The winds of change are swirling around Ethereum, the world’s second-largest cryptocurrency. Despite a recent price dip, the network has witnessed a surge in new user activity, sparking a wave of optimism. However, the outsized influence of large holders, known as whales, continues to cast a long shadow.

New Wallets Open For Business

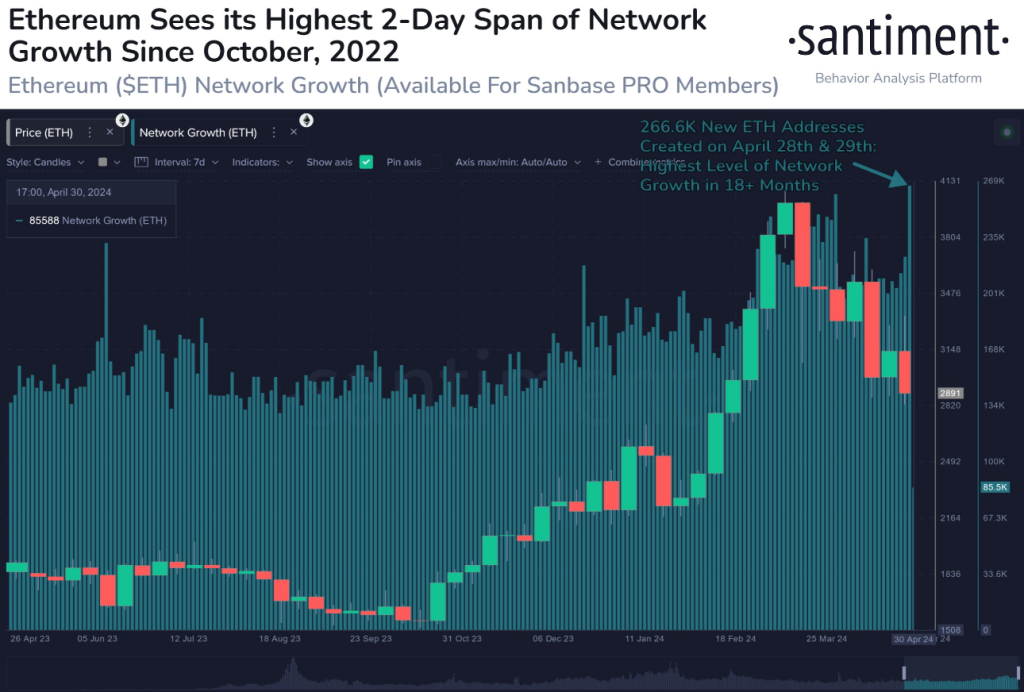

Data from blockchain analytics firm Santiment reveals a surge in new Ethereum wallets, with a record-breaking 267,000 created on April 28th and 29th. This influx marks the highest two-day increase since October 2022 and suggests a potential resurgence of interest in the Ethereum network.

📈 #Ethereum saw a milestone as April came to an end. 266.6K new wallets were created on April 28th and 29th, the highest 2-day stretch of network growth since October 8th and 9th, 2022. It is a strong that $ETH continues expanding despite dipping prices. https://t.co/SN6xqc3JXV pic.twitter.com/KDcjhY30y5

— Santiment (@santimentfeed) May 1, 2024

This trend defies the current market downturn, with many cryptocurrencies experiencing significant price drops. Analysts speculate that the rise in new wallets could be fueled by several factors, including:

- Anticipation of future growth: Investors may be looking towards upcoming Ethereum upgrades that promise improved scalability and security, betting on the network’s long-term potential.

- Bargain hunters: The recent price dip might be seen as an attractive entry point for new investors seeking a discount on Ethereum.

On Minnows And Whales

While the number of new users is encouraging, a closer look at Ethereum’s address distribution reveals a stark disparity in holdings. According to CoinMarketCap, a staggering 97% of Ethereum addresses hold between $0 and $1,000 worth of the cryptocurrency. This signifies a large pool of small-scale investors, often referred to as “minnows.”

However, the real power lies with a select few. Whale tracking platform Clank estimates that whales, representing only 0.10% of all Ethereum addresses, control a whopping 41% of the total circulating supply. This translates to an average holding of nearly 10 million ETH per whale, valued at a staggering $3.7 million.

Ether market cap currently at $362 billion. Chart: TradingView.com

Holding Steady: A Vote Of Confidence?

Despite the recent price decline, Ethereum appears to be weathering the storm better than the broader crypto market. As of today, Ethereum sits at $3,014, with a total market capitalization of $362 billion. Notably, the market experienced an average decline of 8.75% over the last week, highlighting Ethereum’s relative resilience.

Source: CoinMarketCap

Furthermore, data suggests that a majority of Ethereum investors (74%) are long-term holders, demonstrating a strong belief in the project’s future. This “hodling” mentality indicates a commitment to maintaining their Ethereum positions for the long haul, even in the face of short-term market fluctuations.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.