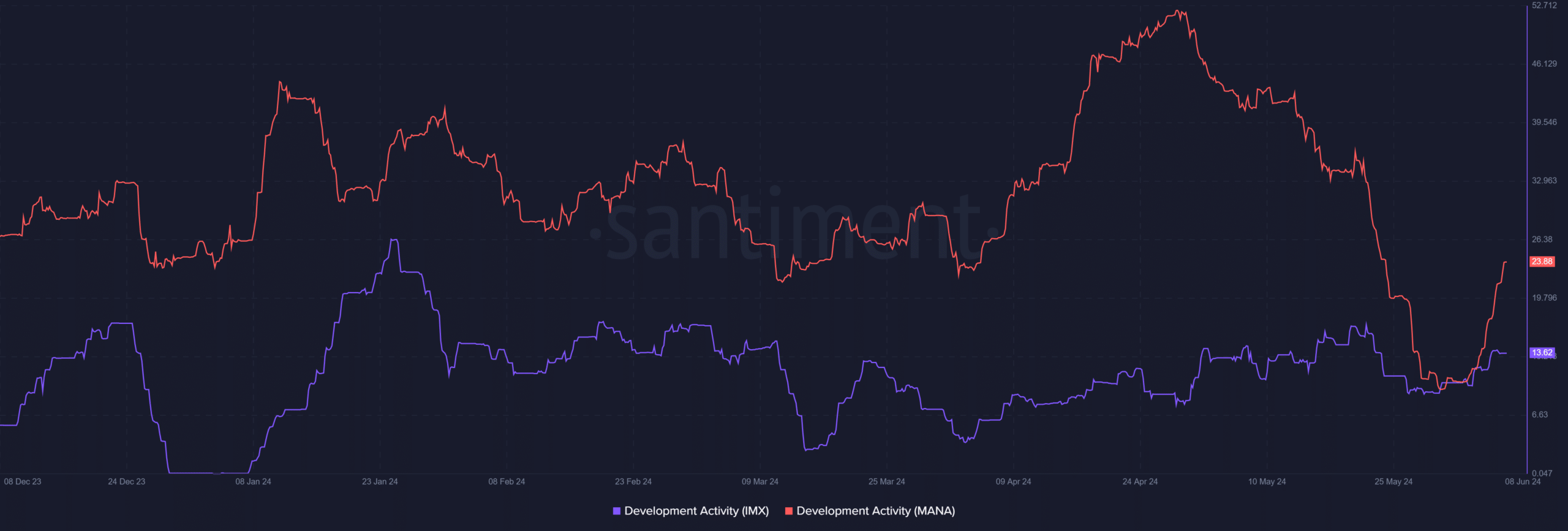

- Development activity of MANA was almost twice that of IMX across a 30-day window

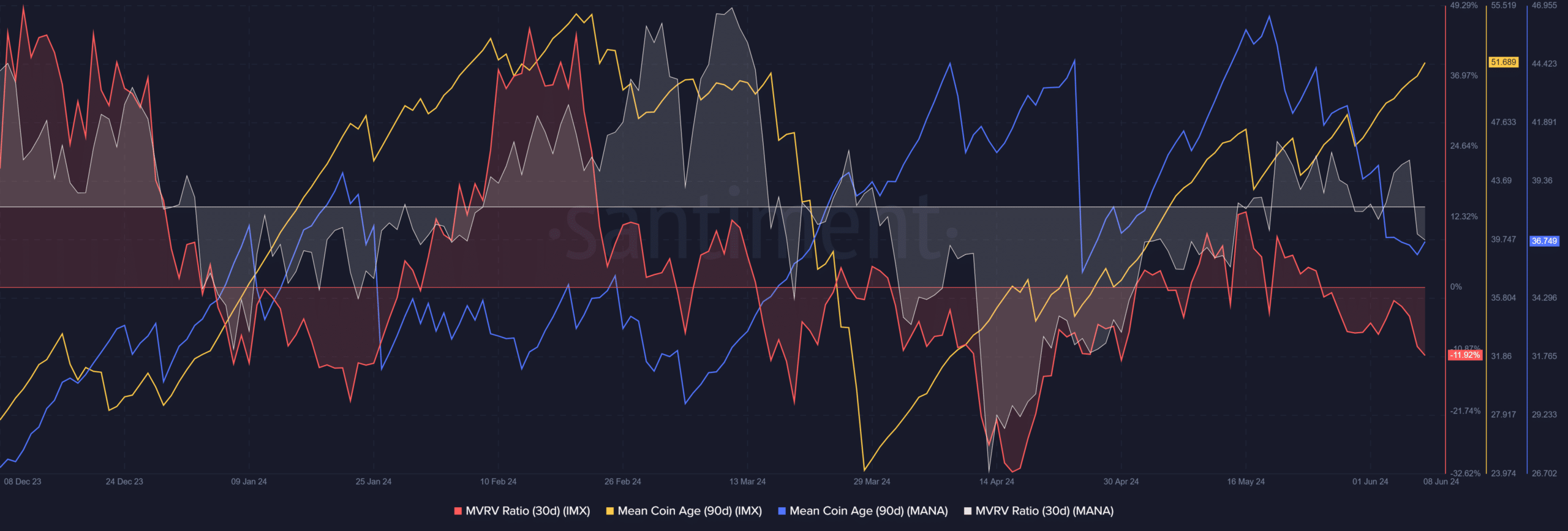

- Network value and holder metrics were not as supportive toward Decentraland

Immutable [IMX] and Decentraland [MANA] are two of the top-10 crypto assets in the gaming sector. The former is number one with a $3 billion market cap, while the latter, which has been around since 2018, had a market cap of just $800 million by comparison.

