- Polkadot’s open interest has increased in the last few days, along with the token’s price.

- Market indicators looked bullish on the token.

As the market displayed high volatility over the past few days, Polkadot [DOT] investors might as well also prepare for a bull rally. This seemed to be the case as the token’s price was approaching a key resistance level, which, if broken, could allow DOT to reach new highs.

Polkadot is preparing for a rally

FLASH, a popular crypto analyst, recently posted a tweet highlighting an interesting development regarding Polkadot. As per the tweet, DOT’s price was approaching a crucial resistance level.

In fact, a similar pattern appeared on the token’s chart back at the beginning of this year. The token managed to break out of the pattern that resulted in the previous bull rally.

If DOT follows that trend, then a price rise above $7.5 could earn investors profits in the coming weeks. The possibility of that happening seemed likely, as Polkadot had already shown bullish signals.

According to CoinMarketCap, DOT was up by over 4%. Additionally, in the last 24 hours alone, its price surged by 4.4%. At press time, it was trading at $7.48 with a market capitalization of over $10.7 billion, making it the 13th largest crypto.

Is a bull run inevitable?

Since Polkadot’s price had already gained upward momentum, AMBCrypto planned to take a look at its on-chain metrics.

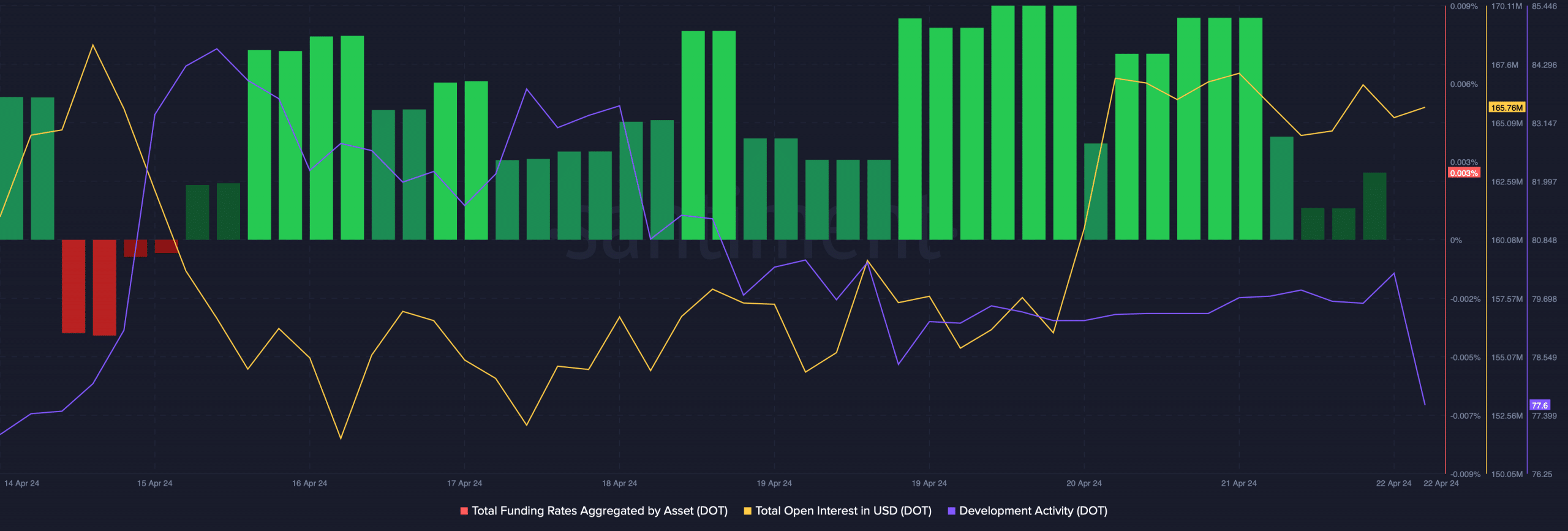

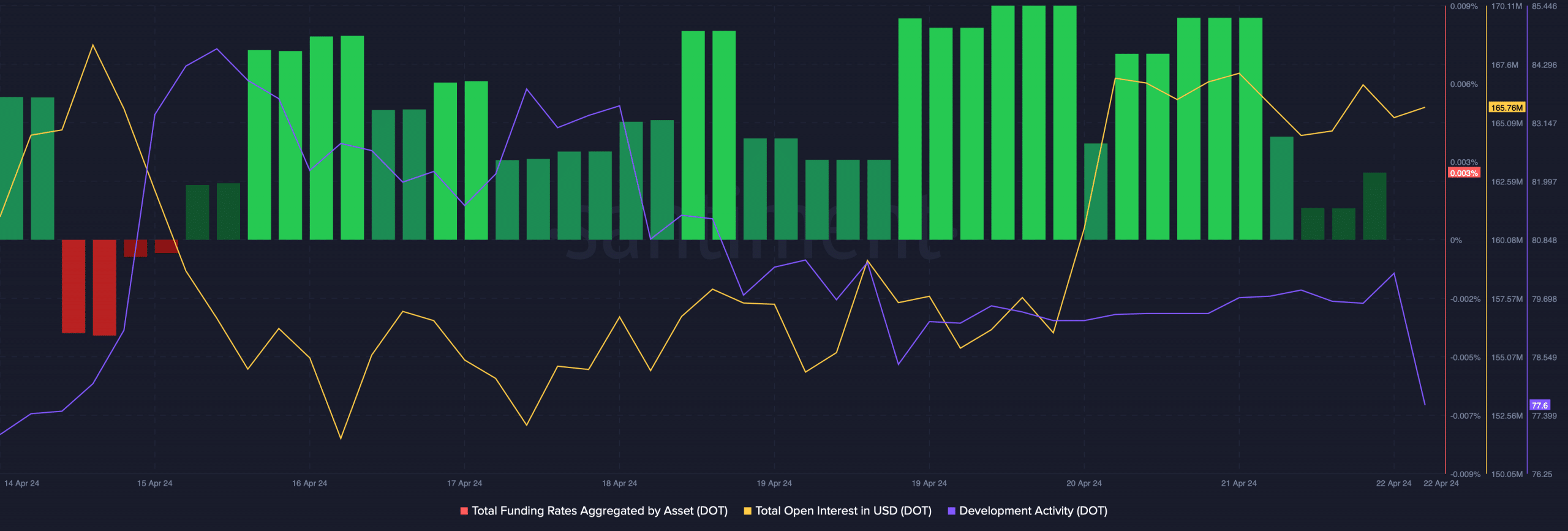

Our analysis of Santiment’s data revealed that DOT’s funding rate dropped on the 22nd of April. This was a bullish metric, as a drop in funding rate is often followed by price hikes.

Additionally, Polkadot’s open interest also went up along with its price, which indicated that the chances of the price uptrend continuing are high.

However, it was surprising to see that Polkadot, which is famous for having high development activity, registered a drop in that metric over the past seven days.

