- RNDR’s price only moved up marginally in the last 24 hours.

- Selling pressure on the AI token has increased of late.

After a massive weekly rally, Render [RNDR] had a setback as the entire crypto market somewhat turned bearish. But the last few hours were in investors’ interest as the token’s chart turned green.

Does this mean that RNDR will soon resume its bull rally?

RNDR pushes the brake

According to CoinMarketCap, RNDR investors had a gala time last week as the AI token’s price surged by nearly 20%, only to face a correction on the 11th of May.

The declining price trend didn’t last long, as the token’s daily chart again turned green. At the time of writing, Render was trading at $10.90 with a market capitalization of over $4.2 billion.

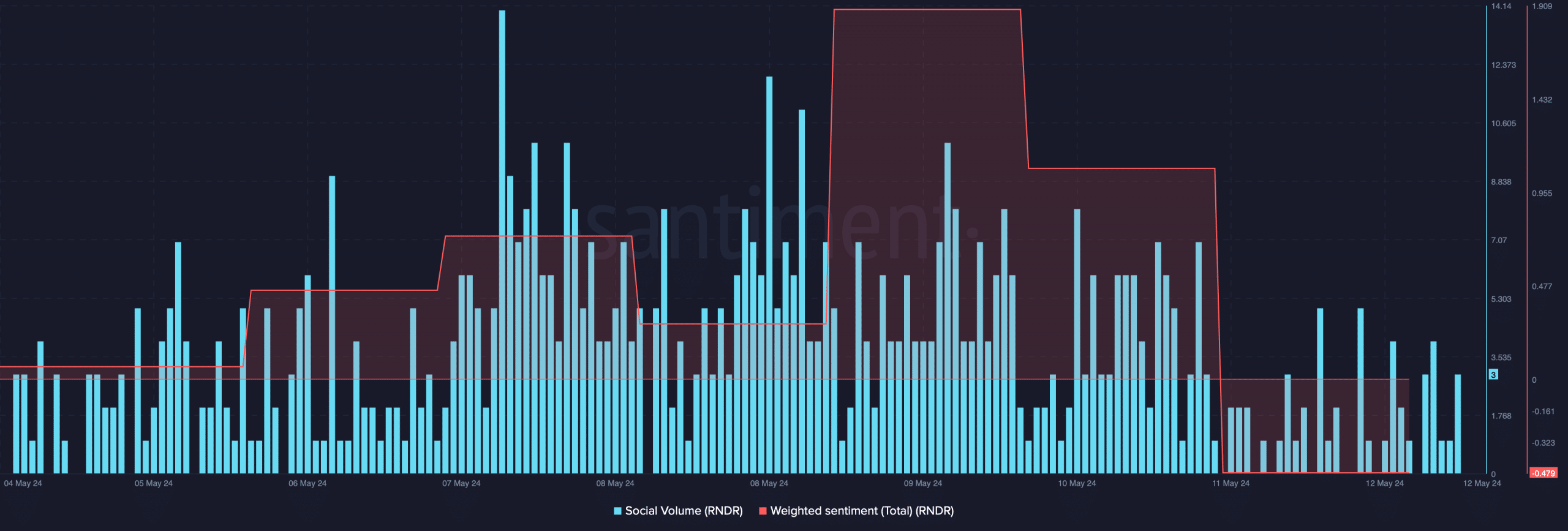

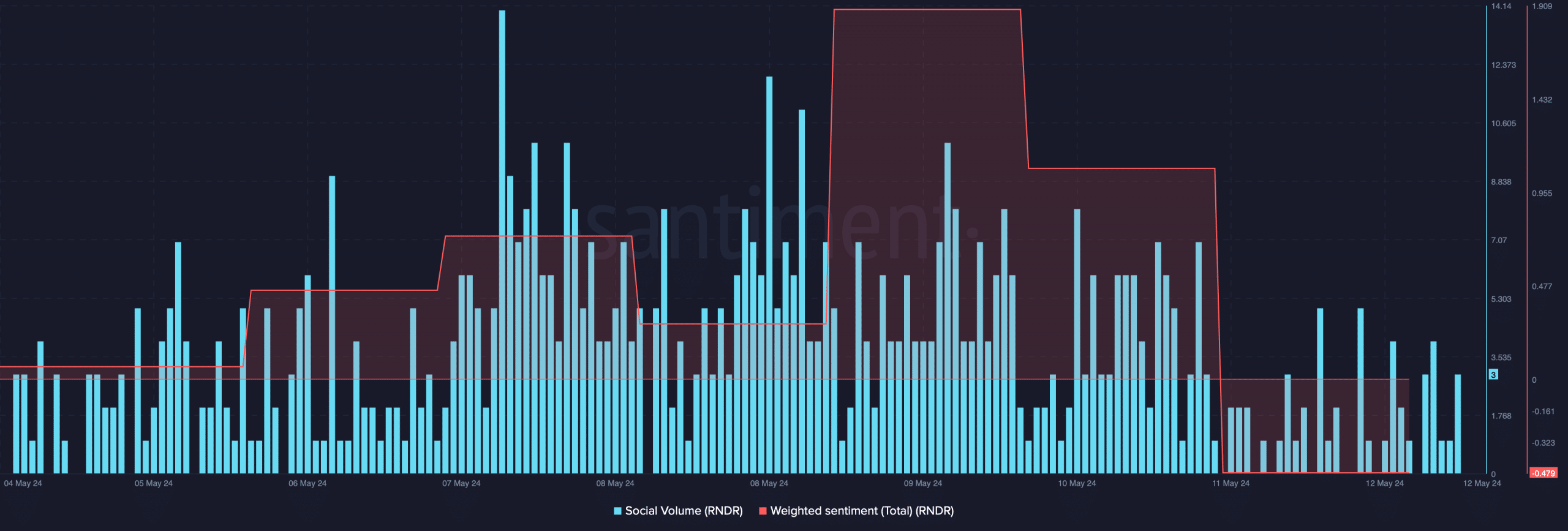

To check whether this was the sign of RNDR resuming its rally, AMBCrypto analyzed its metrics. It was surprising to find that, despite the massive weekly rally, RNDR’s Social Volume declined last week.

Its Weighted Sentiment also went negative on the 11th of May, which indicated that bearish sentiment was dominant in the market.

Source: Santiment

In fact, while the token’s price remained bullish, investors might have thought it to be a market top as they started to sell.

