- Social dominance and circulation escalated, suggesting a return to $11 in the short term.

- On-chain analysis suggested that perp sellers might lose while spot buyers might gain.

Holders of the Uniswap [UNI] governance token have been left terrified since the U.S. SEC revealed that it planned to enforce a lawsuit against the leading DeFi platform.

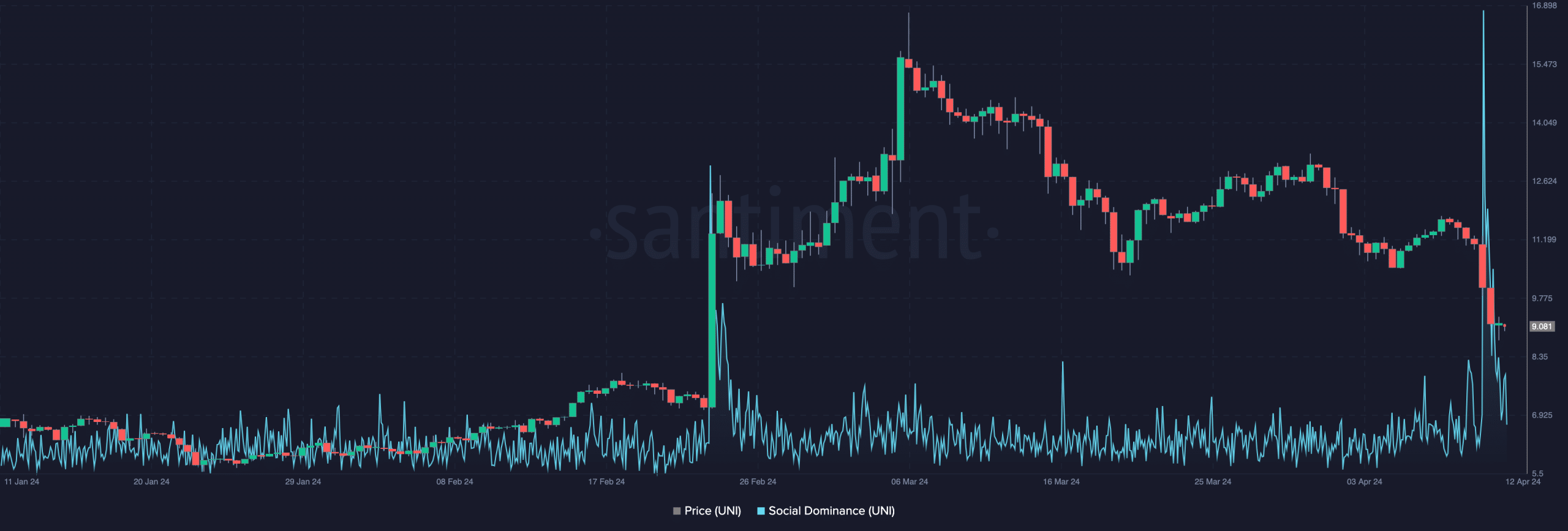

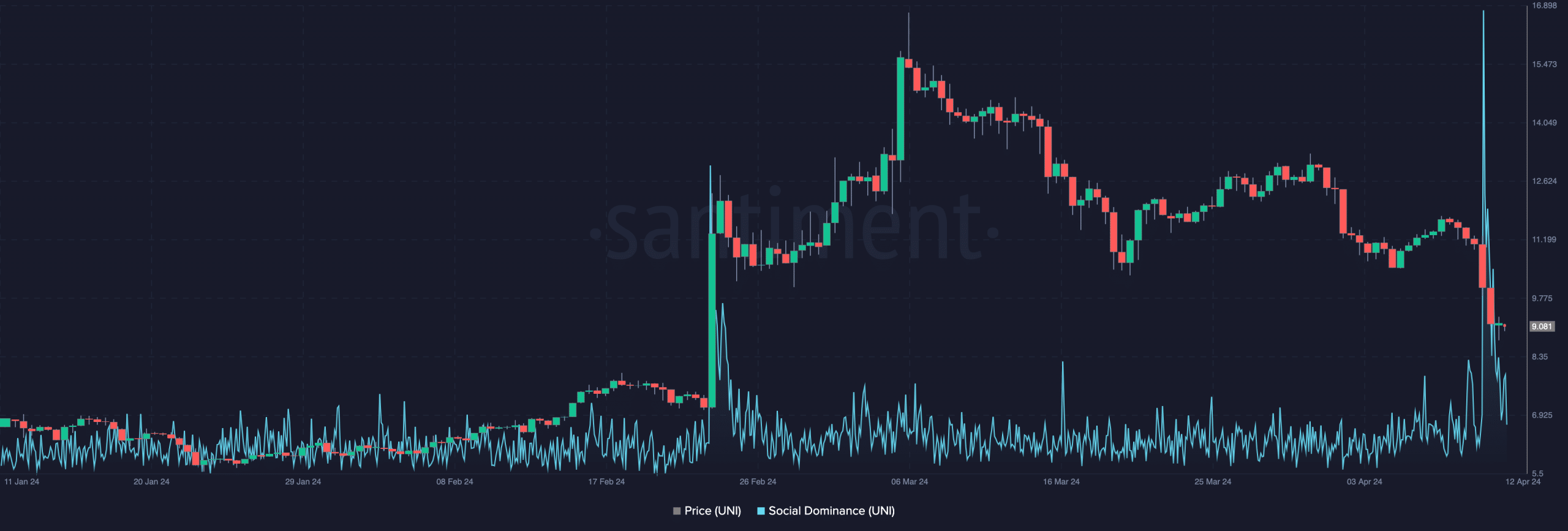

After examining the social dominance, AMBCrypto got the evidence of Fear, Uncertainty, and Doubt (FUD). In crypto, FUD refers to traders’ negative feelings about a rumored or confirmed unpleasant development.

Using on-chain data from Santiment, we observed that social dominance spiked on the 9th of April. This indicated that there was a lot of discussion about Uniswap.

Source: Santiment

UNI likely to follow XRP’s steps

Interestingly, this was also the highest the metric had reached in the last 15 months. Historically, extreme fear is not always bad for the price of a token. An example is Ripple [XRP], which also faced regulatory pressure.

But at different points, the price of XRP pumped days after FUD circled the token. Like Uniswap, XRP’s social dominance skyrocketed before the rebound occurred.

For UNI, the value has been plunging. At press time, UNI changed hands at $9.08, representing a 15.27% decline in the last seven days. But a chunk of the gain erasure started on the 119th of April when the news became public.

