- NOT’s momentum was bearish, and this could lead the price to $0.015.

- The project’s development team plans to buy unclaimed tokens, suggesting a bullish price in the near future.

The widespread market decline might have forced previous Notcoin [NOT] price predictions to be null and void, AMBCrypto discovered. At press time, NOT’s price was $0.017, representing a 12% decline in the last 24 hours.

On the 16th of June, we reported how NOT defied the broader market as the price increased. However, it was surprising that the upswing did not last long, especially as the token had gone against the broader trend on different occasions.

NOT goes back to its old ways

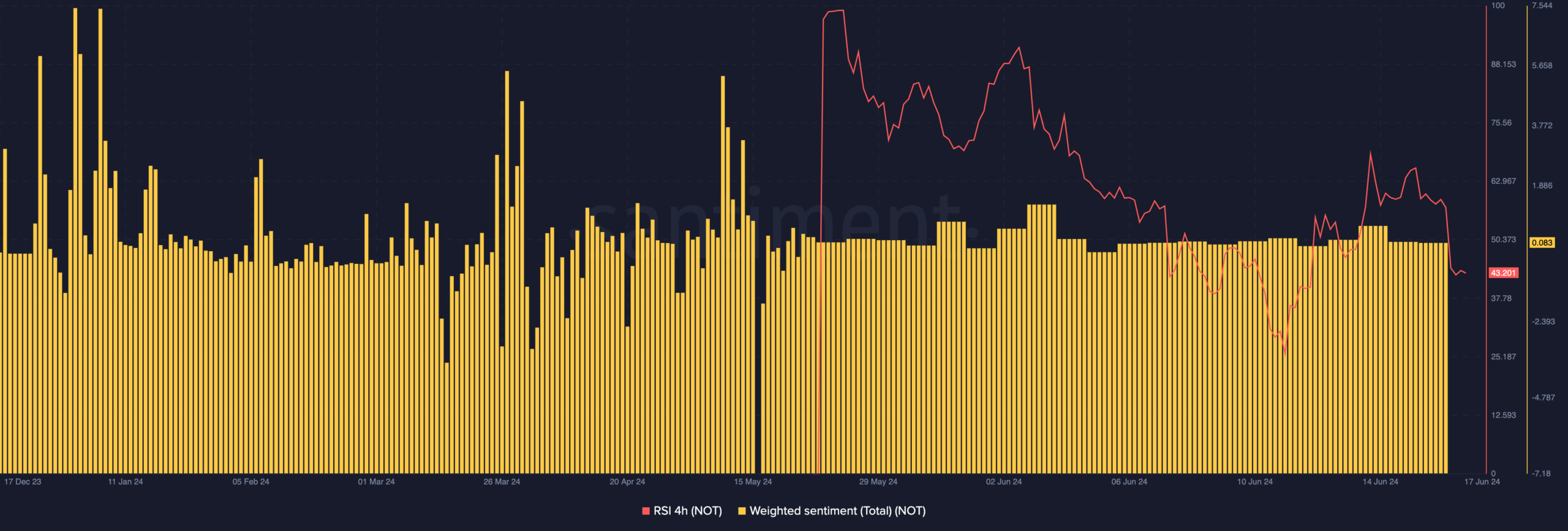

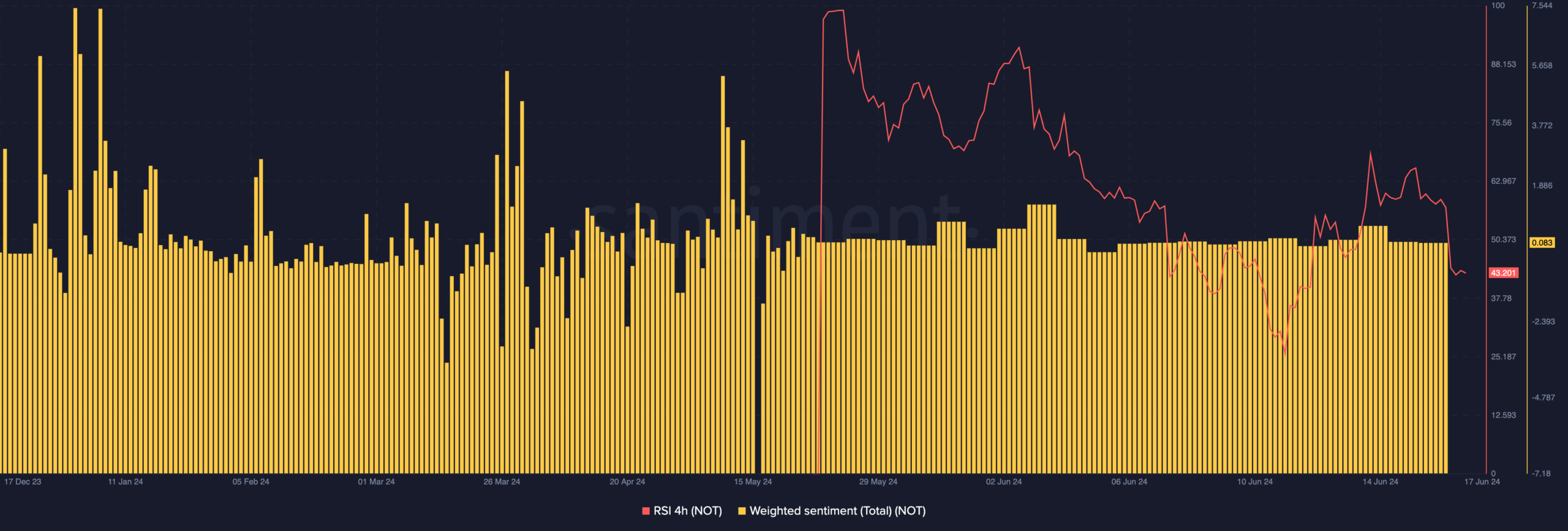

According to our findings, a decline in buying momentum was one of the reasons Notcoin’s price fell. At press time, the Relative Strength Index (RSI) on the 4-hour chart was down to 43.20.

The RSI measures the magnitude of price changes in the market. It also identifies possible overbought or oversold zones. If the reading is 70 or above, it means a cryptocurrency is overbought.

However, when the RSI is below 30, it means that it is oversold.

But the reading for the coin was below the 50.00 midpoint, indicating that the momentum around NOT had become bearish. Should the reading continue to decrease, Notcoin price prediction will become increasingly gloomy.

However, the Weighted Sentiment has managed to stay above the negative territory. Weighted Sentiment gauges the perception the average market participants has about a project.

If the reading is positive, then it means that most comments are bullish. However, a negative reading implies that the broader sentiment is bearish.

Source: Santiment

For NOT, the ability of the Weighted Sentiment to stay in the positive region might prevent it from further correction. If this happens, NOT might jump to $0.021.

On the other other, a fall to the red zone could capitulate the token’s price. If this Notcoin price prediction plays out, the value of the cryptocurrency might slide to $0.015.

Notcoin’s proposal fuels traders’ conviction

In the meantime, the Notcoin team announced the claiming of the NOT airdrop has ended. Recall that NOT launched by rewarding those who participated in the tap-to-earn game.

An airdrop happens when a project sends rewards to certain users with cryptocurrencies for meeting specific requirements.

In addition to the disclosure, the project noted that it had 11.5 million holders. It also mentioned that the unclaimed tokens would be burned while those who staked would get extra rewards. It wrote on X that,

“Most of the drop was distributed already, unclaimed tokens will be put into the future development, part will be burned In addition, there will be an extra reward for those who staked for Gold and Platinum levels.”

If burned, the mechanism would make Notcoin scarce as fewer tokens would be in circulation. Going forward, this could fuel a bullish price prediction for the token.

