- LTC’s price moved marginally in the last 24 hours.

- Bearish sentiment around the coin was dominant in the market.

Litecoin [LTC] investors were not content as LTC was not following the bullish market trend. But things might soon turn in the coin’s favor as its price reached a critical level, which historically has been followed by bull rallies.

What is Litecoin up to?

According to CoinMarketCap, LTC’s price only moved marginally in the last 24 hours, while several cryptos registered promising upticks. At the time of writing, LTC was trading at $75.59 with a market capitalization of over $5.6 billion.

However, the coin does have a trick up its sleeves, which can result in a bull rally in the days to follow.

As per the latest data, LTC’s price was mimicking a pattern that it displayed earlier, which resulted in a bull rally back in 2021. The coin’s price was on the verge of a break above the diagonal trend line, hinting that the chance of a northward price movement is high.

Is a bully rally inevitable?

Since the pattern on LTC’s chart hinted at a bull rally, AMBCrypto checked Litecoin’s on-chain metrics to see whether that outcome is actually possible.

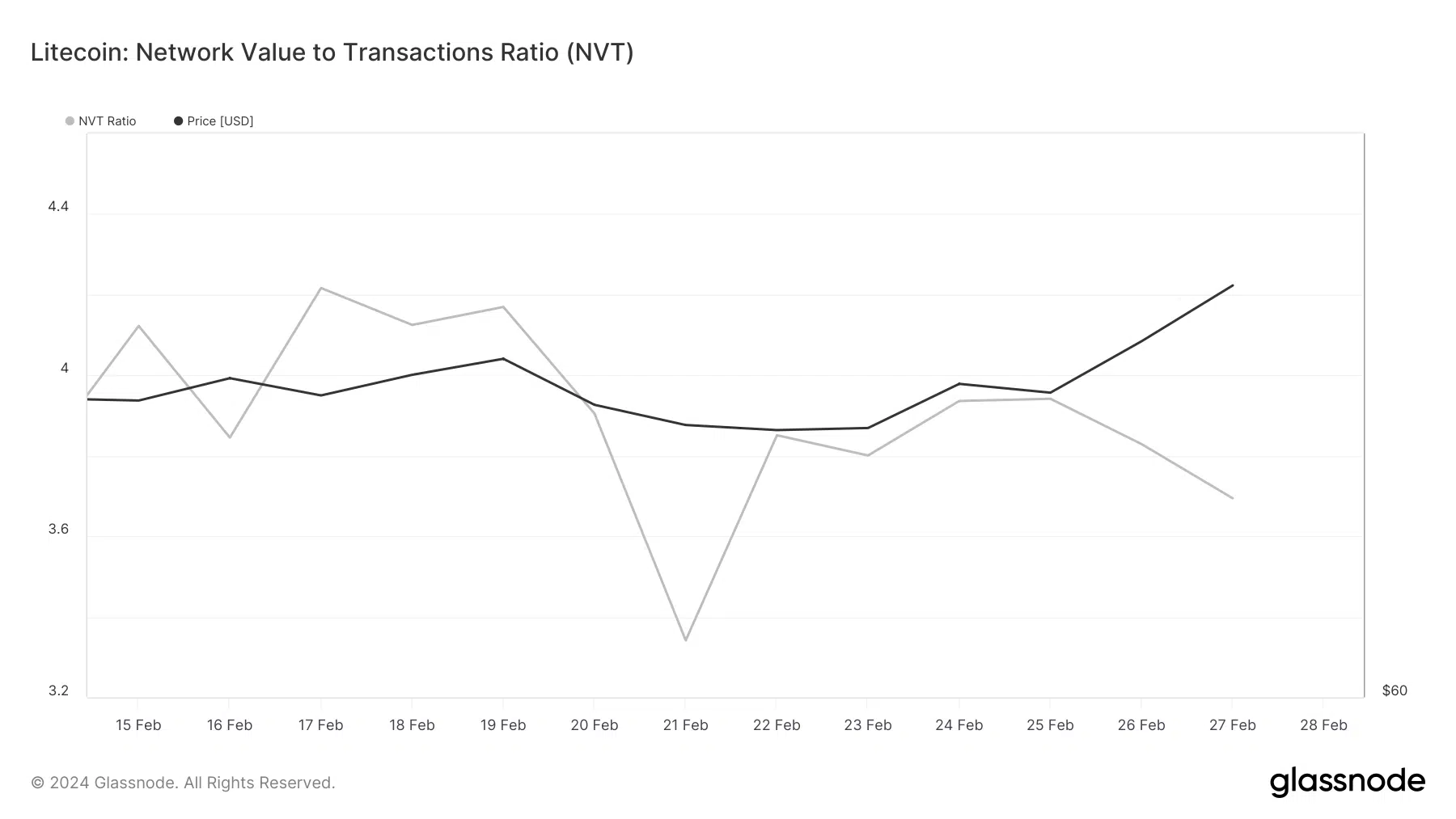

