The Swedish buy now, pay later pioneer said on Tuesday its new design will help users find the products they want using better artificial intelligence recommendation algorithms, and sellers will be able to target customers more effectively.

Rafael Enrique | SOPA Images | LightRocket via Getty Images

Klarna on Wednesday announced a global partnership with Uber to make payments for the taxi giant’s Uber and Uber Eats apps.

The partnership will add the Swedish fintech firm as a payment option in the US, Germany and Sweden, Klarna said in a statement.

In these countries, Klarna will introduce a Pay Now feature across two apps, allowing customers to pay instantly with one click. Users will be able to track all their Uber purchases in the Klarna app.

The company will also offer an additional payment option for Uber users in Sweden and Germany, allowing users to combine purchases into a single interest-free payment that is deducted from their monthly paycheck.

Interestingly, the company is not introducing buy now, pay later installment plans, arguably Uber’s most popular service offering, on its platforms.

Sebastian Siemiatkowski, Klarna’s CEO and co-founder, said in a statement Wednesday that the deal represents an “important milestone” for the company.

“Consumers can quickly and securely pay in full now, which already accounts for more than a third of Klarna’s global volumes, and find it easier to manage their finances in one place,” Siemieniatkowski said.

Klarna declined to disclose the financial terms of the Uber deal.

Seller’s big win before IPO

The Uber deal marks one of Klarna’s biggest trading wins in recent memory and comes as the European fintech giant is rumored to be preparing for a huge initial public offering that could value the company at just over $20 billion.

Klarna has begun detailed talks with investment banks about working on an IPO that could happen as early as the third quarter, Bloomberg News reported in February, citing unnamed people familiar with the matter.

CNBC could not independently verify the accuracy of the report. Klarna said it does not comment on market speculation.

Such a flotation would mark a turning point for the company, which saw its 2022 valuation wiped out by $38.9 billion when worsening macroeconomic conditions caused by Russia’s invasion of Ukraine led to sky-high high-tech valuations being reset to zero.

Klarna reached a staggering $45.6 billion in a 2021 funding round led by SoftBank, before its market value fell to $6.7 billion in a so-called “down round” the following year.

The firm recently launched a monthly subscription plan in the US to attract “power users” ahead of its expected IPO.

The product is called Klarna Plus and costs $7.99 per month. Klarna Plus allows users to waive service fees, earn double rewards points, and access special discounts from partners like Nike and Instacart.

Last year, Klarna reported its first quarterly profit in four years after cutting its credit losses by 56%.

The company reported an operating profit of SEK 130 million (approximately US$11.7 million) in the third quarter of 2023, while in the same period a year earlier it posted a profit and loss of SEK 2 billion (approximately US$183.6 million US dollars).

Buy now, pay later, boom

Klarna is one of many “buy now, pay later” services that allow users to pay for their purchases in monthly instalments.

This payment method is becoming increasingly popular among consumers to pay for online and in-person purchases as an alternative to credit cards, which charge interest and high fees.

However, it has also raised concerns about the affordability of such services and whether this is actually encouraging some consumers – especially younger people – to spend more than they can afford.

In the UK, the government has proposed bills to regulate the buy now, pay later industry.

The US Consumer Financial Protection Bureau has previously said it plans to subject “buy now, pay later” lenders to the same oversight as credit card companies.

Meanwhile, the European Union last year adopted a revised version of its Consumer Credit Directive to include buy now, pay later services.

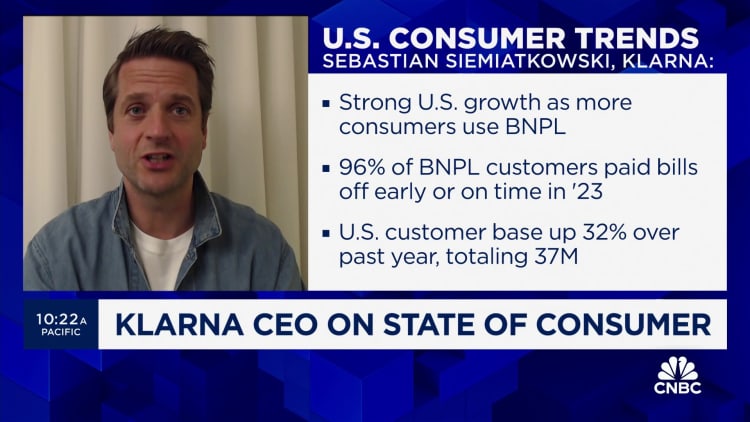

For its part, Klarna defends its buy now, pay later model, saying it offers customers a cheaper way to get credit compared to traditional credit cards and personal loans.

The company also says it welcomes regulation of buy now, pay later products.