A popular crypto analyst is analyzing how long the Bitcoin (BTC) bull market could last.

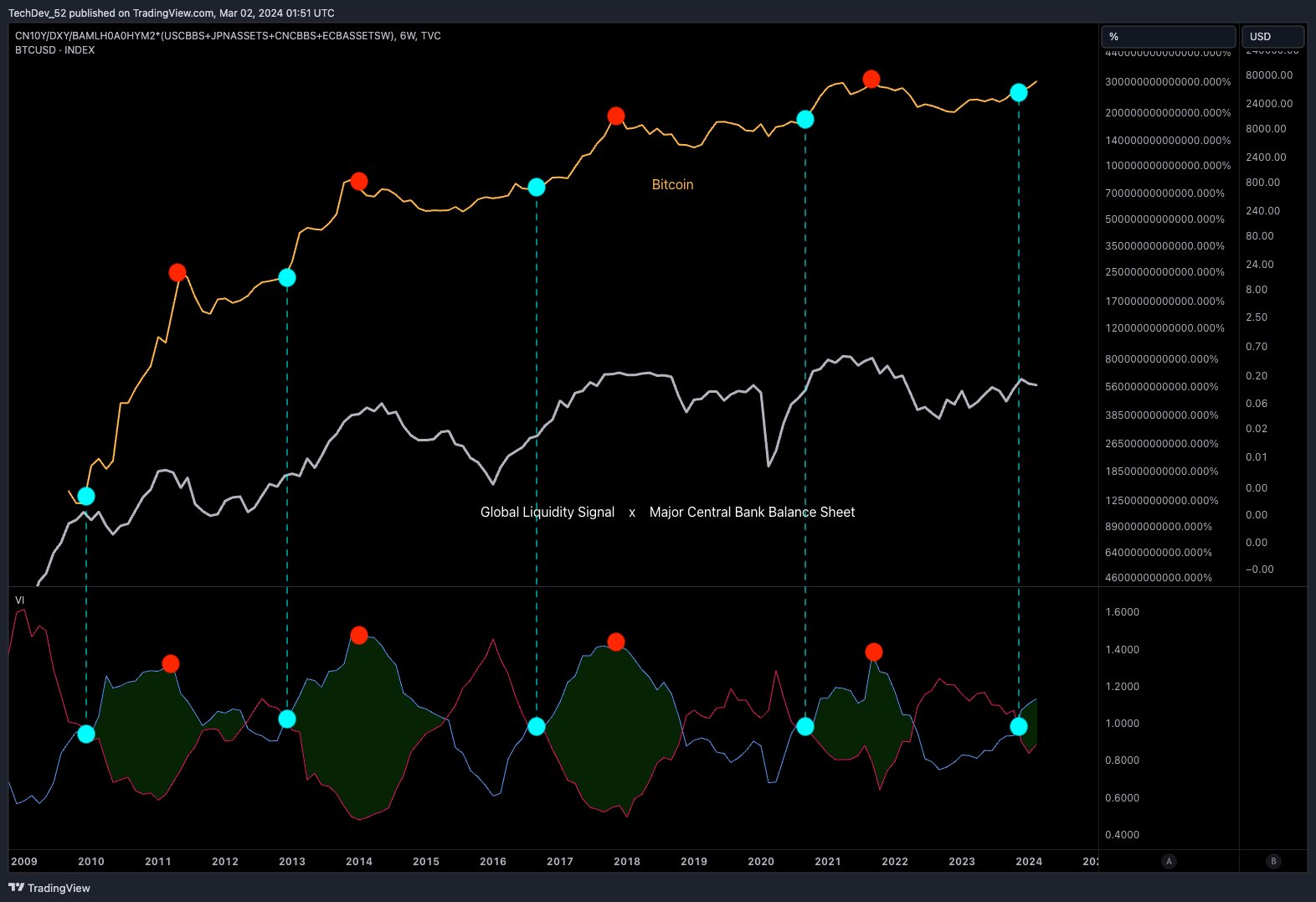

The pseudonymous trader known as TechDev tells his 434,100 followers on the social media platform X that the global liquidity cycle has aligned with “every Bitcoin top and takeoff point.”

“Spacing between blue and red dots has always been 9-11 bars. Do with that what you will.”

TechDev uses a six-week chart, meaning that his indicator suggests Bitcoin will probably hit its top between January and March of 2025.

The analyst examines global liquidity by pitting the Chinese 10-year bonds (CN10Y) against the US dollar index (DXY).

The analyst further elaborates on global liquidity cycles by setting the metric against the aggregate major central bank balance sheet, which tracks the money-printing activities of reserve banks around the world.

TechDev told his followers last week that “mania” could be coming to the crypto markets if past Bitcoin cycles are any indicator of the future.

The trader based his analysis on the supertrend indicator, which generates bull and bear signals based on whether the price breaks previous open or close levels during a given period.

“Bitcoin broke above the seven-week supertrend. Historically, the candles that followed brought mania.”

Bitcoin is trading at $68,015 at time of writing. The top-ranked crypto asset by market cap is up more than 7% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney