- DOT’s high liquidity suggested the token might climb above $7.59

- Project has approved a new upgrade that could fuel a long-term uptrend

Polkadot’s [DOT] price in the last 90 days has been far from assuring. This, because the token has lost 23.60% of its value within the aforementioned period.

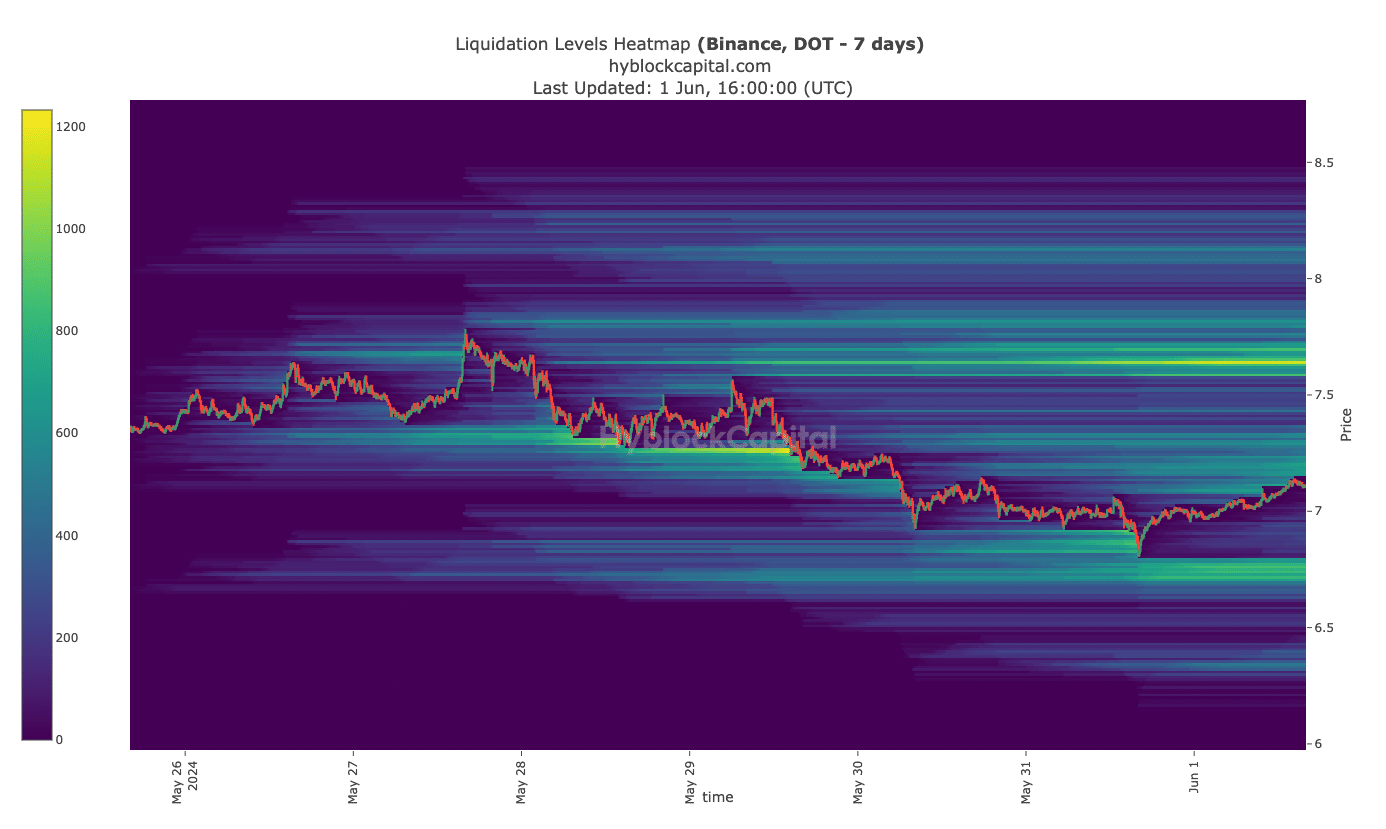

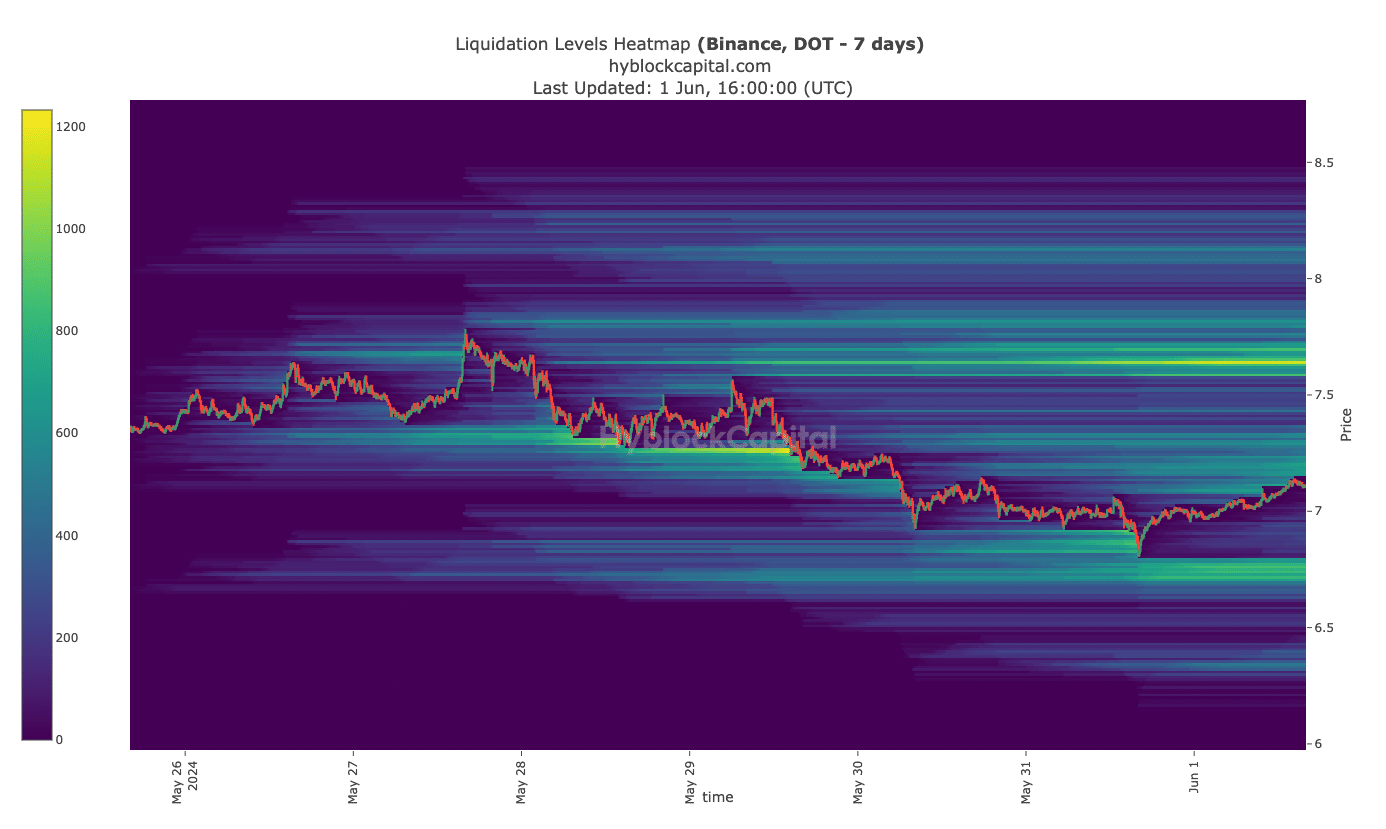

However, according to AMBCrypto’s analysis, DOT holders might soon have reason to celebrate. One of the reasons for this forecast is the liquidation heatmap.

