- Open Interest and volume of PEPE plunged, indicating a dearth of new liquidity for the token.

- Data revealed an increase in HODLing, suggesting a possible short-term recovery.

AMBCrypto observed that the volume of contracts linked to Pepe [PEPE] in the market had decreased. According to Coinglass, the derivatives information portal, PEPE’s volume was down 5.10% ($764.63 million) in the last 24 hours.

To support the point, the Open Interest (OI) also dropped to $158.02 million. OI is the value of contract opened in market. When the OI increases, it means that market participants are increasing their net positions and new money is coming into the market.

Are sellers taking over?

When this happens, buyers are aggressive, and price could move higher.

However, a decline in OI means that traders are increasingly closing their positions and taking liquidity out. In this case, sellers are aggressive.

Source: Coinglass

PEPE’s decline in this regard could be linked to the memecoin’s price. Previously, the price of the token hit impressive highs, triggering traders to open positions and capitalize on the price movements.

However, the price of PEPE was down to $0.000014 – a 8.78% decrease in the last seven days. Should the price continue to decrease, then interest in the token might continue to fall.

Holders may not grieve for long

On the other hand, a rebound for the token could spell a considerable increase in contracts opened. But will price bounce?

AMBCrypto evaluated the possibility by looking at the exchange inflow and outflow. According to data obtained from Santiment, PEPE’s exchange inflow was 5.28 billion.

This figure is the number of token sent into exchanges for possible sell-off within the past week. Conversely, the exchange outflow was 14.71 billion, suggesting that more participants leaned toward holding that letting go of the token for gains.

Source: Santiment

While PEPE’s price might see another decline, this difference could change things for the price. But that would only be the case if the outflow continues to outpace inflows.

Should this happen over the next few days or weeks, PEPE’s price could circle back to $0.000017. Despite the bullish potential, traders were not yet convinced about a possible recovery.

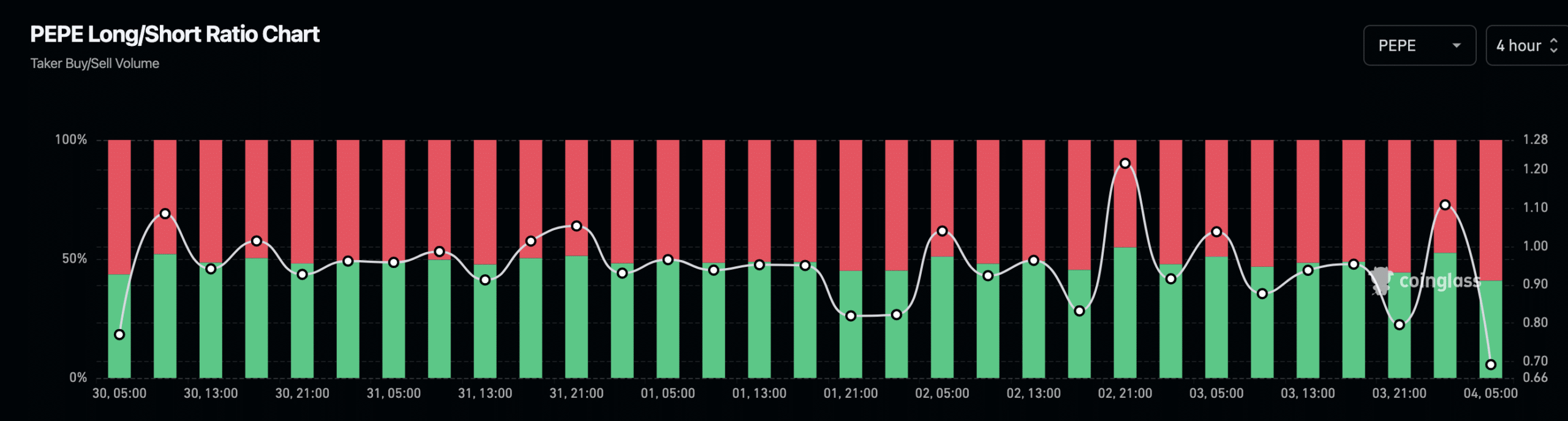

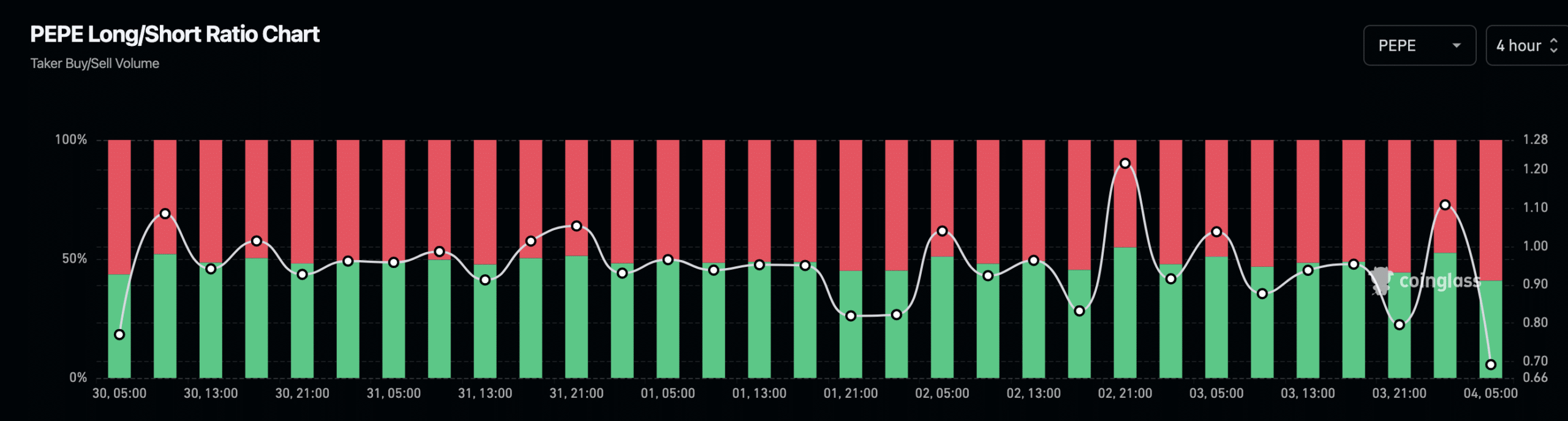

This was evident in thew Long/Short ratio. The Long/Short ratio is a measure of traders’ expectations. Values above 1 indicate the amount of long positions (bets on a price increase) is more than shorts (bets on a decrease).

On the other hand, a ratio below 1 indicates that traders are bearish. At press time, the 4-hour Long/Short ratio ratio was down to 0.69, reinforcing the notion that investors’ expectations was negative.

Source: Coinglass

Read Pepe’s [PEPE] Price Prediction 2024-2025

But this sentiment does not serve as confirmation of a price decline. In the past, when negative sentiment is extreme, it prepares PEPE for another leg-up.

As such, a notable upswing could be in the work for the token.