- Bitcoin maintained a balanced Put/Call Ratio ahead of the deadline

- ETH traders face potential losses as its price was close to the maximum pain point

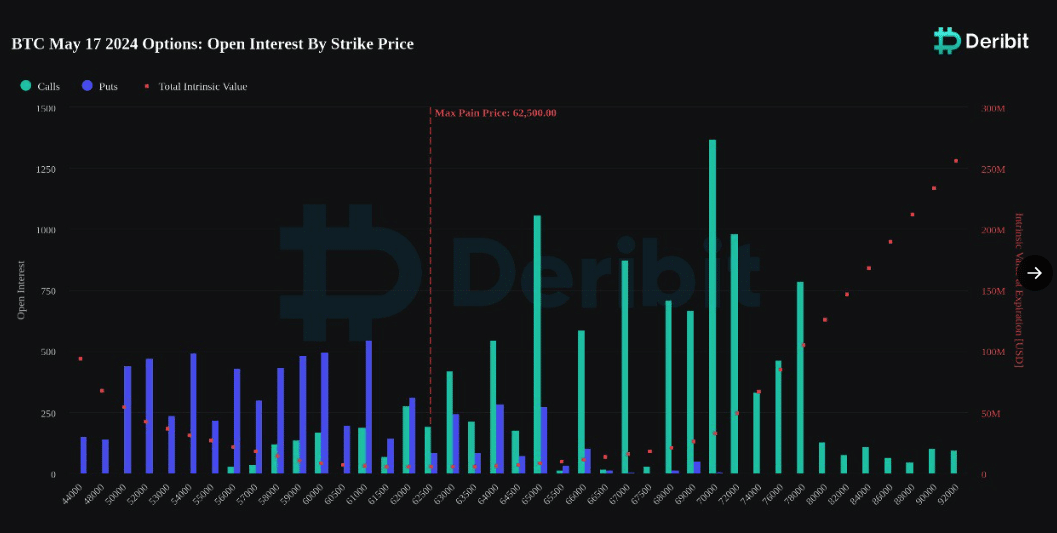

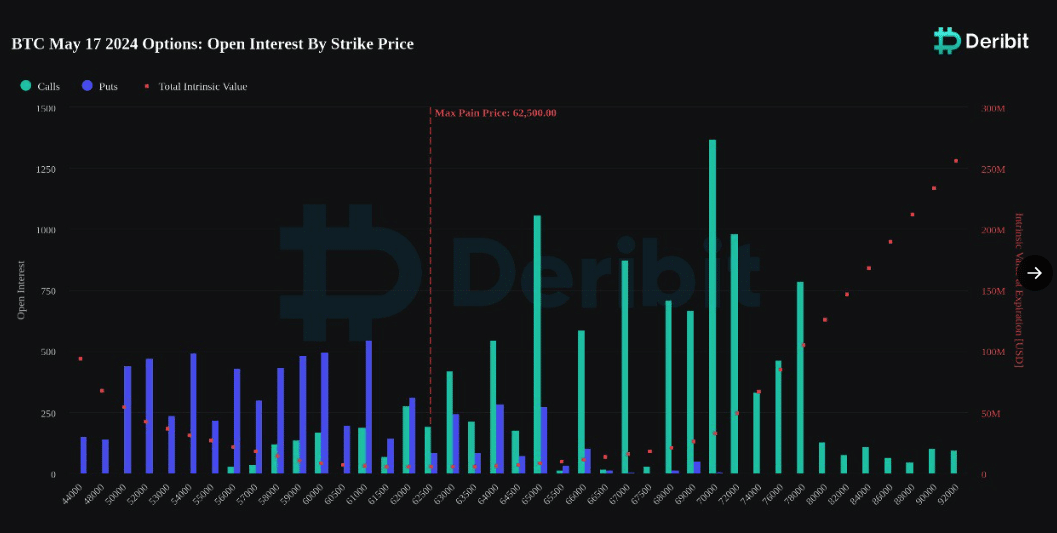

According to data from Deribit, the market-leading derivatives exchange, Bitcoin [BTC] options with a notional value of $1.18 billion will expire on 17 May.