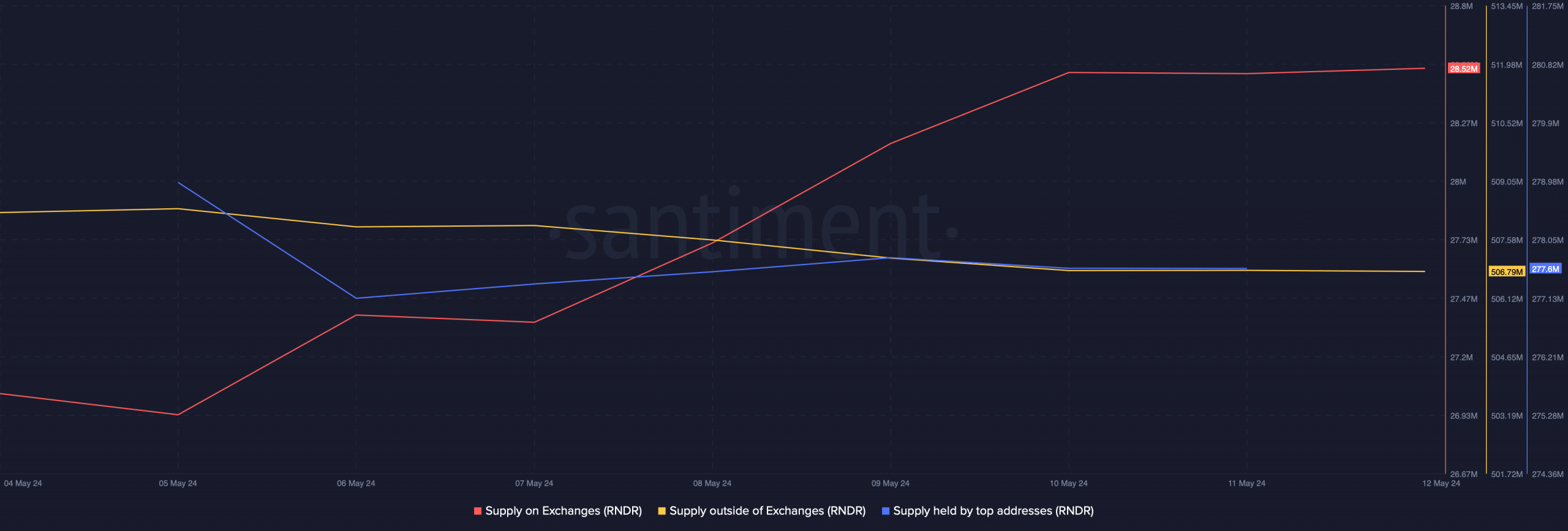

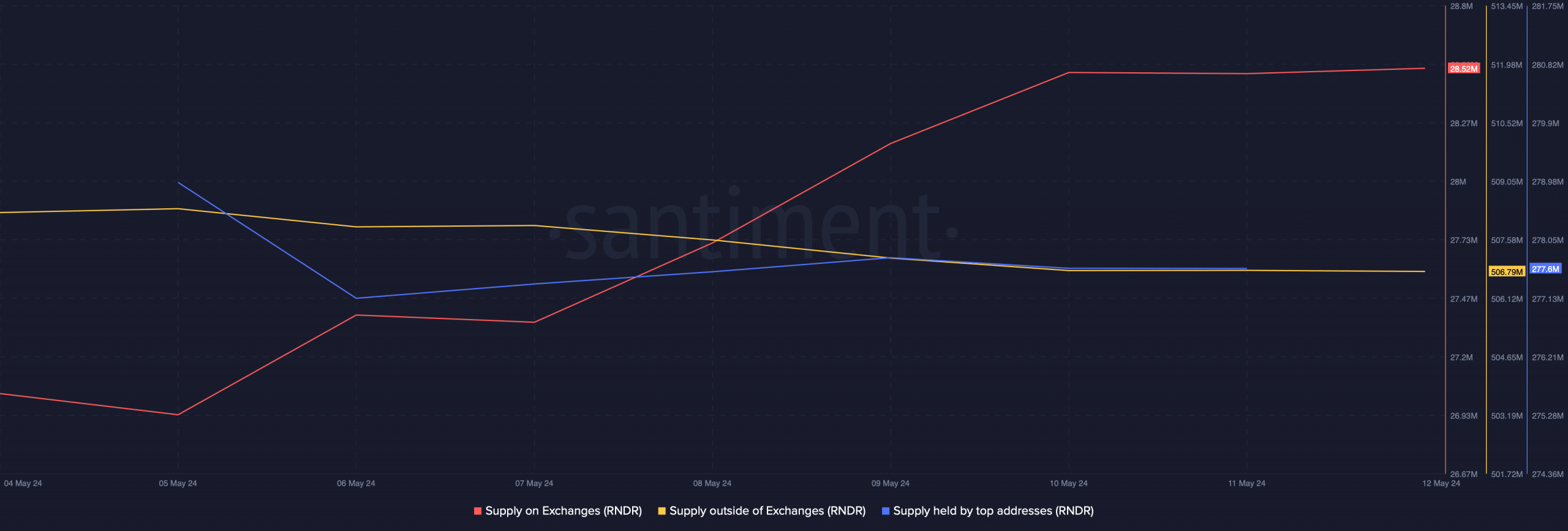

AMBCrypto’s analysis of Santiment’s data revealed that RNDR’s supply on exchanges increased substantially last week.

Meanwhile, its Supply outside of Exchanges dropped, further establishing the fact that selling pressure was high.

On top of that, Render’s supply held by top addresses declined slightly, suggesting that the top players in the crypto market were selling.

Source: Santiment

Render’s bull rally is ending

Though these aforementioned metrics looked bearish, things might turn out to be different. Popular crypto analyst Crypto Tony recently posted a tweet mentioning how he expects an AI tokens season to arrive.

