- Analysts claimed that SOL’s current value was cheap.

- There was not enough price momentum to the upside yet.

In May, Solana [SOL] offered its speculators +30% gains but failed to retest the $200 psychological level it surpassed in March. At the press time, SOL traded at $164, about 53% away from its ATH of $259.

However, a pseudonymous crypto analyst viewed the current SOL’s value as ‘cheap’ and one of the best bargain buys for spot traders re-targeting the all-time high (ATH) of $259.

On his part, another crypto analyst, Ansem, projected a short-term set-up for SOL.

“Buying more $SOL w/ options profits @ $169, still think chop for rest of the summer but adding to spot position here’

Source: X/Ansem

The Ansem setup was solid from a technical analysis standpoint. The entry was slightly above key short-term support in May, above $160. For the take-profit level, he targeted just above the May high.

Additionally, the stop-loss aligned with the resistance-cum-support level of $159, so a drop below that could embolden short sellers.

It was a great set-up for a long position on the spot market. But do sentiment and market positioning support the same scenario?

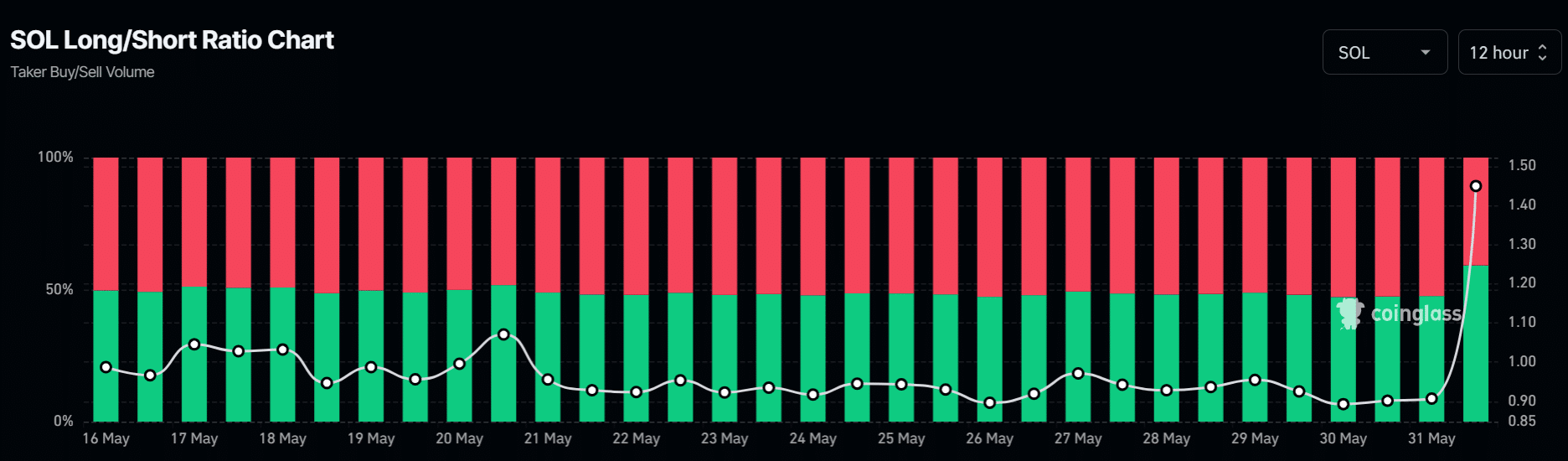

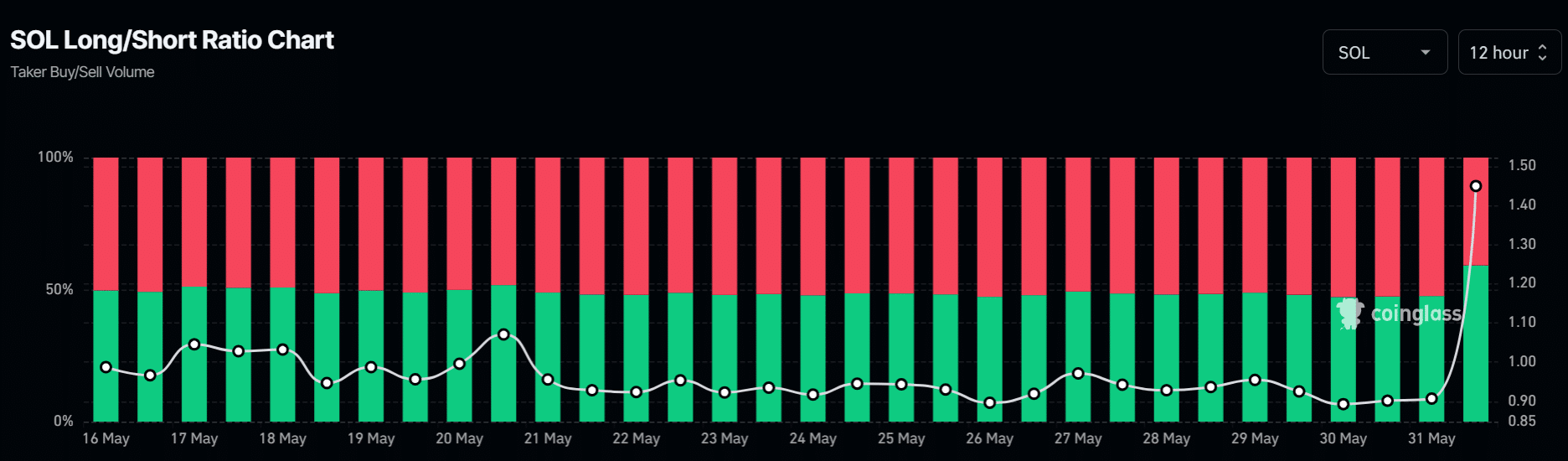

As of press time, the SOL Long/Short Ratio supported the bullish set-up. Between 30th May and 31st May, the number of long positions increased from 47% to 59%. It indicated that most traders, like Ansem, expected SOL’s price to surge from its current level.

