

The daily number of transactions on the Solana network at the time of writing was around 31 million.

Sui network, on the other hand, witnessed a dip. The total number of transactions on the network had fallen to 7 million.

The number of daily active addresses on the Solana network had fallen to 1.5 million. For the Sui network, the number of daily active addresses was 918,000.

Source: X

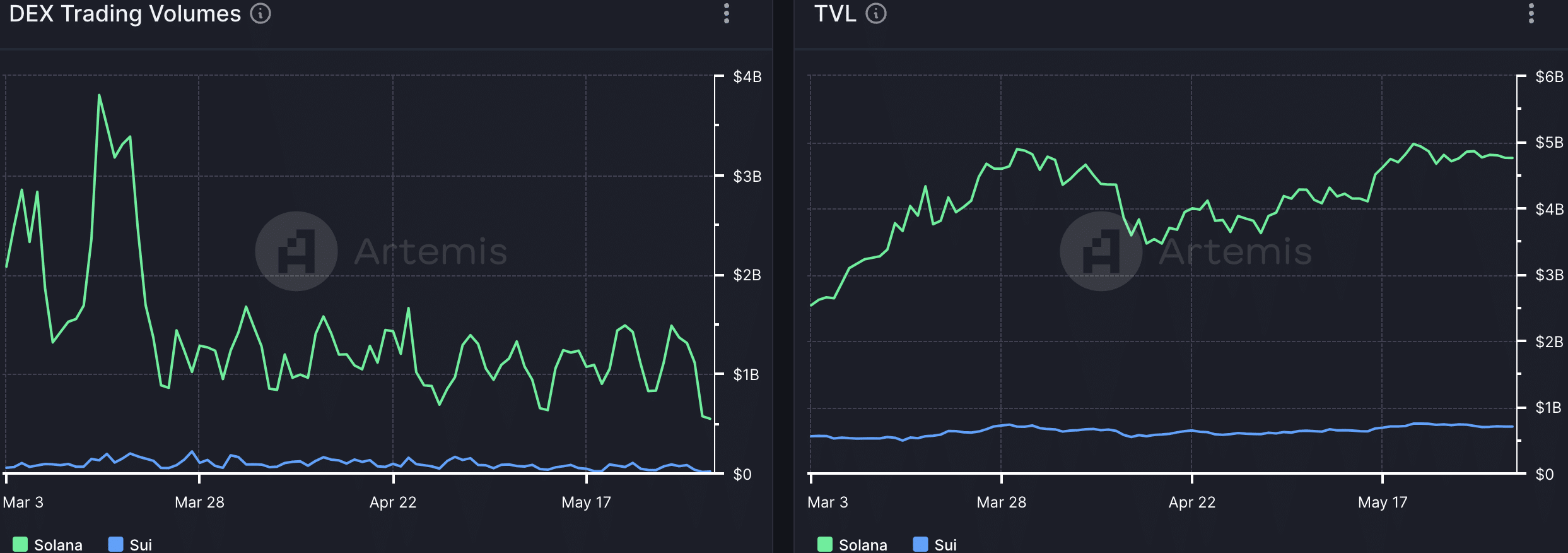

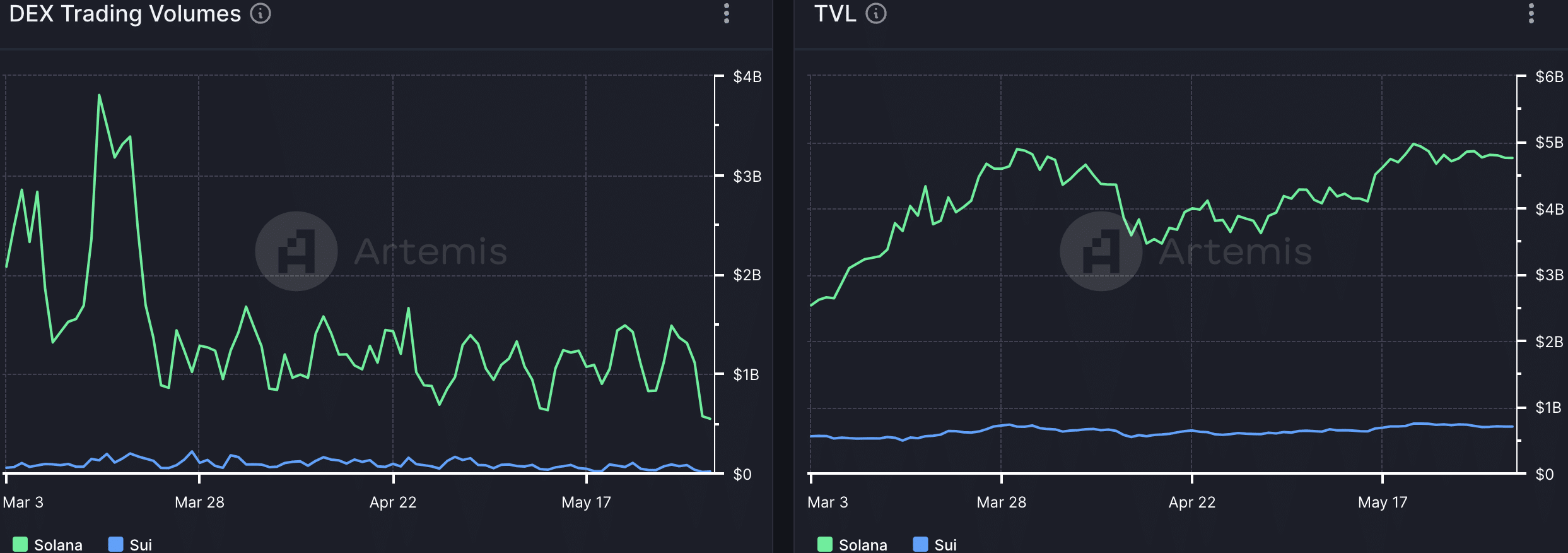

DEX (Decentralized Exchange) volumes on the both the networks fell. The DEX volumes for Solana declined from $3.8 billion to $549 million.

For Sui, it fell from $151 million to $18.9 million.

However, the TVL (Total Value Locked) for both the networks remain the same. Solana’s TVL hovered around the $4.8 billion mark over the past few weeks.

It was steady sailing for Sui network as well. The TVL remained steady around $707 million during the same period.

