- Buying pressure on Lido remained high throughout the past week

- Most indicators and market sentiment looked bullish on LDO’s charts

The hype around Ethereum ETFs had a positive impact on Lido DAO [LDO] as the token pushed its price up considerably. Such was the scale of price appreciation that in the last 24 hours alone, the crypto registered double-digit gains on its charts.

Lido’s bull rally

Lido was one of the tokens that benefited the most from the Ethereum ETF approval episode, as its price rallied by more than 40% in the last 7 days. According to CoinMarketCap, in the last 24 hours, the token’s value hiked by over 11%. At press time, it was trading at $2.53 with a market capitalization of over $2.25 billion.

However, the interesting bit here is that while Lido grew by double digits, ETH’s value only hiked by 1% over the aforementioned period. In fact, LDO’s price might do even better since a bullish pattern is now expected to emerge on its price chart.

World of Charts, a popular crypto-analyst, recently posted a tweet revealing a bullish flag pattern. The latest price uptick pushed LDO’s price towards the upper limit of the pattern. A breakout above the same could propel further growth of nearly 250% in the coming weeks.

Will LDO grow further?

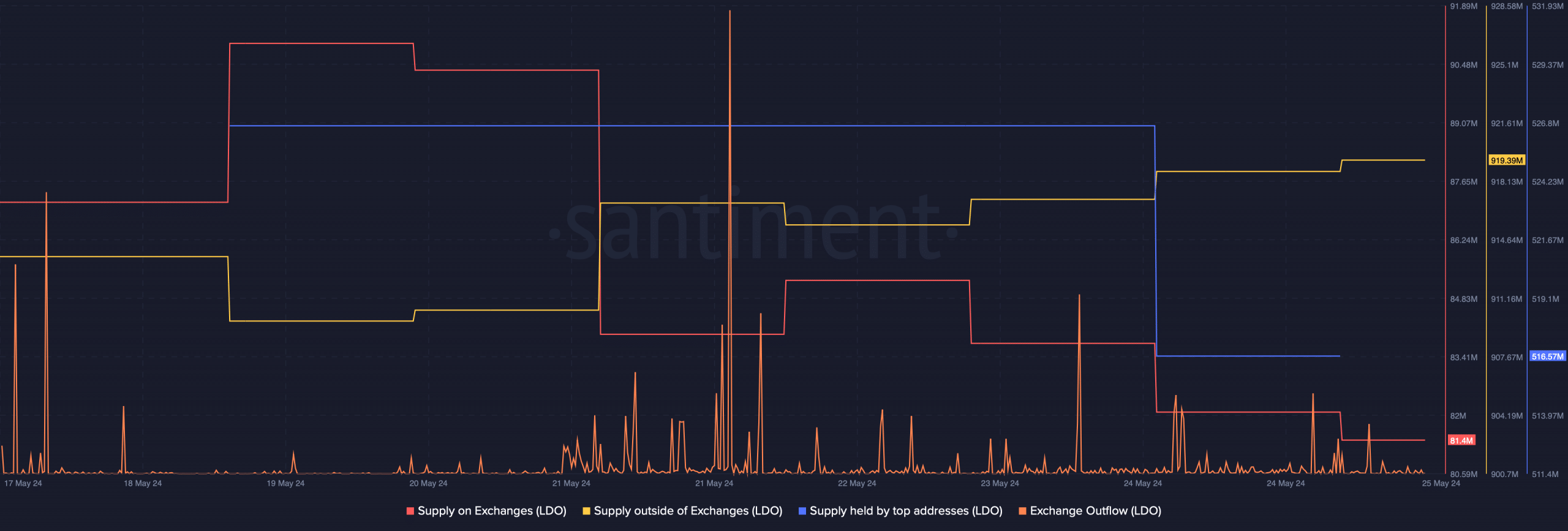

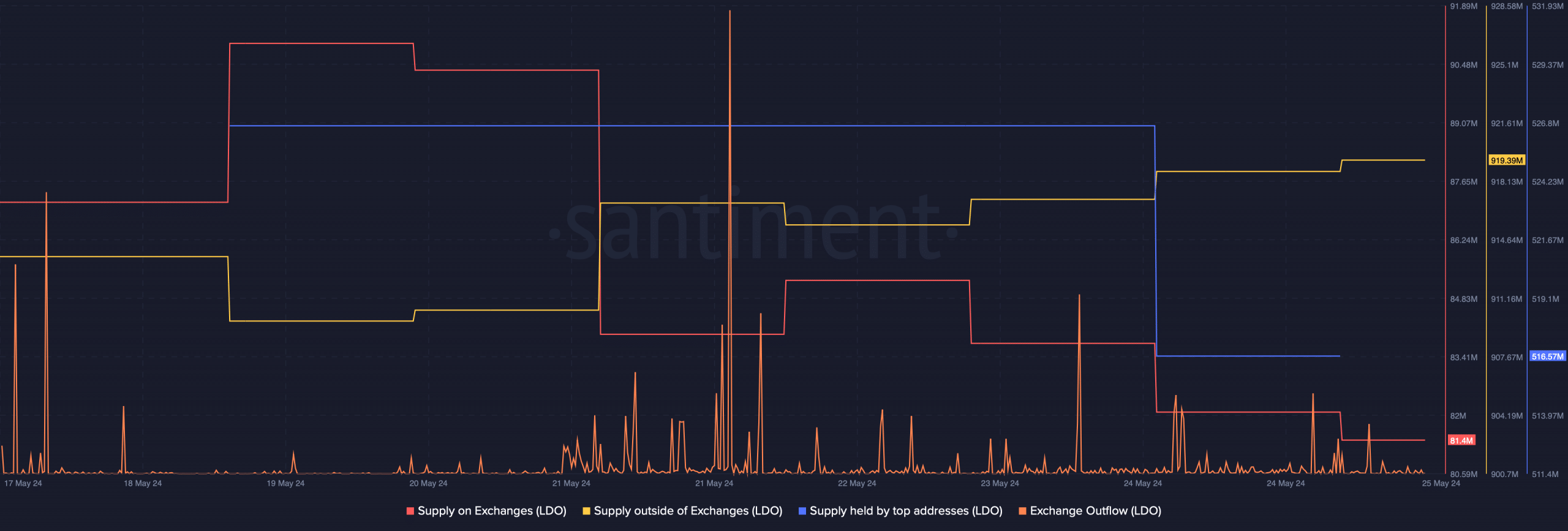

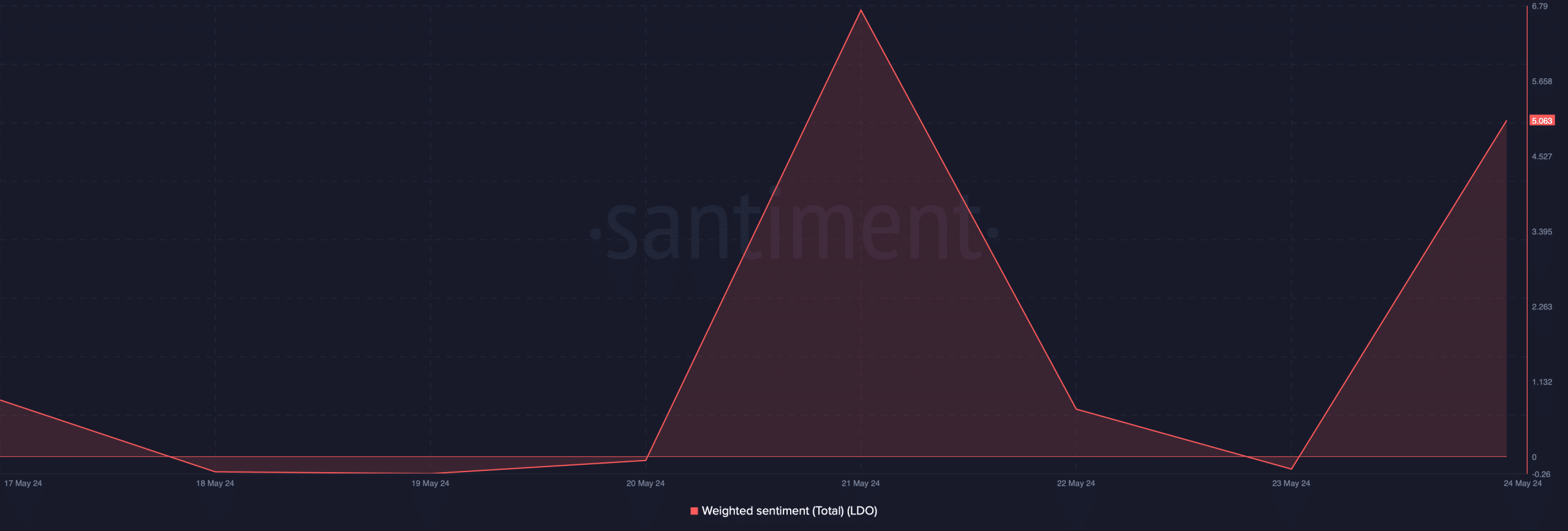

To see whether LDO would manage to break above the bull pattern, AMBCrypto analyzed Santiment’s data. As per our analysis, LDO’s exchange outflows increased sharply last week. This pointed to a hike in buying pressure. The fact that investors have been buying LDO was further proven by its exchange data.

The token’s supply on exchanges plummeted sharply, while its supply outside of exchanges rose. A hike in buying pressure often results in price hikes, increasing the chances of a bullish breakout. However, the token’s supply held by top addresses dropped on 24 May – A sign that whales sold their holdings to earn profits.

