- Franklin Templeton has tokenized a $380 million US government money fund on Polygon.

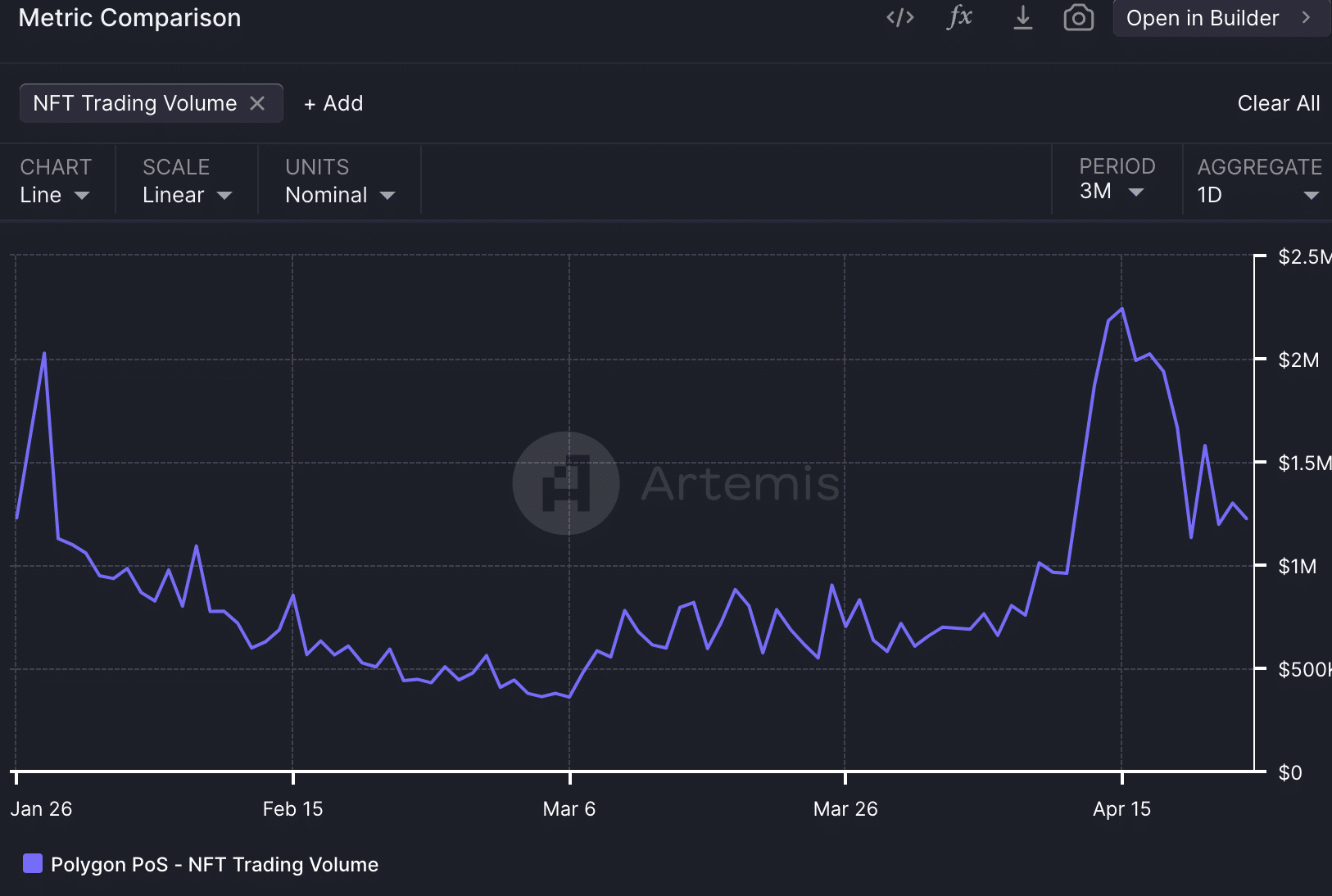

- Interest in Polygon NFTs plummeted.