Source: Coinglass

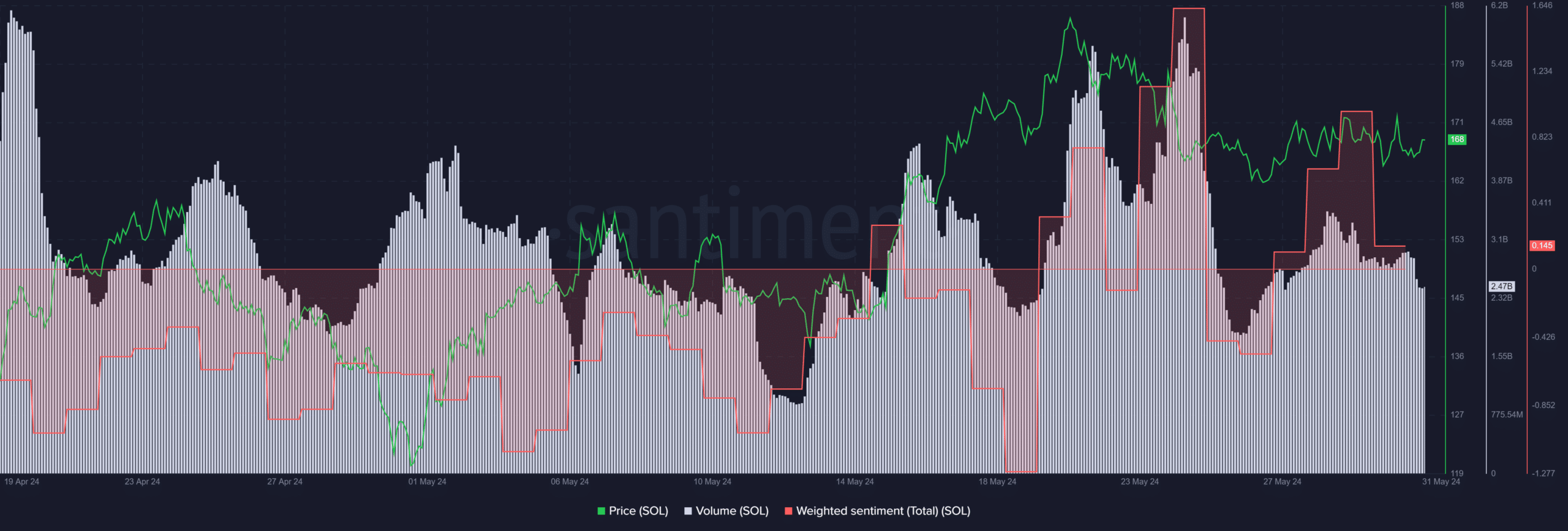

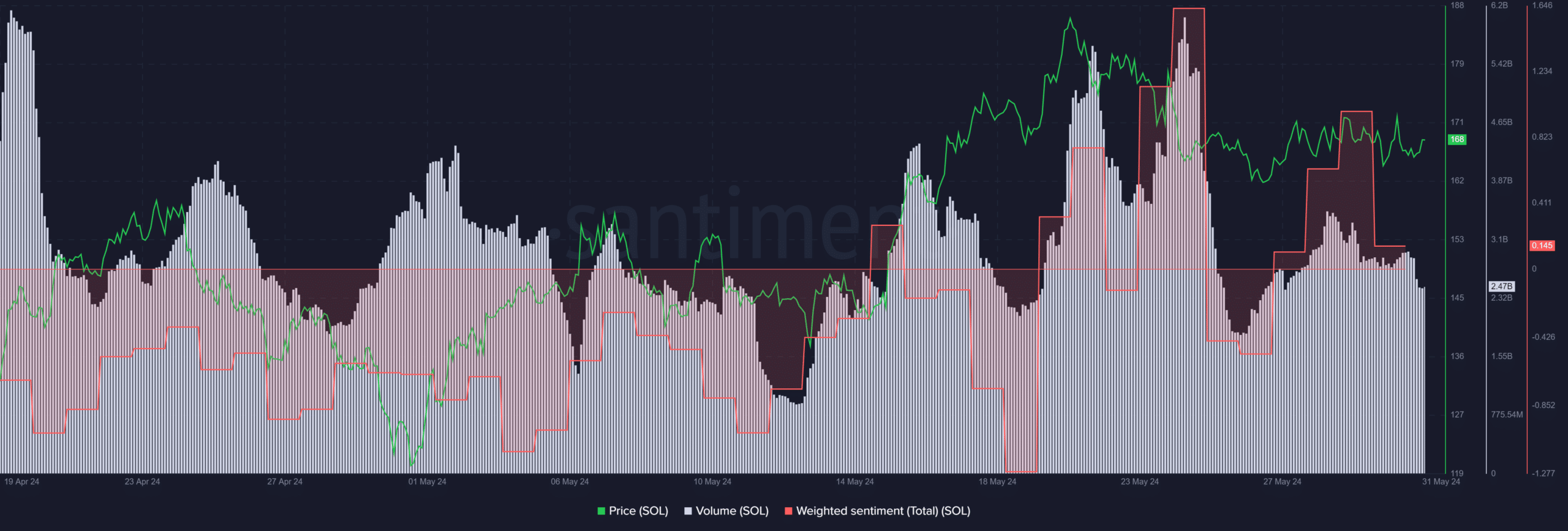

However, overall, market participants saw a significant drop in positive sentiment on the SOL’s price prospect, as shown by the drop in Weighted Sentiment (red).

The declining on-chain volume (marked by white) could further delay the price’s strong revival as user transaction volume remains muted. Even the recent PayPal expansion of the PYUSD update didn’t stir Solana on this front.

So, a further muted price action could be likely over the weekend.

Source: Santiment

Additionally, key price chart technical indicators were neutral per CryptoQuant data. So, the long set-up was great even as other traders also jumped into long positions.

However, the neutral condition meant that the price could go in either direction and called for patience for a defined price direction.