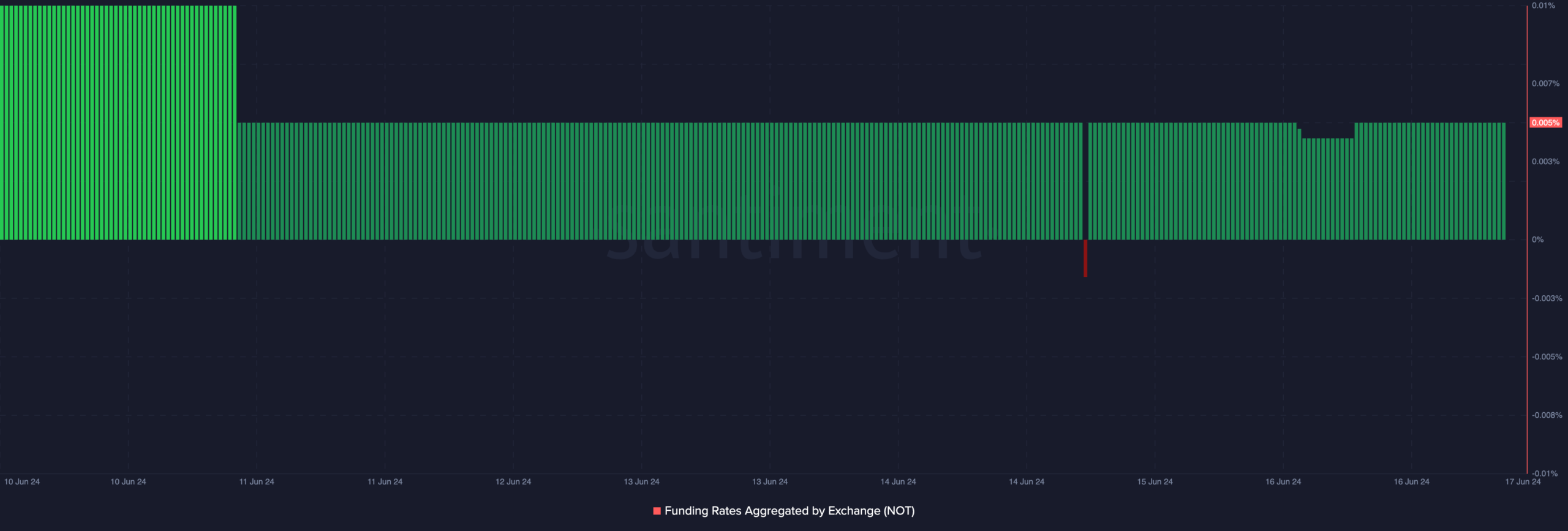

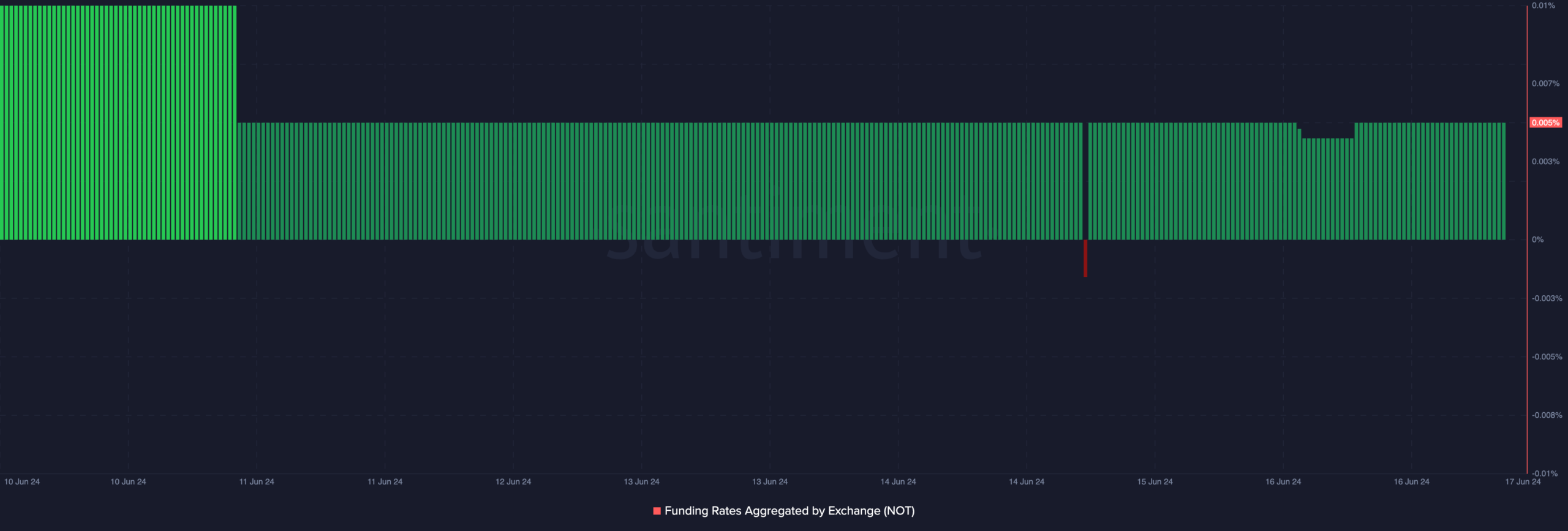

Further, it appeared that traders are confident that NOT’s price would recover. This was evident from the Funding Rate.

Source: Santiment

Realistic not, here’s NOT’s market cap in TON terms

At press time, Notcoin’s Funding Rate was positive. Positive readings of the metric indicate that longs are paying shorts to keep their positions open. This means that the sentiment among traders is bullish on average.

Should this remain the situation moving on, and buying pressure increases in the spot market, Notcoin’s price prediction might be well over previous targets.