- Whale activity on PEPE signaled potential market reversal, despite recent price decline.

- Network growth slowdown and technical indicators suggested a cautious outlook for further price movement.

A major whale activity in the Pepe [PEPE] market has recently caught attention, with 427 billion PEPE ($8.5M) deposited into Kraken over the past 30 hours, causing noticeable market movement.

With 1 trillion PEPE ($18.4M) in total holdings, the whale has made notable profits, including a $2M gain from its latest position.

In the past, it made $11.7M on PEPE, highlighting its belief in the token’s potential.

At press time, the memecoin was trading at $0.00001845, reflecting a -10.18% decline over the last 24 hours. Does this whale activity indicate a new rally, or will resistance levels hold back progress?

What’s next for PEPE’s price movement?

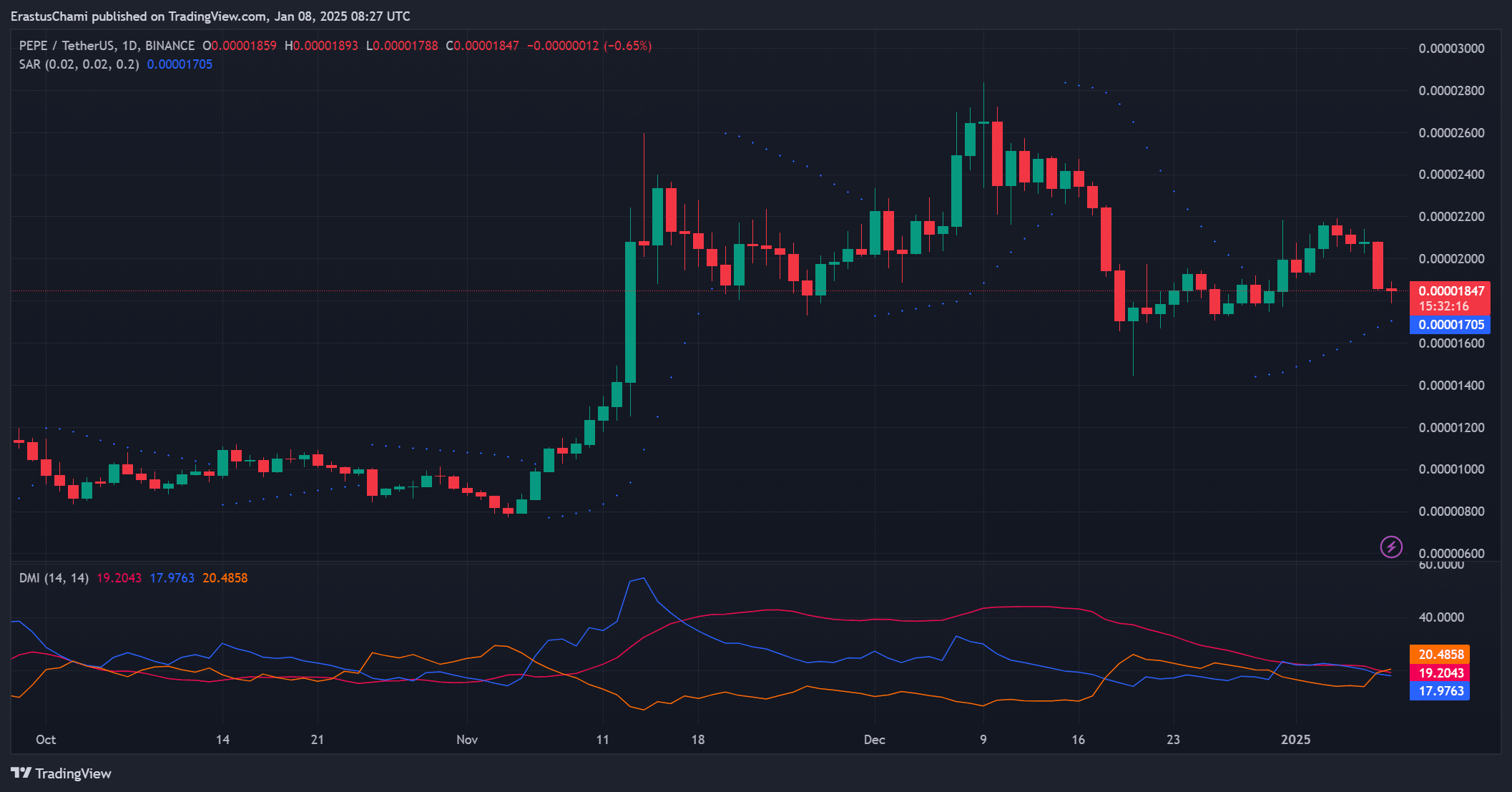

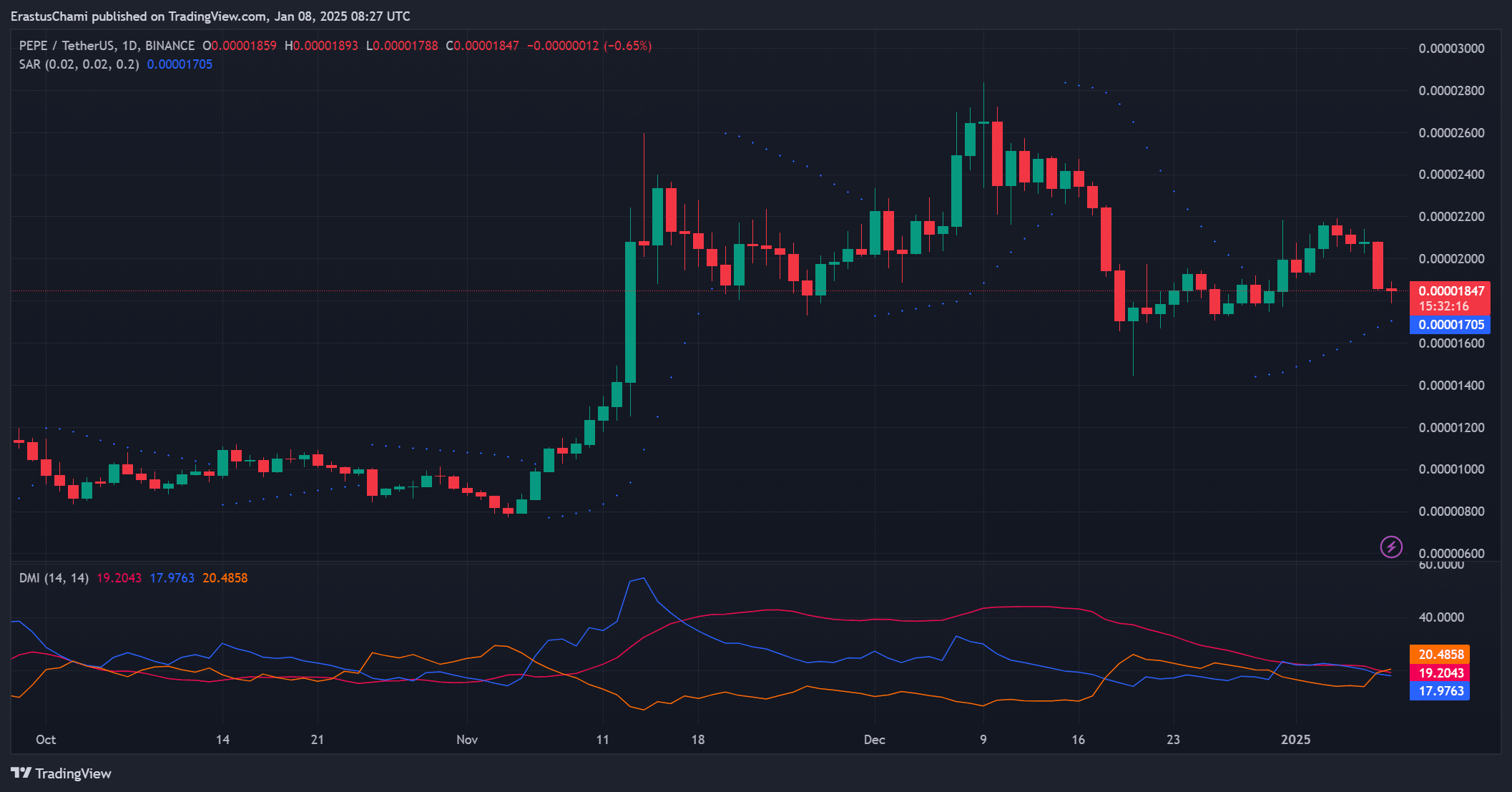

The price action of PEPE is at a crucial juncture. Currently, it is testing key support levels, holding near the demand zone around $0.00001701.

If the price maintains this level, it could see a potential bounce toward the key resistance level at $0.00002196.

However, if selling pressure builds, PEPE could face a decline. Therefore, much will depend on whether buyers can maintain control and prevent further drops, allowing for upward movement.