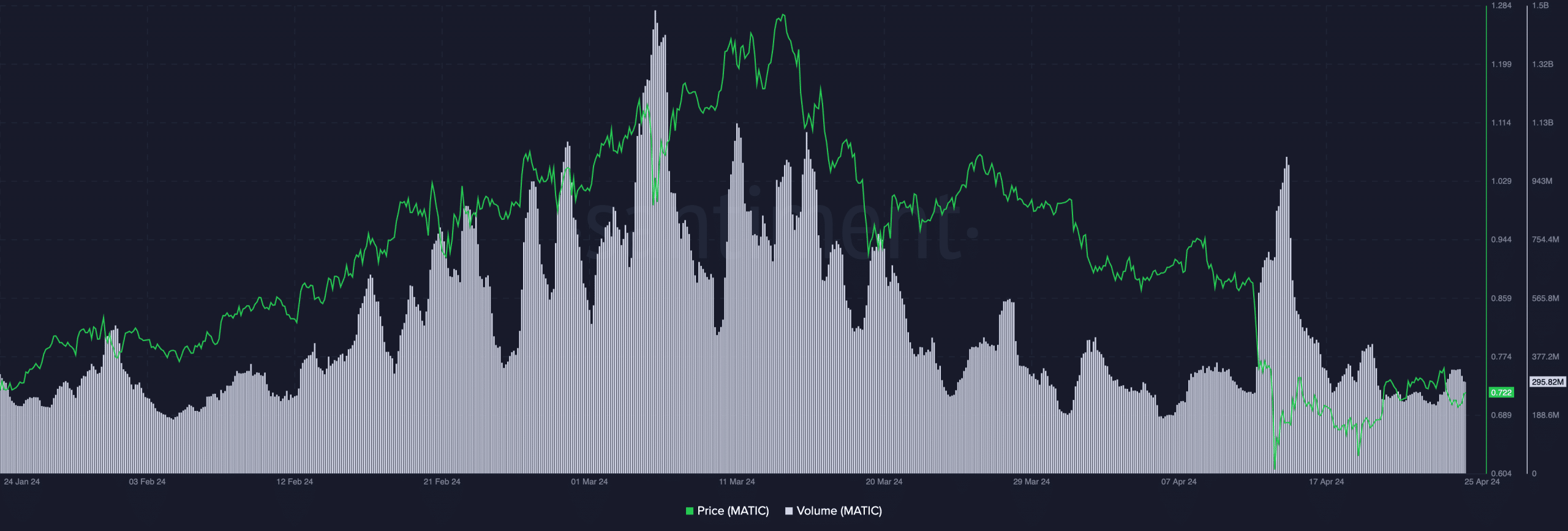

Polygon [MATIC] has seen some positive price movement over the course of last week. This rally can further be sustained by the improved sentiment around Polygon caused by Franklin Templeton’s behavior.

Institutional interest

Franklin Templeton has embarked on an initiative by tokenizing a $380 million treasuries fund on both the Polygon and Stellar blockchains. This move enables direct peer-to-peer (P2P) transfers without the need for intermediaries.

The introduction of the Franklin OnChain United States Government Money Fund (FOBXX) offers shares represented as BENJI tokens. These tokens, tradable on the public Polygon and Stellar blockchains, provide investors with a new level of flexibility in managing their assets through direct exchanges.

This innovative approach aims to streamline transactions and broaden access, empowering investors to manage their assets more efficiently.

With this development, the investment giant positions itself to directly rival BlackRock’s efforts in tokenization.

BlackRock recently introduced its BUIDL fund on Ethereum in collaboration with Securitize, showcasing a similar commitment to innovating traditional finance structures with blockchain solutions.

Having a major investment firm choose Polygon for tokenization validates the potential for Polygon to grow.

This endorsement can significantly improve Polygon’s credibility and reputation within the traditional finance world, attracting further institutional interest and potentially leading to more tokenized assets being built on Polygon.

Moreover, the easy tradability of BENJI tokens on the Polygon blockchain can significantly improve liquidity for the underlying treasuries fund.

This can attract more investors seeking exposure to government securities while offering them the benefits of faster and cheaper transactions on Polygon compared to traditional financial systems.

Looking at the NFT sector

However, it wasn’t all roses and sunshine for the Polygon ecosystem. In the last few days, the NFT sector witnessed a massive decline in terms of trading volume. This can lead to a decrease in network fees, a key revenue stream for Polygon validators.

Moreover, lower trading volume can lead to decreased liquidity for existing NFT projects on Polygon. This means it might be harder for users to buy or sell their NFTs quickly and at a fair price.

Read Polygon’s [MATIC] Price Prediction 2024-2025

Source: Artemis

At press time, MATIC was trading at $0.7183 and its price had grown by 2.43% in the last 24 hours. The volume at which it was trading at had also declined by 16.34% during this period.

Source: Santiment