- LTC’s price had dropped by more than 6% in the last seven days.

- LTC was mimicking its 2021 price action, hinting at a bull rally.

Litecoin’s [LTC] price action has somewhat taken a backseat over the last year, as it didn’t move much. However, the latest datasets suggest that the coin might soon turn volatile and reach new highs.

Litecoin’s dormant year

According to CoinMarketCap, despite volatility, last month was a setback for LTC, as its value dropped by more than 6%.

At the time of writing, Litecoin was trading at $80.66 with a market capitalization of over $6 billion, making it the 19th largest crypto. The sluggish price action also had an impact on the coin’s popularity last year.

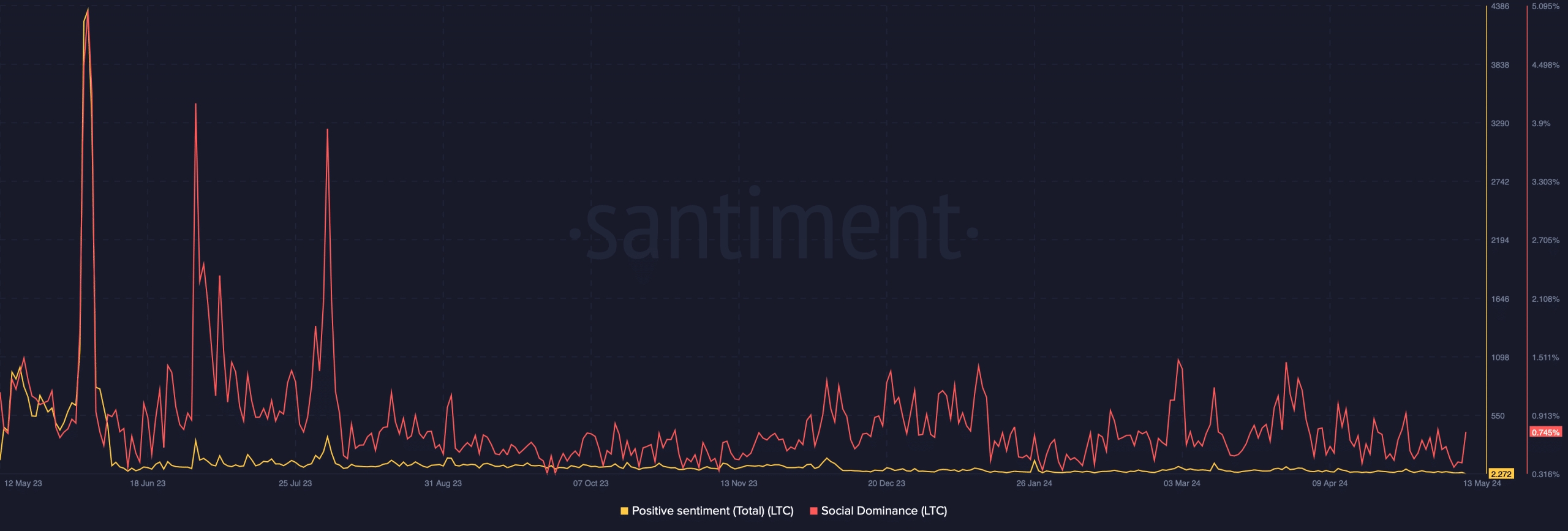

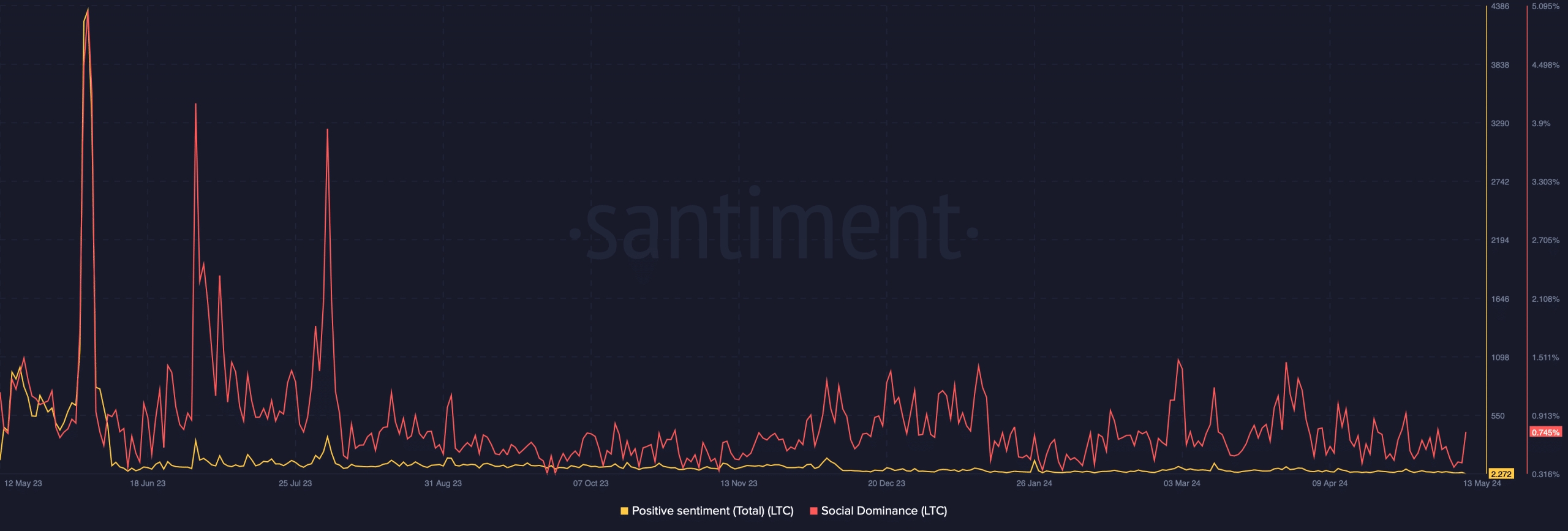

AMBCrypto’s analysis of Santiment’s data clearly revealed a massive drop in its social dominance. Positive sentiment around the coin also plummeted, reflecting a drop in investors’ confidence in the coin.

Source: Santiment

However, all of this might change soon as a bullish pattern formed on LTC’s chart, which earlier resulted in a massive bull rally. The long-term pattern first emerged on LTC’s chart back in 2018.

Since then, the coin’s price consolidated inside the pattern before breaking out in 2021. The breakout resulted in LTC touching an all-time high over the next few months.

Source: TradingView

The good news was that LTC had once again started to consolidate in a similar pattern since the beginning of 2022. As per the latest data, it was on the verge of breaking out.

Therefore, it seemed likely that LTC would turn volatile in the upcoming months and might as well reach an ATH in 2024. Apart from this, yet another metric looked pretty bullish.