The next leg is up

For context, liquidation occurs when a trader’s position is closed due to price fluctuations, insufficient margin balance, or both. However, with the liquidation heatmap, traders can identify high areas of liquidity.

This can help predict likely entry and exit points. At press time, using Hyblock’s data, there was a concentration of liquidity between $7.59 and $7.70. This area is known as a magnetic zone, and the price of Polkadot could move in that direction.

If DOT hits $7.70 and buying pressure increases, the price might continue to move higher. However, if the liquidation levels identified come with the sell side of the order book, the price might reverse itself.

According to analyst Michaël van de Poppe’s assessment on X, DOT has been undervalued. He believes that Polkadot’s scalability and security offerings are primary reasons why the token has been trading at a discount. He wrote,

“DOT is one of the blockchains that’s heavily undervalued. They released their JAM Upgrade & the project is focusing on RWA. Why? – DOT focuses on scalability & security.”

Polkadot community “JAMs” to the rhythm

Here, JAM stands for Join-Accumulate Machine. A few days ago, the Polkadot community voted on whether to implement the upgrade or not.

However, it did not take a lot of time for the community to unanimously agree to the deployment. With the JAM upgrade, the project can replace the relay chain, and interaction with other blockchains might get better.

In addition, Polkadot’s links with creating an ecosystem for Real World Assets (RWAs) could fuel DOT’s hike. However, that could be for the long term, and this could push the price towards $20 on the charts.