Source: Santiment

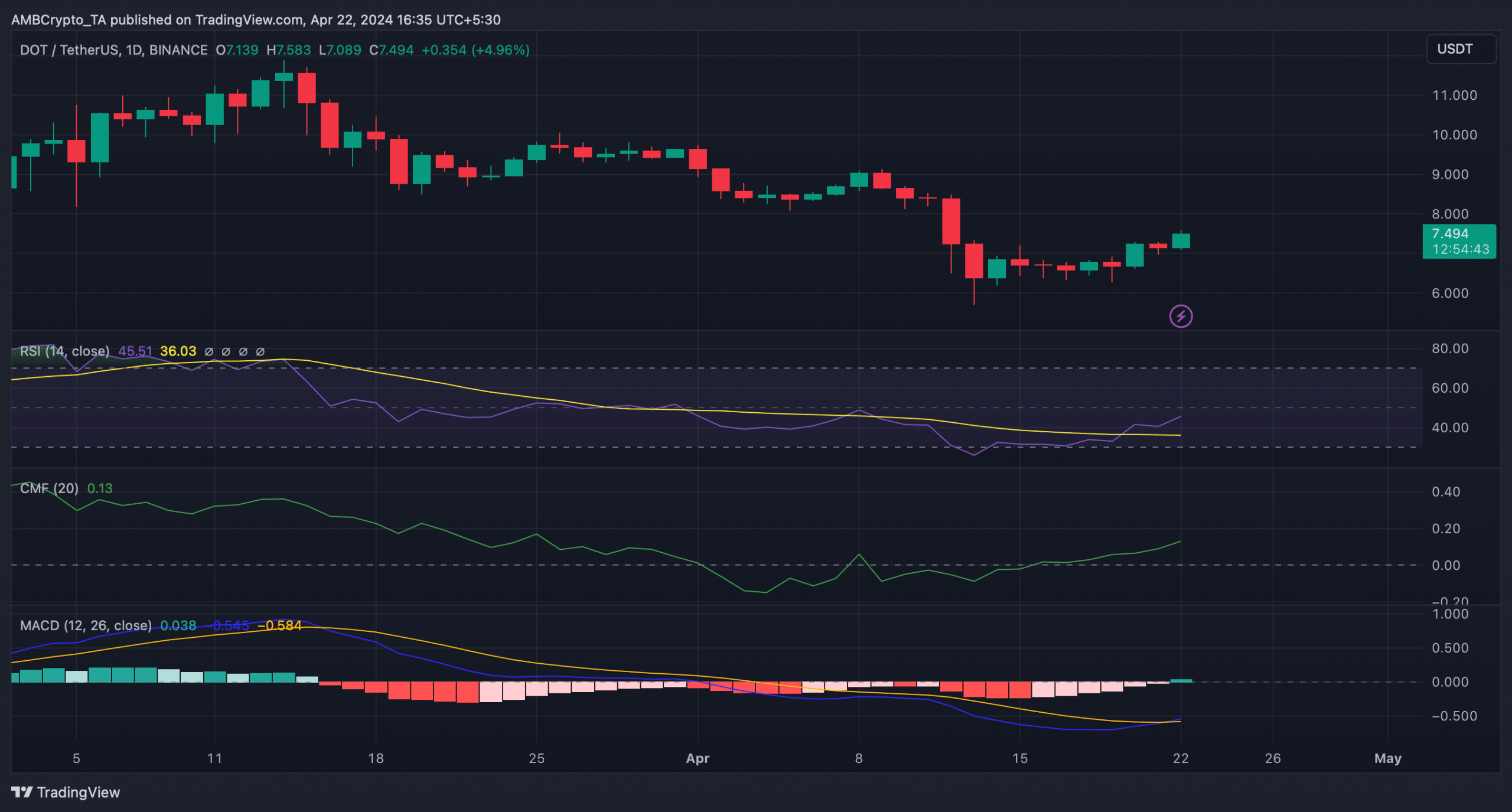

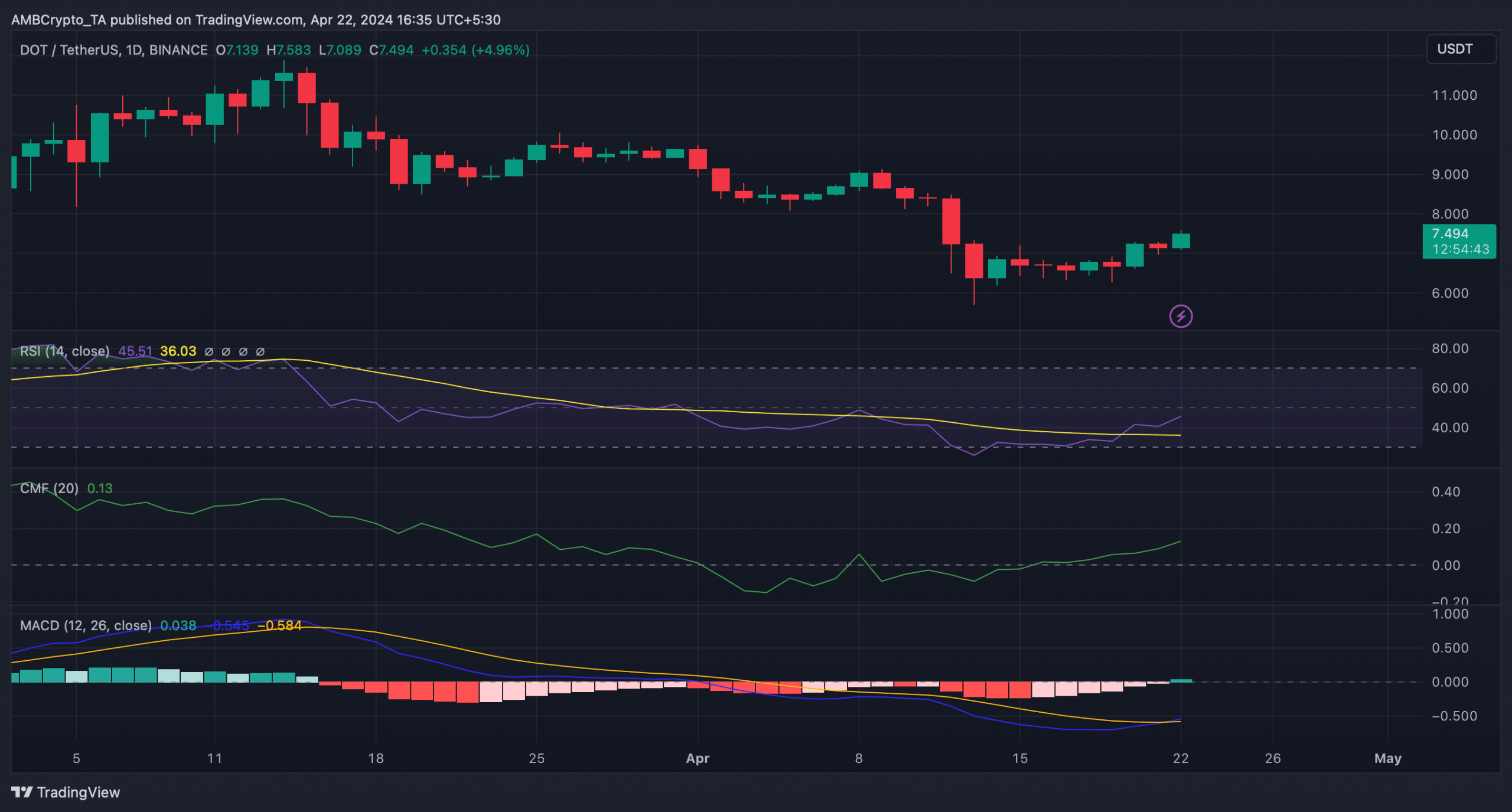

We then checked the token’s daily chart to better understand whether a further price increase is likely to happen, which can allow DOT to go above the $7.5 resistance level. The technical indicator MACD displayed a bullish crossover.

Its Relative Strength Index (RSI) registered an uptick and was headed towards the neutral mark. The token’s Chaikin Money Flow (CMF) also followed a similar increasing trend, further indicating that DOT’s bull rally might continue.

