- The Puell Multiple suggests Bitcoin is undervalued, indicating potential investment opportunities.

- Recent market volatility led to significant liquidations, with Bitcoin traders facing over $71 million in losses.

Bitcoin [BTC], the pioneering crypto, recently experienced a rally that pushed its price above $71,000 earlier this week.

However, Bitcoin is currently seeing a decline of 3.3% in the past 24 hours, bringing its trading price down to $67,197 at press time. Despite this, the asset has maintained an overall week-long uptrend with a 2.3% increase.

Amid these fluctuations, Bitcoin has faced significant changes in market dynamics, including adjustments in mining difficulty and hash rate, as well as shifts in trader behavior leading to notable liquidations.

Insights into miner revenue and market valuation

In the context of this price volatility, a CryptoQaunt analyst has recently shared an on-chain data that has provided insightful indicators of Bitcoin’s valuation.

The Bitcoin Puell Multiple, an on-chain metric that calculates the ratio of daily issuance value of BTC to the 365-day moving average of the issuance, has fallen into what is traditionally considered ‘undervalued’ territory.

Source: CryptoQuant

This movement suggests that despite the price pullback, Bitcoin might be trading at a discount, offering potential opportunities for investors.

The Puell Multiple is specifically designed to gauge the economic health of Bitcoin mining activities by comparing daily miner revenues to a historical average.

Miners earn revenue through block rewards, which are consistent in BTC terms but fluctuate in USD value, directly impacted by Bitcoin’s price changes.

When the Puell Multiple is above 1, it typically indicates that miners’ earnings are higher than the average, suggesting that Bitcoin may be overvalued relative to historical norms.

Conversely, a Puell Multiple below 1, as is currently the case, signals that miners are earning less, which could imply that Bitcoin is undervalued.

This drop in the Puell Multiple coincides with the recent Bitcoin halving event, which reduced miner rewards by half, significantly affecting the metric.

