On August 14, MANTRA, a dedicated layer-1 (L1) blockchain for real-world assets (RWAs), announced a partnership with Novus Aviation Capital. This collaboration aims to tokenize assets within the $200 billion aviation financing market.

By doing so, it makes owning assets more accessible and streamlines the process in aviation finance.

MANTRA and Novus to Offer Fractional Ownership in Aviation Through Tokenization

Established in 1994, Novus Aviation Capital specializes in aircraft trading, leasing, and financing. Moreover, it has a significant presence in Europe, Asia, and the Middle East.

Now, by partnering with MANTRA, Novus aims to integrate blockchain technology into aviation asset management, enhancing transparency and efficiency. The partnership focuses on leveraging MANTRA’s blockchain infrastructure to tokenize aviation assets. This process also promises to increase liquidity, reduce risks through fractional ownership, and make high-value assets accessible to a broader range of investors.

Read more: Where To Buy Tokenized or Fractionalized Real Estate and Art

Mounir Kuzbari, co-CEO of Novus Aviation Capital, highlighted the partnership’s strategic significance. He mentioned that Novus Aviation Capital’s objective is to innovate and collaborate with its partners to achieve strong, risk-adjusted returns within the aviation sector.

“By collaborating with MANTRA, we are exploring tokenization’s benefits to broaden our investor base and simplify the process of buying, financing, and trading aircraft,” Kuzbari said in a statement.

John Patrick Mullin, co-founder and CEO of MANTRA, also expressed his excitement for this partnership. He acknowledged that the aviation finance market is recognized as a substantial asset class with considerable potential benefits that could arise from tokenization.

“By tokenizing aviation assets, we introduce a new asset class to the RWA sector, democratizing access to aviation finance. This partnership will unlock novel opportunities for Web3 users and introduce a new stream of funds for the aviation industry. Tokenization of aviation assets also has the potential to reduce risk exposure for individual investors through fractionalization,” Mullin explained to BeInCrypto.

Read more: How To Invest in Real-World Crypto Assets (RWA)?

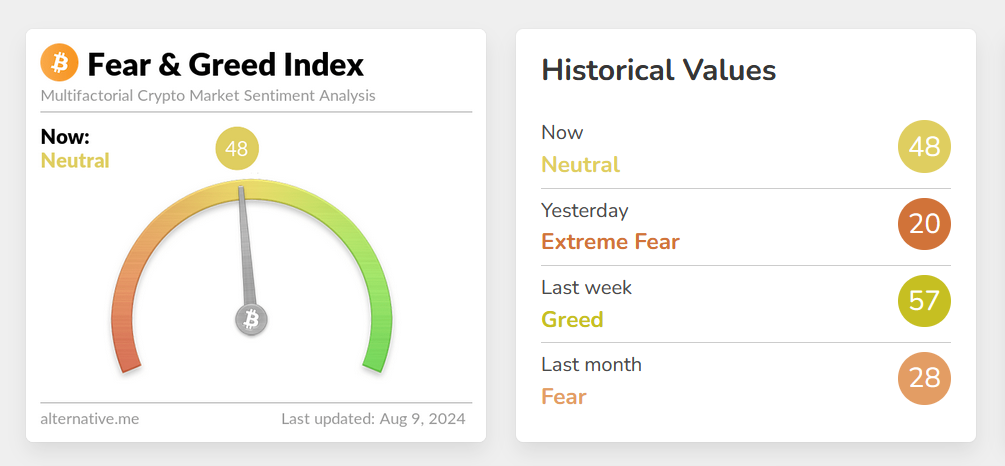

Tokenized Assets Market Prediction by 2030. Source: McKinsey

This collaboration also aligns with broader trends in the financial industry, where traditional finance players are increasingly exploring tokenization. A recent McKinsey report suggested that the tokenized financial assets market could reach $2 trillion by 2030. The report emphasized tokenization’s potential to democratize investments by lowering entry barriers and allowing more investors to participate in high-value assets.