Source: Artemis

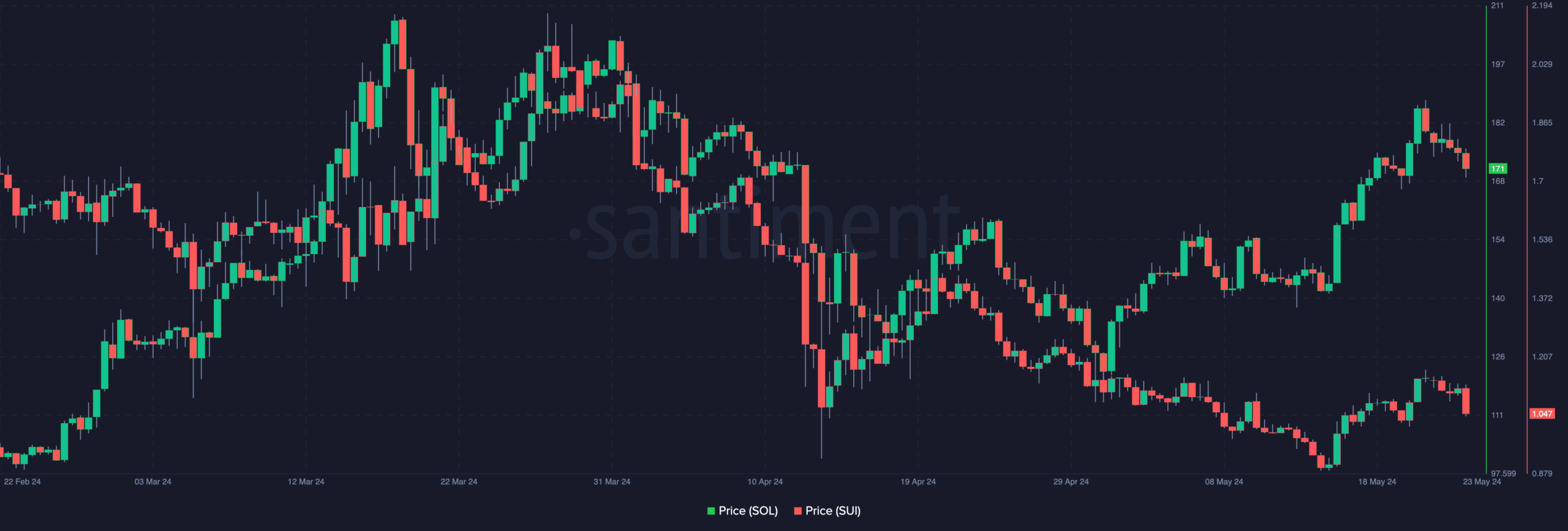

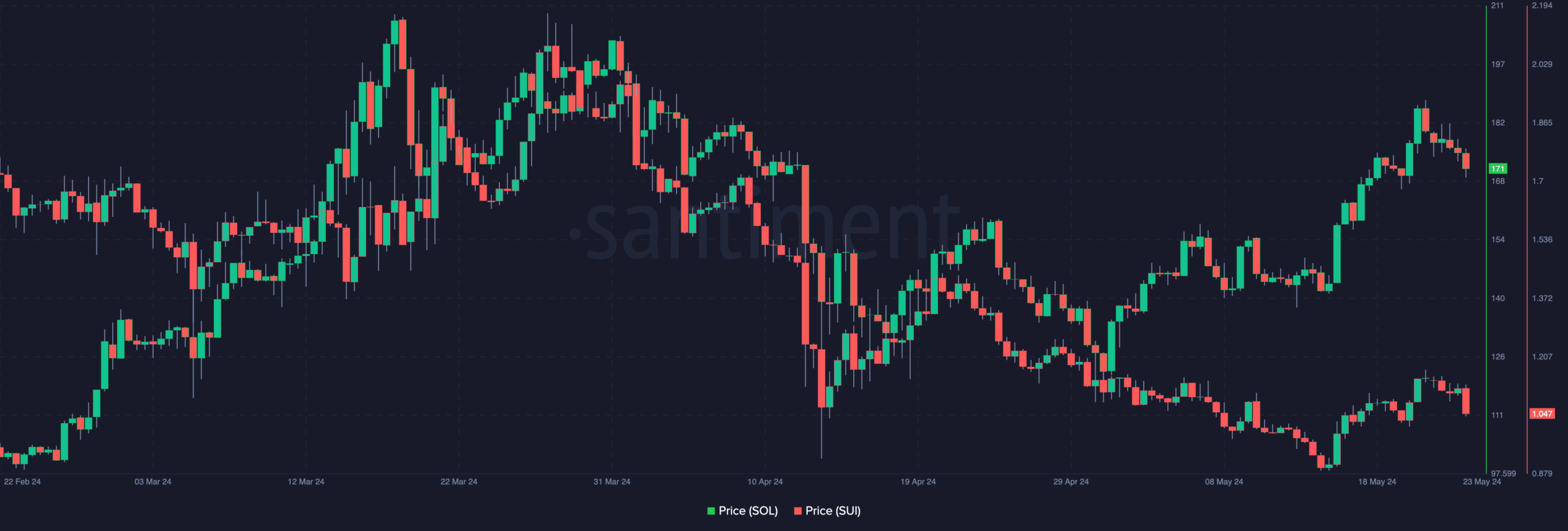

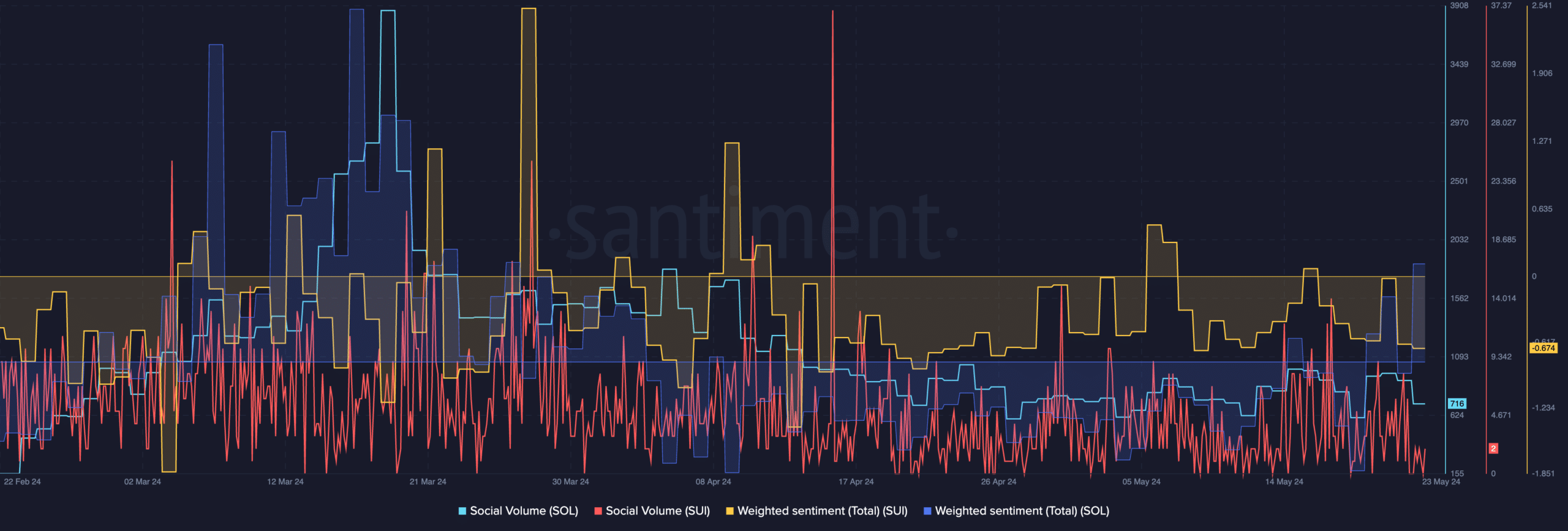

The price of both the SOL and SUI saw some correlation from the 3rd of March to the beginning of May. However, there was a disconnect observed after.

SOL moved in a positive direction and surged from $126 to $171. On the other hand, the price of SUI fell drastically from $1.410 and $1.047.

