- Garlinghouse criticizes the SEC and the U.S. government regarding Tether.

- Tether maintained dominance despite controversies, indicating resilience.

In a recent development, Ripple [XRP] CEO Brad Garlinghouse was found taking a U-turn from his bold remarks against Tether [USDT]. Taking to X (formerly Twitter) on the 13th of May, Garlinghouse said,

“I wasn’t attacking Tether…the next words out of my mouth during the podcast were that I view Tether as a hugely important part of the ecosystem.”

Further justifying his stance, he added,

“My point was that the US govt has clearly indicated they want more control over USD-backed stablecoin issuers, and thus, Tether, as the largest player, is in their line of sight.”

Behind the scenes

All this started with Ripple’s CEO, recent appearance on the “World Class” podcast, where he accused the U.S. Securities and Exchange Commission (SEC) of overreach and bullying tactics and said,

“The SEC has been a bully.”

He further criticized the U.S. government for targeting Tether. Expressing frustration with the U.S. government’s actions, he claimed,

“The U.S. government is going after Tether, that much is clear to me.”

This sparked a lot of speculation within the crypto industry. Additionally, it highlighted a growing tension between cryptocurrency leaders and regulatory bodies, with Tether being the new player.

Tether’s CEO in defense

Interestingly, Tether CEO Paolo Ardoino entered the fray, criticizing Ripple’s CEO for his remarks. Seeking to clarify the situation, Ardoino stated,

“An uniformed CEO, leading a company being investigated by the SEC, launching a competitive stablecoin (cui prodest), is being reported spreading fear about USDt.”

Tether’s CEO Paolo Ardoino emphasized that USDT is the world’s most widely used stablecoin, serving millions in emerging markets and unbanked communities.

He claimed that USDT provides stability, liquidity, top-notch custodianship, and compliance, making it essential for a secure global financial system.

Ardoino further stressed Tether’s mission to ensure everyone benefits from a safe financial ecosystem.

Various controversies surrounding USDT

Tether has been embroiled in controversies since October 2023, when U.S. Senator Cynthia Lummis and Representative French Hill expressed concerns about Binance and Tether potentially aiding terrorism.

Further, Circle’s USD Coin (USDC) recently overtook Tether in stablecoin transactions, signaling a notable change in the cryptocurrency landscape.

These recent developments have taken a toll on USDT, resulting in a 0.03% drop in its price over the past 24 hours.