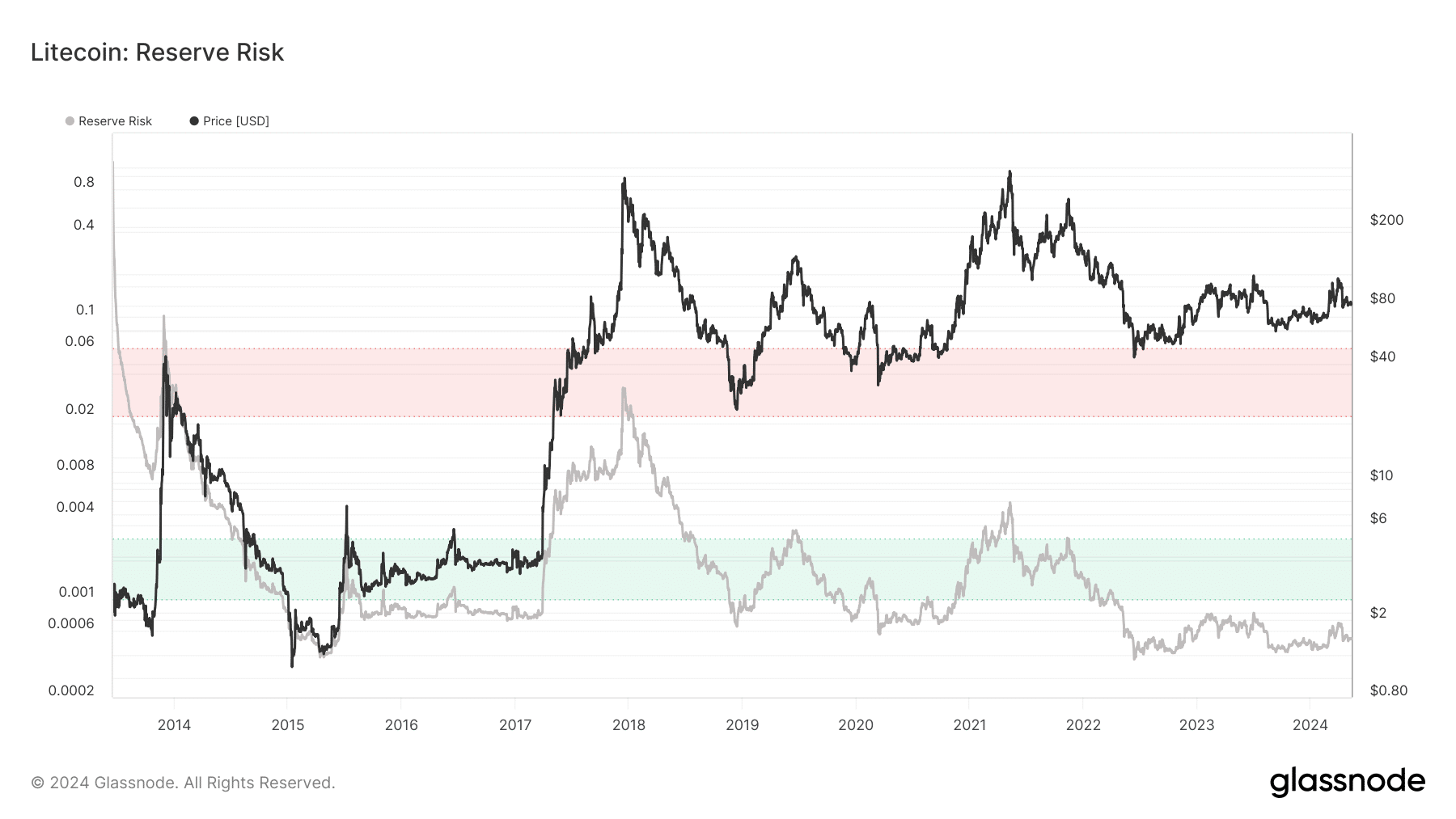

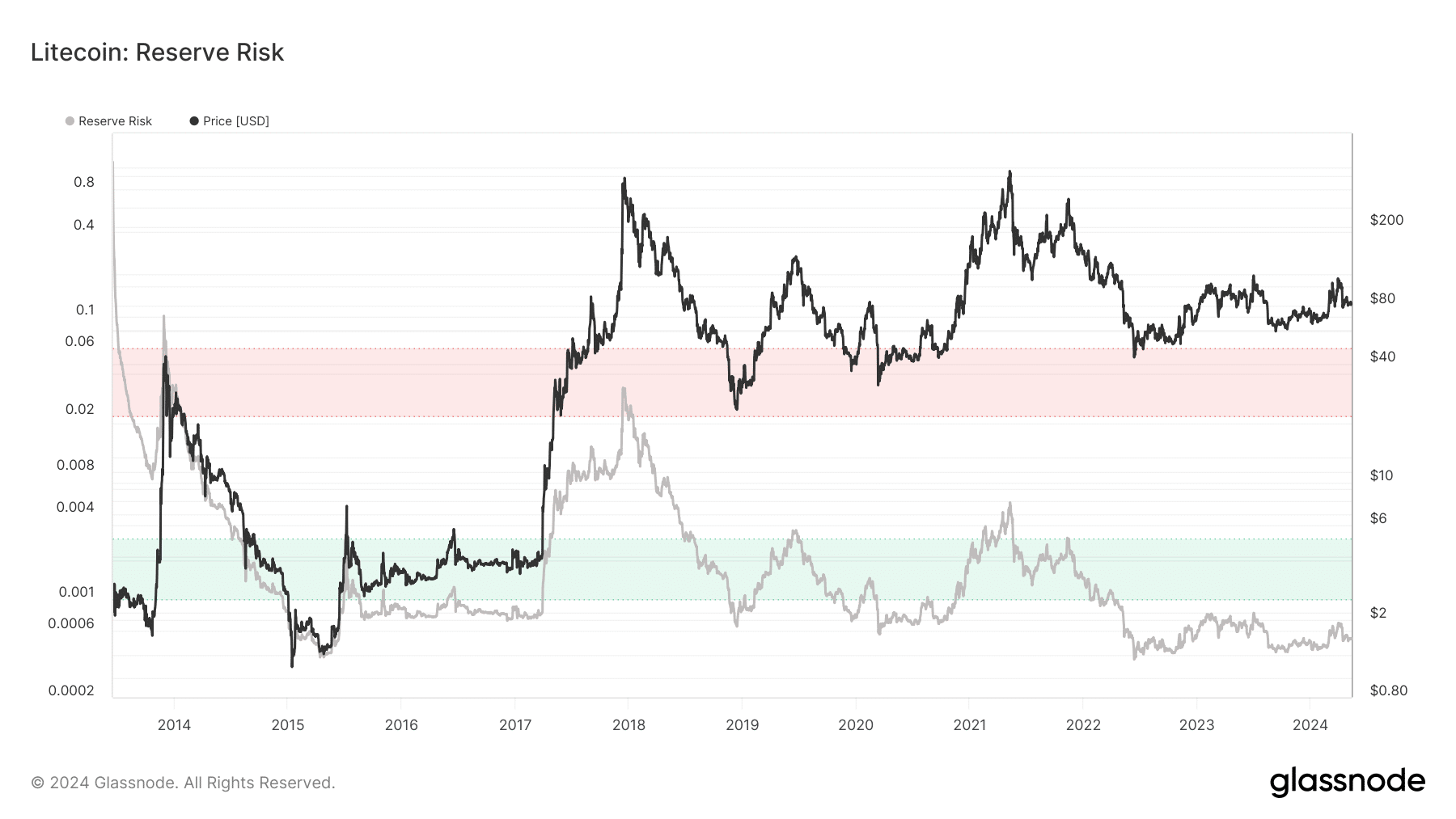

AMBCrypto’s look at Glassnode’s data revealed that Litecoin’s reserve risk was near its all-time low. This also hinted at a possible bull rally in the coming weeks.

Source: Glassnode

What’s in store in the short term?

