- FET’s price has rallied by 30% in the past 24 hours.

- Despite this, token holders continue to record losses.

Fetch.ai [FET] has recorded a 30% price surge in the past 24 hours, to lead as the cryptocurrency asset with the most gains during that period. As of this writing, the artificial intelligence-based token exchanged hands at a seven-day high of $1.61.

FET’s double-digit rally follows Nvidia [NVDA], a leading AI chipmaker, becoming the world’s most valuable company.

On 18th June, it surpassed Microsoft (MSFT) to become the world’s most valuable company, just two weeks after overtaking Apple (AAPL) for the second position.

Fetch.ai is the talk of the town

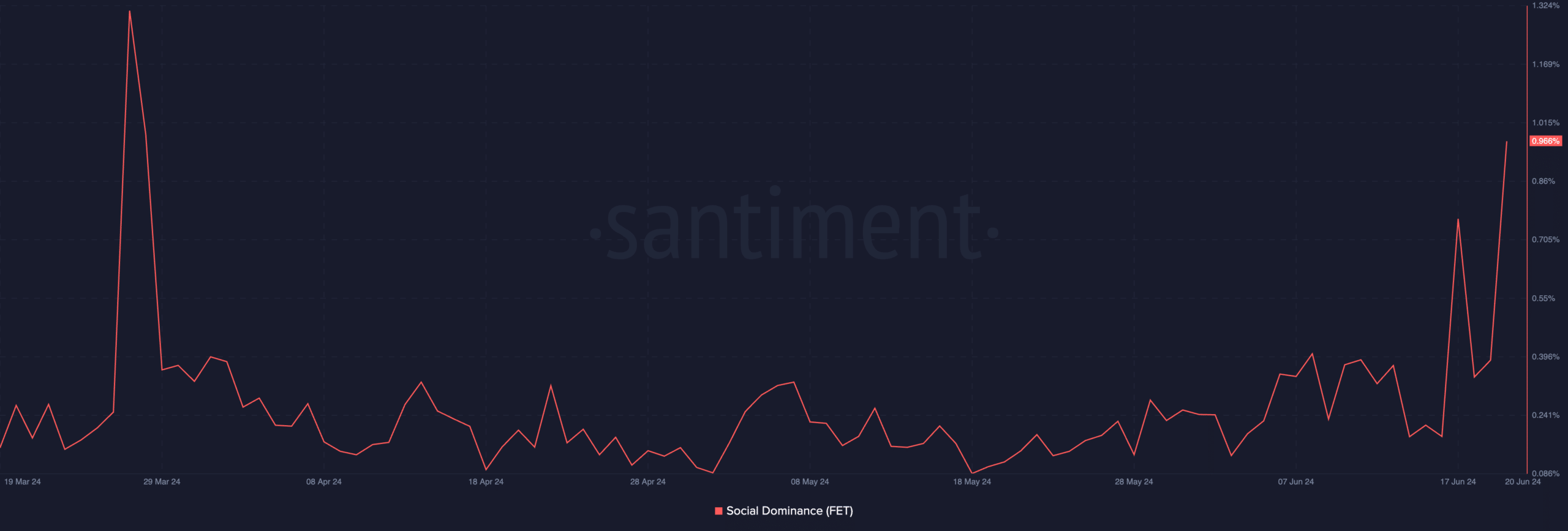

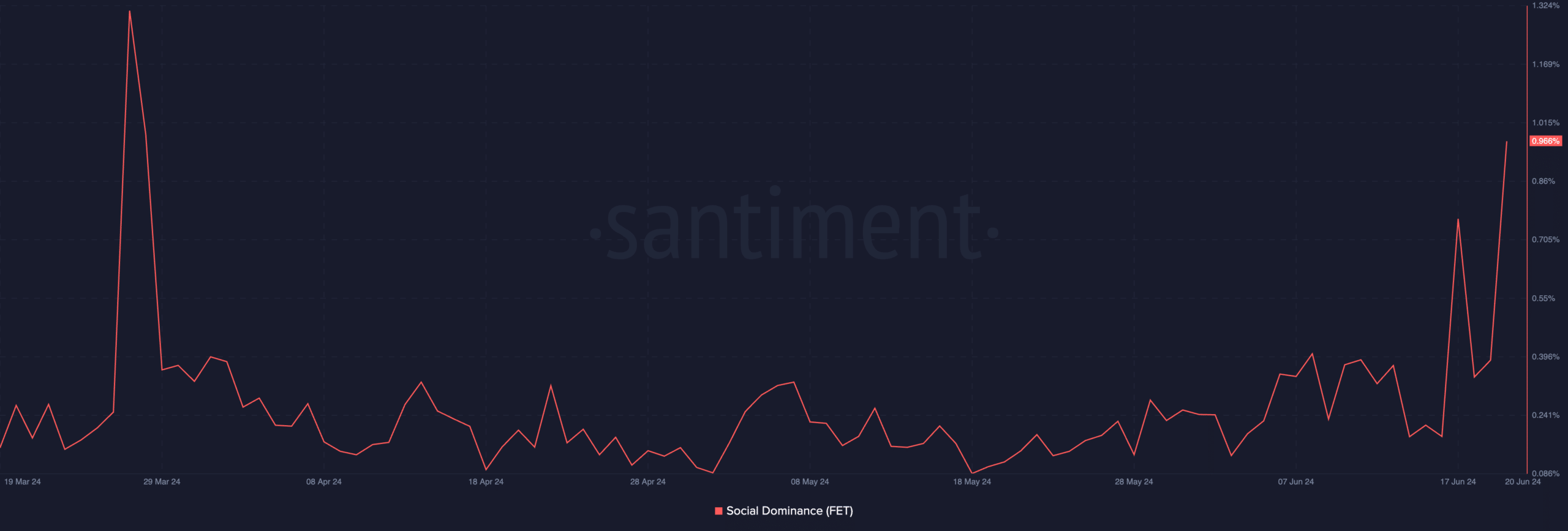

FET’s performance in the past 24 hours has led to an uptick in its social dominance, data from Santiment showed. At press time, FET’s social dominance was 0.96%, a level last observed in March.

Source: Santiment

An asset’s social dominance measures its share of online discussions that mention it relative to the total discussions about the top 100 cryptocurrencies by market capitalization.

When it rises like this, it means that discussions about the asset in question form a significant part of the overall conversations happening in the crypto market compared to before.

FET’s social dominance indicates that, as of this writing, 0.96% of all online discussions about the top 100 cryptocurrencies by market capitalization specifically mention it.

This has also led to a spike in the token’s trading volume. In the last 24 hours, FET’s trading volume has totaled $377 million, rising by 92%