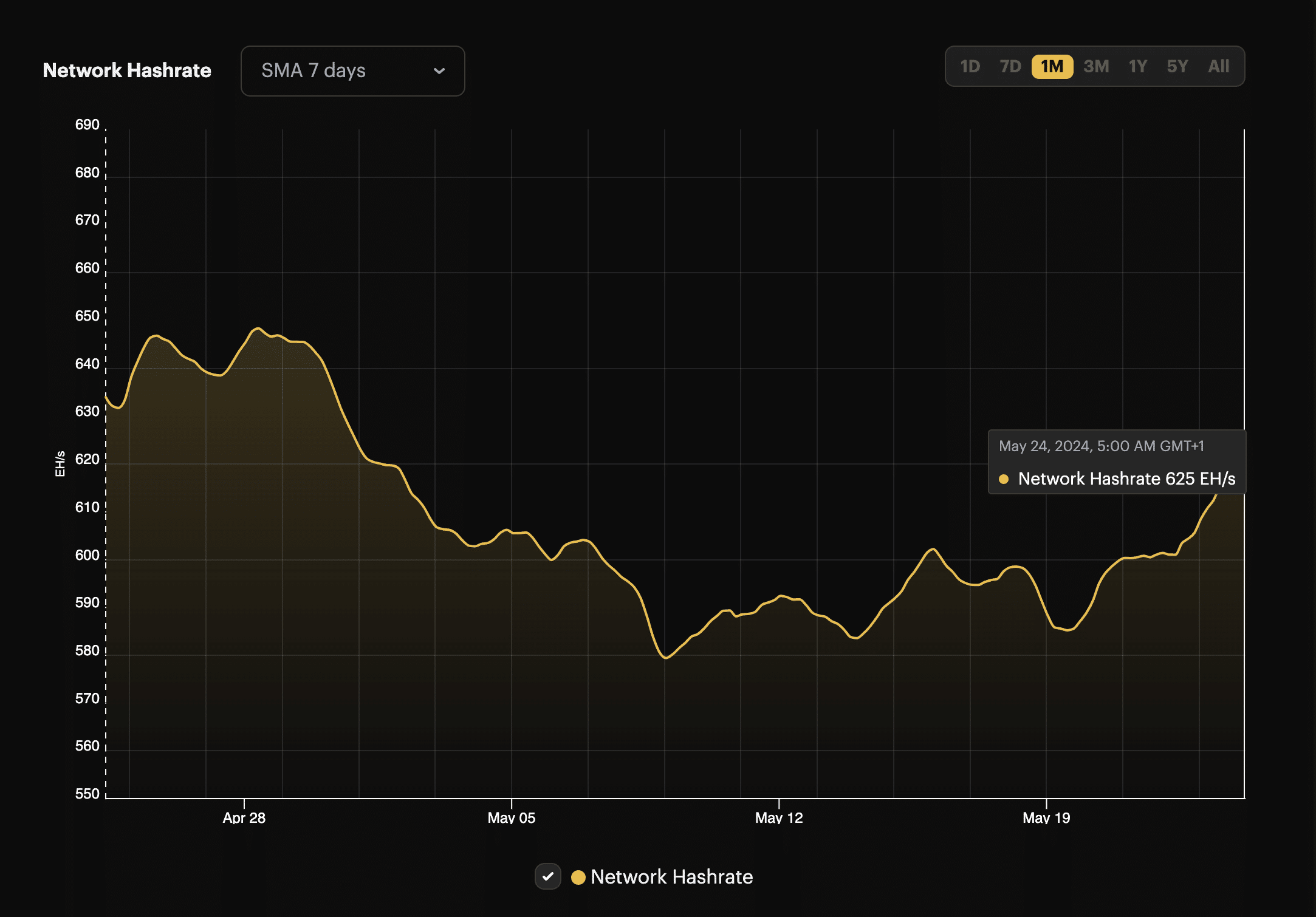

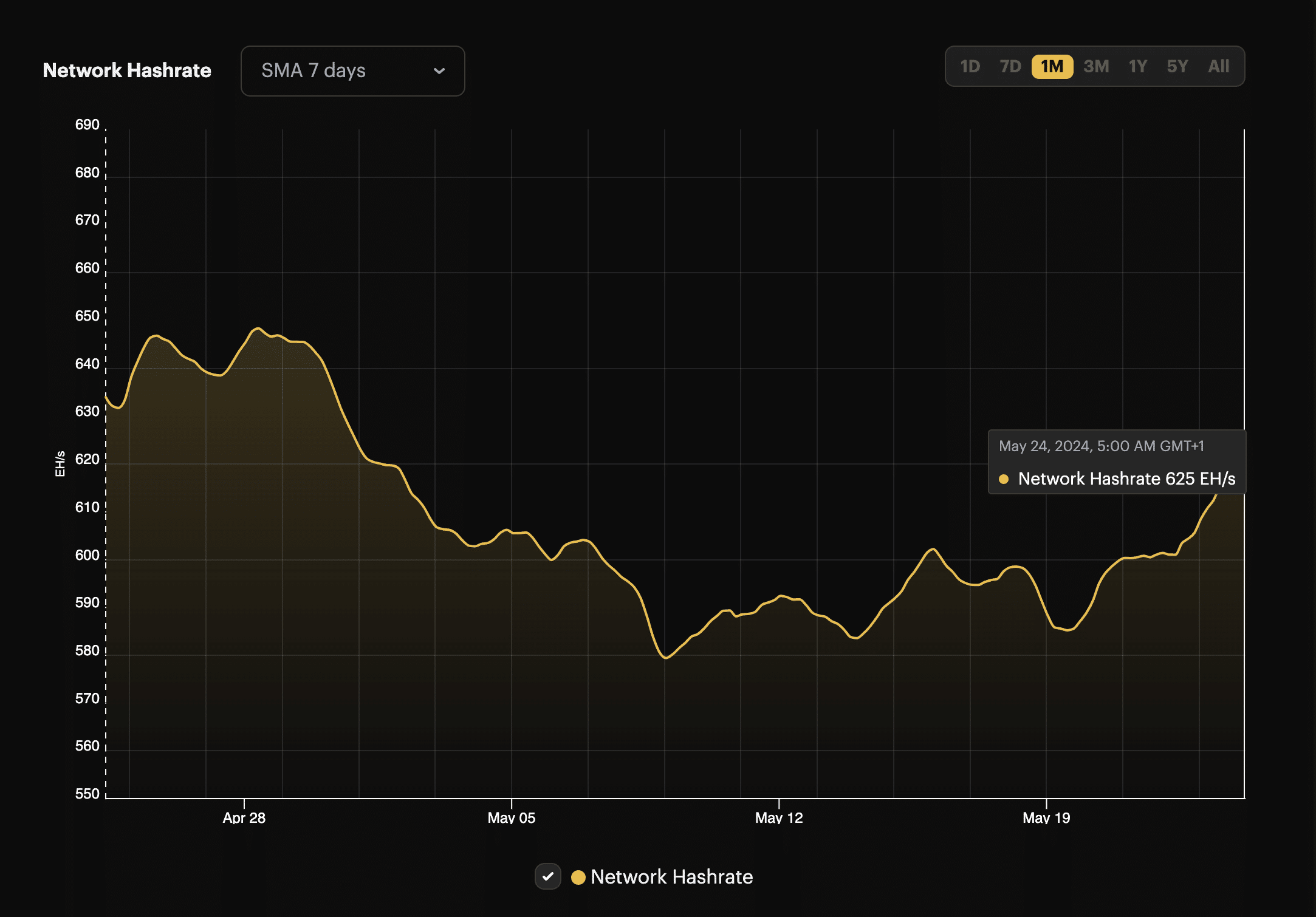

The timing of these shifts is crucial as they align with broader market movements, including Bitcoin’s price consolidation and increased network activity marked by a rising hash rate, which recently surpassed 600 EH/s.

Source: Bitcoihasrateindex

This increase in hash rate follows a significant adjustment in mining difficulty, reflecting growing optimism and activity in the cryptocurrency market, possibly fueled by the recent anticipation of the approvals of spot Ethereum ETFs in the United States.

