Solana (SOL) is posed for a significant price surge and is currently gaining notable attention from crypto enthusiasts. It just happened following SOL’s impressive performance and rise in trading volume.

Solana Price Performance

On September 10, 2024, SOL has experienced a massive price surge of over 5% in the last 24 hours and is currently trading near $134.6. Meanwhile, its trading volume has skyrocketed by 115% during the same period, indicating more heightened participation from crypto traders and investors.

Solana Technical Analysis and Key Levels

According to expert technical analysis, SOL is currently facing strong resistance near the $135 level, which it has been experiencing for the last ten trading days. If it gives a breakout and closes a daily candle above that level, we may see a significant price rally of up to 35% to the $185 level in the coming days.

Despite trading below the 200 Exponential Moving Average (EMA) on a daily time frame, Solana (SOL) appears bullish. However, its Relative Strength Index (RSI) has formed a bullish divergence, indicating a trend reversal from a downtrend to an uptrend.

Bullish On-chain Metrics

On the other hand, on-chain metrics also support this bullish outlook. CoinGlass’s SOL OI-Weighted Funding Rate currently stands at +0.0068% and it is in green, indicating bullish sentiment.

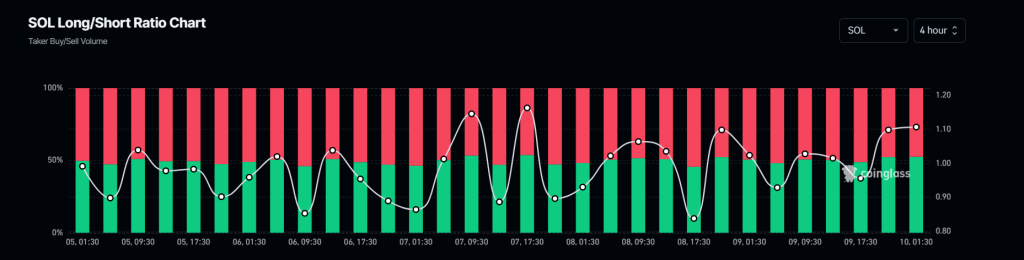

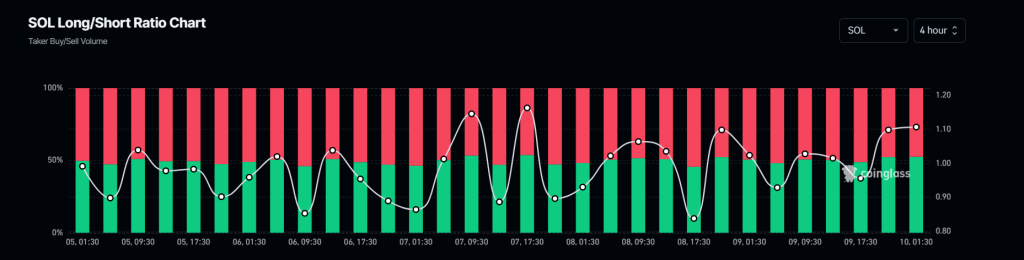

Meanwhile, the SOL Long/Short ratio stands above 1.12, suggesting traders are showing bullish sentiment. Currently, 53.25% of top Solana traders hold long positions, while 46.7% hold short positions.

This data shows that bulls are dominating the assets and there is a high possibility, that SOL could break out of that hurdle for an upcoming price surge. However, this bullish outlook and price surge thesis will only hold if SOL breaks out the resistance level and closes a daily candle above the $138 level, otherwise, it may fail.