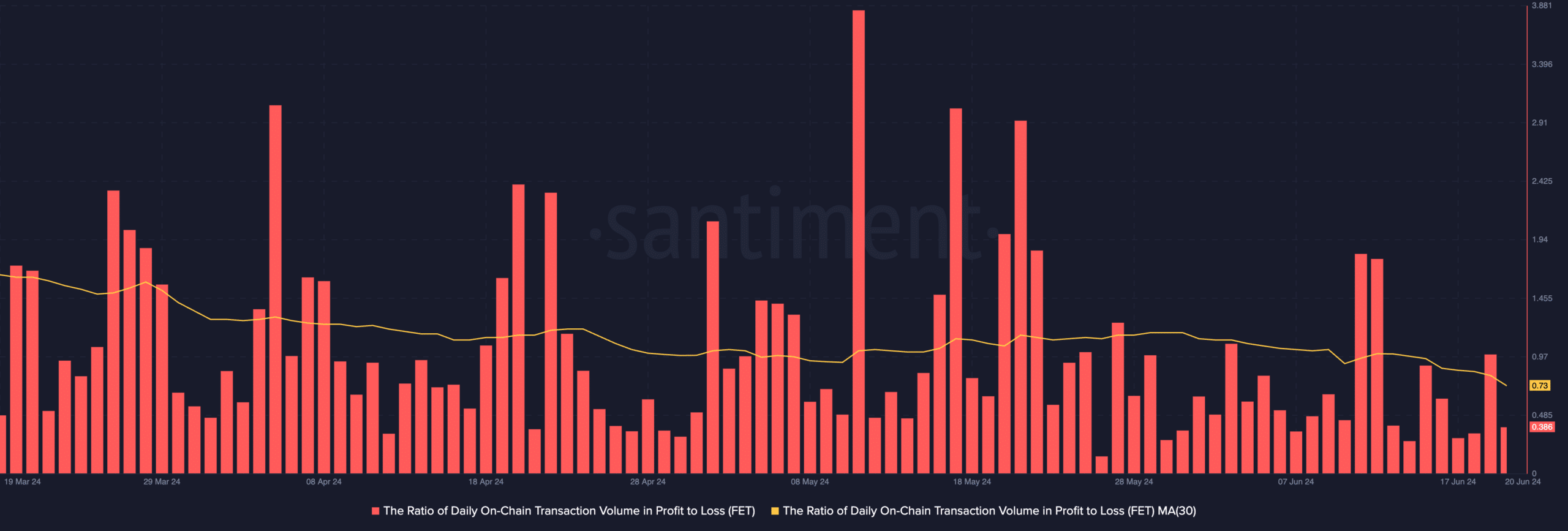

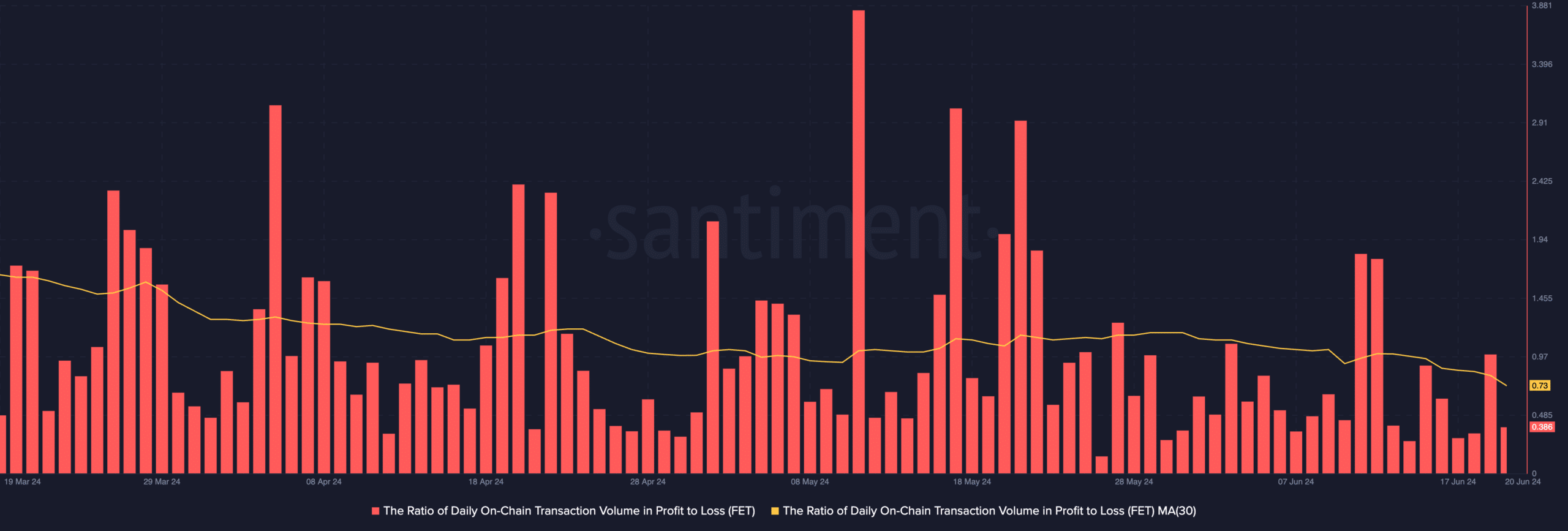

Interestingly, despite the double-digit surge in FET’s value and its social dominance climbing to a multi-month high, its holders have failed to record profits on their transactions.

AMBCrypto assessed the daily ratio of FET’s transaction volume in profit to loss and found that on 19 June, this was 0.98. At press time, it was 0.38. Assessed on a 30-day moving average, the metric’s value was 0.73.

Source: Santiment

Read Fetch.ai [FET] Price Prediction 2024-25

This suggested that in the past 30 days, for every FET transaction that ended in a loss, only 0.73 transactions returned a profit.

It suggests that FET holders have recorded more losses than they have seen profit in the past 30 days, and the current price surge has not changed that.