Source: Santiment

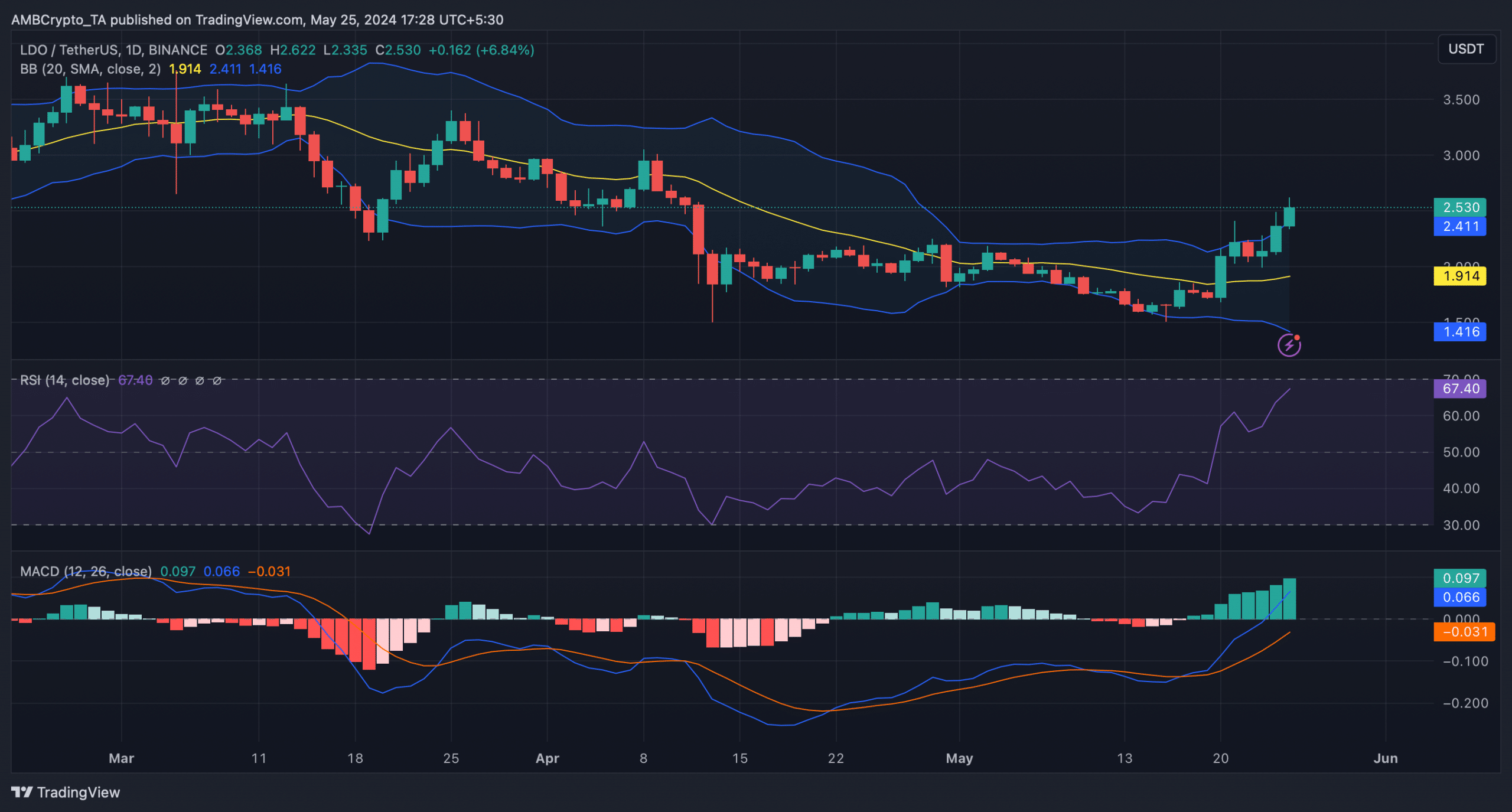

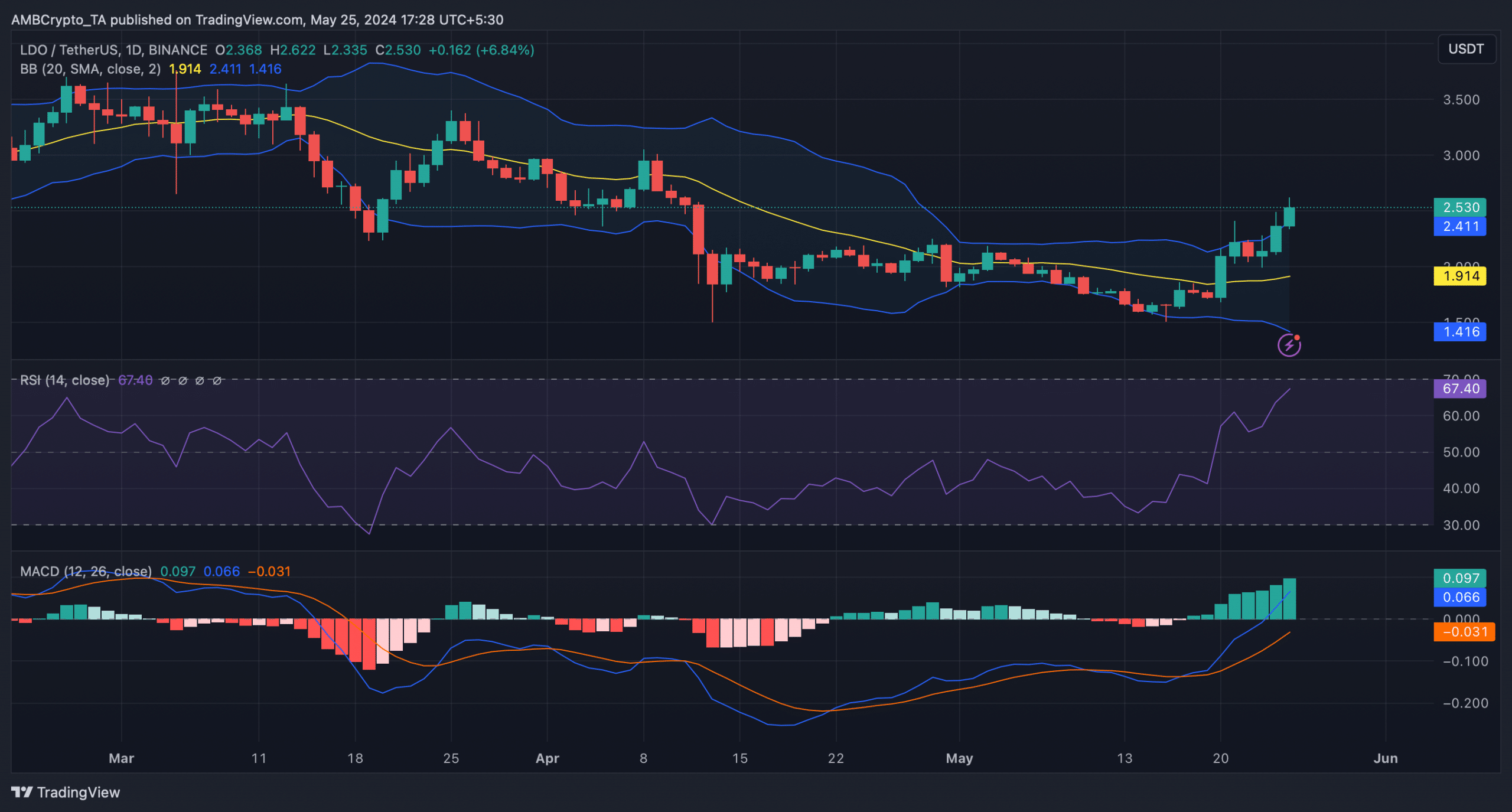

We then analyzed its daily chart to better understand whether LDO would continue its bull rally. The technical indicator MACD displayed a clear bullish upper hand in the market.