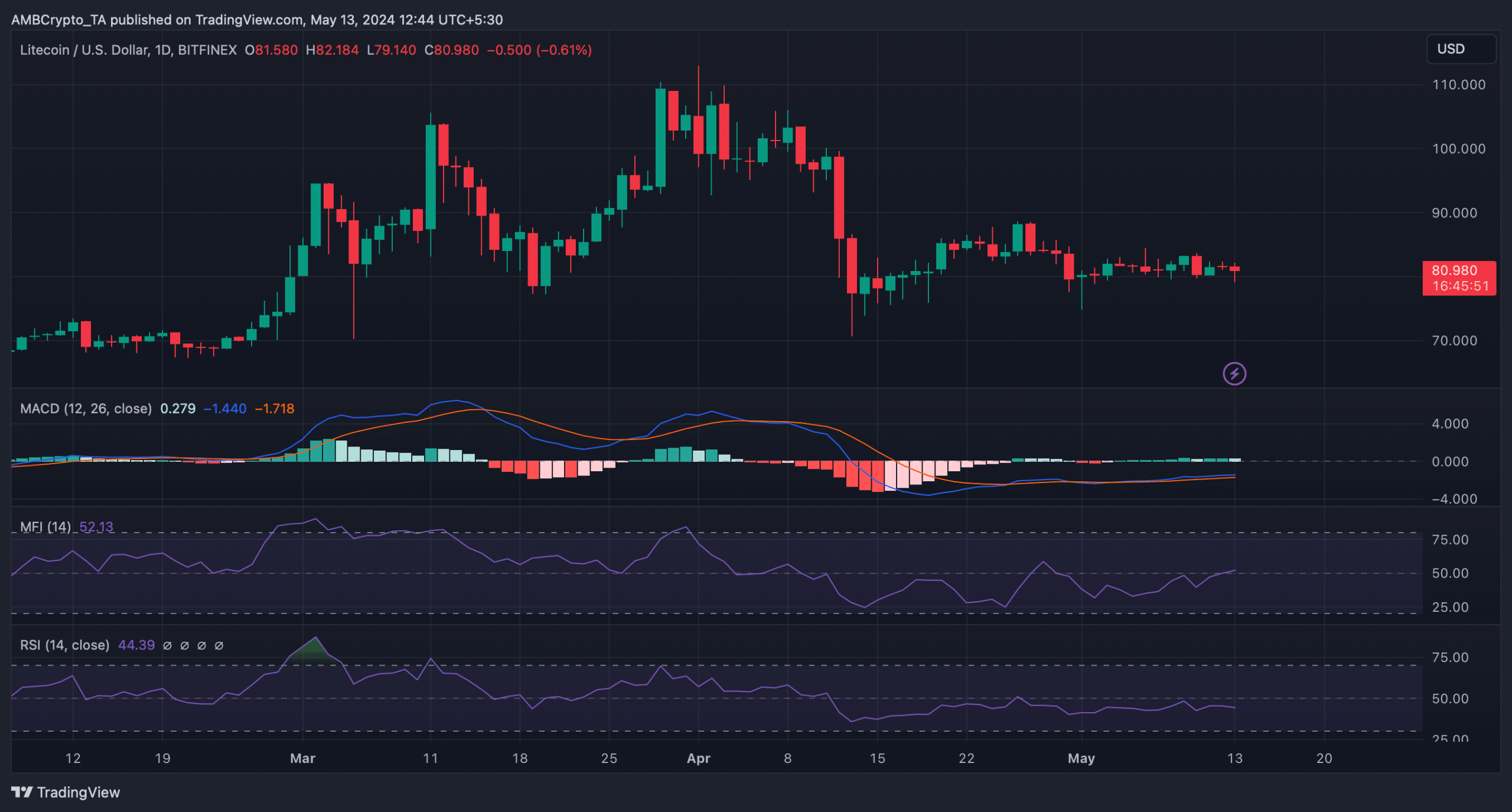

Since the possibility of Litecoin turning volatile was high, AMBCrypto then checked its daily chart to see whether things could turn bullish anytime soon.

As per our analysis, the MACD displayed a bullish advantage in the market. The Money Flow Index (MFI) also registered an uptick and was headed further away from the neutral mark, indicating a price uptick.

But the Relative Strength Index (RSI) remained bearish as it rested under the neutral mark.