Source: TradingView

Realistic or not, here’s DOT’s market cap in ETH terms

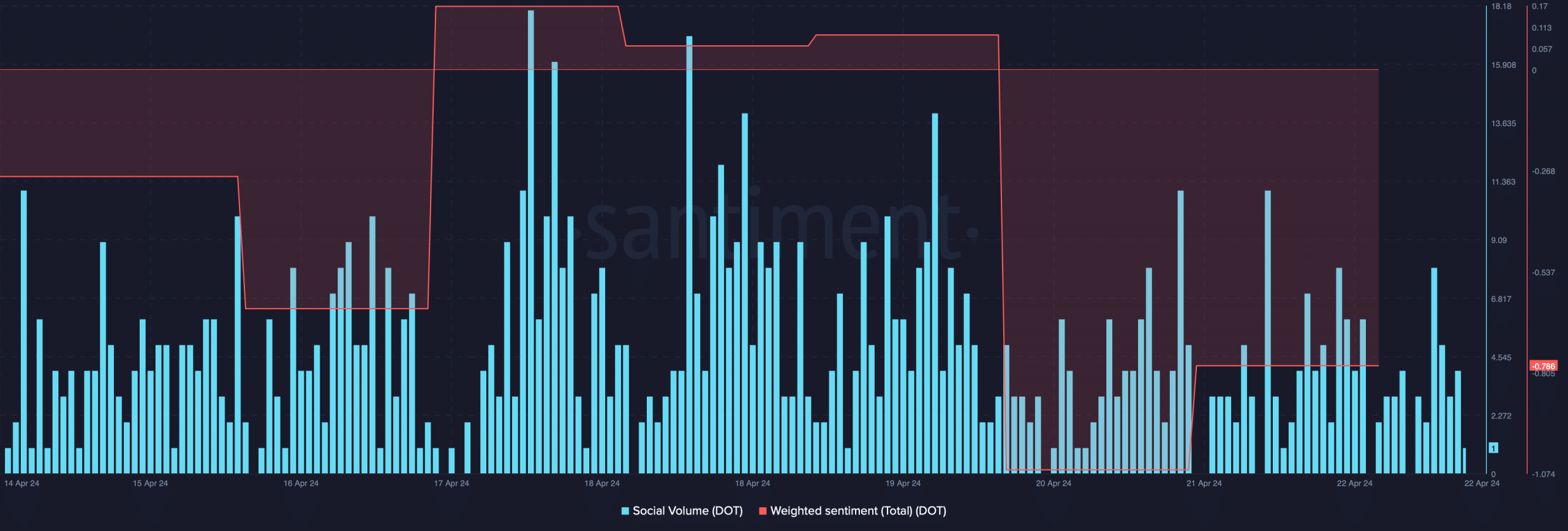

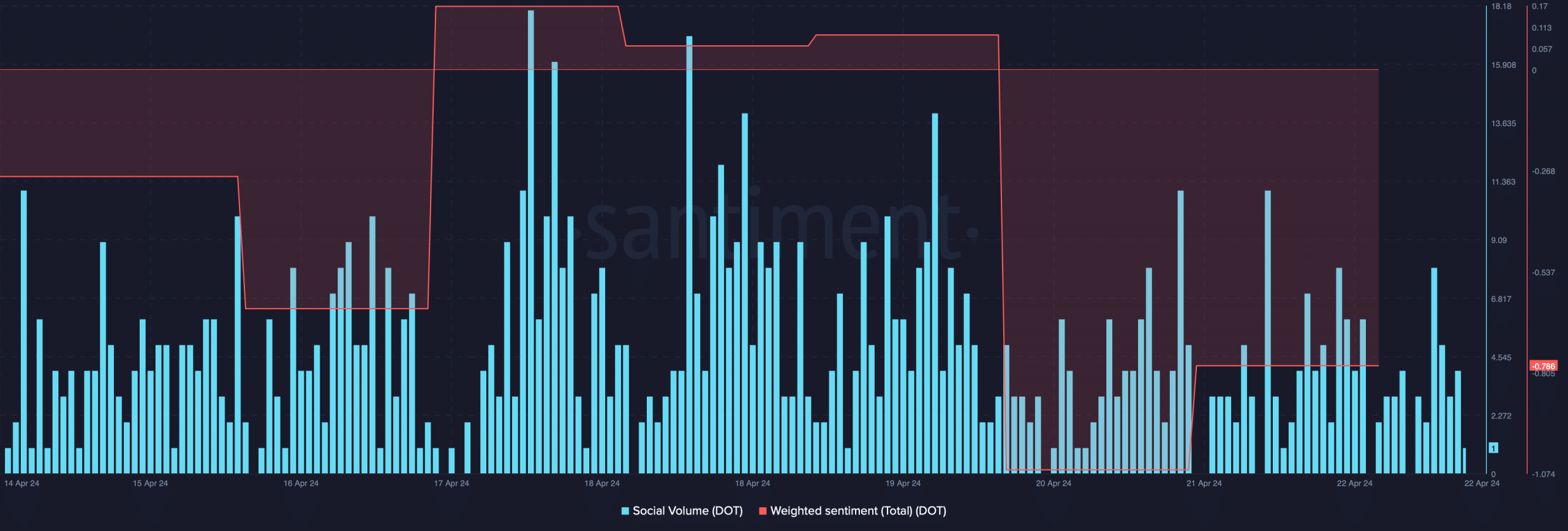

However, despite these bullish indicators and positive price action, sentiment around the token remained bearish. This was evident from the massive decline in its weighted sentiment.

Its social volume also plummeted last week, reflecting a decline in its popularity in the crypto space.

Source: Santiment