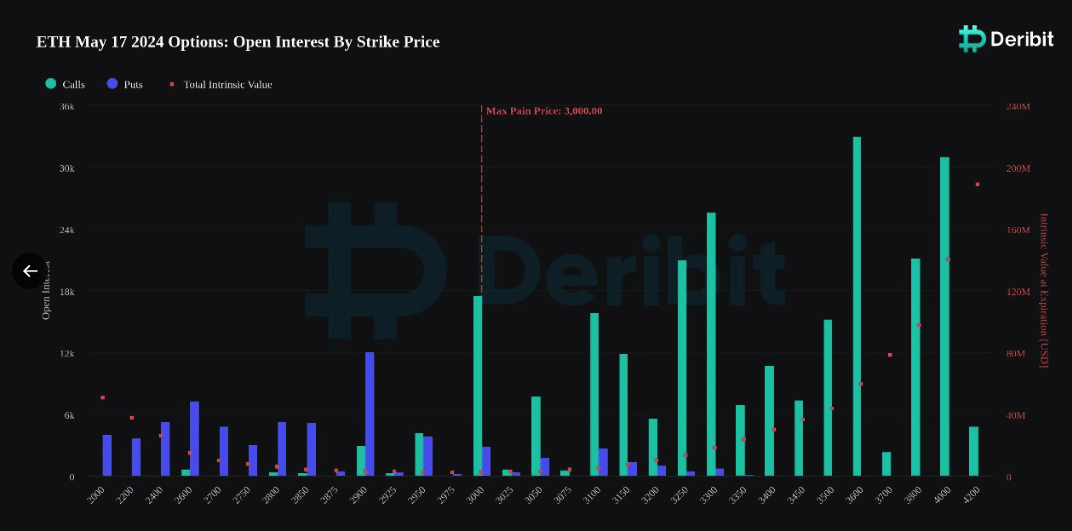

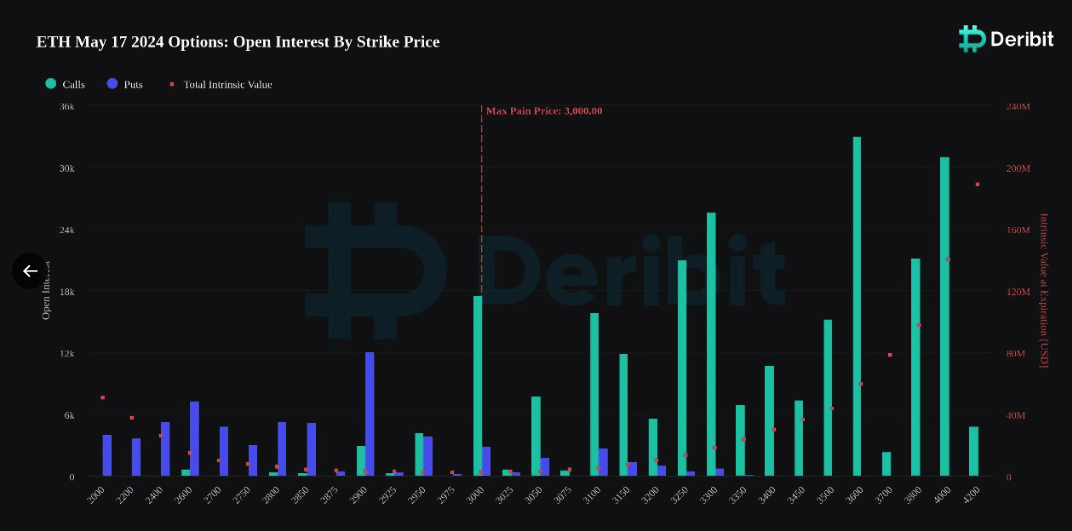

Also, Ethereum [ETH] contracts, valued at $950 million, would expire on the same day. At press time, the Put/Call Ratio for Bitcoin was 0.61 while the maximum pain point was $62,500.

Source: Deribit

Where do both BTC and ETH stand?

In trading options, a put means that a trader has placed a position to place a contract up for sale. In this case, the expectation is that the price of the asset decreases so the position can make gains.

On the other hand, a call implies a purchase, indicating that the bet is for a price hike. If the reading of the Put/Call Ratio is 0.70 and above, it means that traders are buying more puts than calls.

Conversely, a reading of 0.50 and below implies a bullish sentiment in the market. For Bitcoin, the ratio revealed that the number of put and call positions was close, indicating a balance between bearish and bullish positions.

For ETH, the Put/Call Ratio was 0.21 – A sign that most of the bets were bullish. ETH had a maximum pain point of $3,000. If the cryptocurrency trades at this level or below by the end of the day, a lot of traders might face huge financial losses.

Source: Deribit

It would be the same for Bitcoin if the price hits $62,500 or drops below it. At the time of writing, the price of Bitcoin was $66,443, indicating that it might be difficult for the crypto to cause a lot of pain.

However, at the same time, ETH was valued at $3,018. The closeness of this to the maximum pain point leaves ETH traders at a big risk of losing.

ETH’s weakness has not deterred future bets

In addition, Greeks.live, an options trading repository, commented on the matter. The handle agreed with AMBCrypto’s analysis for Bitcoin via X. For Ethereum, it noted,

“Btc is more balanced between long and short, while the ETH price is weak leading to continued weakening of the market confidence, and selling calls have become the absolute main deal.”

However, data from Deribit revealed that traders expect ETH to recover from its struggles going forward. Based on AMBCrypto’s observations, there has been an increase in bets targeting $3,600 between the last week of May and June.

One of the reasons for this prediction could be the looming SEC decision on the numerous Ethereum ETF applications. A nod on this front could drive ETH’s price higher, and traders might gain from the same.

Realistic or not, here’s ETH’s market cap in BTC terms

On the other hand, delay or rejection could force the price of the altcoin further lower. Should this be the case, traders might have to deal with huge financial losses.