In a post on X (formerly Twitter), Santiment compared the development activity of crypto’s top gaming assets. MultiverseX [EGLD] led the pack by a significant margin, but Decentraland was not too far behind either.

Additionally, MANA’s dev activity outpaced that of IMX. Does this mean investors should start betting more on Decentraland?

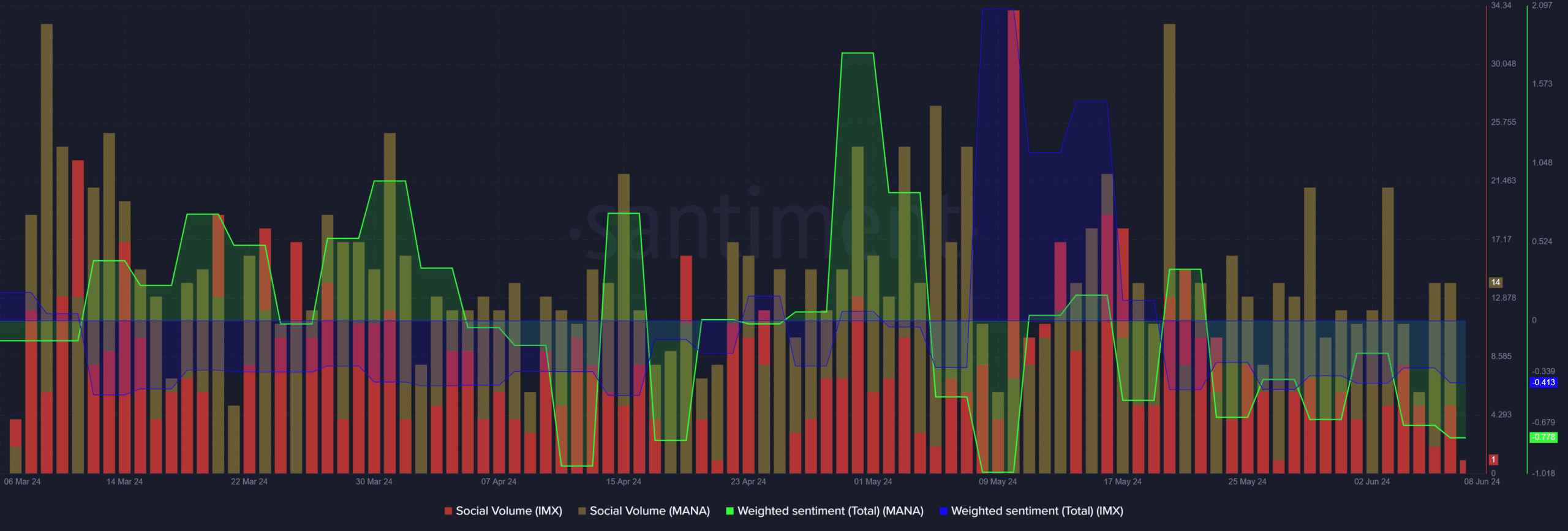

Social metrics were anemic for both tokens

AMBCrypto compared the social volume and weighted sentiment of IMX and Decentraland. MANA’s social volume was marginally higher, but the social volumes for both tokens have trended south over the past month.

The weighted sentiment fared no better. It was -0.77 for MANA and -0.41 for IMX. This signalled bearish engagement. Overall, both tokens’ bulls seemed to be starved of social media hype. Hence, a recovery might be difficult at this point.

Mean coin age gave bulls some hope

The 30-day MVRV ratio of both tokens had been positive in mid-May, but they have fallen since. For context, both tokens were trading within a range since April, but IMX saw a more pronounced bullish trend in May than MANA, which was more firmly range-bound with the extremes 12% apart.

The MVRV decline meant that short-term holders were at a loss due to the recent retracement. To gauge which token might recover quicker, the mean coin age (MCA) was examined.

The MCA of Immutable has been on a steady uptrend since late March. Meanwhile, Decentraland’s MC has fallen lower over the past two weeks. This indicated an accumulation phase for IMX, but selling pressure and notable volumes of token movement for MANA.

Therefore, IMX has a more bullish outlook in the coming weeks than MANA. Swing traders can look to go long in the $1.85-$2 region since it was a demand zone throughout May.

Realistic or not, here’s IMX’s market cap in BTC’s terms

There is another reason why MANA holders must be wary. It is the token’s second bull run, and those from the 2020-21 run who bought quite late might be waiting for a price hike to take profits or get out at break even. This would hinder bullish attempts to break out and weaken the price rally when it arrives.