- BTC had hit long liquidity at $67K and could reverse recent losses post-FOMC.

- Trading firms underscored traders’ short-term bullish prospects despite the recent dip.

Bitcoin [BTC] extended losses to the $67K region amidst investors’ worries about the Fed decision.

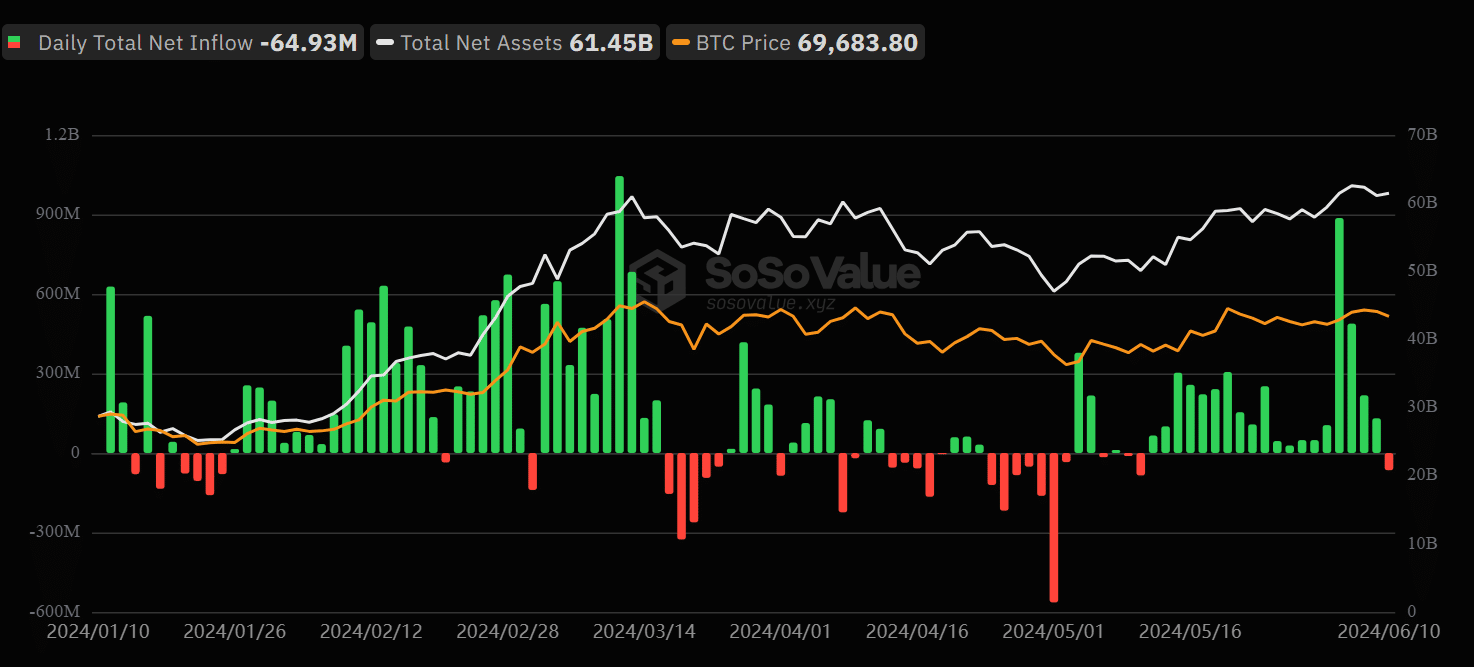

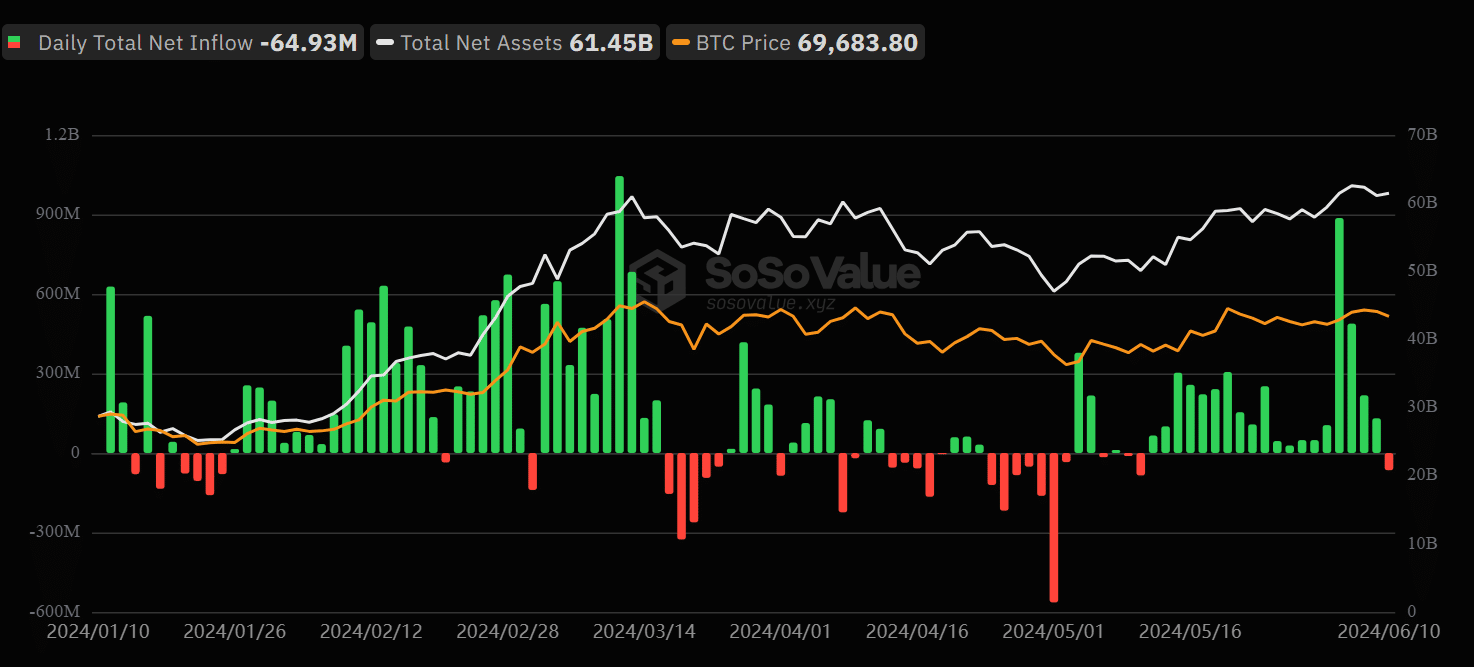

The short-term bearish sentiment was reflected in the BTC ETFs, too, as the products broke a month-long streak of inflows.

On the 10th of June, spot BTC ETFs recorded a daily net outflow of $64.9 million per SoSo Value data.

Source: SoSo Value

The bearish sentiment followed a stronger US Jobs report on the 7th of June, and extra volatility was expected at the FOMC (Federal Open Market Committee) meeting scheduled for the 12th of June.