Source: TradingView

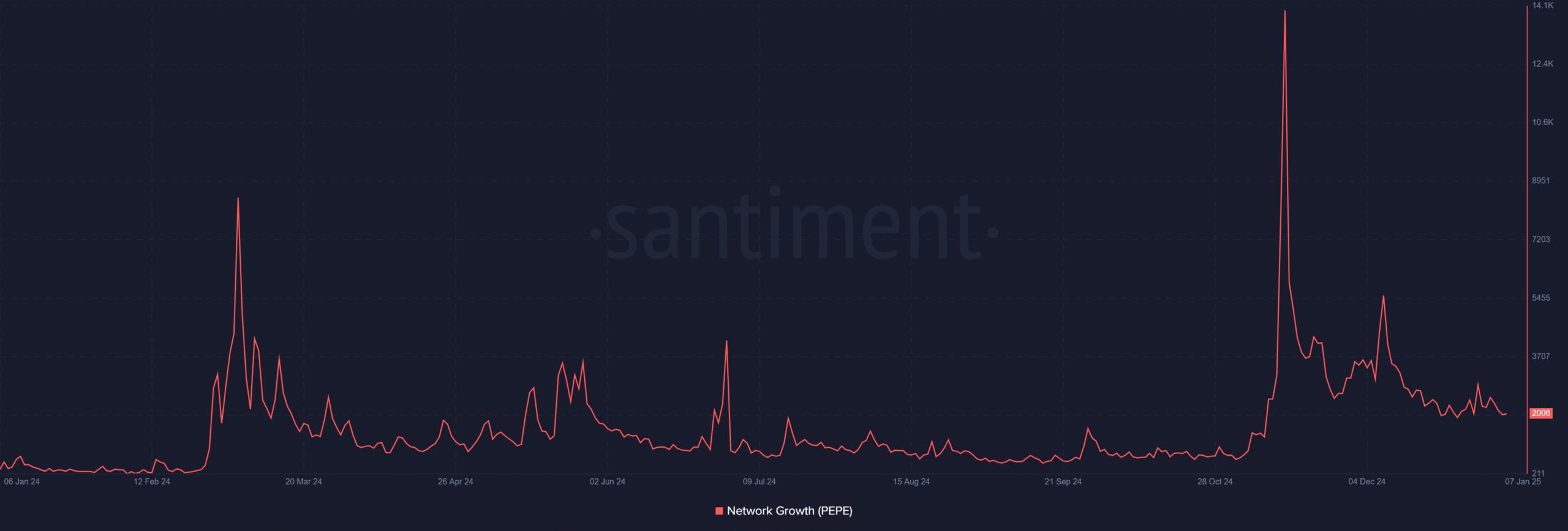

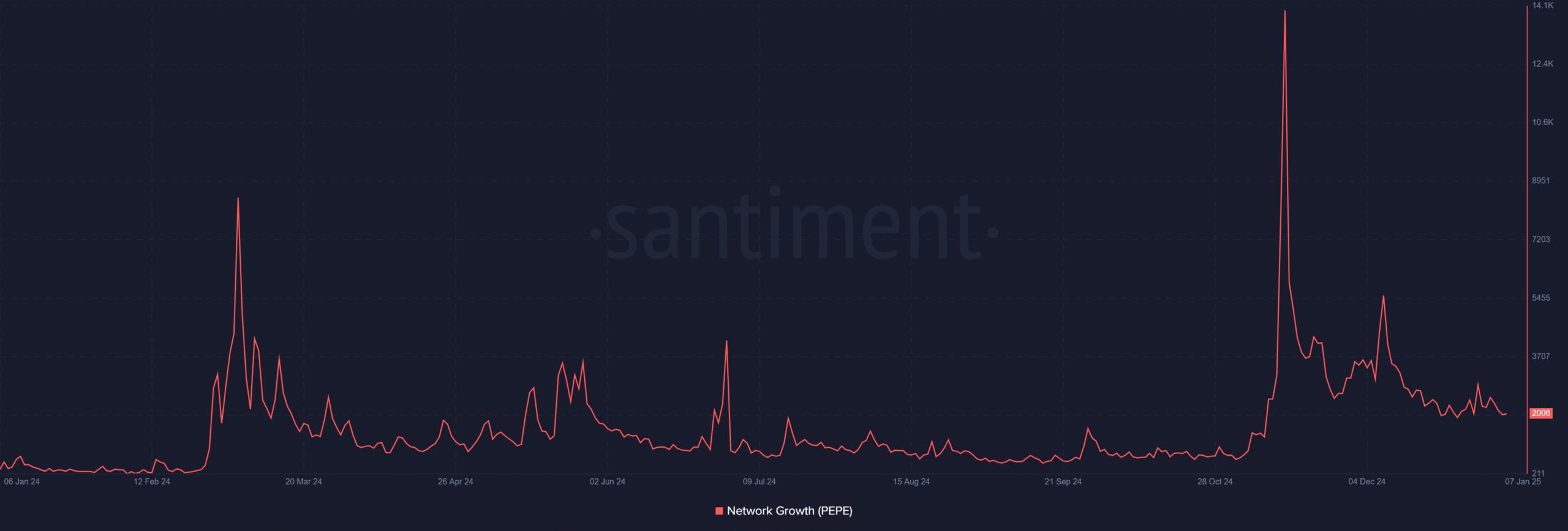

Does the network growth suggest a bullish future?

Network growth has experienced a decline, standing at 2006 at press time. This suggested a slowdown in user activity and transactions, which typically follows major price movements.

However, this could just be a temporary cooling-off period. Whether this decline will affect the price in the long run depends on whether whale activity can spark fresh network growth and boost investor sentiment.

Source: Santiment

Technical indicators

The Parabolic SAR indicates that the price is above the dotted lines, showing bullish momentum. PEPE is trading at $0.00001705, suggesting positive momentum.

The Directional Movement Index (DMI) showed +D at 17.876, -D at 20.485, and ADX at 19.20. These figures revealed that the bears werestill have control, but the trend strength is weak.

If buyers increase pressure, momentum could shift, and the bulls might take charge.

Source: TradingView

Is the market ready for PEPE to break resistance levels?