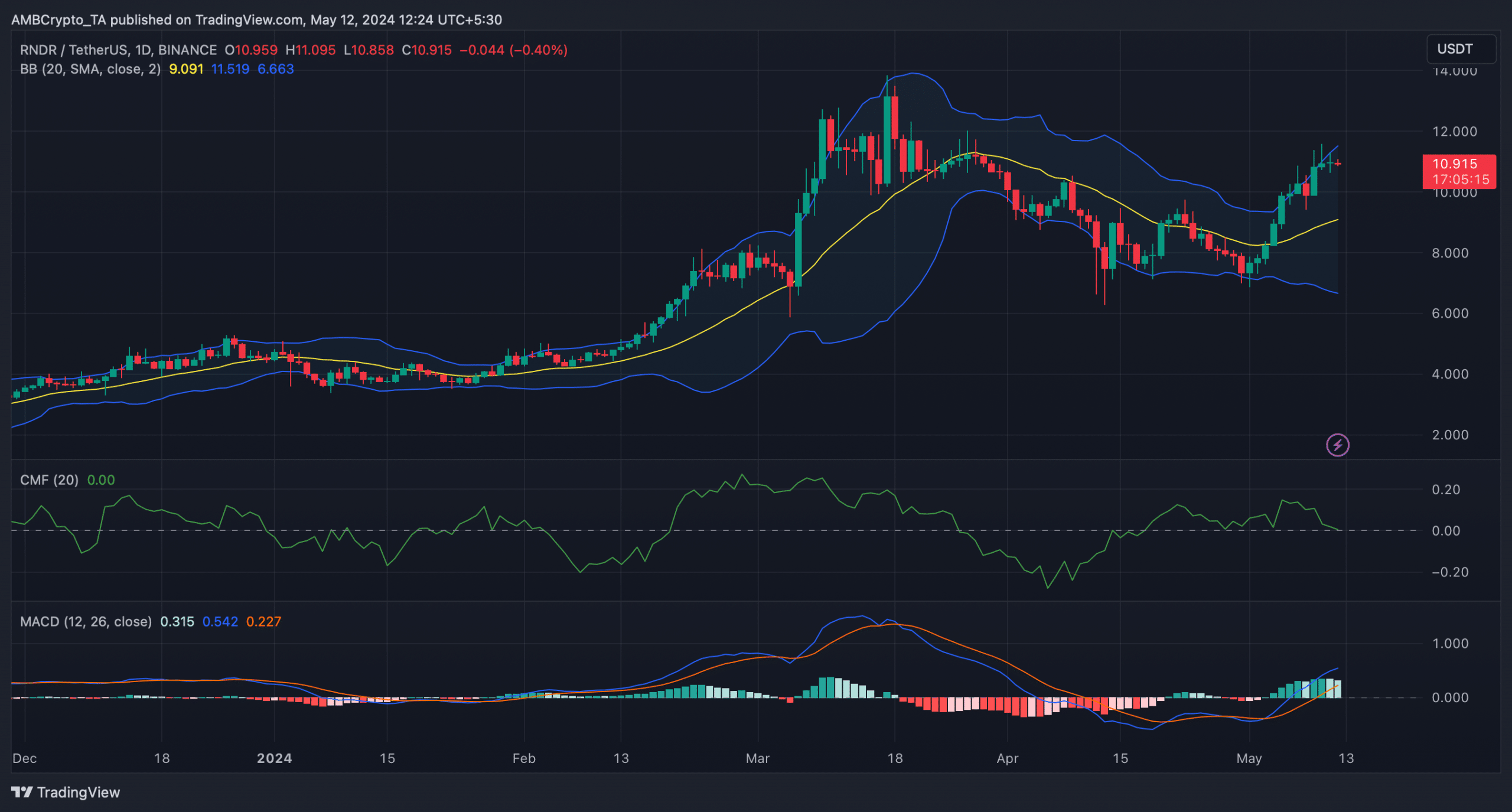

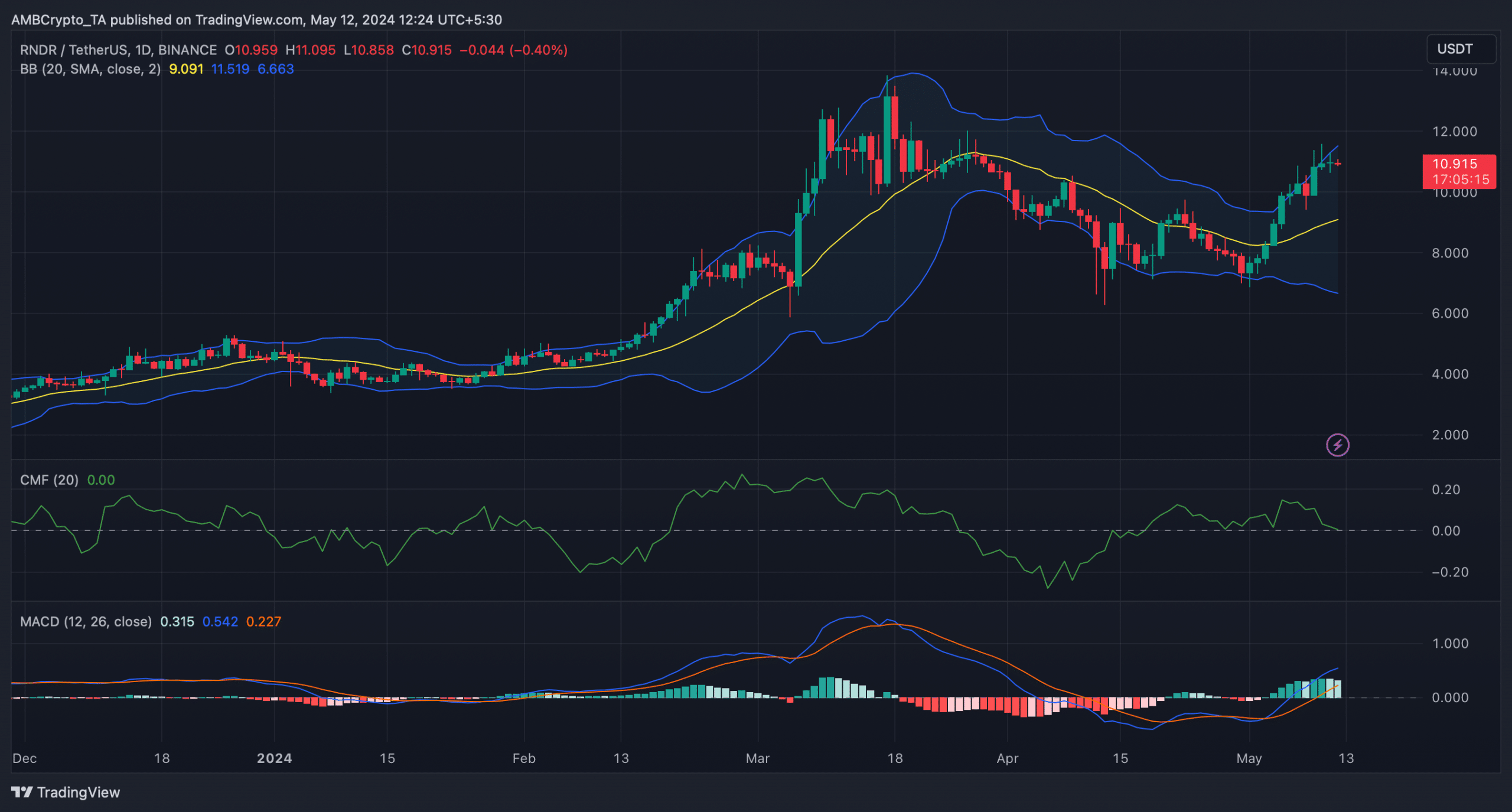

To check whether that possibility is likely to happen in the short-term, AMBCrypto then took a look at RNDR’s daily chart. As per our analysis, the MACD displayed a clear bullish upperhand in the market.

Its price was also resting well above its 20-day Simple Moving Average (SMA), which can be inferred as a bullish signal.

Source: TradingView

Nonetheless, the rest of the indicators suggested otherwise. For example, the token’s price touched the upper limit of the Bollinger Bands, which often results in price corrections.

Read Render’s [RNDR] Price Prediction 2024-2025

The Chaikin Money Flow (CMF) also registered a sharp downtick and was headed under the neutral mark at press time.

These two indicators hinted that Render bears were stepping up and might push the token’s price down in the near term.

![Render’s [RNDR] 20% surge halts: Is the AI token’s bull run over?](https://traderfan.io/wp-content/uploads/2024/05/Renders-bull-rally-is-ending-1000x600.webp)