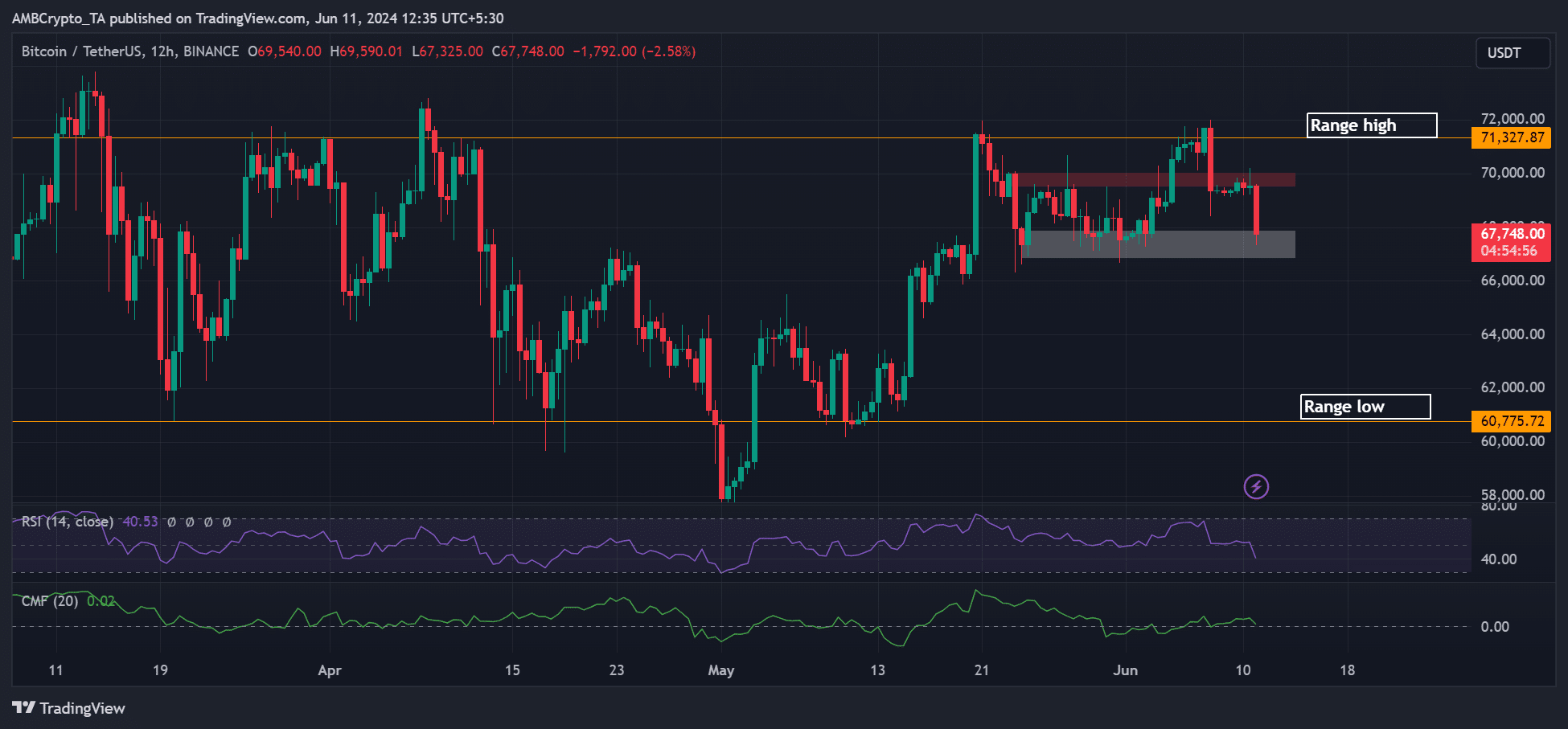

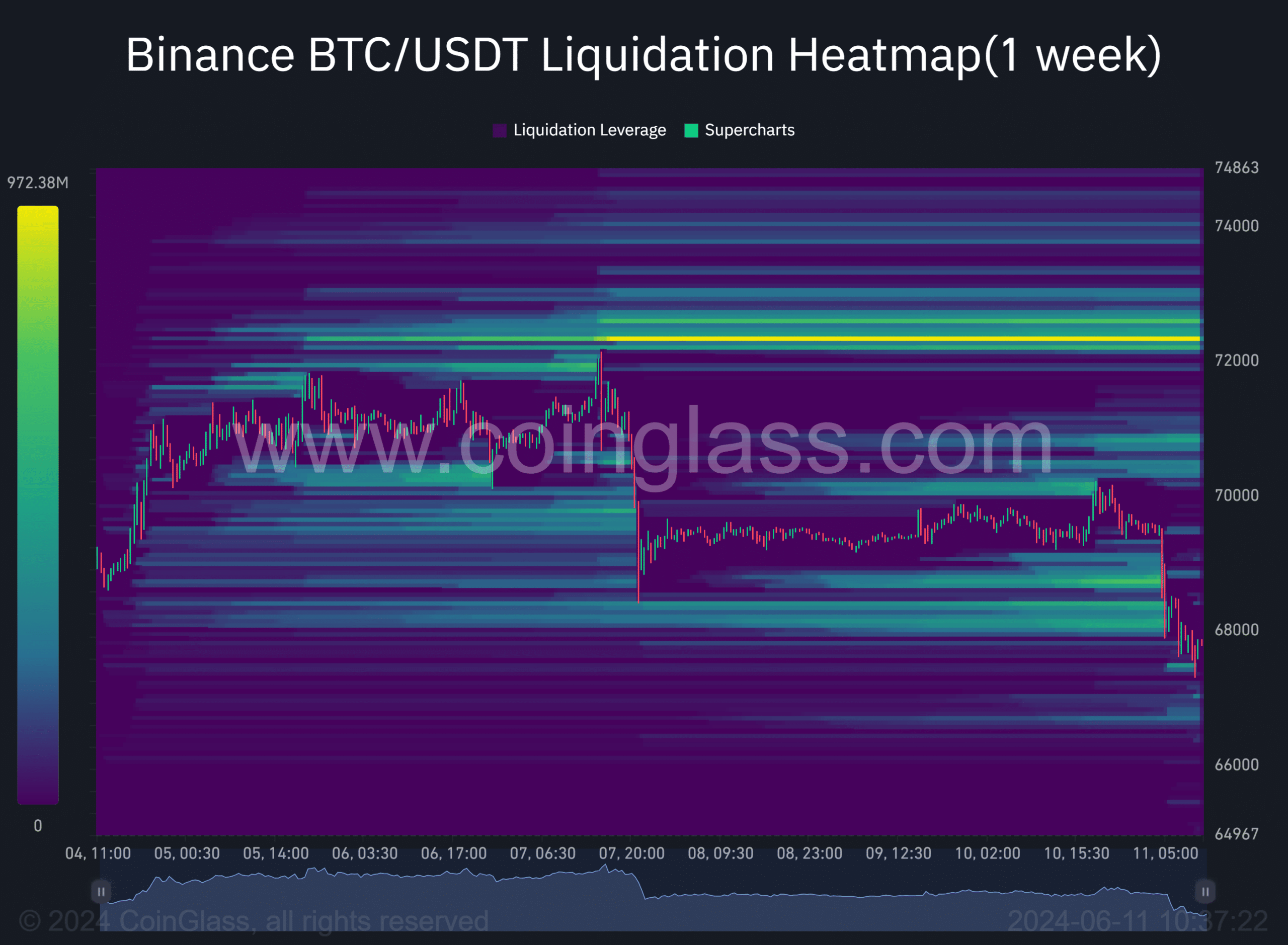

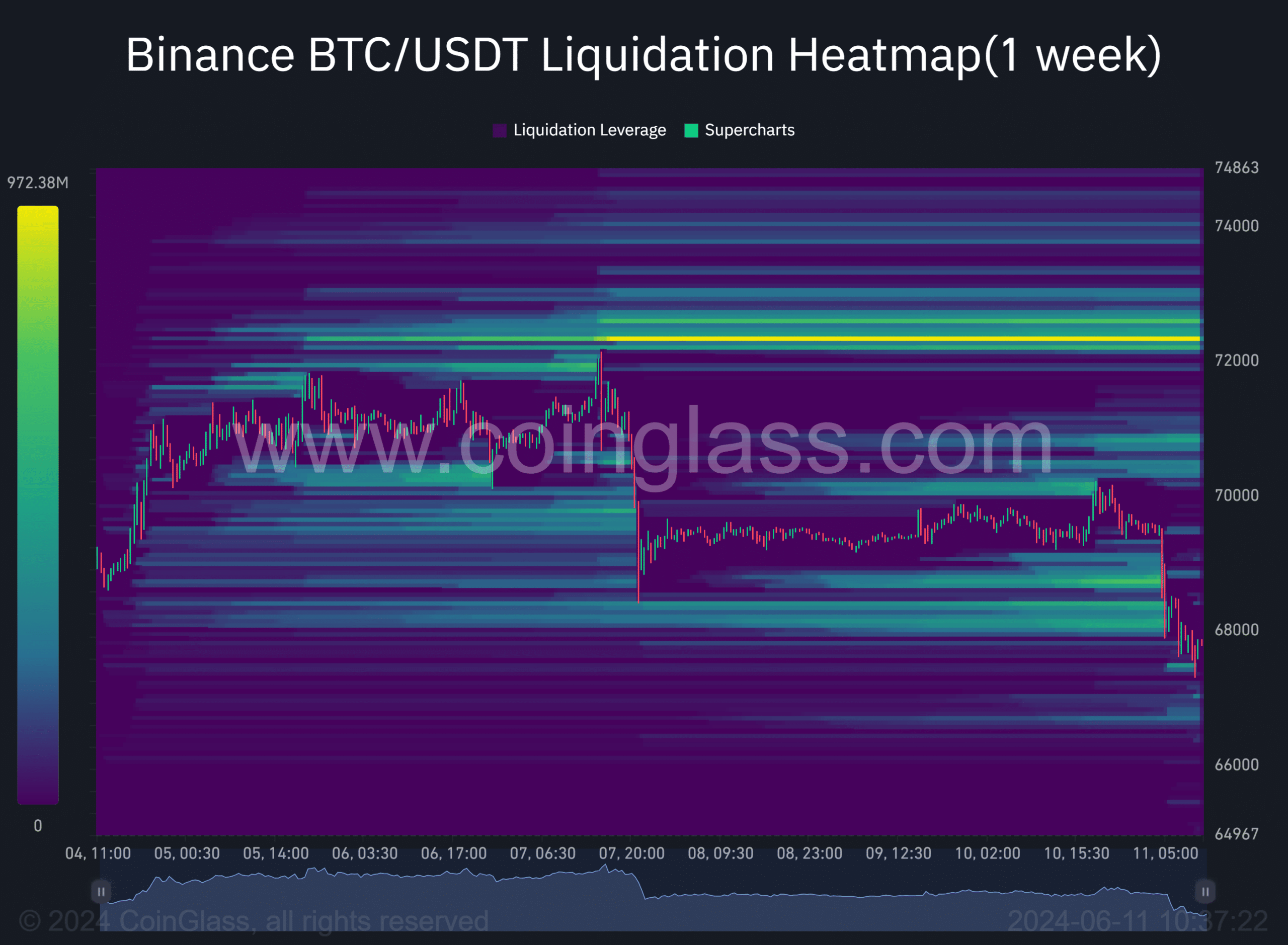

Already, BTC’s dip has hit a weekly low and retested a previous short-term demand of $66.8K—$67.92K. Interestingly, Hyblock Capital data marked the level as a key long liquidity area.

Will the short-term support above $67K hold post-FOMC, or will sellers overwhelm it?

Bitcoin predictions: Will $67K hold?

