Grayscale, one of the leading digital asset management firms, has reportedly sold $41 million worth of Bitcoin. This significant transaction comes at a time when Bitcoin price is experiencing upswings, halting the current momentum near the $47K mark. Nevertheless, the selling pressure on Bitcoin triggered by GBTC’s outflow could be reduced as other ETF providers are actively increasing their Bitcoin holdings in their portfolios.

Grayscale Moves Total $83 Million In BTC

Bitcoin initiated a notable rally yesterday, climbing to $45,000 for the first time in a month. The next 12 hours maintained a positive trajectory, sending the cryptocurrency to surpass $47,000, marking another monthly high. This rapid increase in Bitcoin’s value resulted in the liquidation of positions, amounting to over $155 million.

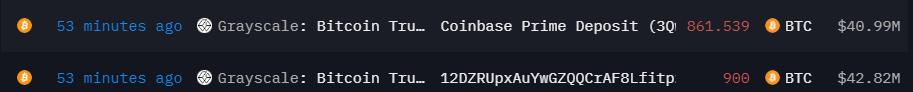

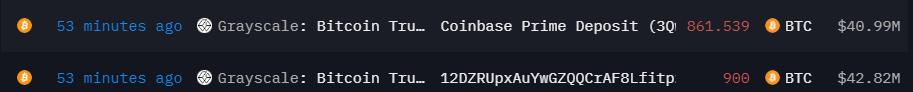

Amidst an exponential surge in BTC’s price, Grayscale has acted strategically by reallocating positions worth approximately $83 million, with $41 million in BTC being transferred to Coinbase for sale.

This action contributed to a $1,000 fluctuation in Bitcoin’s price around the $47K mark. Notably, Bitcoin’s price saw a liquidation of $8.2 million in the last hour, with the majority being buyers’ liquidations, totaling about $5.2 million. Concurrently, BTC’s price is undergoing a correction, falling below $47K.

Concerns are rising over potential further outflows from GBTC in the coming days, as traders set their sights on a short-term target of $50,000. The outflow from Grayscale’s Bitcoin ETF could intensify as companies facing bankruptcy liquidate their holdings and the fund loses its edge in liquidity compared to its competitors.

Genesis is set to request permission from the court of the Southern District of New York to sell off approximately $1.6 billion worth of GBTC shares held by Grayscale. This move comes after FTX redeemed nearly $1 billion from the same fund in January.

Since its transition to an ETF on January 11, Grayscale’s GBTC has seen liquidation of over $6 billion.

Will This Impact BTC Price?

Grayscale’s dominance came to an end on Feb. 1 when BlackRock’s iShares Bitcoin Trust (IBIT) and ProShares’ Bitcoin Strategy ETF (BITO) became the first of the nine ETFs to surpass GBTC’s trading volume.

As Grayscale proceeds with the reduction of their GBTC holdings, other ETF providers are actively adding Bitcoin to their portfolios, maintaining the overall netflow in positive territory.

The amount of Bitcoin sent out by Grayscale’s GBTC totals approximately 1.7K BTC, valued at around $83 million. This marks one of the lowest figures to date.

Contrastingly, netflows into ETFs experienced a substantial surge, with an increase of $405 million. This continues a streak of 10 consecutive days with positive net inflows.

Should significant inflows continue and the netflow stays positive, Bitcoin may avoid big price corrections. Nonetheless, any such corrections could trigger holders to engage in panic selling.