- Bitcoin has seen more NFT sales than Ethereum in the last week.

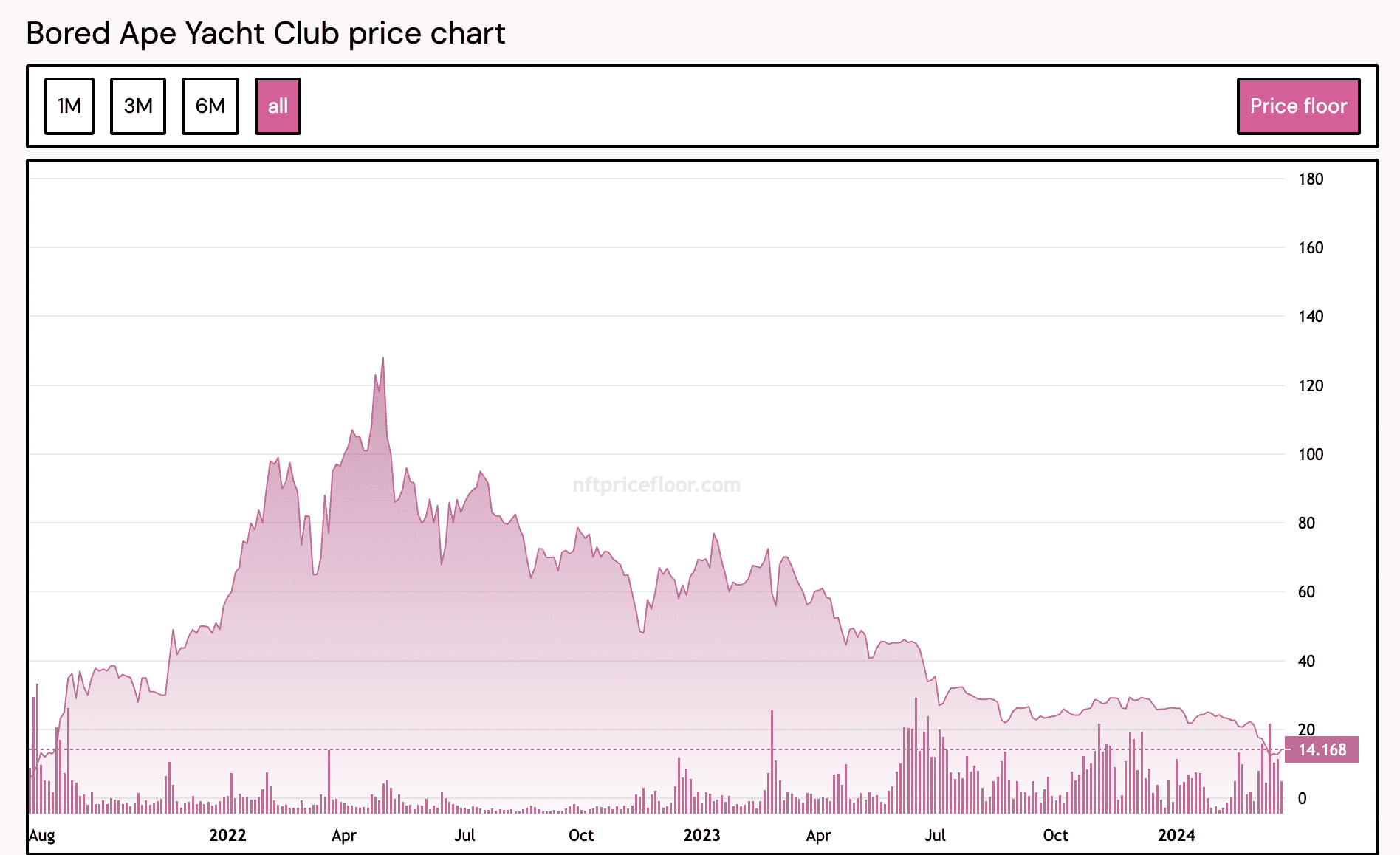

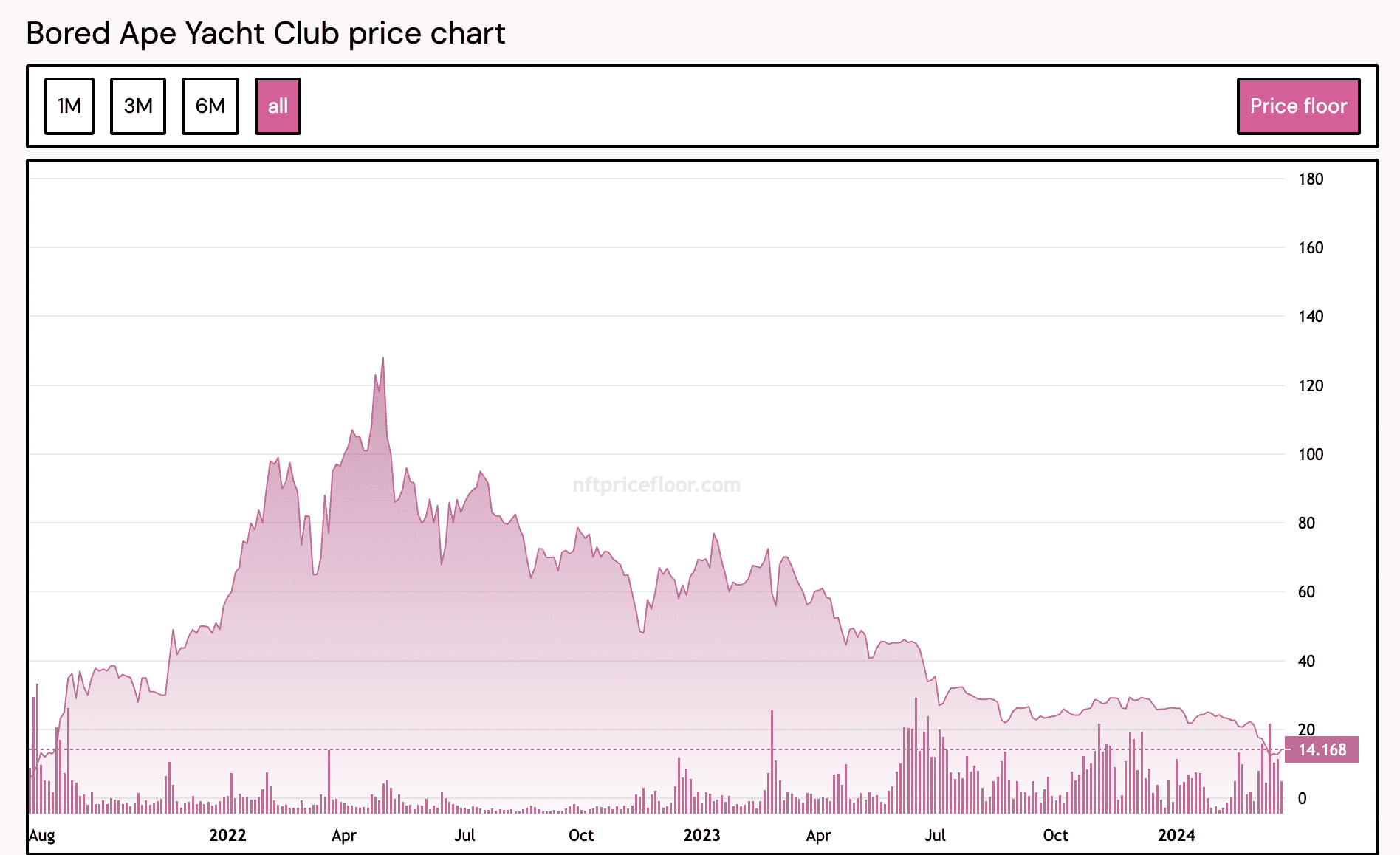

- BAYC’s floor price has plunged to its 2021 levels.

The sales volume of non-fungible tokens (NFTs) on the Ethereum [ETH] network has surged in the past two days, exceeding that of Bitcoin [BTC]. However, according to CryptoSlam’s data, the Bitcoin network holds the lead in overall weekly trading volume.

AMBCrypto found that between the 20th and 21st of March, NFT sales volume on Ethereum totaled $43 million, dwarfing Bitcoin’s $20 million by 115%. However, NFT sales on both networks assessed over a seven-day period show that Bitcoin has seen higher activity.

During that window period, NFT sales volume on the Bitcoin network amounted to $126 million from 50,000 transactions. According to CryptoSlam’s data, these sales were completed between 49,228 unique sellers and 54,780 unique buyers.

In the past 21 days, the USD value of all NFTs sold on the Bitcoin network is $408 million, marking a 32% uptick from the $307 million recorded in February.

On the other hand, NFT sales volume on Ethereum in the last week totaled $108 million. This was recorded from 134,178 total transactions, completed between 46,985 unique sellers and 57,209 unique buyers.

BAYC value craters to new lows

An assessment of the leading NFT collection, Bored Ape Yacht Club (BAYC), revealed a significant decline in its floor price since the beginning of the year.

According to data from NFTPriceFloor, as of 22nd March, an NFT from the BAYC collection can be acquired at a floor price of 14.16 ETH, worth around $50,000 at the altcoin’s current price.

This marked a 46% decline from the collection’s floor price of 26 ETH, which it recorded on 1st January. At its current floor price, the NFTs that make up the BAYC collection currently sell at their lowest values since August 2021.

Source: NFTFloorPrice

Taking advantage of this month’s decline in BAYC’s value, market participants have sold and bought more NFTs from the collection than they did in February and January.

So far this month, BAYC’s sales volume has totaled $33 million, exceeding February’s $21 million by 57% and January’s $17 million by 94%.

Although there are still eight days until the end of March, the month already stands out as the one with the highest year-to-date sales volume.