- Some PEPE whales bagged billions of tokens, suggesting a price increase in the near term.

- The NVT ratio indicated that PEPE’s price might decrease before the potential pump.

Four different investors bought large sums of Pepe [PEPE] in the last 24 hours, a post from Lookonchain revealed.

From the post and proof from Etherscan, a certain participant withdrew 350 billion PEPE tokens from Binance [BNB].

This withdrawal confirmed a decision to hold the token instead of selling it in the short term. Within the same period, another buyer took out 101 billion, valued at $885,000 from the exchange.

The other two purchases include a massive 123.66 billion and a 74.5 billion accumulation.

Buying these big amounts of the memecoin is not something new to the market, as AMBCrypto has reported similar activity on several occasions.

Big players are getting ready

However, when things like this happen, it implies that the participants involved are gearing up for a significant price increase.

Past events have also shown that this sort of accumulation foreshadows a rise in PEPE’s value.

At press time, PEPE changed hands at $0.00000875, representing a mild 1.32% increase in the last 24 hours. However, the token could jump more than that.

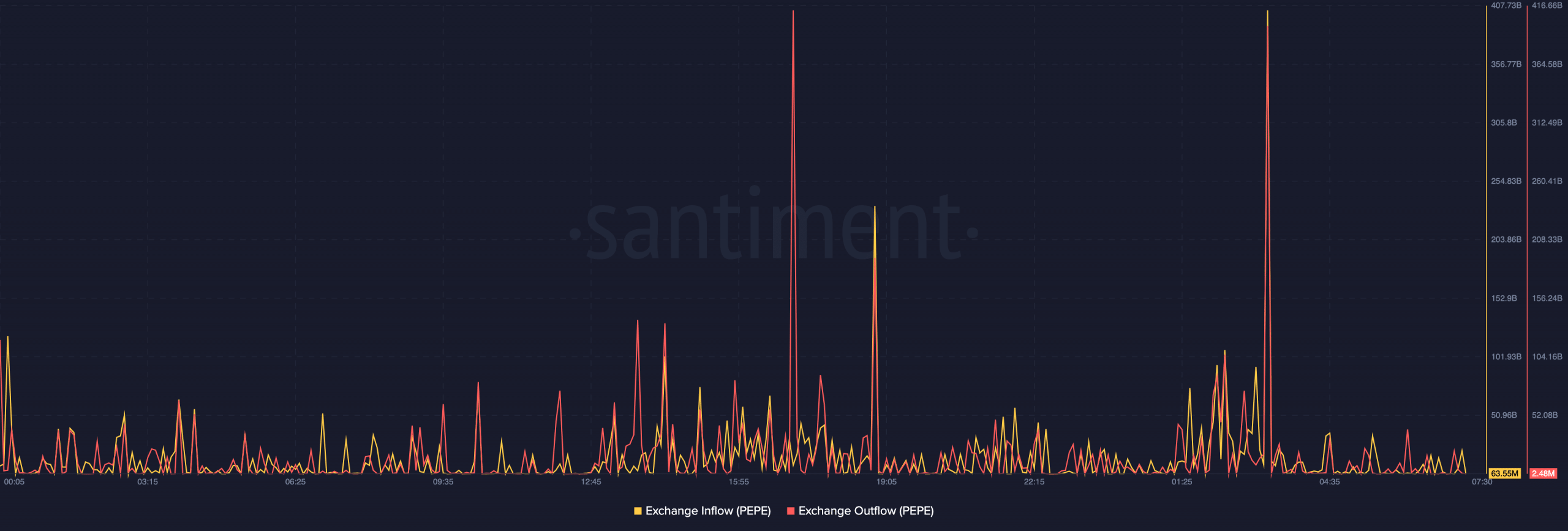

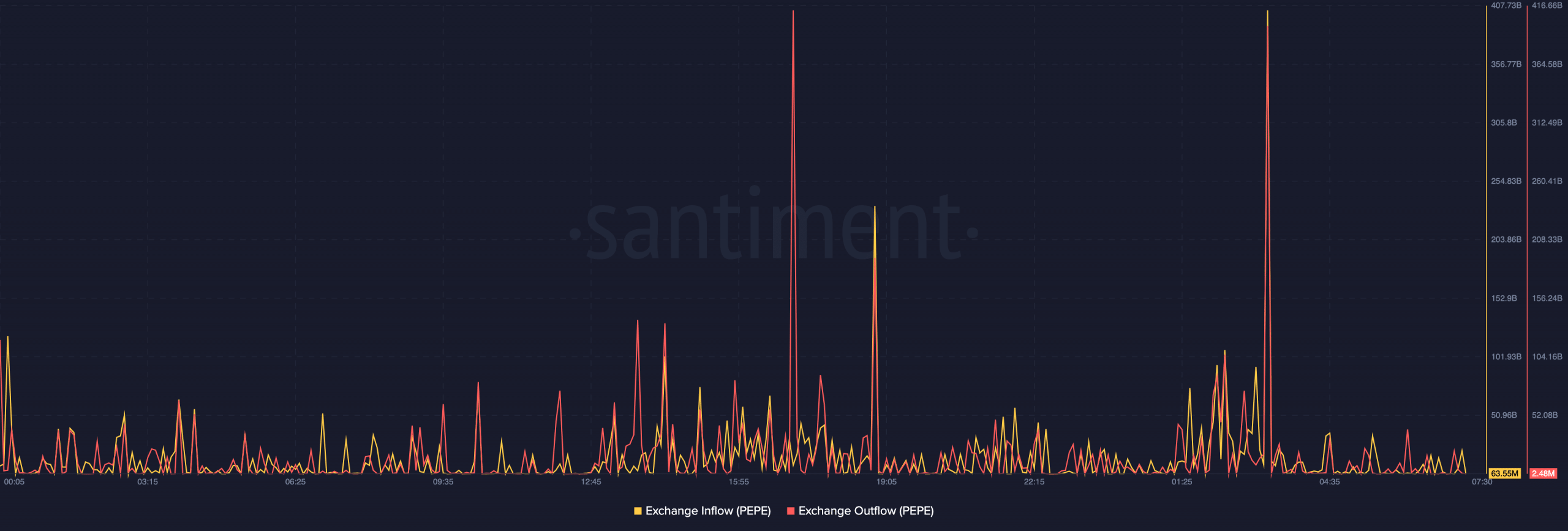

But first, AMBCrypto looked at other on-chain metrics. This was done to ascertain if the bullish prediction was valid. The first metric we considered was the exchange flow.

According to data from Santiment, 63.55 million PEPE tokens have left exchanges within the last day. On the other hand, 2.48 million have flown into the platforms.

Source: Santiment

The notable difference in exchange inflow and outflow suggests that more investors are willing to hold the memecoin than those planning to sell.

With this update, one can imply that PEPE might not experience a significant plunge soon. Instead, the price of the token could be getting set for a rerun to $0.000010.