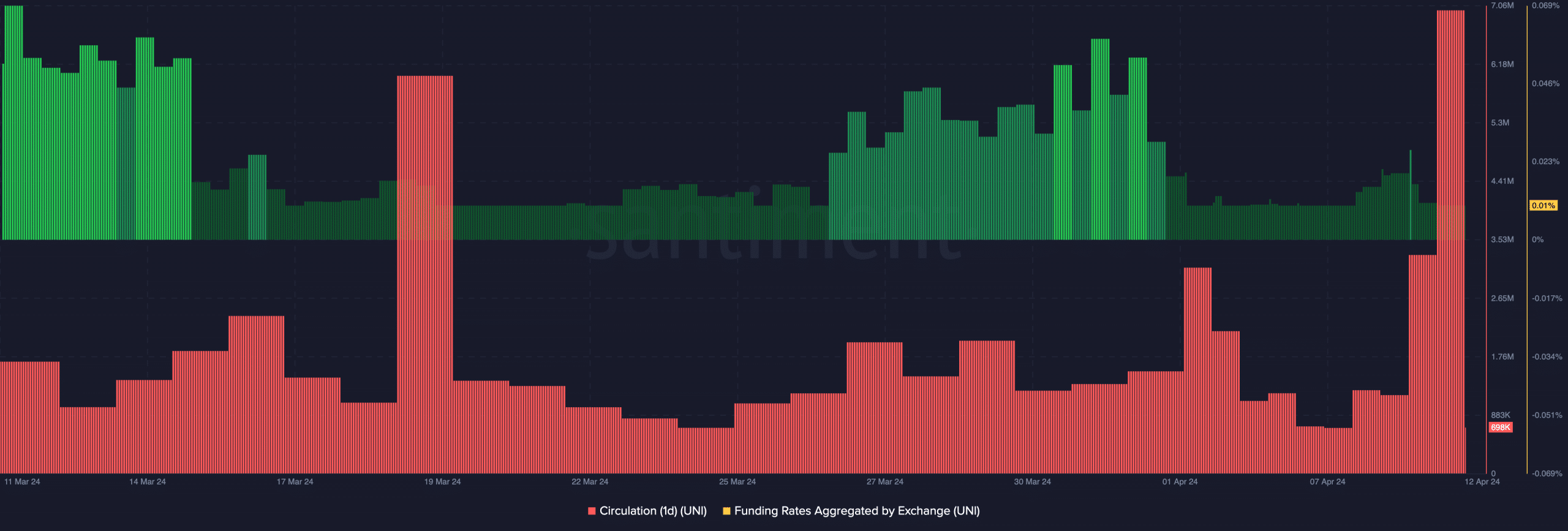

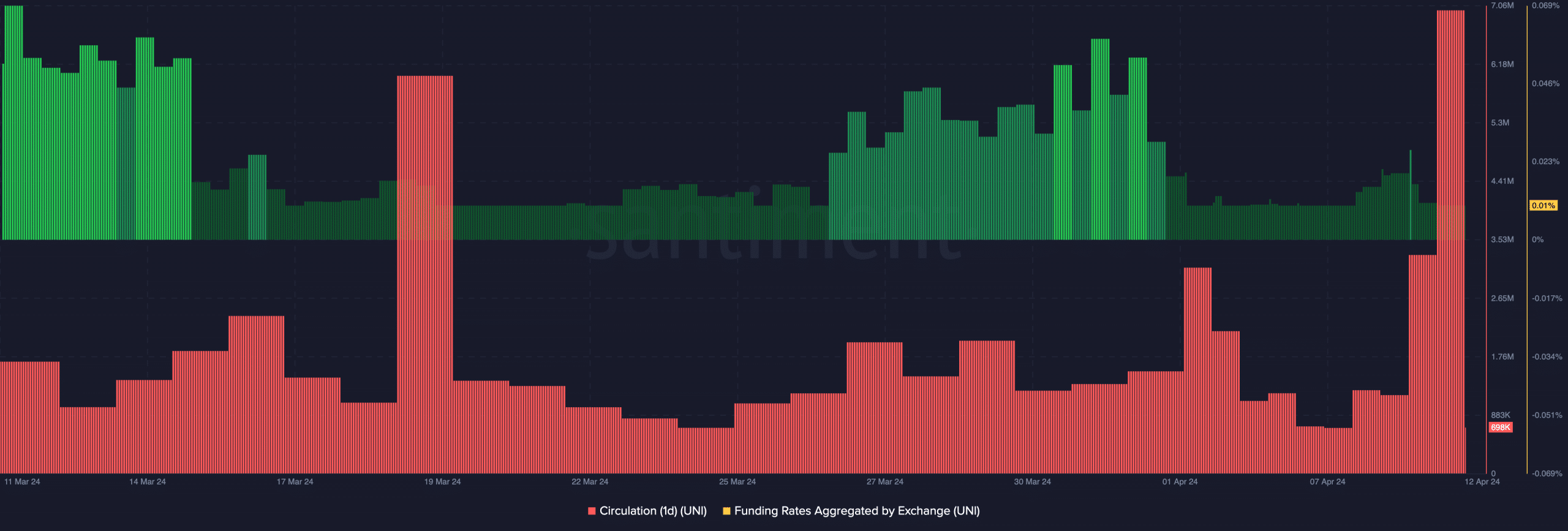

Another metric reinforcing a bounce was circulation. According to our analysis, UNI’s one-day circulation jumped to 6.99 million.

However, this hike was a sign of increased selling pressure. However, the same metric was 10 times lower at press time, suggesting that the selling pressure had subsided.

Should you get your spot bags ready?

Therefore, the token might cool off from the nosedive, and a potential rally toward the $11 region could be next. At the same time, it is important to check what traders are doing in the derivatives market.

For this part, AMBCrypto considered Uniswap’s Funding Rate. Positive funding implies that longs are paying short fees to keep their positions open.

Source: Santiment

On the other hand, a negative reading suggests that shorts are paying longs. Beyond the fees paid, Funding Rate, depending on its direction, can impact prices.

At press time, UNI’s Funding Rate was 0.01% but it was lower than the reading on the 9th of April. To be clear, funding becoming more positive, as price moves lower is typically bearish. In this instance, the price might keep plummeting.

Realistic or not, here’s UNI’s market cap in XRP terms

However, UNI has been on a slow recovery within the last hour. With funding becoming less positive, it implies that perp sellers are fading the jump, and spot buyers could be ready to drive the price higher.

For now, it remains uncertain if Uniswap’s case will take a long time like that of Ripple. If that’s the case, FUD might appear at different intervals. If not, UNI, as a token, might significantly appreciate like other altcoins.