Recent liquidations and future market predictions

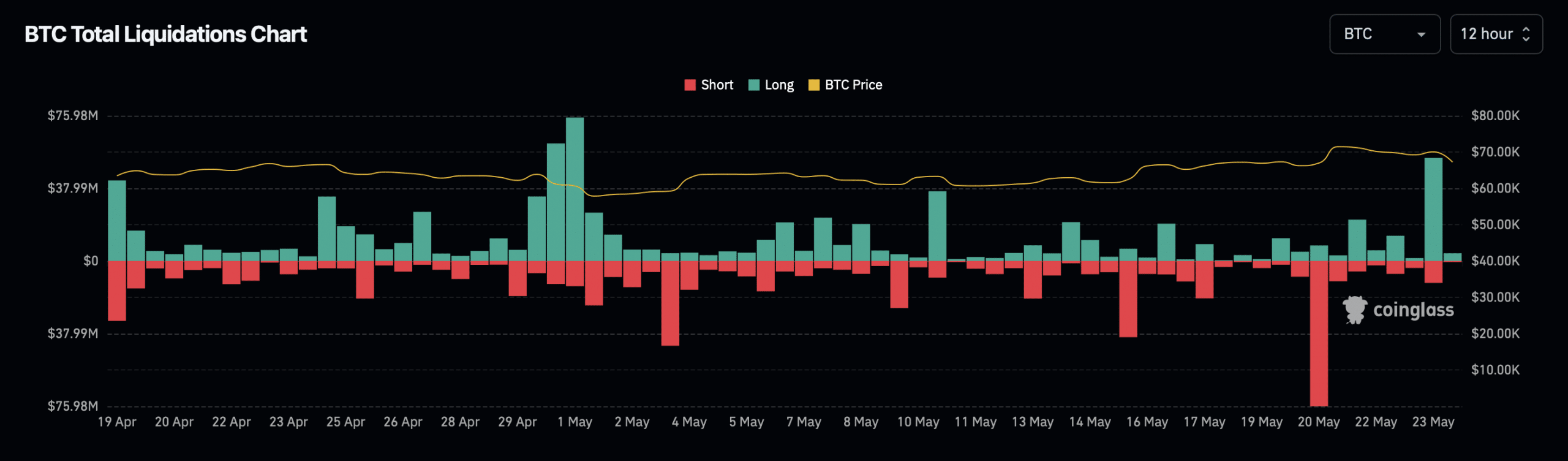

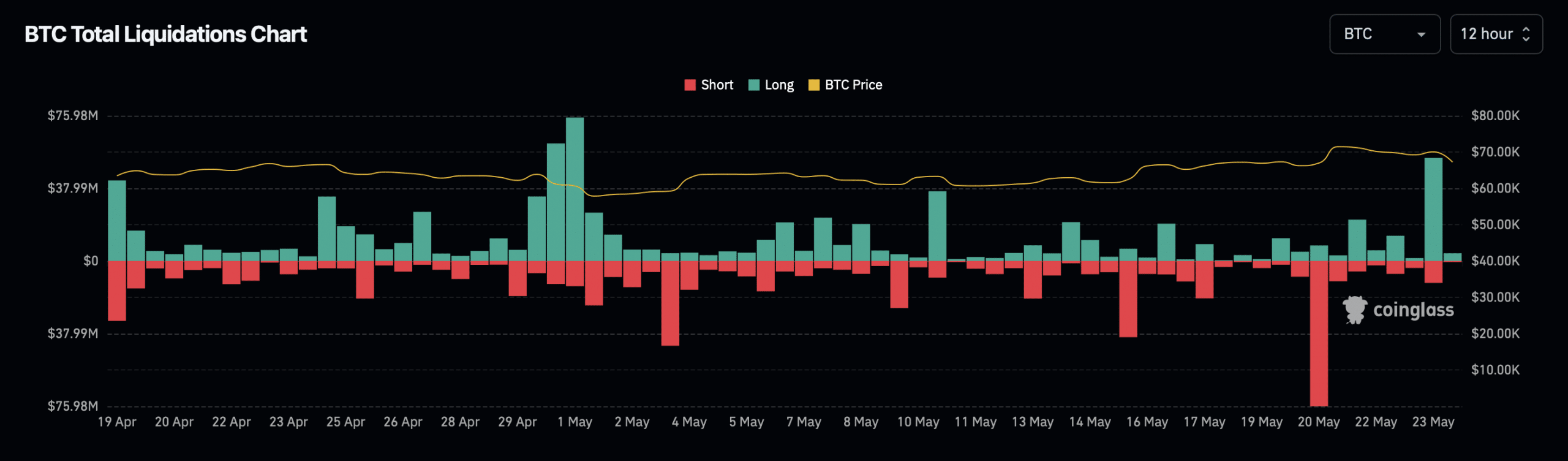

The recent downturn in Bitcoin’s price has not only impacted investors’ portfolios but also led to substantial market liquidations.

In the last 24 hours, Bitcoin long traders faced approximately $57.84 million in liquidations, while short traders also experienced significant losses with around $13.75 million.

These events contributed to a total of $390.80 million in crypto liquidations, affecting over 107,700 traders globally.

Source: Coinglass

Despite the current market challenges, AMBCrypto recent report suggests that Bitcoin could soon enter an ‘escape velocity’ phase, potentially pushing its price past $73,000.

This phase is expected to mark a significant bullish trend, possibly driven by enhanced investor interest and broader financial market developments.