An analysis of Glassnode’s data revealed that LTC’s Network Value to Transactions (NVT) Ratio registered a downtick. For starters, the NVT Ratio is computed by dividing the market cap by the transferred on-chain volume measured in USD.

Whenever the metric drops, it means that the asset is undervalued, indicating that a price uptrend is likely to happen.

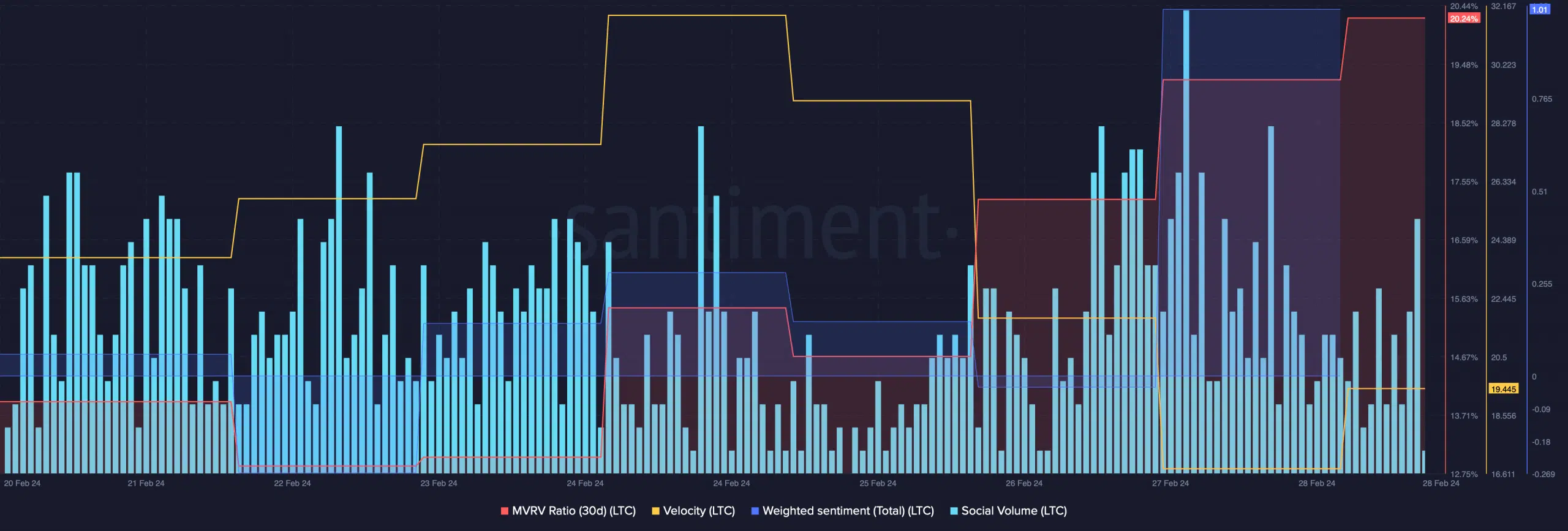

Apart from that, a few of the other metrics also looked optimistic on the coin. For instance, Litecoin’s MVRV ratio went up. Its social volume also remained high, reflecting its popularity.

Additionally, its weighted sentiment graph turned positive, meaning that bullish sentiment around the coin was dominant in the market. However, network activity somewhat dropped last week as its velocity plummeted.

Read Litecoin’s [LTC] Price Prediction 2024-25

Litecoin’s MACD also suggested that a bull rally is possible, as it displayed a bullish crossover. However, the Relative Strength Index (RSI) was about to enter the overbought zone. This might exert selling pressure on the token and, in turn, push the coin’s price down in the coming days.

Another bearish indicator was the Bollinger bands, as LTC’s price touched the upper limit of the indicator, which also hinted at the possibility of a rise in selling pressure.