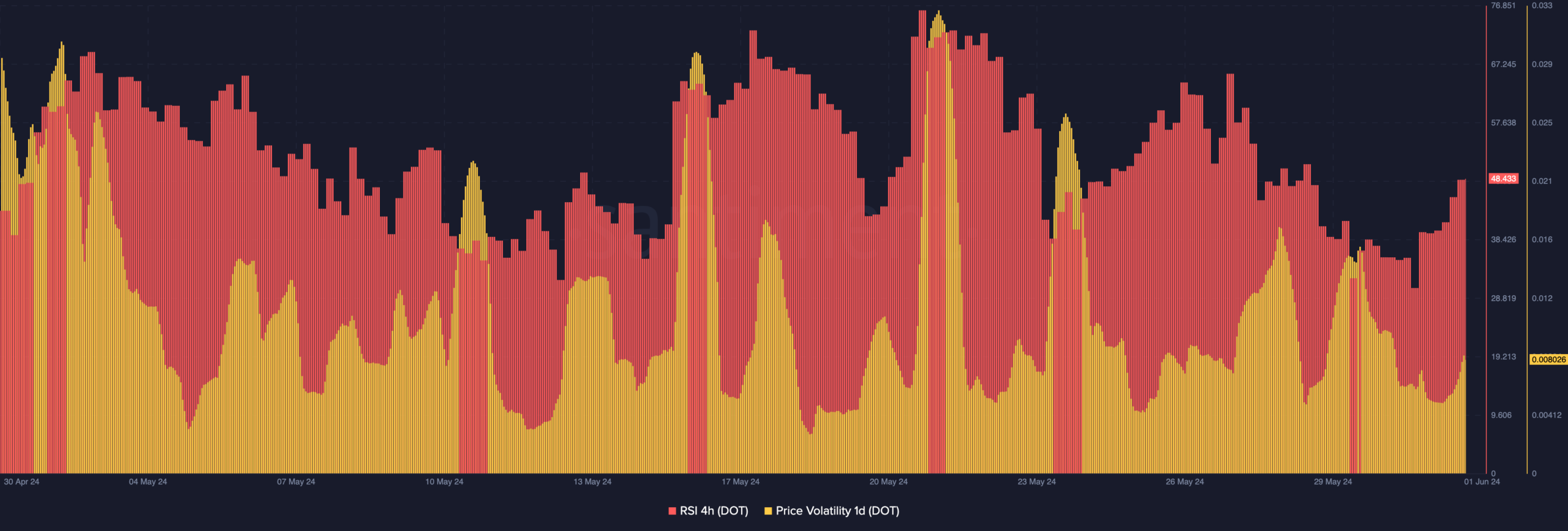

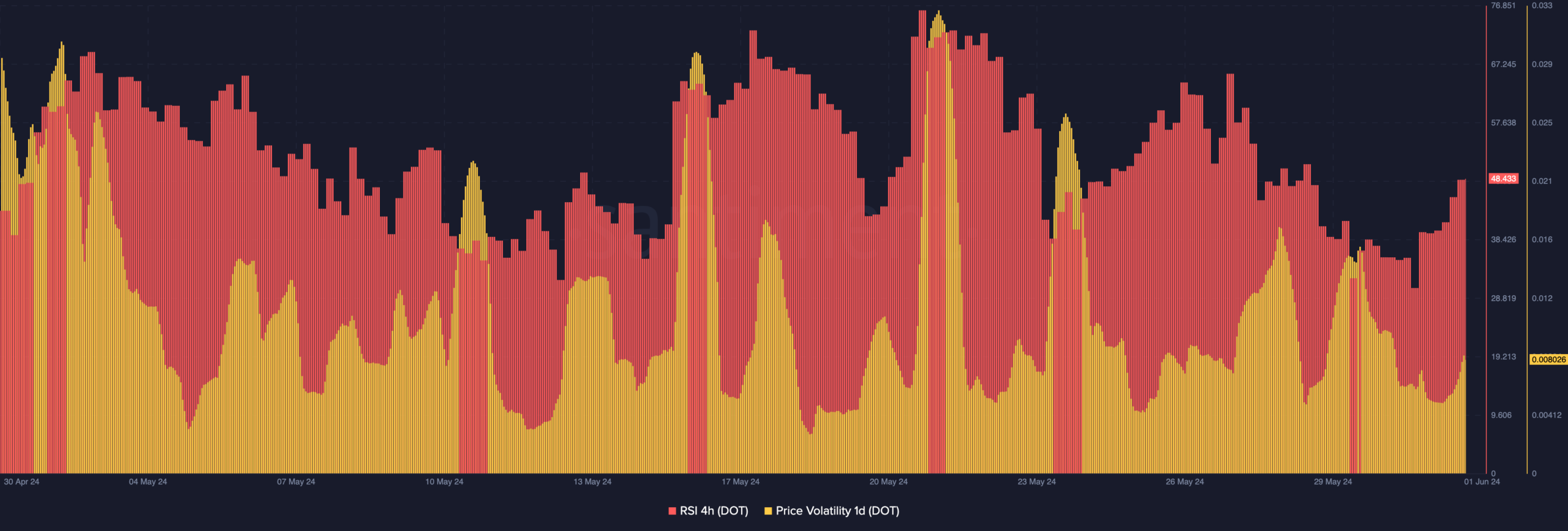

Looking at its short-term potential again, according to Santiment, the Relative Strength Index (RSI) had a reading of 48.43. Previously, the RSI was at 29.97 – A sign that the token was oversold.

Source: Santiment

Ergo, its most recent bounce off the lows suggested that DOT’s momentum was exiting its bearish phase. If sustained and if the altcoin crosses the 50.00 neutral region, the bullish prediction could be validated, and the price might hit $7.70.

AMBCrypto also looked at the one-day volatility. At press time, the metric was starting to expand, indicating that the price fluctuation could be significant.

Read Polkadot’s [DOT] Price Prediction 2024-2025

Should the increasing volatility come with the said buying pressure, DOT’s hike can be validated. However, if bears come into the picture, the forecast will be neutralized.