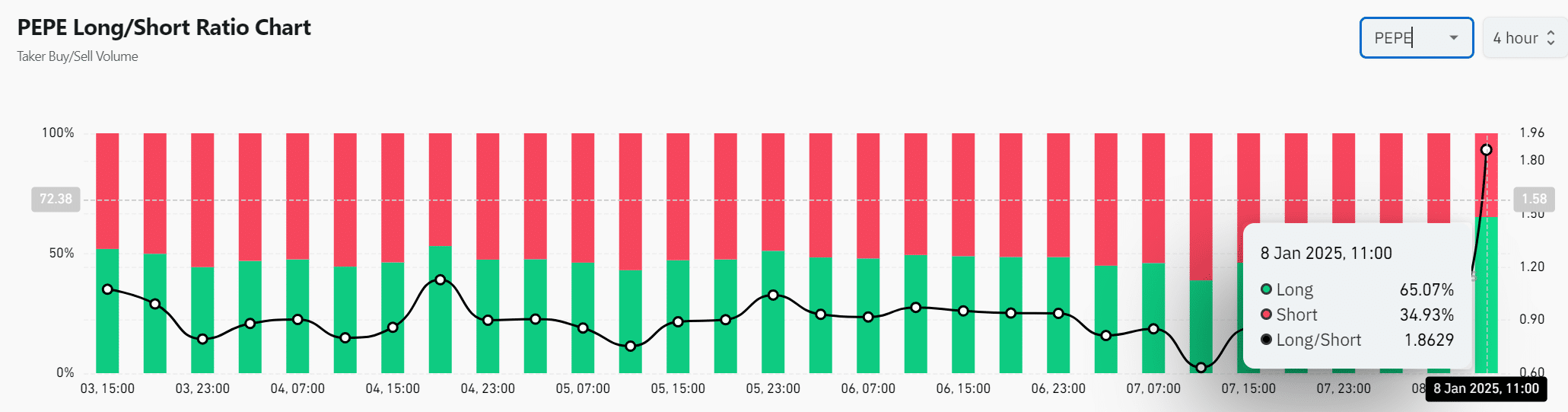

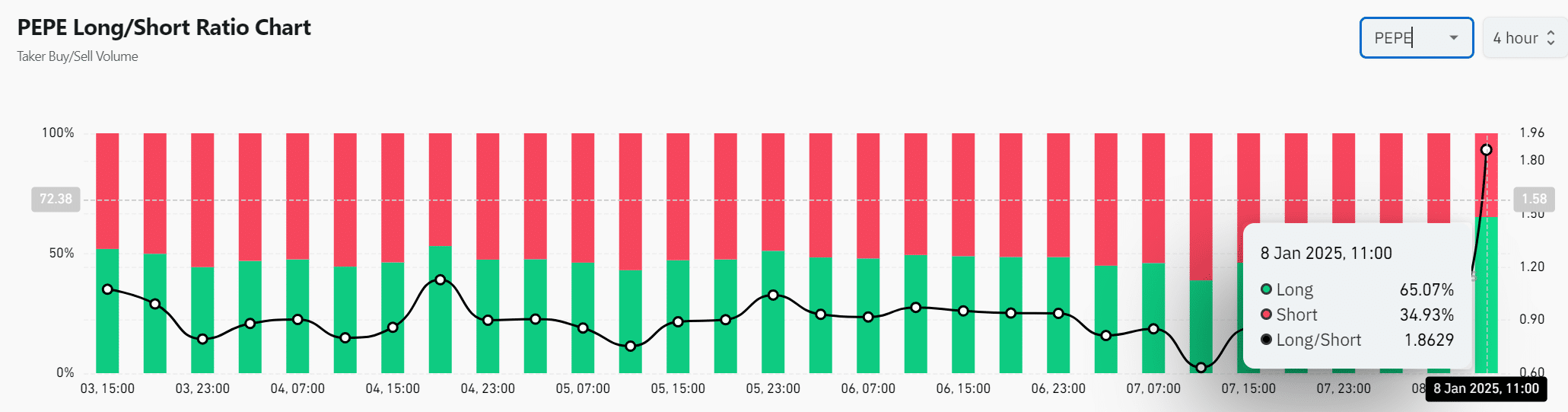

Analyzing the Long/Short Ratio, 65.07% of positions were long, indicating bullish sentiment. This long bias, combined with recent whale activity, suggests the potential for the memecoin to break key resistance levels.

However, if sentiment shifts and sellers dominate, upward movement could stall. The success of PEPE’s rally will depend on continued buying interest and overcoming resistance.

Source: Coinglass

PEPE has potential for further growth due to whale activity and strong bullish sentiment. However, overcoming key resistance levels remains crucial.

Read Pepe’s [PEPE] Price Prediction 2025–2026

If it holds support and breaks resistance, it could experience a price surge. Without sufficient buying pressure, resistance could keep it from advancing.

Therefore, PEPE’s ability to break through resistance will determine its next price movement.