Source: TradingView

Read Litecoin’s [LTC] Price Prediction 2024-2025

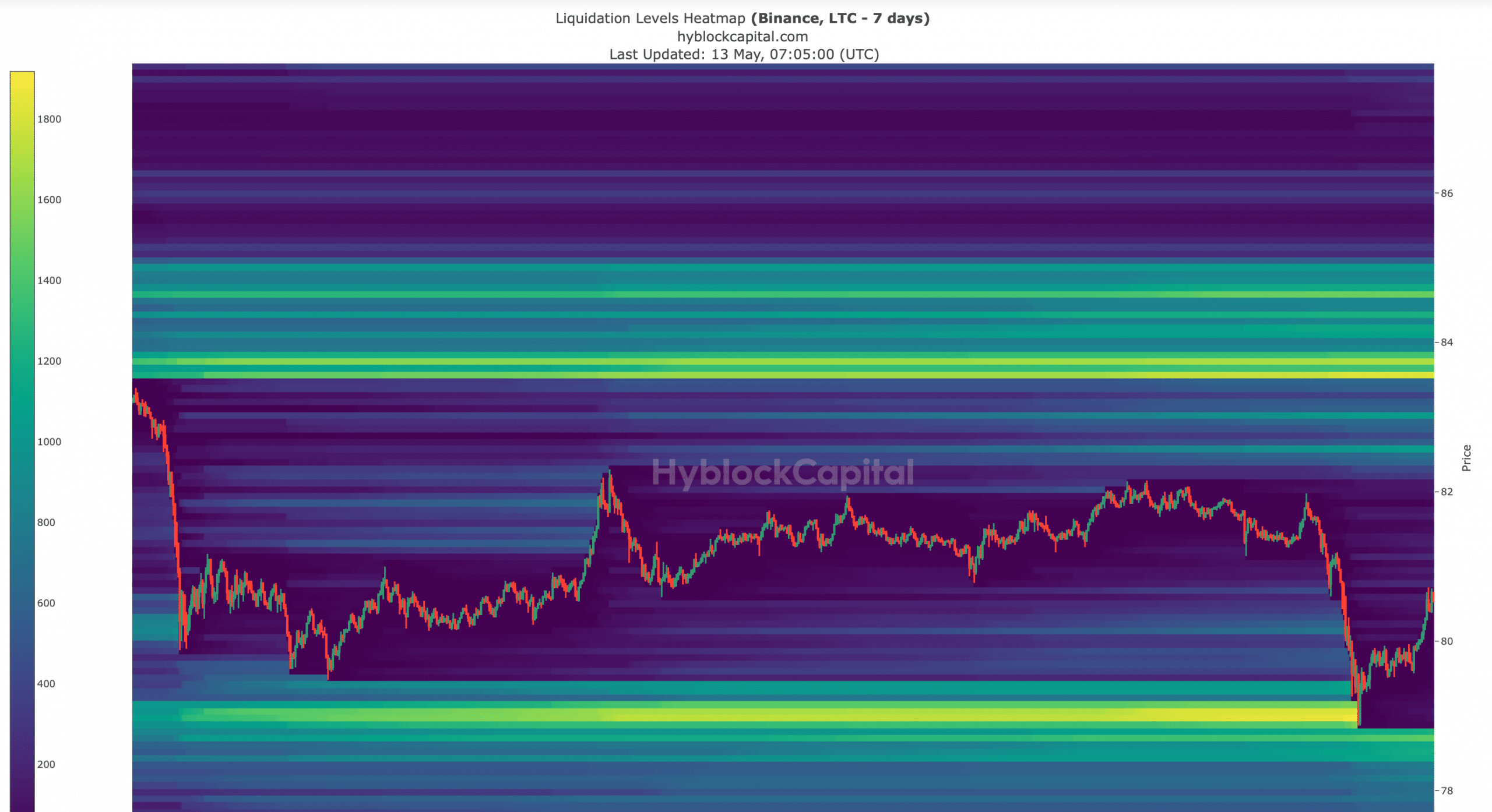

If a northward price movement happens, then LTC might first reach $83.6. Litecoin’s liquidation would rise at that level, which might result in a short-term price correction.

A successful breakout above that resistance would clear this path towards $90 and $100.

Source: Hyblock Capital