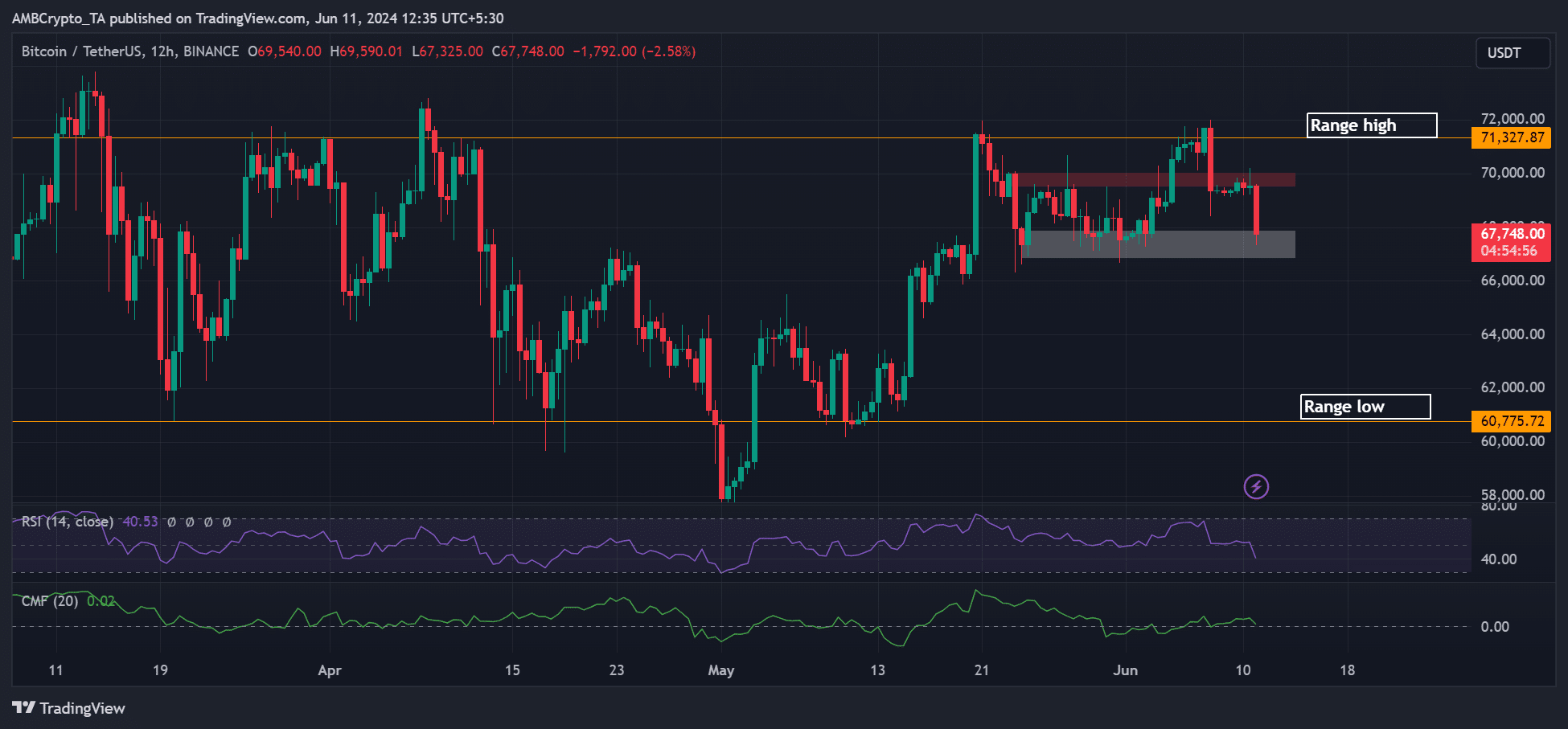

Source: BTC/USDT, TradingView

The HTF (higher timeframe) chart showed a record weakening in buying pressure, as demonstrated by the southbound RSI (Relative Strength Index).

However, the capital inflows into the king coin were still slightly above average as of press time, as shown by the CMF (Chaikin Money Flow).

Notably, the $67K have prevented further BTC plunge from mid-May, but a hawkish Fed decision could swiftly tip sellers to break below the support.

However, U.S. Senators, led by Elizabeth Warren, recently urged the Fed to consider lowering the interest rates. Should the Fed heed their call, the $67K could hold.

That said, the recent drop has cleared the long liquidity at $68K. However, the next key liquidity was overhead, at $70K and $72K, as shown by Coinglass data.

This meant that BTC could reverse the recent losses if it eyes the overhead liquidity.

Source: Coinglass

The bullish scenario was also projected by crypto trading firm QCP Capital, who said,

“As we anticipate what the Fed has to say in this week’s FOMC meeting, the desk saw more near-dated bullish flows this session, with Call skew increasing over Puts.”

This meant that the firm’s trading desk recorded more bullish bets (Call options) than bearish bets (Put options) on the derivatives market.

The leading crypto options firm, Deribit, also reinforced QCP’s short-term bullish stance and noted,

“Technical analysis indicates potential for a Bitcoin rally, with traders eyeing a bullish trend and considering Call Butterfly Spread strategies.”

However, a hawkish Fed will dent the bullish thesis and could lower BTC to $64K or range lows.