Taking it one step at a time

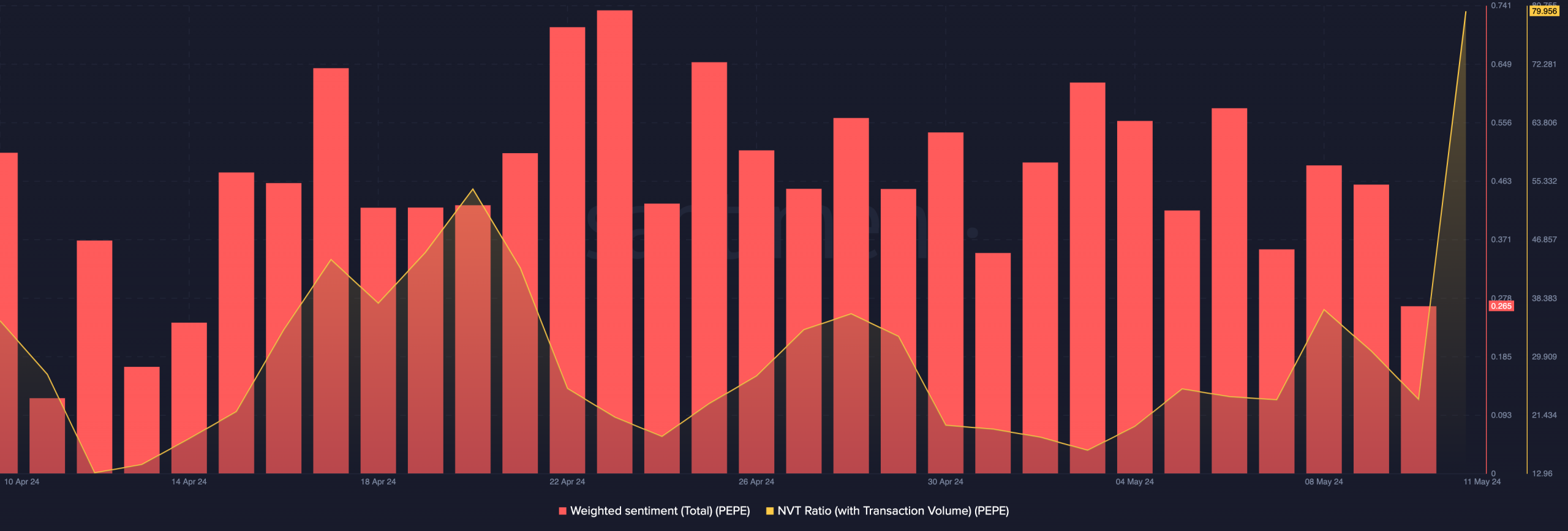

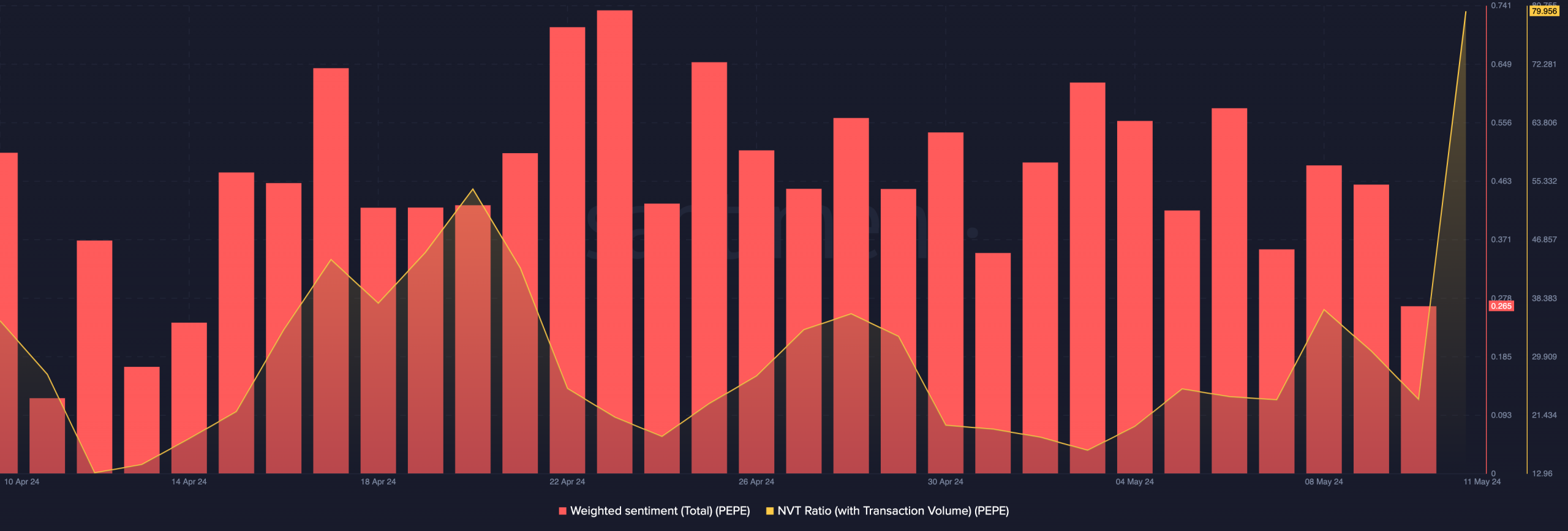

Despite the possible price increase, market participants were not convinced that PEPE’s rally could be close. AMBCrypto noticed this after looking at the Weighted Sentiment.

Weighted Sentiment measures the unique comments about a project— either negative or positive. At press time, the Weighted Sentiment was 0.265.

Being in a positive region implies that most comments about the memecoin were positive. However, this reading was a decline from what it was on the 9th of May, meaning the optimism was losing steam.

But as long as the sentiment has not turned negative, PEPE has a chance to bounce. However, the NVT ratio spiked to 79.95.

Source: Santiment

NVT stands for Network Value to Transaction (NVT) and it tells if a network’s market cap is justified by the transaction activity. If the NVT ratio is low, it means that the volume is growing faster than the market.

Is your portfolio green? Check the PEPE Profit Calculator

In this instance, the price could be ready for the next leg up.

Therefore, PEPE’s NVT ratio’s increase implied that the market cap growing at a faster pace than the volume, indicating that the price might trend downward first before a significant jump.