Additionally, the Relative Strength Index (RSI) also registered a sharp uptick, hinting at a sustained price hike. Nonetheless, the token’s price did touch the upper limit of the Bollinger Bands, which often results in price corrections.

Source: TradingView

Read Lido DAO’s [LDO] Prie Prediction 2024-25

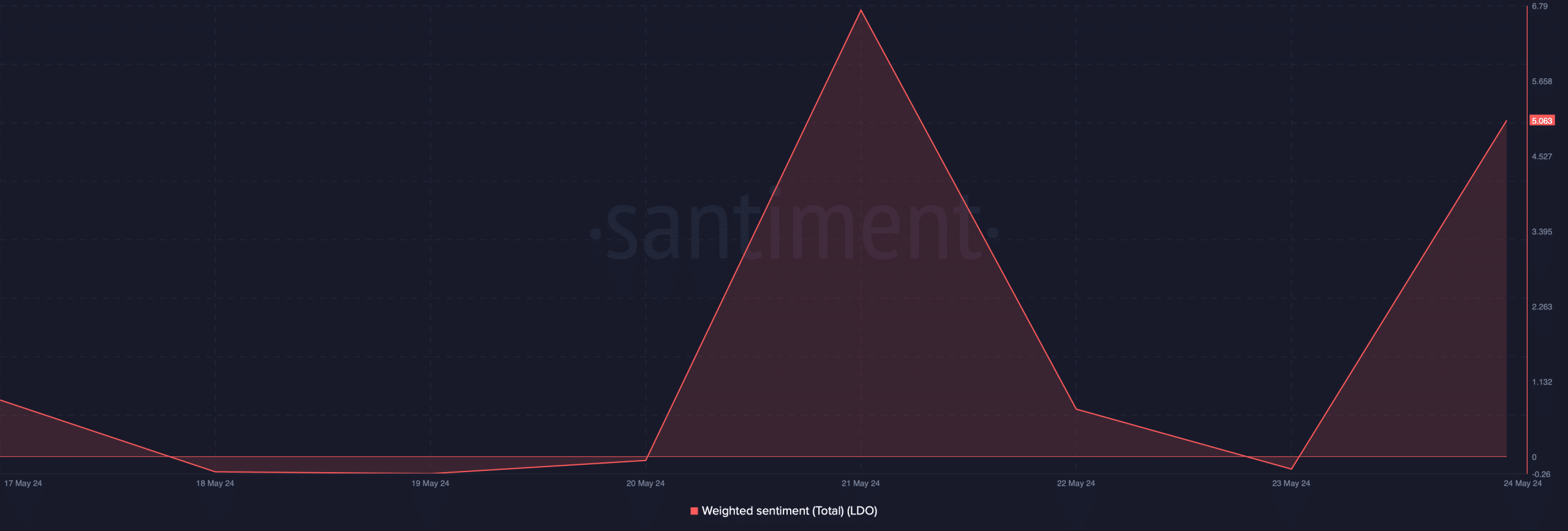

That being said, investors’ confidence in Lido remains high.

The same was evidenced by Santiment’s data which revealed that after a dip, LDO’s weighted sentiment spiked on 24 May.

Source: Santiment