Tether still wins the race

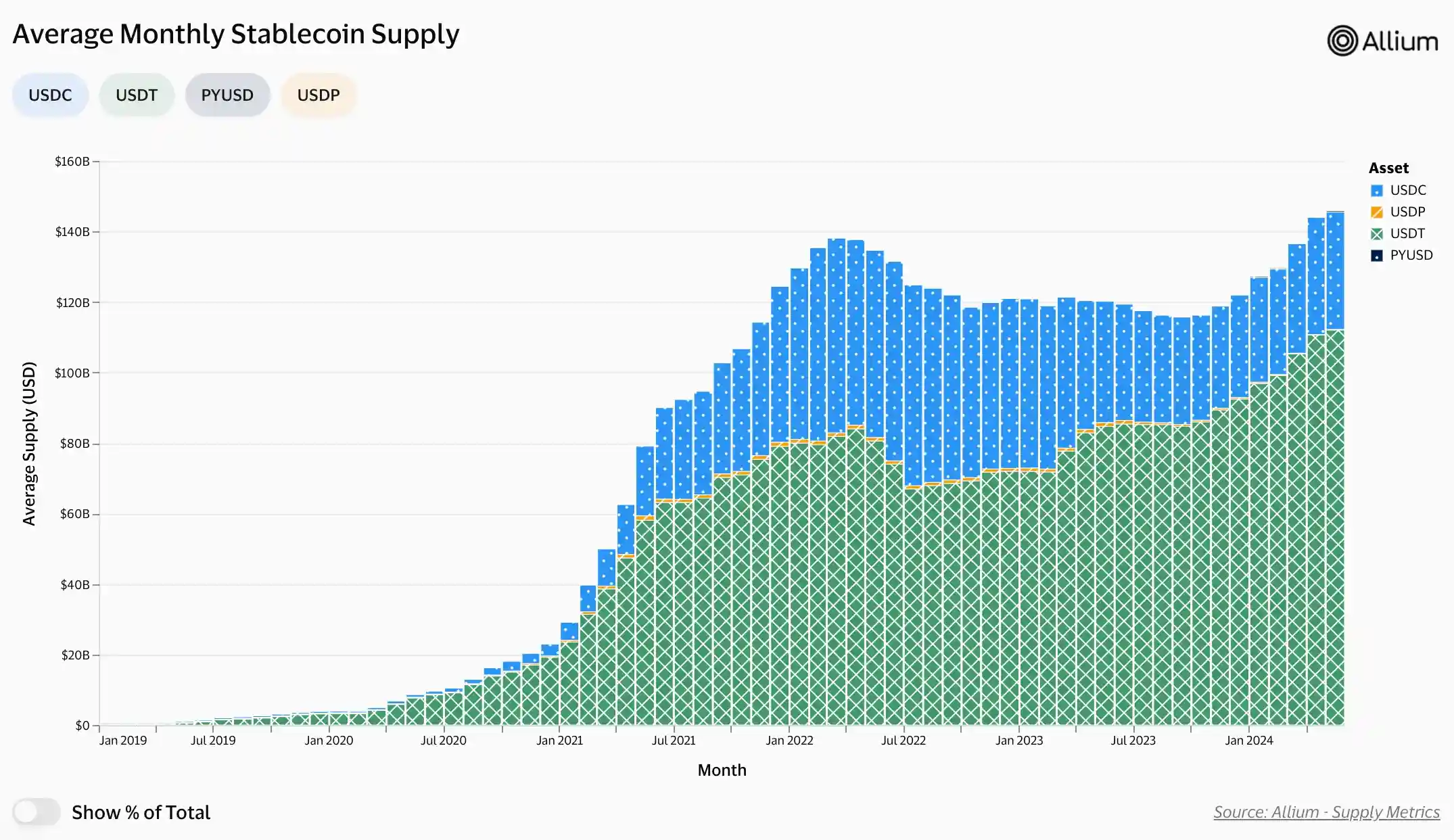

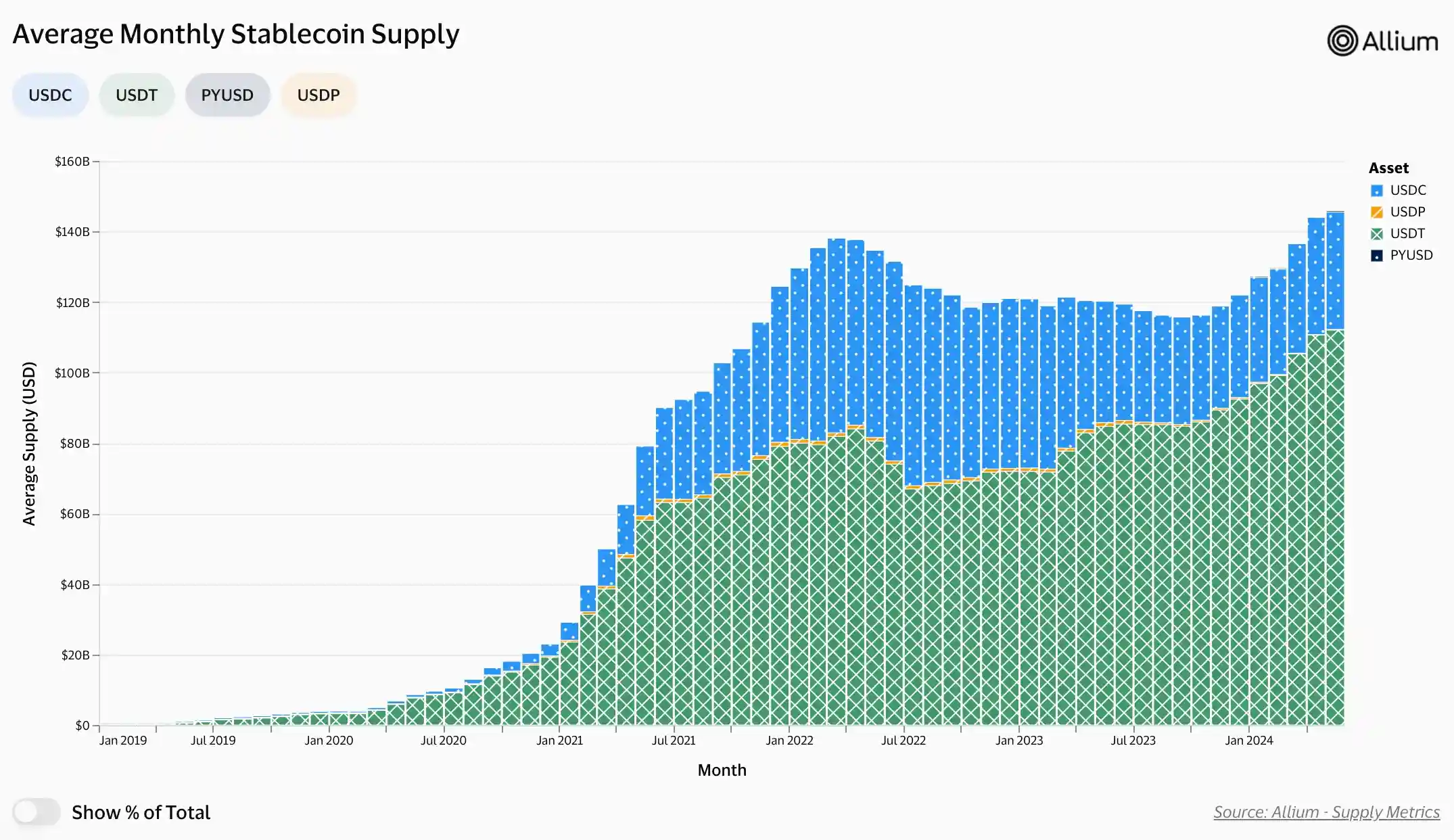

In conclusion, despite facing such obstacles, the average monthly USDT supply continues to surpass that of USDC.

Source: Visa on-chain analytics

This highlights the resilience and dominance of USDT despite the challenges it faces, indicating its continued popularity and widespread usage compared to USDC.