Source: Santiment

Looking at the social activity

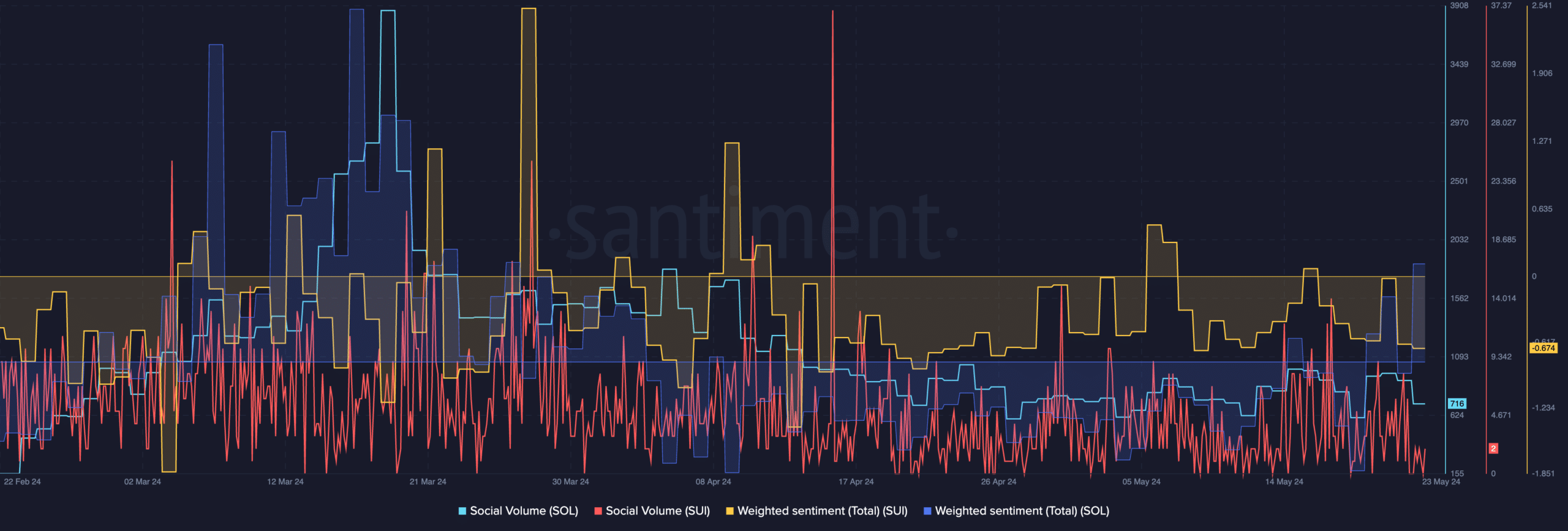

On the social front, both the networks witnessed a decline in popularity.

AMBCrypto’s analysis of Santiment’s data, the social volume for both the tokens declined over the past few weeks. This meant that the number of comments around these tokens had fallen.

However, there was a disrepancy between the weighted sentiment around both these tokens. Sui network’s weighted sentiment fell materially over the last few weeks.

Read Solana’s [SOL] Price Prediction 2024-25

This meant that the number of negative comments around SUI had increased compared to the positive ones on social media.

Solana had a more positive time across social media sectors. Over the past few days, the weighted sentiment around SOL had surged indicating a positive turn of events for SOL.

Source: Santiment